Standalone 5G Network Market to Hit USD 145.45B by 2034 | CAGR of 54.98%

Global Standalone 5G Network Market Size, Share, Analysis Report By Component(Solutions, Services), Spectrum Type (mmWave, Sub-6 GHz - leads), Network Type (Private, Public), Industry Vertical (Automotive and Transportation, Manufacturing, Enterprise/Corporate, Healthcare/Hospitals, Energy & Utilities, Smart Cities, Others) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

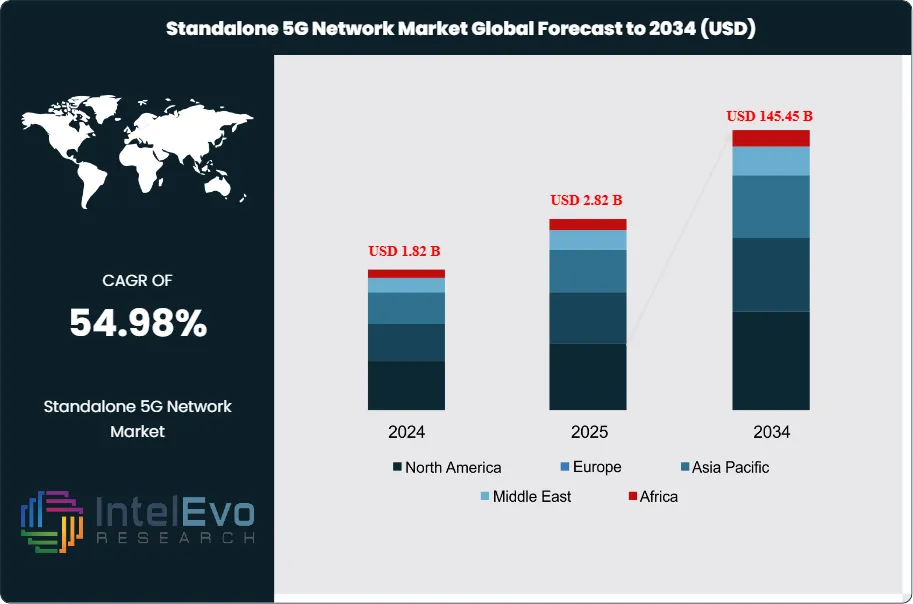

The Standalone 5G Network Market size is expected to be worth around USD 145.45 Billion by 2034, from USD 1.82 Billion in 2024, growing at a CAGR of 54.98% during the forecast period from 2024 to 2034. The Standalone 5G Network market represents a transformative segment within the global telecommunications infrastructure ecosystem, encompassing next-generation wireless networks that operate independently of legacy 4G infrastructure through dedicated 5G core networks and radio access networks. Standalone (SA) 5G networks deliver the full spectrum of 5G capabilities including ultra-low latency, massive machine-type communications, enhanced mobile broadband, and network slicing functionalities that enable innovative applications across industries.

Get More Information about this report -

Request Free Sample ReportThese networks form the foundation for emerging technologies including autonomous vehicles, industrial IoT, augmented reality, and smart city infrastructure by providing the reliable, high-performance connectivity that traditional networks cannot support. The market's explosive growth is driven by enterprise digital transformation initiatives, government infrastructure investments, and the proliferation of IoT applications that require advanced network capabilities beyond conventional wireless technologies.

Several key factors influence the expansion and evolution of the standalone 5G network market. The primary driver is the enterprise demand for private 5G networks that provide dedicated, high-performance connectivity for manufacturing, healthcare, and logistics applications requiring ultra-reliable low-latency communications. The transition from non-standalone (NSA) 5G implementations that rely on 4G core infrastructure to full standalone deployments enables advanced features including network slicing, edge computing integration, and mission-critical applications. Government initiatives and smart city projects worldwide create substantial infrastructure investment opportunities for standalone 5G deployments. Additionally, the emergence of Industry 4.0 applications, autonomous systems, and real-time analytics creates new use cases that demand the full capabilities of standalone 5G networks. The increasing focus on network sovereignty and security drives preference for independent 5G infrastructure that reduces dependence on legacy network components.

