Specialty Insurance Market

Global Specialty Insurance Market Size, Share, Forecast& Analysis Report by Type (Marine, Aviation and Transport (MAT) Insurance, Professional Liability Insurance, Property Insurance, Cyber Liability Insurance, Directors and Officers (D&O) Insurance, Entertainment Insurance, Art Insurance, Others), Distribution Channel (Brokers, Non-Brokers (Direct Sales)), End User(Business, Individuals) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

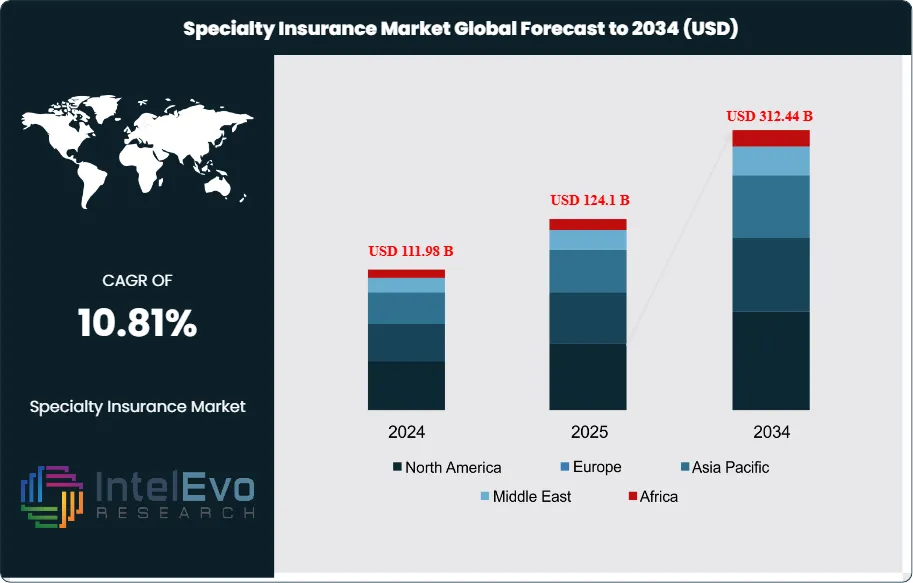

The Specialty Insurance Market size is expected to be worth around USD 312.44 billion by 2034, rising from USD 111.98 billion in 2024, and expanding at a CAGR of 10.81% during the forecast period from 2024 to 2034. This strong growth is driven by increasing demand for customized risk coverage across sectors such as cyber liability, marine, aviation, energy, and professional indemnity. Rising business complexity, heightened regulatory scrutiny, and growing exposure to climate-related and digital risks are further accelerating adoption, positioning specialty insurance as a critical component of modern enterprise risk management strategies worldwide.

Get More Information about this report -

Request Free Sample ReportThe Specialty Insurance Market encompasses insurance products designed to address unique, exceptional, or atypical risks that fall outside standard insurance policies. Unlike traditional coverage, specialty insurance provides customized solutions for specific industries, high-value assets, and complex risk scenarios including marine operations, aviation, cyber threats, professional liability, fine arts, and entertainment ventures.

The specialty insurance market is experiencing robust expansion driven by increasing complexity of business operations, emerging cyber threats, climate-related risks, and growing wealth concentrations requiring specialized asset protection. Digital transformation initiatives, regulatory changes, and globalization of trade are creating new risk categories that demand tailored insurance solutions beyond conventional coverage limitations.

