Spintronics Market Forecast Size, Trends & Innovation| 10.5% CAGR

Global Spintronics Market Size, Share & Analysis By Technology (Giant Magnetoresistance (GMR), Tunnel Magnetoresistance (TMR), Spin-Transfer Torque (STT), Spin Hall Effect, Other Technologies), By Application (Data Storage, Magnetic Random Access Memory (MRAM), Sensors, Semiconductor Devices, Spintronic Logic and Quantum Computing)Industry Innovations, R&D Pipeline, Competitive Positioning & Forecast 2025–2034

Report Overview

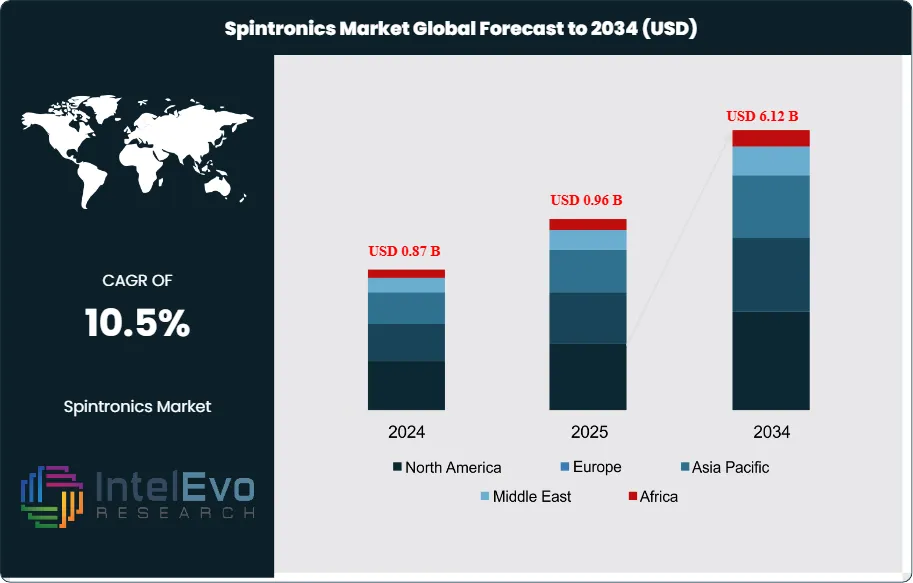

The Spintronics Market was valued at approximately USD 0.87 Billion in 2024 and is projected to reach nearly USD 6.12 Billion by 2034, growing at an estimated CAGR of around 10.5% from 2025 to 2034. Breakthroughs in MRAM, quantum materials, and ultra‐low-power data storage technologies are accelerating spintronics adoption across electronics and computing industries. With ongoing miniaturization, energy-efficient processors, and next-gen semiconductor innovation, spintronics is emerging as a critical pillar of future memory and logic device architectures. Rising investments in quantum computing and automotive sensors further enhance long-term market momentum.

Get More Information about this report -

Request Free Sample ReportSpintronics leverages electron spin alongside charge to deliver faster, more energy-efficient devices, and the market’s size evolution reflects the electronics industry’s search for performance gains beyond conventional CMOS scaling. After a cyclical dip in semiconductors—global sales totaled USD 526.8 billion in 2023, down 8.2% year over year—the demand backdrop improved in the second half, with Q4 2023 sales of USD 146.0 billion (+11.6% YoY; +8.4% QoQ) and December at USD 48.6 billion (+1.5% month over month), signaling a healthier setup for next-generation memory and sensor investments that underpin spintronics. Growth in the period will be propelled by surging data creation, AI/ML acceleration, and edge-to-cloud architectures that require non-volatile, low-latency memory such as STT-MRAM, along with magnetic tunnel junction (MTJ) sensors for industrial and automotive systems.

On the demand side, the ramp-up of 5G—China alone is projected to reach 1.6 billion 5G connections by 2030, nearly one-third of the global base—will expand device counts and bandwidth, intensifying needs for power-efficient memory and signal-processing components. Supply-side drivers include maturing foundry support for MRAM at advanced nodes, rising yields, and public-private R&D aimed at spin-orbit torque devices, racetrack memory, and spin-based logic. Key challenges remain: materials integration with BEOL processes, variability at scale, capital intensity, and exposure to semiconductor cyclicality and export controls.

