Stand-Alone Radio Receivers Market Size | CAGR 3.3% (2025–2034)

Global Stand-Alone Radio Receivers Market Size, Share & Consumer Electronics Analysis By Type (AM/FM Radios, Digital Radio Receivers (DAB/DAB+), Satellite Radio Receivers (SiriusXM, etc.), Internet Radio Receivers), By Distribution Channel (Offline, Online), Rural & Emergency Use Trends, Smart Radio Integration, Regional Demand Patterns & Forecast 2025–2034

Report Overview

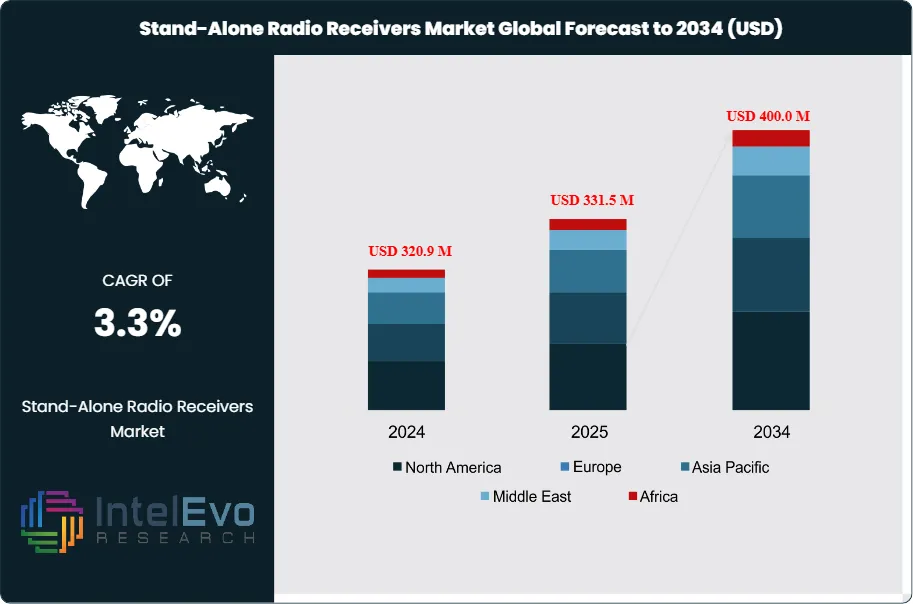

The Stand-Alone Radio Receivers Market is estimated at USD 320.9 million in 2024 and is projected to reach approximately USD 400.0 million by 2034, registering a CAGR of about 3.3% during 2025–2034. This steady growth is supported by the ongoing transition from analog to digital broadcasting standards, particularly DAB and HD Radio adoption across Europe and Asia-Pacific. Continued demand from rural households, emergency preparedness users, and aging consumer segments—along with the introduction of hybrid and smart-enabled radio models—will help sustain market relevance despite competitive pressure from streaming platforms.

Get More Information about this report -

Request Free Sample ReportThe market has shown steady resilience despite the proliferation of multifunctional devices such as smartphones and connected infotainment systems. While overall growth remains moderate, the sector continues to attract demand from both consumer and professional segments that value reliability, independence from internet connectivity, and long-term durability. Historical demand has been anchored by radio enthusiasts, rural populations, and professional broadcasters, and this base is now being reinforced by new use cases in emergency preparedness and outdoor recreation.