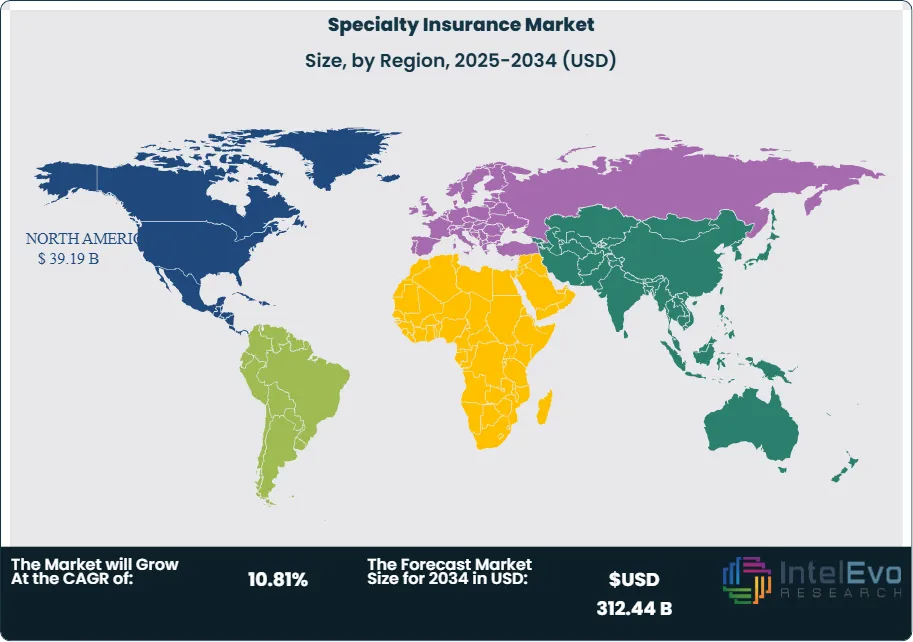

North America leads the specialty insurance market with strong regulatory frameworks, mature financial markets, and advanced risk assessment capabilities. The U.S. drives growth through surplus lines infrastructure, data-driven underwriting, and innovative insurance-linked securities. Europe excels in ESG-focused and sustainability-driven products, supported by London’s Lloyd’s market. Asia-Pacific is the fastest-growing region, with China and India expanding opportunities through economic growth, infrastructure investment, and relaxed reinsurer participation, fueling demand for specialized coverage.

The pandemic accelerated demand for specialty insurance products, particularly cyber liability coverage as remote work expanded attack surfaces, and business interruption policies gained prominence. Supply chain disruptions highlighted the need for specialized trade credit and political risk insurance, while healthcare-related specialty coverages experienced significant growth.

Geopolitical tensions and trade uncertainties have intensified demand for political risk insurance, trade credit coverage, and specialized international business protection. Supply chain volatilities and sanctions regimes have created new specialty insurance categories while driving premium increases across marine, aviation, and transport coverage segments.

Key Takeaways

- Market Growth: The Specialty Insurance Market is expected to reach USD 312.44 Billion by 2034, fueled by complex business operations, cyber threats, climate risks, and rising wealth requiring tailored protection.

- Type Dominance: Marine, Aviation and Transport (MAT) Insurance leads the specialty insurance market, driven by global trade expansion and complex transportation risk management needs. This segment includes marine cargo, aviation liability, and transport logistics coverage. Among these, MAT dominates due to high-value international trade requirements and regulatory compliance needs.

- Distribution Channel Dominance: Brokers dominate the specialty insurance distribution landscape, powered by their specialized expertise and risk assessment capabilities. The segment comprises direct brokers and wholesale intermediaries, with brokers gaining prominence due to their ability to navigate complex specialty risk scenarios and connect clients with appropriate coverage solutions.

- End User Dominance: Business segment holds the largest share in the specialty insurance market, owing to diverse operational risk exposures and regulatory compliance requirements. Key sub-segments include large enterprises, SMEs, and specialized industries. Business users excel due to complex risk profiles requiring tailored coverage solutions beyond standard commercial policies.

- Market Drivers: Key drivers accelerating growth include digital transformation creating cyber risk exposures and climate change intensifying environmental liability needs, which boost market expansion through new specialty product development and coverage innovations.

- Market Restraints: Growth is hindered by limited market size constraints and high specialization costs, which create challenges such as reduced scalability and elevated underwriting expenses for niche risk categories.

- Market Opportunities: The market is poised for expansion due to opportunities like agricultural sector risk evolution and emerging technology adoption, which enable specialized coverage development for precision farming, drone operations, and sustainable agriculture practices.

- Market Trends: Emerging trends including artificial intelligence integration and ESG consideration mainstreaming are reshaping the market by enhancing risk assessment capabilities and creating new specialty coverage categories for environmental and social governance risks.

- Regional Leader: North America leads the global specialty insurance market through established regulatory frameworks, mature financial infrastructure, and strong corporate awareness of specialized risk management needs.

Type Analysis:

The specialty insurance type segmentation reveals Marine, Aviation and Transport (MAT) Insurance as the dominant category, commanding 25% market share through its essential role in global commerce protection. This segment encompasses cargo insurance, hull coverage, aviation liability, and logistics protection services. The leadership position stems from increasing international trade volumes, complex regulatory requirements across jurisdictions, and the high-value nature of transported goods requiring specialized underwriting expertise. Professional liability and property insurance follow as significant contributors, addressing growing business complexity and asset protection needs. The diversification within this segment reflects the expanding risk landscape facing modern enterprises and individuals seeking protection beyond traditional coverage boundaries.