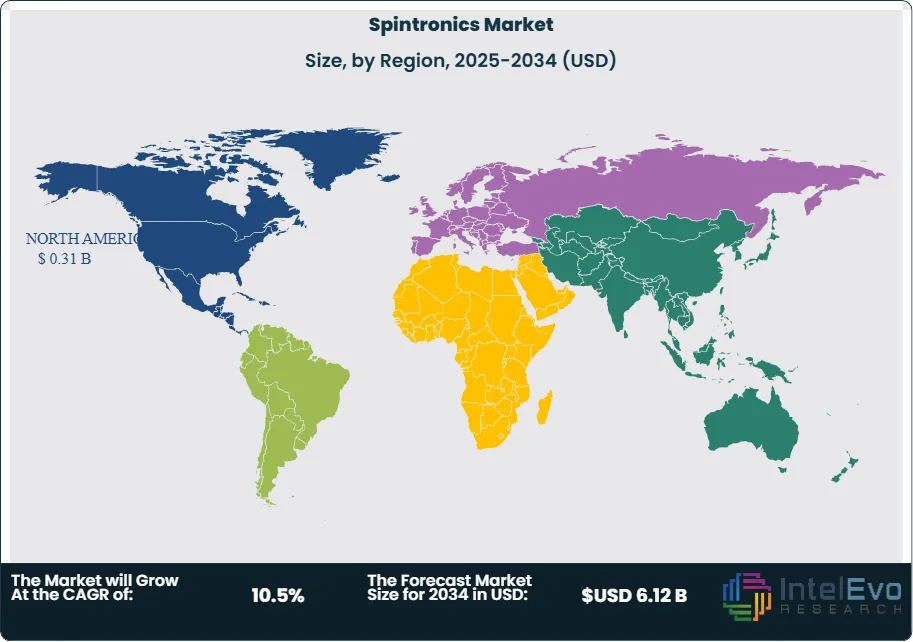

Regionally, Asia Pacific remains the manufacturing nucleus despite 2023 contraction in China (-14.0%) and broader APAC (-10.1%), while Japan (-3.1%) and the Americas (-5.2%) showed comparatively smaller declines; over the forecast, North America and Europe are poised to attract investment under onshoring and resilience agendas, with Korea and Taiwan as critical ecosystem anchors and India emerging as a design and packaging hub.

For investors, near-term hotspots include automotive-grade MRAM and TMR sensors, data-center-class persistent memory for AI workloads, and partnerships that align device innovation with wafer-level scalability, IP portfolios, and reliability standards (AEC-Q100, ISO 26262), positioning spintronics as a strategic enabler of efficient computing through 2034.

Key Takeaways

- Market Growth: The global spintronics market stood at USD 0.87 Billion in 2024 and is projected to reach USD 6.12 Billion by 2034, a 10.5% CAGR, underpinned by AI/ML workloads, edge-to-cloud architectures, and demand for low-power, non-volatile memory and precision magnetic sensing. Semiconductor cyclicality eased in late 2023, improving the capex backdrop for next-gen memory and sensor nodes.

- Technology: Giant Magnetoresistance (GMR) led in 2023 with ~32.6% share, supported by its maturity in HDD read heads and cost-efficient magnetic tunnel junction (MTJ) stacks for high-volume sensing. GMR’s entrenched supply chain and proven reliability maintain an installed-base advantage versus newer SOT devices.

- Application: Data Storage accounted for >35% of 2023 revenue as STT-MRAM begins displacing SRAM/eFlash in caches and embedded memory while HDDs remain vital for hyperscale cold storage. Adoption is propelled by faster access speeds, endurance, and energy savings in consumer, enterprise, and cloud workloads.

- Driver: Scale effects from network upgrades and compute demand are accelerating spintronics adoption—global semiconductor sales rebounded in late 2023 (Q4 at USD 146.0 billion, +11.6% YoY) and China alone is expected to reach ~1.6 billion 5G connections by 2030, expanding the device base that benefits from MRAM and TMR sensors.

- Restraint: Integration complexity (BEOL thermal budgets, variability, endurance retention trade-offs) and semiconductor cyclicality are near-term brakes; global chip sales declined 8.2% in 2023, pressuring near-term tool purchases and extending time-to-yield for new spin-based processes.

- Opportunity: Automotive and industrial use of TMR/AMR sensors and AEC-Q qualified MRAM represents a high-growth pocket, with automotive electronics outpacing broader semis; mobility-linked spintronic components are poised for ~10% CAGR through 2033 as ADAS, xEV platforms, and safety requirements scale.

- Trend: Foundry enablement of embedded MRAM at 22–28 nm (e.g., Samsung, GlobalFoundries, TSMC) is shifting the mix from GMR-only toward STT-MRAM and early SOT-MRAM, enabling persistent caches and fast boot for edge AI MCUs and industrial controllers; design-ins are rising for 2025–2027 ramps.

- Regional Analysis: North America led with ~35.4% share in 2023 on strong R&D and hyperscale demand; Asia Pacific remains the manufacturing hub despite 2023 contractions (China −14.0%, APAC −10.1%), while Europe benefits from sovereignty initiatives and India emerges in design/OSAT. Investors should watch Korea and Taiwan for ecosystem scale and IP depth.

