Stainless Steel Flexible Hose Market Size | 5.8% CAGR

Global Stainless Steel Flexible Hose Market Size, Share & Analysis By Product Type (Corrugated Hoses, Strip-Wound Hoses), By Steel Grade (304 SS, 316 SS, 321 SS), By Application (Oil & Gas, Chemical, Automotive, Pharmaceutical, HVAC Systems, Others) By End-User Industry Industry Regions & Key Players – Durability Advantages, Safety Standards & Forecast 2025–2034

Report Overview

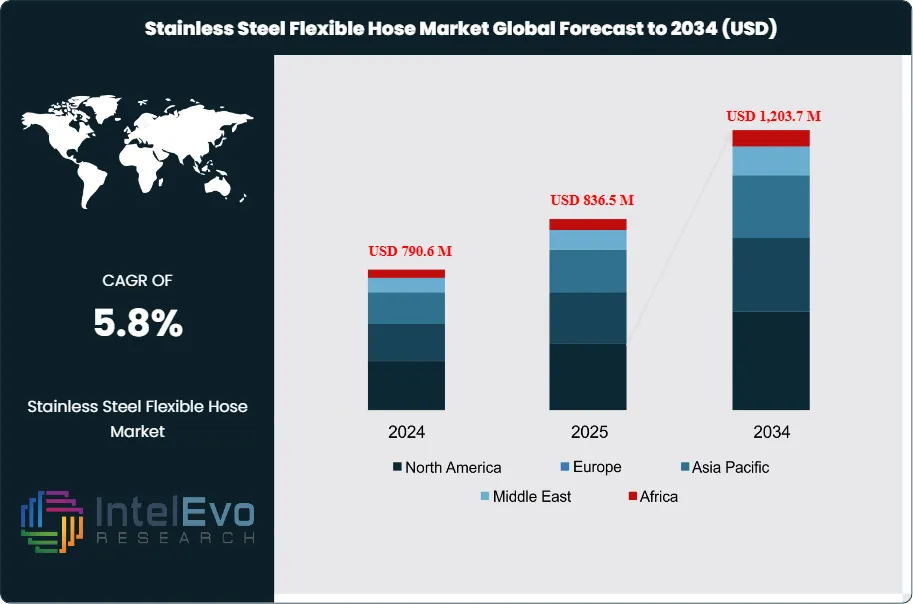

The Stainless Steel Flexible Hose Market is estimated at USD 790.6 million in 2024 and is on track to reach nearly USD 1,203.7 million by 2034, reflecting a steady CAGR of 5.8% during 2025–2034. This rise is fueled by the global shift toward hygienic, corrosion-resistant, and high-durability components across food, chemical, and energy industries. As automation accelerates and safety regulations tighten worldwide, stainless-steel hoses are becoming a default choice for CIP systems and high-purity operations. With Industry 4.0 integrations and smart hose technologies gaining momentum, the market is rapidly attracting attention across engineering, manufacturing, and industrial innovation platforms.

Get More Information about this report -

Request Free Sample ReportThis growth trajectory reflects the expanding application of stainless-steel flexible hoses across critical industrial sectors such as food and beverage, pharmaceuticals, petrochemicals, and power generation. These components are valued for their durability under extreme temperatures, pressure conditions, and corrosive environments. As industrial processes demand higher performance and compliance with stringent safety and sanitation standards, stainless steel flexible hoses have emerged as indispensable solutions—particularly in settings requiring hygienic fluid transfer, vibration absorption, and alignment flexibility.

The market's evolution is closely tied to the accelerating growth of the global food processing industry. For instance, India's food processing sector, valued at INR 30 lakh crore (approximately USD 360 billion) in FY2022, is projected to expand at a CAGR exceeding 10.4% through FY2026, according to the Ministry of Food Processing Industries. This growth directly influences demand for CIP-compatible and FDA-compliant hose assemblies, particularly in dairy, meat, and beverage processing plants. Similarly, the U.S. FDA and USDA regulations mandating the use of food-grade and hygienic components are propelling adoption across North America and other mature markets.

Government-led industrial modernization efforts and incentive programs further contribute to market momentum. India's Production Linked Incentive (PLI) scheme for the food sector, which allocated INR 10,900 crore (USD 1.31 billion) in 2023, has incentivized upgrades in manufacturing capabilities, thereby increasing demand for flexible, high-performance hoses. Export-driven economies also demonstrate rising demand: India's food exports reached USD 19.69 billion in 2022–23, underscoring the need for reliable, sanitary-grade equipment.

