Squalene Market Size, Trends & Forecast 2025–2034 | 8.9% CAGR

Global Squalene Market Size, Share, Analysis Report By Source (Plants, Animal, Synthetic), Extraction Method (Supercritical Fluid Extraction (SFE), Molecular Distillation, Counter Current Chromatography (CCC)), End-Use (Personal Care & Cosmetics, Pharmaceuticals, Food Supplements, Others), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

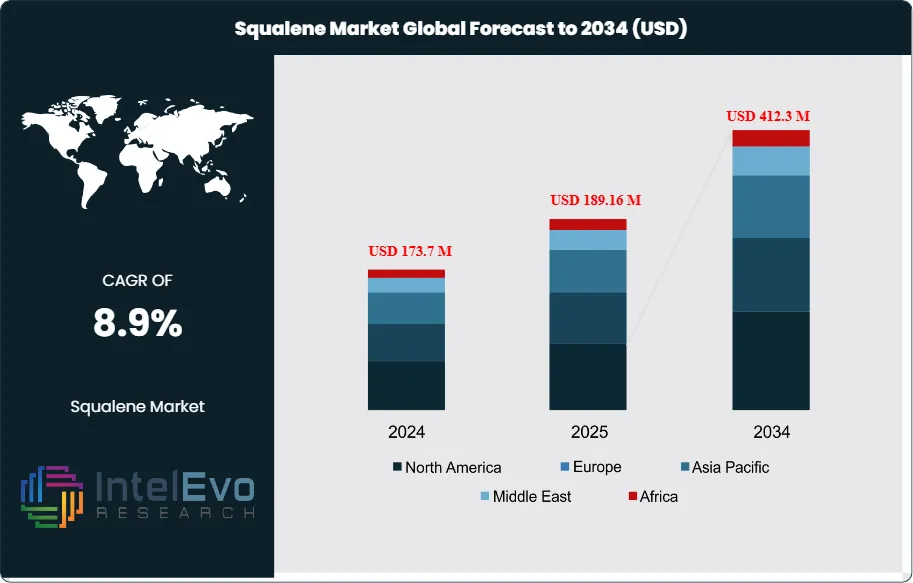

The Squalene Market size is expected to be worth around USD 412.3 million by 2034, from USD 173.7 million in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034. The market growth is driven by the rising use of squalene in pharmaceutical formulations, cosmetics, and dietary supplements, supported by an increasing preference for bio-based and sustainable sources. Moreover, the adoption of plant-derived squalene continues to expand due to ethical and environmental considerations, boosting global production and innovation in the personal care and healthcare sectors.

Get More Information about this report -

Request Free Sample ReportSqualene is a naturally occurring triterpene hydrocarbon predominantly found in shark liver oil, as well as in plant sources like olives, amaranth seeds, and sugarcane. Renowned for its exceptional moisturizing, antioxidant, and emollient properties, squalene has become a vital ingredient in various industries, including cosmetics, pharmaceuticals, and nutraceuticals. The global squalene market has witnessed significant growth, driven by increasing consumer demand for natural and sustainable products, advancements in extraction technologies, and expanding applications across multiple sectors.

This growth is primarily attributed to the rising consumption of natural ingredients in the personal care and cosmetics sector, where squalene is favored for its non-toxic and moisturizing properties. The shift towards plant-based and synthetic sources, driven by environmental concerns and regulatory frameworks, has further propelled market expansion.

