Sports Betting Software Market Size, Share & Forecast | 10.8% CAGR

Global Sports Betting Market Size, Share & Analysis By Deployment Mode (Cloud, On-Premises), By End-User (Bookmakers, Betting Enthusiasts, Casinos, Others (including media companies, sports leagues, and organizations)), By Sports Type (Football (Soccer), Basketball, Baseball, American Football, Tennis, Horse Racing, Others) Demographics Industry Outlook, Regulatory Landscape, Revenue Models, Key Players & Forecast 2025–2034

Report Overview

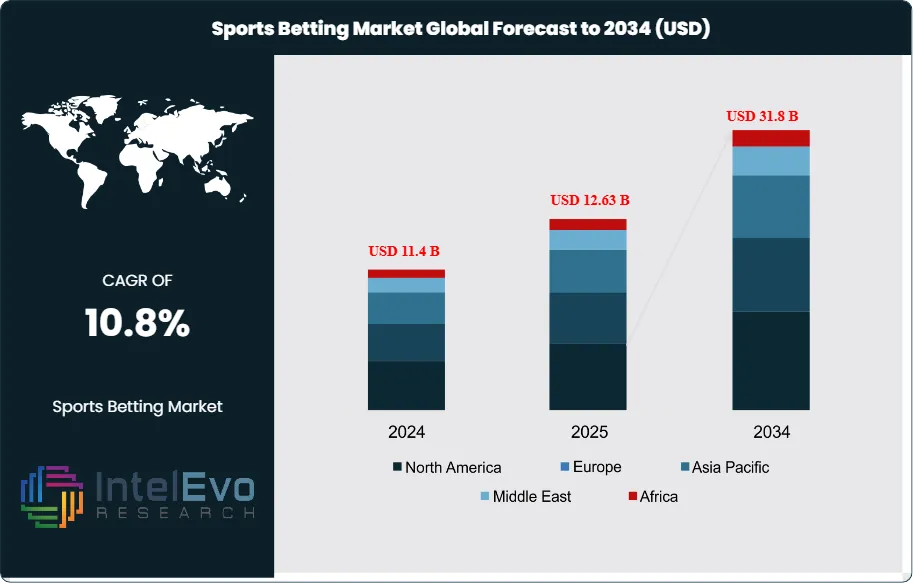

The Sports Betting Software Market is projected to grow from USD 11.4 Billion in 2024 to approximately USD 31.8 Billion by 2034, expanding at a CAGR of around 10.8% during 2025–2034. Rapid legalization of sports betting, coupled with digital transformation and mobile gaming innovation, is fueling global market expansion. AI-powered odds generation, blockchain-based transparency, and secure payment integration are revolutionizing user engagement across platforms. As esports and real-time data analytics reshape betting experiences, software providers are unlocking new revenue streams and fan interaction models worldwide. This driven by the rapid legalization of sports betting and the accelerating shift toward digital platforms, offering strategic opportunities for operators, investors, and technology providers.

Get More Information about this report -

Request Free Sample ReportSports betting software encompasses advanced digital platforms that enable bettors to place wagers across a wide spectrum of sporting events while offering operators robust tools for managing betting operations. These platforms integrate real-time odds, secure payment systems, predictive analytics, and customizable interfaces, ensuring both an enhanced user experience and operational efficiency. The widespread adoption of smartphones and improved internet connectivity has significantly fueled the expansion of online betting, transforming the sector into a mainstream entertainment and investment channel.

Several growth drivers are shaping the market trajectory. The surge in demand for mobile betting applications, coupled with evolving regulatory frameworks in North America, Europe, and parts of Asia, has created favorable conditions for expansion. In the United States, for instance, sports betting app revenues surged by 71% in 2022, reaching USD 7.4 billion, underscoring the sector’s rapid digital penetration. Similarly, the United Kingdom recorded £2.36 billion in revenues from sports betting applications in the same year, supported by strong consumer adoption, established sporting culture, and transparent regulatory oversight. However, challenges such as stringent compliance requirements, cybersecurity threats, and rising competition from emerging providers remain critical considerations for market participants.

Technological innovations are central to market differentiation. Software developers are leveraging machine learning, artificial intelligence, and big data analytics to deliver advanced prediction models, personalized betting recommendations, and fraud detection mechanisms. These innovations not only enhance user engagement but also strengthen trust and transparency across platforms. Additionally, gamification features, interactive betting formats, and multi-sport integration are further elevating customer retention.