Technological innovation is a key enabler of market expansion. The integration of smart sensors for predictive maintenance and the adoption of Industry 4.0 principles are transforming traditional hose assemblies into intelligent systems capable of minimizing downtime and ensuring continuous operational integrity. Environmentally, stainless steel’s recyclability aligns with global sustainability priorities, enhancing its appeal to environmentally conscious manufacturers and investors.

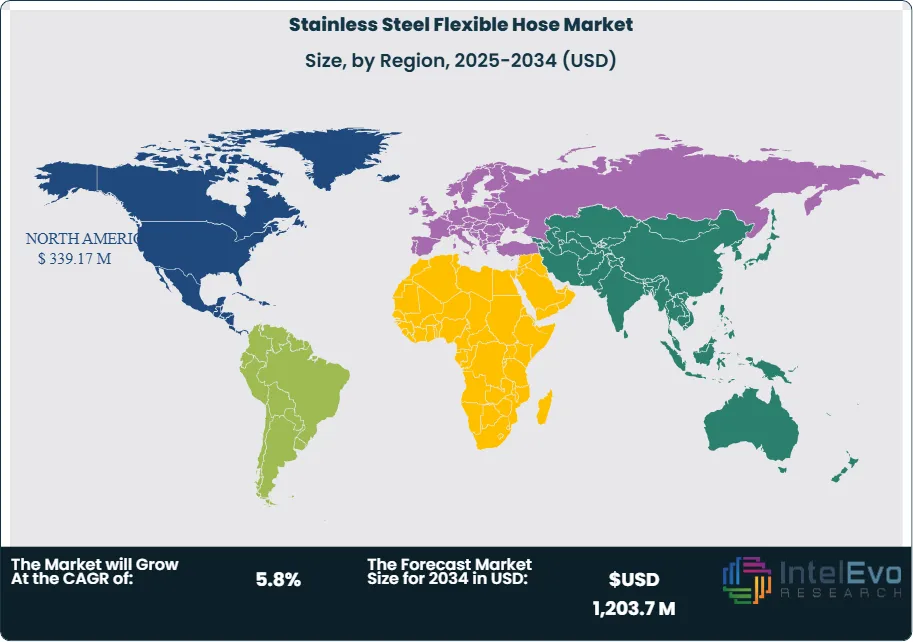

Regionally, North America and Asia-Pacific remain investment hotspots, with the latter emerging rapidly due to infrastructure growth and policy support. As regulatory frameworks tighten and digital transformation advances, stainless steel flexible hoses are poised for sustained, global demand over the next decade.

Key Takeaways

- Market Growth: The global Stainless Steel Flexible Hose market is projected to grow from USD 790.6 million in 2024 to USD 1,203.7 million by 2034, registering a CAGR of 5.8%. Growth is primarily driven by rising demand for high-performance fluid conveyance solutions across food processing, petrochemicals, and power generation industries.

- Product Type: Corrugated Hoses dominate the product landscape with a commanding 79.3% market share, owing to their superior flexibility, pressure resistance, and compatibility with a wide range of industrial applications.

- Material Type: 304 Stainless Steel (SS) emerged as the leading material choice, accounting for 51.9% of the market, due to its optimal balance between cost-efficiency, corrosion resistance, and regulatory compliance in hygienic environments.

- End Use Industry: The Oil & Gas sector holds the largest end-use share at 31.6%, driven by the sector’s reliance on robust hose assemblies for fluid handling, high-pressure tolerance, and resistance to corrosive environments.

- Driver: Increasing investment in food processing infrastructure, such as India's Production Linked Incentive (PLI) scheme worth INR 10,900 crore (USD 1.31 billion), is fueling demand for CIP-compatible stainless steel hoses compliant with FDA and USDA hygiene regulations.

- Restraint: High initial cost and complex manufacturing processes of stainless steel flexible hoses pose a barrier to widespread adoption in price-sensitive markets, particularly among small-scale industrial users.

- Opportunity: Rapid adoption of smart sensor-enabled hose systems for predictive maintenance presents a high-growth opportunity, particularly in automated manufacturing environments seeking to reduce unplanned downtime and extend asset life cycles.

- Trend: The rise of Industry 4.0 is accelerating the integration of intelligent hose assemblies with real-time monitoring capabilities, as seen in high-volume food and pharmaceutical manufacturing sectors aiming to enhance operational efficiency and regulatory compliance.

- Regional Analysis: North America leads the global market with a 42.9% share (USD 296.2 million in 2024), supported by stringent industrial safety standards and high-tech manufacturing adoption, while Asia-Pacific is emerging as a high-growth region due to infrastructure development, expanding food exports, and favorable policy initiatives.