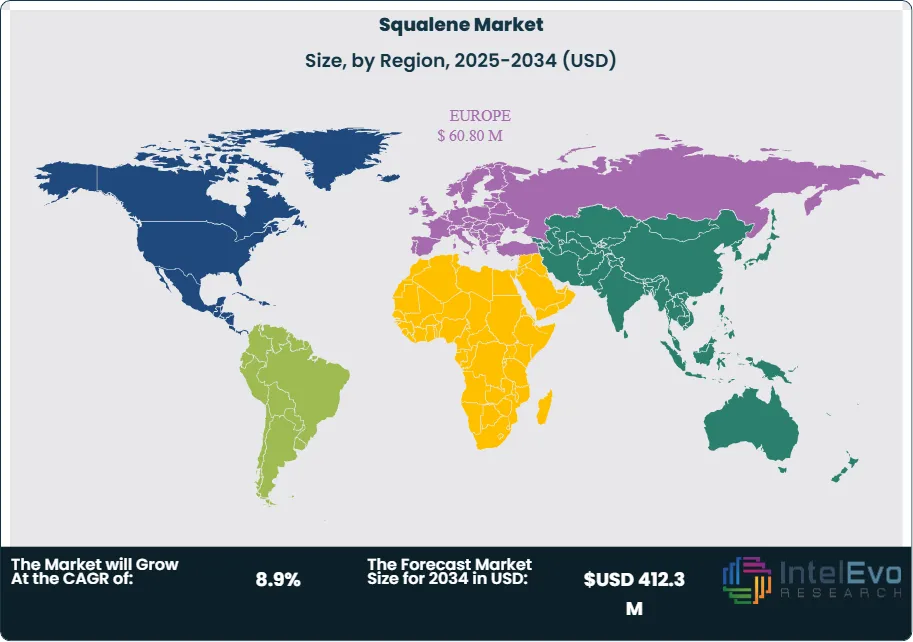

Europe dominated the global squalene market in 2023, this dominance is attributed to the region's robust cosmetics and pharmaceutical industries, stringent regulations promoting sustainable sourcing, and high consumer awareness regarding natural products. Countries like France, Germany, and Italy are key contributors, with significant investments in research and development for bio-based ingredients.

The COVID-19 pandemic had a multifaceted impact on the squalene market. On one hand, disruptions in supply chains and reduced manufacturing capacities affected the production and distribution of squalene-based products. On the other hand, the heightened focus on health and immunity led to increased demand for pharmaceuticals and dietary supplements containing squalene. Moreover, squalene's application as an adjuvant in vaccine development garnered significant attention, further emphasizing its importance in the pharmaceutical sector during the pandemic.

Key Takeaways:

- Market Growth: The Squalene Market is expected to reach USD 412.3 million by 2034, growing at a robust CAGR of 8.9% from 2024, fueled by consumer demand for natural and sustainable products, technological advancements in production, and expanding applications across various industries.

- Source Dominance: Plant-based squalene currently leading due to rising demand for sustainable and ethical ingredients. Synthetic squalene is expected to witness notable growth in the future, driven by advancements in biotechnology and scalability.

- Extraction Method Dominance: Molecular Distillation is currently leading due to its efficiency and scalability. However, Supercritical Fluid Extraction is anticipated to grow rapidly in the future, driven by its eco-friendliness and high purity yield.

- End-Use Dominance: Personal Care & Cosmetics currently dominate due to squalene’s moisturizing and antioxidant properties, while Pharmaceuticals are poised to grow the fastest owing to expanding therapeutic applications and increasing research investment.

- Driver: The driving factors include the rising demand for natural ingredients in personal care products and the expansion of its applications in the pharmaceutical sector, particularly as a vaccine adjuvant.

- Restraint: The squalene market faces challenges due to ethical concerns over shark-derived sources and the high costs associated with plant-based alternatives, impacting supply chains and pricing.

- Opportunity: Opportunities in the squalene market include the development of sustainable production methods and the expansion into emerging markets with growing demand for natural health and beauty products.

- Trend: Key trends in the squalene market include a shift towards plant-based sources and the incorporation of squalene into multifunctional skincare and health products, reflecting consumer preferences for sustainability and efficacy.

- Regional Analysis: European region dominates the global squalene market, driven by stringent regulations favoring sustainable and ethical sourcing, as well as a highly mature cosmetic and pharmaceutical industry.

Source Analysis:

Plant-derived squalene primarily sourced from olives, amaranth seed, and sugarcane has gained popularity. It appeals strongly to cosmetics and pharmaceutical companies that prioritize eco-friendly and cruelty-free sourcing. Plant-based squalene aligns with the rising trend of vegan and clean-label beauty products, making it the leading segment in terms of both volume and value.