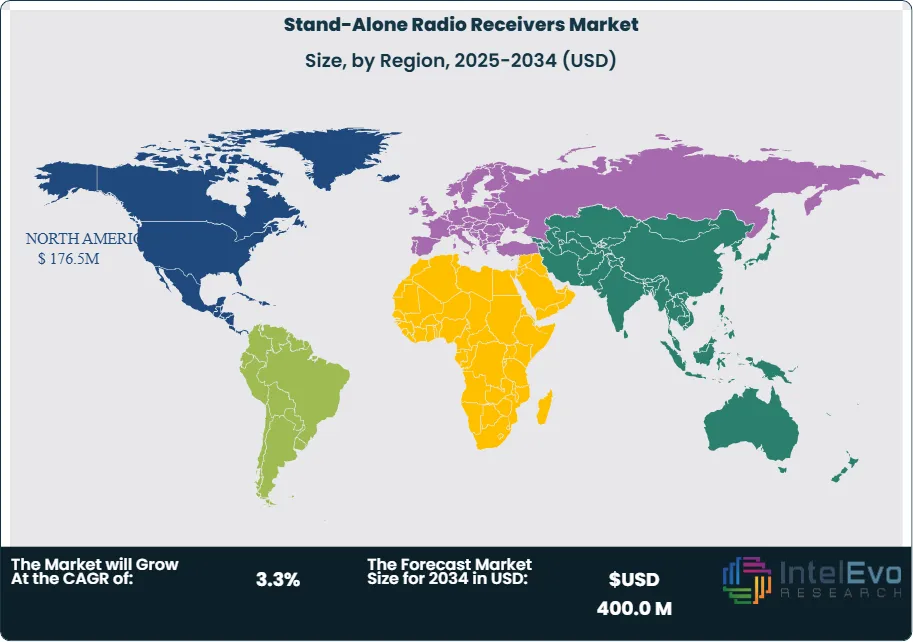

North America accounted for more than 58% of global revenue in 2024, generating approximately USD 179 million. The region benefits from a strong culture of radio listening, established broadcasting infrastructure, and consumer preference for dedicated devices in specific applications. Europe follows with steady demand in markets such as Germany and the UK, while Asia-Pacific is emerging as a growth hotspot due to rising adoption in rural communities and expanding consumer interest in affordable, portable devices. Investors should also monitor Latin America and Africa, where radio remains a primary channel for information dissemination in areas with limited internet penetration.

Several factors underpin the market’s trajectory. On the demand side, consumers continue to seek stand-alone radios for their simplicity, reliability, and independence from cellular or broadband networks. Emergency management agencies and NGOs also rely on these devices for disaster response and public safety communication. On the supply side, manufacturers face challenges from declining mass-market adoption and competition from multifunctional devices, but opportunities exist in niche categories such as ruggedized outdoor models and retro-style collectibles.

Technological progress is reshaping product appeal. Enhanced signal reception, longer battery life, and the integration of digital displays and presets are broadening the user base. Advances in weatherproofing and durable materials are strengthening adoption in outdoor and professional environments. While the market is not expected to deliver high double-digit growth, its resilience, niche expansion, and role in critical communication systems position it as a stable and strategically relevant segment for investors seeking steady returns.

Key Takeaways

- Market Growth: The global stand-alone radio receivers market is projected to expand from USD 320.9 million in 2024 to USD 400 million by 2034, reflecting a CAGR of 3.3%. Growth is supported by steady demand from radio enthusiasts, emergency preparedness applications, and rural populations with limited internet access.

- Segment Dominance – Product Type: AM/FM radios accounted for over 47% of global revenue in 2024, making them the largest product category. Their dominance is driven by widespread consumer familiarity, affordability, and continued reliance on terrestrial broadcasting.

- Segment Dominance – Distribution Channel: Offline sales captured more than 61% of the market in 2024. Specialty electronics stores and mass retail outlets remain the primary purchase channels, particularly in regions where consumers prefer physical inspection of devices before purchase.

- Driver: Emergency communication needs are a key growth driver. Stand-alone radios remain critical in disaster-prone regions, where they provide reliable access to information without dependence on cellular or broadband networks.

- Restraint: Market expansion is constrained by competition from multifunctional devices such as smartphones and connected car infotainment systems. This substitution effect has slowed adoption rates, particularly in urban markets.

- Opportunity: Asia-Pacific presents a strong growth opportunity, with rising adoption in rural communities and expanding consumer bases in India, Indonesia, and the Philippines. The region is expected to post above-average CAGR compared with mature markets.

- Trend: Product enhancements such as improved battery life, digital tuning, and weather-resistant designs are reshaping consumer appeal. Manufacturers are also targeting niche demand from outdoor enthusiasts and retro electronics collectors.

- Regional Analysis: North America led the market in 2024 with a 58% share, generating USD 179 million in revenue, supported by strong U.S. demand valued at USD 168.4 million. Europe maintains steady adoption, while Asia-Pacific and Latin America are emerging as investment hotspots due to expanding rural penetration and government-backed broadcasting initiatives.

Type Analysis

As of 2025, AM/FM radios continue to represent the largest share of the stand-alone radio receivers market, accounting for more than 45% of global revenue. Their dominance is supported by the universal availability of AM and FM signals, which remain the most reliable broadcast medium across both developed and developing economies. Affordability and ease of use further strengthen their position, particularly in rural and semi-urban regions where digital infrastructure is limited. This segment is expected to maintain steady demand through 2034, supported by consumer preference for simple, durable devices that operate independently of internet or cellular networks.