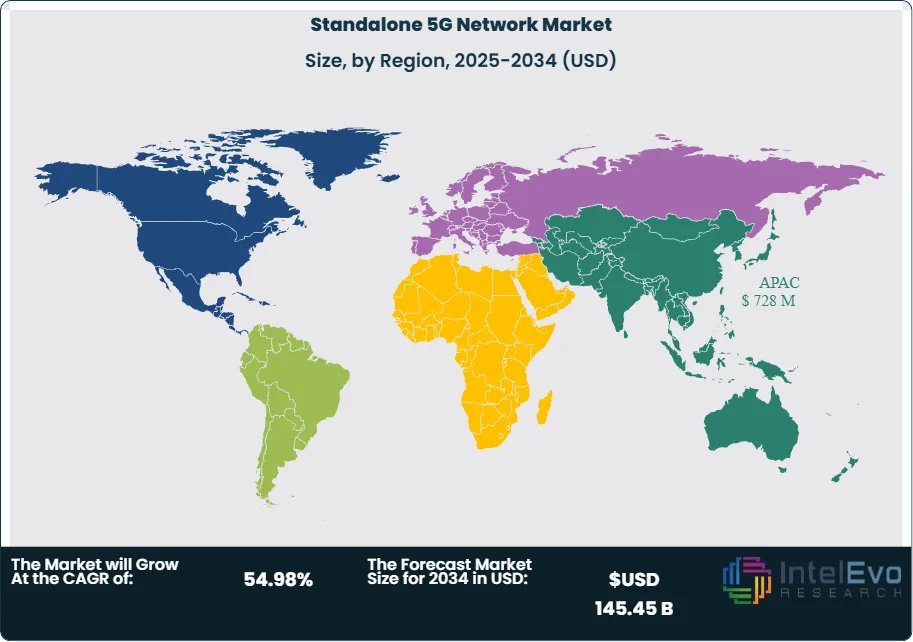

Regionally, the Standalone 5G Network market exhibits dynamic growth patterns reflecting varying levels of infrastructure investment, regulatory support, and industrial digitalization initiatives. Asia-Pacific leads global deployment and maintains the largest market share, with countries like China, South Korea, and Japan implementing comprehensive standalone 5G rollouts supported by government backing and substantial technology sector investment. North America demonstrates rapid growth driven by enterprise private network adoption, telecommunications carrier investments, and government infrastructure modernization programs. Europe maintains significant market presence through industrial automation initiatives, smart city projects, and regulatory frameworks that support digital infrastructure development. Latin America and the Middle East & Africa represent emerging markets with substantial growth potential as governments prioritize telecommunications infrastructure modernization and digital economy development.

The COVID-19 pandemic significantly accelerated standalone 5G network adoption by highlighting the critical importance of reliable, high-capacity telecommunications infrastructure for supporting remote work, telemedicine, and digital service delivery during unprecedented operational challenges. Organizations rapidly recognized the limitations of existing network infrastructure for supporting increased data traffic, video conferencing demands, and IoT applications that became essential for business continuity. The pandemic demonstrated the strategic value of standalone 5G networks for enabling resilient communications infrastructure that could adapt to changing usage patterns and support emergency response coordination. Healthcare applications including remote patient monitoring and telemedicine consultations highlighted the importance of ultra-reliable communications that standalone 5G networks provide more effectively than legacy infrastructure.

Geopolitical tensions and national security considerations significantly impact the standalone 5G network market through technology export restrictions, vendor exclusion policies, and supply chain security requirements that influence deployment strategies and vendor selection processes. Trade restrictions particularly affecting Chinese equipment manufacturers have created market opportunities for alternative vendors while complicating global supply chains and increasing costs for some deployments. National security concerns drive government policies favoring trusted vendors and domestic technology development that reshape competitive dynamics and market opportunities. Data sovereignty requirements and cybersecurity regulations influence network architecture decisions toward solutions that maintain control over critical infrastructure while meeting performance requirements. These dynamics encourage regional technology partnerships and supply chain diversification strategies that may increase deployment complexity but improve long-term security posture.

Key Takeaways

- Market Growth: The Standalone 5G Network Market is expected to reach USD 145.45 Billion by 2034, driven by enterprise private network adoption, IoT expansion, and ultra-reliable low-latency application requirements.