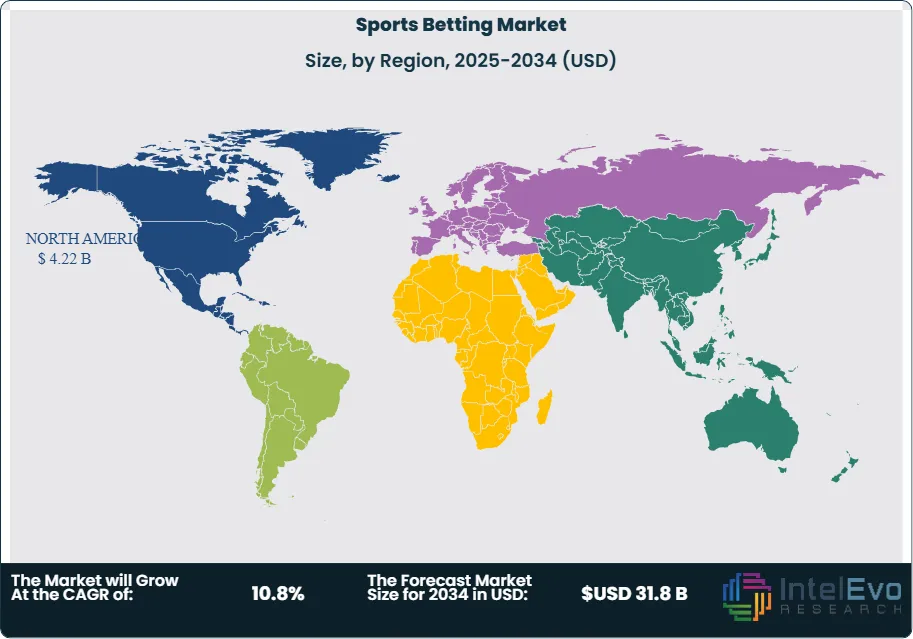

From a regional perspective, North America is emerging as one of the most lucrative markets due to the steady legalization of sports betting across multiple U.S. states. Europe remains a mature and well-regulated hub, driven by established operators and sophisticated customer bases. Meanwhile, Asia-Pacific is expected to present strong growth opportunities, supported by rising internet penetration, digital wallets, and expanding sports fan bases. Collectively, these dynamics position the global sports betting software market as a rapidly evolving sector with compelling prospects for long-term growth and investment.

Key Takeaways

- Market Growth: The global Sports Betting Software Market is projected to reach USD 31.8 Billion by 2034, expanding at a CAGR of 10.8% (2024–2033), driven by the growing adoption of digital betting platforms and expanding user engagement.

- Deployment Model: The Cloud-based segment led the market in 2023 with a 69.3% share, reflecting the shift toward scalable, flexible, and cost-efficient betting solutions.

- End-User: The Bookmakers segment accounted for 34.5% of the market in 2023, underscoring its central role in driving software adoption and operational demand.

- Sports Type: Football (Soccer) dominated sports betting categories, capturing over 30% share in 2023, fueled by global fan engagement and widespread betting activity across major leagues and tournaments.

- Driver: Increasing legalization of sports betting across multiple regions and the rapid integration of digital platforms are accelerating market penetration.

- Restraint: Regulatory complexities and inconsistent gambling laws across jurisdictions pose significant barriers to uniform global adoption.

- Opportunity: Advancements in AI-driven analytics, real-time data integration, and personalized betting experiences present substantial growth potential for software vendors.

- Trend: Cloud migration and mobile-first betting platforms are emerging as transformative trends, reshaping customer engagement and expanding access to real-time betting.

- Regional Analysis: North America led the market in 2023 with a 36.8% share, supported by regulatory liberalization in the U.S. and rising digital betting adoption, while Europe and Asia-Pacific remain high-growth regions due to strong sports culture and increasing smartphone penetration.

Deployment Mode Analysis

By 2025, cloud-based deployment continues to lead the global sports betting software market, accounting for well over two-thirds of total adoption. This dominance reflects the clear advantages of cloud infrastructure compared to traditional on-premises systems. Cloud platforms provide unmatched scalability, enabling operators to handle sharp spikes in betting volumes during high-profile sporting events and tournaments.

In addition to scalability, the cloud model significantly lowers capital and operational expenditures, reducing reliance on physical infrastructure and maintenance. It also facilitates faster integration of real-time betting features, dynamic odds updates, and in-play betting capabilities—critical differentiators for retaining bettors in a competitive marketplace. Security and compliance, a top concern for operators, are also strengthened through partnerships with established cloud providers, many of whom offer advanced data protection, fraud prevention, and regulatory alignment tools.

Beyond cost and security, cloud platforms are proving integral to innovation. Technologies such as artificial intelligence and blockchain are more seamlessly deployed in cloud environments, enabling bookmakers to deliver personalized betting experiences, predictive analytics, and transparent digital transactions. This ability to adapt rapidly to regulatory shifts and evolving consumer expectations ensures the continued dominance of cloud-based deployments through the forecast period.