Digital radio receivers (DAB/DAB+) are gaining traction, particularly in Europe, where regulatory mandates and government-backed digital switchover programs are accelerating adoption. Countries such as the UK, Germany, and Norway have already achieved significant penetration, with DAB accounting for more than 40% of radio listening in some markets. Asia-Pacific is also emerging as a growth hub, with Japan and South Korea expanding digital broadcasting coverage. Enhanced audio quality, reduced interference, and the ability to display metadata such as song titles and news updates are driving consumer interest.

Satellite radio receivers remain a niche but profitable segment, concentrated in North America. SiriusXM continues to dominate this category, with over 34 million subscribers in the United States alone. The appeal lies in extensive channel variety, premium content, and uninterrupted coverage across large geographies. Although growth is slower compared with digital formats, satellite receivers are expected to retain a loyal customer base, particularly among automotive users. Internet radio receivers, while still a smaller category, are expanding rapidly as Wi-Fi-enabled devices and smart speakers integrate radio streaming functions, creating opportunities for hybrid models that combine traditional and digital listening.

Application Analysis

Consumer demand for stand-alone radios remains strongest in personal entertainment and outdoor use, where portability and independence from mobile networks are key. Pavers and compact portable models dominate this segment, serving hobbyists, outdoor enthusiasts, and households seeking reliable audio devices. Emergency preparedness is another critical application, with governments and NGOs distributing radios in disaster-prone regions to ensure uninterrupted communication during crises.

Retaining wall applications, particularly in professional broadcasting and institutional use, continue to sustain demand for high-performance receivers. Broadcasters, schools, and community organizations rely on stand-alone radios for consistent signal reception and low maintenance requirements. This segment is expected to grow steadily as public safety agencies and humanitarian organizations expand their reliance on radios for field operations.

Other applications, including retro collectibles and specialty electronics, are creating niche demand. The resurgence of interest in vintage-style radios has opened opportunities for manufacturers targeting collectors and lifestyle consumers. While smaller in scale, this segment adds diversity to the market and supports premium pricing strategies.

End-Use Analysis

Residential use remains the largest end-use segment, accounting for more than half of global demand in 2025. Households continue to purchase stand-alone radios for personal listening, emergency kits, and recreational activities. The affordability of AM/FM models ensures continued penetration in both developed and emerging markets.

Commercial buildings, including retail outlets, restaurants, and hospitality venues, represent a growing application area. Businesses use stand-alone radios for background music, customer engagement, and emergency communication systems. This segment is projected to expand at a moderate pace, supported by demand for reliable, low-cost audio solutions.

Industrial end-use, while smaller in scale, is significant in sectors such as construction, mining, and logistics. Radios are valued for their durability and ability to function in remote or high-noise environments where internet connectivity is limited. Growth in this segment is expected to align with infrastructure development projects in Asia-Pacific, Africa, and Latin America.

Regional Analysis

North America remains the largest regional market, contributing more than 55% of global revenue in 2025. The United States alone accounts for over USD 170 million in sales, driven by strong consumer adoption of AM/FM and satellite receivers. SiriusXM’s dominance in satellite broadcasting continues to underpin regional growth.

Europe is the second-largest market, with digital radio adoption accelerating due to regulatory mandates. Countries such as Norway, which has already phased out FM broadcasting, highlight the shift toward DAB/DAB+. Germany, the UK, and France are also expanding digital coverage, creating opportunities for manufacturers of advanced receivers.

Asia-Pacific is emerging as the fastest-growing region, supported by rising demand in rural communities and expanding middle-class consumption. India, Indonesia, and the Philippines rely heavily on AM/FM radios for information dissemination, while Japan and South Korea are advancing digital adoption. Latin America and the Middle East & Africa present long-term opportunities, particularly in underserved rural areas where radio remains the most accessible communication medium. These regions are expected to post above-average CAGR through 2034, supported by government initiatives and NGO-led distribution programs.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- AM/FM Radios

- Digital Radio Receivers (DAB/DAB+)

- Satellite Radio Receivers (SiriusXM, etc.)

- Internet Radio Receivers

By Distribution Channel

- Offline

- Online

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 320.9 M |

| Forecast Revenue (2034) | USD 400.0 M |

| CAGR (2024-2034) | 3.3% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (AM/FM Radios, Digital Radio Receivers (DAB/DAB+), Satellite Radio Receivers (SiriusXM, etc.), Internet Radio Receivers), By Distribution Channel (Offline, Online) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Sharp Corporation, Roberts Radio, Geneva Lab, Sony Corporation, Pioneer Corporation, Philips, Tivoli Audio, Panasonic Corporation, Sangean Electronics, Bose |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Stand-Alone Radio Receivers Market

Published Date : 30 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date