- Component Dominance: Solutions dominate the standalone 5G network market as enterprises and telecom operators prioritize deploying complete infrastructure, software platforms, and network management systems over service-based offerings.

- Spectrum Type Dominance: Sub-6 GHz spectrum leads the standalone 5G market due to its broader coverage range, cost efficiency, and suitability for nationwide deployments compared to the higher-frequency mmWave spectrum.

- Network Type Dominance: Public standalone 5G networks lead the market as telecom operators deploy nationwide infrastructure to serve both consumer and enterprise demands, ensuring mass accessibility and scale.

- Industry Vertical Dominance: Manufacturing leads the standalone 5G vertical market as Industry 4.0 adoption intensifies, requiring ultra-reliable, low-latency networks to power automation, robotics, and smart factories.

- Drivers: Key growth drivers include private 5G network demand, edge computing integration, and IoT application expansion that accelerate deployment of standalone infrastructure.

- Restraints: Growth faces challenges from high infrastructure costs, spectrum availability limitations, and integration complexities that create deployment barriers.

- Opportunities: Market expansion opportunities include network slicing commercialization, edge computing convergence, and vertical industry specialization that enable new revenue models.

- Trends: Emerging trends include Open RAN adoption, AI-native network operations, and cloud-native core implementations that transform network architecture and operational models.

- Regional Analysis: Asia-Pacific leads with over 45% market share due to government infrastructure investment and early commercial deployments. North America shows rapid enterprise adoption growth.

Component Analysis:

Solutions Infrastructure Leads With more than 75% Market Share In Standalone 5G Network Market, Within the component category, solutions lead due to the critical need for hardware, core networks, and software-defined platforms that enable true 5G standalone functionality. These solutions include 5G core architecture, network slicing, and edge computing setups that support ultra-low latency and massive connectivity. Businesses and telecom providers rely heavily on comprehensive solution packages to establish robust connectivity, especially as industries transition toward Industry 4.0. Services, while growing steadily, primarily include consulting, managed services, and integration support. These are vital in ensuring smooth deployment and efficient operation, but they are secondary to the actual infrastructure that powers the network. Increasing demand for scalable, secure, and flexible 5G infrastructure ensures that solutions remain the leading revenue driver, while services are expected to grow as complementary enablers for long-term adoption and lifecycle management.

Spectrum Type Analysis:

The Sub-6 GHz band is the current backbone of standalone 5G networks since it offers an ideal balance between speed and coverage, making it suitable for large-scale rollouts in urban and rural areas. Telecom operators prefer this spectrum type for its affordability and ability to penetrate physical barriers more effectively, ensuring stronger connectivity indoors and across dense environments. Conversely, mmWave spectrum provides ultra-high bandwidth and extreme speeds, making it ideal for densely populated city centers, stadiums, and enterprise campuses where capacity demand is highest. However, its limited coverage range and high infrastructure costs restrict its widespread use. As markets mature, mmWave adoption is expected to complement existing Sub-6 GHz networks, catering to specialized use cases that demand lightning-fast speeds. Despite mmWave’s potential, Sub-6 GHz continues to dominate as the practical and cost-effective foundation for global standalone 5G rollouts.

Network Type Analysis:

Public 5G standalone networks hold the largest share since they provide connectivity to the broader population, enabling carriers to support millions of users while also catering to commercial and enterprise needs. Telecom operators are heavily investing in these networks to accelerate nationwide broadband availability, enhance mobile internet speeds, and improve coverage for diverse applications, from streaming to IoT integration. Private standalone 5G networks, while smaller in scale, are gaining traction in industries such as manufacturing, logistics, and healthcare. These networks enable secure, localized control of operations with ultra-reliable low latency communication (URLLC). Though enterprises are showing growing interest in adopting private implementations, public deployments remain the cornerstone of the market due to their scale, extensive infrastructure funding, and critical role in enabling mass adoption of advanced connectivity worldwide.