End-User Analysis

In 2025, bookmakers remain the largest end-user segment in the sports betting software industry, representing over one-third of total market share. Their role as the primary intermediaries between bettors and platforms ensures steady demand for advanced software solutions that can manage odds setting, bet settlement, compliance, and large-scale transaction volumes.

The expansion of legalized betting across multiple jurisdictions has been a decisive growth driver, prompting bookmakers to adopt robust software platforms capable of scaling with market opportunities. Enhanced features such as live betting, cash-out options, and automated risk management tools further strengthen the appeal of bookmakers’ platforms to bettors worldwide.

Moreover, bookmakers are increasingly leveraging data-driven tools, including machine learning algorithms and behavioral analytics, to better understand wagering patterns and personalize customer experiences. These insights not only boost engagement but also help optimize margins and improve customer retention. As the global betting landscape becomes more competitive, bookmakers’ ability to innovate through software adoption will remain a cornerstone of their market leadership.

Sports Type Analysis

Football (soccer) continues to be the most lucrative sports type within the betting software market in 2025, accounting for more than 30% of activity. This dominance is rooted in the sport’s unrivaled global fan base and the continuous stream of matches played across leagues, tournaments, and international competitions. Events such as the FIFA World Cup, UEFA Champions League, and leading domestic leagues consistently drive surges in betting volumes.

Sports betting software tailored for football provides comprehensive market coverage, including pre-match and live betting options, player performance wagers, and long-term bets on tournament outcomes. These platforms increasingly integrate AI-powered predictive analytics and real-time data feeds, which enhance odds accuracy and improve user engagement.

The rising popularity of mobile betting apps and interactive features has further cemented football’s position as the top betting category. With enhanced functionality such as micro-betting on specific in-game actions and social betting features, software providers are unlocking new engagement opportunities. As technology continues to evolve, football is expected to remain the most dynamic and revenue-generating segment of the sports betting market.

Regional Analysis

North America holds a commanding position in the global sports betting software market in 2025, with more than one-third of global share. The region’s growth trajectory is strongly influenced by the accelerating legalization of sports betting across U.S. states and Canadian provinces. The market, valued at nearly USD 3.8 billion in 2023, has expanded considerably as regulatory frameworks have matured, attracting substantial investment from both domestic and international operators.

The presence of major sports leagues—including the NFL, NBA, MLB, and NHL—provides a powerful cultural and commercial foundation for betting activity. These leagues, often in partnership with betting platforms, are integrating wagering features into broadcasting, streaming, and fan engagement channels, driving mainstream adoption.

North America’s advanced digital infrastructure has also been instrumental in supporting the rollout of feature-rich betting applications and seamless mobile platforms. Strategic collaborations between software providers, sports franchises, and technology firms have further strengthened the ecosystem, legitimizing betting as a mainstream entertainment activity. With additional U.S. states expected to legalize sports betting and technology-driven innovations reshaping user experiences, North America is poised to sustain its leadership in the global sports betting software market well into the next decade.

Get More Information about this report -

Request Free Sample Report

Market Key Segments

By Deployment Mode

- Cloud

- On-Premises

By End-User

- Bookmakers

- Betting Enthusiasts

- Casinos

- Others (including media companies, sports leagues, and organizations)

By Sports Type

- Football (Soccer)

- Basketball

- Baseball

- American Football

- Tennis

- Horse Racing

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 11.4 B |

| Forecast Revenue (2034) | USD 31.8 B |

| CAGR (2024-2034) | 10.8% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Deployment Mode (Cloud, On-Premises), By End-User (Bookmakers, Betting Enthusiasts, Casinos, Others (including media companies, sports leagues, and organizations)), By Sports Type (Football (Soccer), Basketball, Baseball, American Football, Tennis, Horse Racing, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DraftKings Inc., Flutter Entertainment PLC, Betsson AB, 888 Holdings PLC, Entain, William Hill, GammaStack, Fexle, Kindred Group, Bet365 Group Ltd., Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Sports Betting Market?

The Sports Betting Software Market is projected to grow from USD 11.4 Billion in 2024 to USD 31.8 Billion by 2034, at a CAGR of 10.8%. Rising digital transformation, AI-driven betting analytics, and mobile-friendly platforms are revolutionizing global sports wagering experiences and driving market expansion.

Who are the major players in the Sports Betting Market?

DraftKings Inc., Flutter Entertainment PLC, Betsson AB, 888 Holdings PLC, Entain, William Hill, GammaStack, Fexle, Kindred Group, Bet365 Group Ltd., Other Key Players

Which segments covered the Sports Betting Market?

By Deployment Mode (Cloud, On-Premises), By End-User (Bookmakers, Betting Enthusiasts, Casinos, Others (including media companies, sports leagues, and organizations)), By Sports Type (Football (Soccer), Basketball, Baseball, American Football, Tennis, Horse Racing, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date