Technology Analysis

Spintronics technologies are consolidating into two volume pillars by 2025: magnetoresistance sensing (GMR/TMR) and embedded non-volatile memories (primarily STT-MRAM). GMR remains the workhorse in HDD read heads and commodity magnetic sensors, anchoring the installed base and cost structure; TMR is increasingly preferred in precision sensors and next-generation heads as signal-to-noise requirements tighten with ultra-high areal densities enabled by HAMR roadmaps (30TB drives are now broadly shipping). At the memory layer, eMRAM is moving from option to roadmap default at leading foundries: Samsung mass-produced 28nm eMRAM and outlined a 14nm→8nm→5nm shrink path, GlobalFoundries’ 22FDX® eMRAM is in volume, and TSMC has 22ULL eMRAM in production with automotive-grade initiatives

Beyond STT-MRAM, device innovation is shifting toward spin-orbit-torque (SOT) write schemes to lower power and accelerate write latency, while ReRAM emerges as a rival for embedded code storage at 22–40nm nodes. TSMC and ecosystem partners have accelerated embedded ReRAM—complementing eMRAM—as an eFlash replacement for IoT/MCUs, with 22nm platforms qualified and 12nm consumer-grade RRAM demonstrated. These parallel pathways—STT today, SOT/RRAM next—underpin a pragmatic tech stack: MRAM where endurance/latency dominate; ReRAM where density/cost per bit drive selection.

Application Analysis

Data storage remains the largest value pool, supported by hyperscale deployments that favor HDDs for cold storage and sequential AI data lakes. Seagate’s commercial release of 30TB HAMR drives and ongoing 40TB customer sampling lift capacity per rack, keeping GMR/TMR read heads economically relevant even as NAND scales vertically. In parallel, MRAM—both discrete and embedded—continues to gain share in caches, boot code, and wear-sensitive logs where non-volatility and endurance matter; specialist vendor Everspin remained active through 2024–2025 despite cyclical softness, illustrating steady end-market pull.

Sensor applications—particularly TMR in automotive position/speed sensing and industrial condition monitoring—are expanding with electrification and safety regulations, while spintronic logic and quantum computing stay largely pre-commercial but strategically funded. The application mix is therefore bifurcating: near-term revenue anchored in storage and embedded NVM; medium-term upside tied to intelligent sensing and early spin-logic demonstrators integrated into advanced packaging.

End-Use Analysis

Automotive and industrial equipment are the fastest-growing adopters of spintronics, driven by software-defined vehicles (SDV), functional safety, and harsh-environment requirements. Foundry-backed automotive-grade eMRAM (e.g., TSMC’s collaboration with NXP at 16nm FinFET) targets over-the-air update durability and instant-on behavior, while TMR sensors proliferate across xEV traction inverters, e-axles, and ADAS actuators.

Consumer and enterprise electronics remain foundational: embedded MRAM in MCUs and application processors shortens boot cycles and reduces standby leakage for premium devices, whereas data-center operators deploy HAMR-based HDD tiers to lower $/TB for AI pipelines. The net effect is a barbell demand profile—high-reliability automotive/industrial designs growing at double-digit CAGRs alongside hyperscale storage refreshing at the platform level.

Regional Analysis

North America retains outsized influence in 2025 given its concentration of hyperscale buyers, HDD suppliers, and materials/device R&D, sustaining the region’s leadership established in 2023. Europe is stepping up with sovereignty-led funding and an emerging memory focus; notably, TSMC expanded advanced MRAM/RRAM development in the region to target automotive and AI edge applications

Asia Pacific remains the manufacturing and deployment epicenter. China’s 5G trajectory—projected to reach ~1.6 billion connections by 2030 and contribute ~$260 billion to GDP—widens the addressable base for spintronic memories and sensors across handsets, infrastructure, and IoT. Concurrently, Korea and Taiwan anchor the foundry ecosystem for eMRAM/eRRAM, while U.S.–APAC supply chains co-evolve around high-capacity HAMR storage for cloud and AI.

Get More Information about this report -

Request Free Sample ReportMarket Key Players

By Technology

- Giant Magnetoresistance (GMR)

- Tunnel Magnetoresistance (TMR)

- Spin-Transfer Torque (STT)

- Spin Hall Effect

- Other Technologies

By Application

- Data Storage

- Magnetic Random Access Memory (MRAM)

- Sensors

- Semiconductor Devices

- Spintronic Logic and Quantum Computing

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 0.87 B |

| Forecast Revenue (2034) | USD 6.12 B |

| CAGR (2024-2034) | 10.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Technology (Giant Magnetoresistance (GMR), Tunnel Magnetoresistance (TMR), Spin-Transfer Torque (STT), Spin Hall Effect, Other Technologies), By Application (Data Storage, Magnetic Random Access Memory (MRAM), Sensors, Semiconductor Devices, Spintronic Logic and Quantum Computing) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | IBM Corporation, Rhomap Ltd., Toshiba Corporation, Spin Memory, Inc., Organic Spintronics S.A., Samsung Electronics Co., Ltd., NVE Corporation, Intel Corporation, Spintronics International Pte. Ltd., Everspin Technologies, Inc., Avalanche Technology, Inc., Spin Transfer Technologies, Inc., QuantumWise A/S, Advanced MicroSensors Corporation (AMS), Crocus Technology, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date