By Product Type Analysis

As of 2025, corrugated stainless steel hoses continue to dominate the global market, accounting for approximately 79.3% of total revenue share. Their widespread adoption is largely driven by their exceptional structural flexibility and capacity to endure high pressure and temperature conditions, making them indispensable in demanding applications across oil & gas, automotive, and heavy manufacturing sectors. Corrugated hoses are engineered with a helical or annular corrugation pattern, allowing for superior vibration absorption, noise dampening, and movement compensation, which enhances performance and safety in dynamic operational environments.

While strip-wound hoses remain relevant in specific low-pressure or protective conduit applications, their market share is significantly lower due to limitations in pressure handling and flexibility. As global industries move toward more automated and high-precision systems—particularly in environments where reliability and regulatory compliance are non-negotiable—corrugated hoses are expected to maintain their market leadership well into the next decade.

By Steel Grade Analysis

304 stainless steel continues to lead the material segment, capturing over 51.9% of market share in 2025. Renowned for its balance of corrosion resistance, strength, and affordability, 304 SS is extensively used in water treatment, food processing, and chemical industries where hygiene, durability, and cost efficiency are paramount. Its performance in moderately corrosive environments and across a broad temperature range makes it a preferred choice for a variety of mid-range industrial applications.

316 stainless steel, while more expensive, is gaining traction in marine, pharmaceutical, and chemical processing industries due to its superior resistance to chloride-induced corrosion. Similarly, 321 SS, known for its stability at elevated temperatures, is used in aerospace and thermal systems. However, both grades remain niche compared to 304 SS. As global safety standards tighten and sustainability goals gain prominence, demand for high-grade, recyclable stainless materials—especially 304 and 316—will likely grow steadily across developed and emerging economies.

By Application Analysis

The oil and gas industry remains the dominant application sector in 2025, holding a 31.6% share of the global stainless steel flexible hose market. These hoses are mission-critical for upstream and downstream operations, including crude oil transfer, gas processing, and offshore drilling, where durability, pressure resistance, and fire safety are paramount. The ability of stainless steel hoses to withstand corrosive fluids and volatile environments positions them as essential components in ensuring both operational continuity and personnel safety.

Beyond oil and gas, HVAC systems and chemical processing industries are increasingly contributing to market demand. As global industrial infrastructure expands and modernization accelerates—especially in Asia-Pacific—applications in high-efficiency heating and cooling systems are boosting hose adoption. Meanwhile, pharmaceutical and food-grade applications are benefiting from stricter hygiene regulations, which mandate the use of clean, CIP-compatible materials like stainless steel, thereby expanding the overall application landscape.

By Region

North America continues to command a leading position in the global stainless steel flexible hose market, representing approximately 42.9% of total revenue, which equated to around USD 296.2 million in 2024. The region’s dominance is supported by stringent industrial standards, widespread infrastructure modernization, and strong demand from high-value sectors such as oil & gas, automotive, and pharmaceuticals. Regulatory agencies such as the FDA and OSHA enforce strict compliance, reinforcing demand for durable and hygienic hose systems.

Meanwhile, Asia Pacific is emerging as the fastest-growing regional market, driven by rapid industrialization, urban expansion, and governmental manufacturing incentives. Countries such as India, China, and South Korea are investing heavily in food processing, energy infrastructure, and smart manufacturing—all of which require high-performance fluid transfer systems. With rising foreign direct investment and increasing domestic consumption, Asia Pacific is forecasted to post a CAGR exceeding 6.5% over the forecast period, presenting a prime opportunity for both local and international hose manufacturers.

Europe, Latin America, and the Middle East & Africa also present growth potential, particularly in renewable energy, petrochemical expansion, and clean water infrastructure. However, challenges such as import dependency, pricing volatility, and uneven regulatory enforcement may temper growth rates in some of these regions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Corrugated Hoses

- Strip-Wound Hoses

By Steel Grade

- 304 SS

- 316 SS

- 321 SS

By Application

- Oil & Gas

- Chemical

- Automotive

- Pharmaceutical

- HVAC Systems

- Others

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 790.6 M |

| Forecast Revenue (2034) | USD 1,203.7 M |

| CAGR (2024-2034) | 5.8% |

| Historical data | 2021-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Corrugated Hoses, Strip-Wound Hoses), By Steel Grade (304 SS, 316 SS, 321 SS), By Application (Oil & Gas, Chemical, Automotive, Pharmaceutical, HVAC Systems, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Thunder Technologies LLC, Omega Flex Inc., Amnitec Ltd, Polyhose Incorporated, Aeroflex Industries Limited, Flexline Specialty Hose Assemblies, Witzenmann GmbH, Unisource Manufacturing Inc., Penflex Corporation, Plumberstar China, Others |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Stainless Steel Flexible Hose Market

Published Date : 04 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date