Synthetic squalene is expected to grow at the fastest rate due to breakthroughs in biotechnology, offering a stable, ethical, and cost-efficient alternative. As the demand for pharmaceutical-grade squalene rises especially for vaccine adjuvants synthetic sources provide a consistent supply chain, boosting long-term adoption.

Extraction Method Analysis:

Molecular Distillation remains the most widely adopted due to its proven ability to extract high-purity squalene from natural sources such as olive oil or shark liver oil with excellent efficiency. This method is particularly valued in the cosmetics and pharmaceutical industries for maintaining thermal stability and minimizing product degradation. Its scalability and cost-effectiveness make it the leading extraction method in the current market.

SFE is projected to experience the fastest growth as sustainability, purity, and solvent-free extraction become central to industry standards. Its alignment with green chemistry and clean-label product trends supports its rising adoption in cosmetics and nutraceuticals.

End-Use Analysis:

Personal Care & Cosmetics Leads With over 60% Market Share in Squalene Market. Personal Care & Cosmetics remains the leading end-use segment in the squalene market. This dominance stems from squalene’s exceptional emollient, hydrating, and skin-replenishing properties, making it a preferred ingredient in moisturizers, anti-aging creams, and sunscreens. The growing consumer preference for natural and sustainable cosmetic ingredients particularly plant-based squalene further drives demand in this sector. Pharmaceutical applications are expanding rapidly due to squalene’s use in vaccine adjuvants and drug delivery systems, supported by increasing healthcare investment and scientific validation.

Region Analysis:

Europe Leads With over 35% Market Share in Squalene Market. Europe holds a commanding position in the global squalene market, attributed to its strong inclination toward environmentally responsible and cruelty-free sourcing. The EU’s regulatory frameworks (e.g., REACH and EU Cosmetics Regulation) emphasize the use of bio-based, non-animal-derived squalene, thereby accelerating the adoption of plant-based and synthetic variants. Countries like France, Germany, and Italy are frontrunners, hosting several cosmetic giants and pharmaceutical leaders that integrate squalene for its emollient, antioxidant, and immune-enhancing properties.

Asia-Pacific, while historically significant due to shark-based production in Japan and China, is now experiencing a paradigm shift toward more ethical plant-derived and synthetic squalene. Growing middle-class affluence, rising skincare trends (particularly in South Korea and China), and the expansion of domestic pharmaceutical industries are contributing to the region’s rapid growth trajectory.

North America benefits from advanced extraction technologies, increasing demand for natural ingredients, and an aging population driving pharmaceutical and nutraceutical uptake. However, the market here is more saturated compared to Asia-Pacific.

Latin America and the Middle East & Africa are in nascent stages of market development. Their potential lies in increasing urbanization, expanding retail networks, and improving access to cosmetic and healthcare products.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Source

- Animal-based Squalene

- Plant-based Squalene

- Synthetic/Bio-based Squalene

By End-Use Industry

- Cosmetics & Personal Care

- Pharmaceuticals

- Food & Dietary Supplements

- Others (Biofuels, Industrial Applications)

By Form

- Liquid Squalene

- Powder Squalene

By Extraction Method

- Supercritical Fluid Extraction (SFE)

- Molecular Distillation

- Counter Current Chromatography (CCC)

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 189.16 M |

| Forecast Revenue (2034) | USD 412.3 M |

| CAGR (2025-2034) | 8.9% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Source: Animal-based Squalene, Plant-based Squalene, Synthetic/Bio-based Squalene, By End-Use Industry: Cosmetics & Personal Care, Pharmaceuticals, Food & Dietary Supplements, Others (Biofuels, Industrial Applications), By Form: Liquid Squalene, Powder Squalene, By Extraction Method: Supercritical Fluid Extraction (SFE), Molecular Distillation, Counter Current Chromatography (CCC) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | KISHIMOTO SPECIAL LIVER OIL CO. LTD., Amyris Inc., AASHA BIOCHEM, Nucelis, NUCELIS LLC, SOPHIM, Oleicfat, Arbee, Kuraray Co. Ltd, Evonik Industries AG, Gracefruit Ltd, Arista Industries, VESTAN, Empresa Figueirense de Pesca |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date