Distribution Channel Analysis:

Brokers Leads With over 70% Market Share In Specialty Insurance Market: The distribution channel segmentation demonstrates brokers' commanding 60% market share dominance through their specialized knowledge and intermediary value proposition. Brokers excel in the specialty insurance market due to their deep understanding of complex risk scenarios, established relationships with specialized underwriters, and ability to navigate intricate policy structures that individual buyers find challenging. Their expertise in risk assessment and coverage customization creates significant value for clients seeking non-standard protection. The non-broker segment, while smaller, shows growth potential through direct insurer relationships and digital distribution innovations that reduce intermediary costs while maintaining coverage quality and accessibility.

End User Analysis:

Business end users maintain 59% market share leadership driven by their exposure to diverse operational risks requiring specialized coverage solutions. This dominance reflects the complex risk profiles of modern enterprises facing cyber threats, professional liability exposures, supply chain vulnerabilities, and regulatory compliance requirements that standard commercial policies cannot adequately address. Individual consumers represent a growing segment as high-net-worth individuals, collectors, and specialty lifestyle participants seek customized protection for unique assets and activities. The business segment's leadership position is reinforced by increasing regulatory requirements, technological adoption creating new risk categories, and globalization expanding enterprise risk exposures across multiple jurisdictions and operational areas.

Regional Analysis

North America Leads With more than 35% Market Share In Specialty Insurance Market: North America's specialty insurance leadership stems from its comprehensive regulatory environment that has fostered the development and widespread adoption of specialized insurance products across multiple industry verticals. The region benefits from mature financial markets and established institutional knowledge that enables sophisticated risk assessment and product development capabilities. Corporate awareness regarding operational risks has significantly elevated demand for customized insurance solutions that address unique business challenges not covered by standard policies. The United States serves as the primary driver within the North American market, leveraging its well-developed surplus lines infrastructure and regulatory stability to maintain competitive advantages in specialty coverage areas. The region's strength lies in its abundant capacity for complex risks, supported by developed loss-data pools and innovative insurance-linked securities that provide comprehensive coverage options. Advanced analytics capabilities and established broking networks enable efficient distribution and pricing of specialized products across diverse market segments.

Europe demonstrates strong performance in specialty insurance through stringent regulatory standards and emphasis on corporate governance, particularly excelling in ESG-linked innovation and sustainability-focused coverage solutions. The region benefits from London's position as a global specialty hub and Lloyd's syndicated capacity, despite Brexit-related operational complexities.

Asia-Pacific represents the fastest-growing specialty insurance region, driven by rapid economic development, infrastructure investments, and supply-chain diversification initiatives that create demand for specialized coverage. Countries like China and India are progressively relaxing foreign reinsurer participation, expanding product offerings and competitive choices.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Type

- Marine, Aviation and Transport (MAT) Insurance

- Professional Liability Insurance

- Property Insurance

- Cyber Liability Insurance

- Directors and Officers (D&O) Insurance

- Entertainment Insurance

- Art Insurance

- Others

Distribution Channel

- Brokers

- Non-Brokers (Direct Sales)

End User

- Business

- Individuals

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 124.1 B |

| Forecast Revenue (2034) | USD 312.44 B |

| CAGR (2025-2034) | 10.81% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type (Marine, Aviation and Transport (MAT) Insurance, Professional Liability Insurance, Property Insurance, Cyber Liability Insurance, Directors and Officers (D&O) Insurance, Entertainment Insurance, Art Insurance, Others), Distribution Channel (Brokers, Non-Brokers (Direct Sales)), End User (Business, Individuals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | American International Group (AIG), Chubb Limited, Allianz SE, Kinsale Capital Group, Beazley, Hiscox Ltd, Munich Re, Tokio Marine Holdings, QBE Insurance Group |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Specialty Insurance Market?

Specialty Insurance Market

Who are the major players in the Specialty Insurance Market?

American International Group (AIG), Chubb Limited, Allianz SE, Kinsale Capital Group, Beazley, Hiscox Ltd, Munich Re, Tokio Marine Holdings, QBE Insurance Group

Which segments covered the Specialty Insurance Market?

Type (Marine, Aviation and Transport (MAT) Insurance, Professional Liability Insurance, Property Insurance, Cyber Liability Insurance, Directors and Officers (D&O) Insurance, Entertainment Insurance, Art Insurance, Others), Distribution Channel (Brokers, Non-Brokers (Direct Sales)), End User (Business, Individuals)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date