Industry Vertical Analysis:

The manufacturing sector dominates the standalone 5G application market, fueled by the rise of smart factories, industrial IoT, and real-time automation that demand enhanced connectivity. 5G enables predictive maintenance, high-speed sensor communication, and seamless integration of robotics, ensuring improved efficiency and reduced downtime. Automotive and transportation is another prominent sector, with connected vehicles, autonomous driving, and smart traffic solutions requiring ultra-fast and reliable communication. Enterprise and corporate applications leverage 5G to enhance digital workflows, cloud integration, and workforce mobility. In energy and utilities, 5G supports smart grids, remote monitoring, and efficient energy distribution. Healthcare benefits from connected devices, telemedicine, and real-time patient monitoring. Smart cities also increasingly integrate 5G for traffic management, surveillance, and public infrastructure optimization. While all industries are on the path toward digital transformation, manufacturing takes the lead for its immediate need for scalable, mission-critical connectivity powered by standalone 5G.

Regional Analysis

Asia-Pacific Leads With over 40% Market Share In Standalone 5G Network Market, Asia-Pacific maintains market leadership through aggressive government infrastructure investment programs, early commercial standalone 5G deployments, and substantial technology sector development that creates favorable conditions for comprehensive network modernization initiatives. The region benefits from supportive regulatory frameworks, coordinated spectrum allocation policies, and strategic national priorities that position 5G infrastructure as essential for economic competitiveness. Asia-Pacific Standalone 5G Network Market size is likely to reach $83.08 Bn by 2034 expanding at a CAGR of 55.12%, driven by major deployments in China, South Korea, and Japan. Manufacturing sector concentration in the region creates substantial demand for private 5G networks supporting industrial automation and smart factory initiatives. Government smart city projects and digital infrastructure development programs provide additional growth drivers for standalone 5G adoption.

North America represents a mature market characterized by enterprise-driven adoption, telecommunications carrier network upgrades, and substantial venture capital investment in 5G application development that supports ecosystem growth and innovation. The region's emphasis on technological leadership and competitive advantage drives early adoption of standalone 5G for mission-critical applications including public safety, healthcare, and financial services. Strong enterprise technology spending and sophisticated IT infrastructure requirements create opportunities for specialized 5G solutions and high-value service offerings. Regulatory frameworks support innovation while addressing security and privacy concerns that influence vendor selection and deployment strategies.

Europe demonstrates steady growth driven by industrial digitalization initiatives, smart city projects, and sustainability requirements that align with standalone 5G capabilities for energy-efficient, high-performance connectivity solutions. The region's focus on digital sovereignty and data protection encourages development of European-based 5G capabilities and vendor ecosystems. Manufacturing sector strength in countries including Germany and Sweden drives demand for industrial 5G applications supporting automation and IoT deployments. Regulatory coordination across EU member states facilitates harmonized spectrum allocation and cross-border 5G service delivery.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Component

- Solutions

- 5G Radio Access Network (RAN)

- 5G Core Network

- Others (Backhaul and Fronthaul, Switches, Routers)

- Services

Spectrum Type

- mmWave

- Sub-6 GHz - leads

Network Type

- Private

- Public

Industry Vertical

- Automotive and Transportation

- Manufacturing

- Enterprise/Corporate

- Healthcare/Hospitals

- Energy & Utilities

- Smart Cities

- Others

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.82 B |

| Forecast Revenue (2034) | USD 145.45 B |

| CAGR (2025-2034) | 54.98% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component(Solutions, (5G Radio Access Network (RAN), 5G Core Network, Others (Backhaul and Fronthaul, Switches, Routers)), Services), Spectrum Type (mmWave, Sub-6 GHz - leads), Network Type (Private, Public), Industry Vertical (Automotive and Transportation, Manufacturing, Enterprise/Corporate, Healthcare/Hospitals, Energy & Utilities, Smart Cities, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems Inc., Qualcomm Technologies, Inc., Intel Corporation, NVIDIA Corporation, Amazon Web Services Inc., Microsoft Corporation, Mavenir Systems, Inc., Affirmed Networks (Microsoft), Parallel Wireless Inc., Altiostar Networks Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Standalone 5G Network Market?

The Standalone 5G Network Market will skyrocket from USD 1.82B in 2024 to USD 145.45B by 2034, growing at a record CAGR of 54.98%. Explore trends, insights, and drivers!

Who are the major players in the Standalone 5G Network Market?

Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems Inc., Qualcomm Technologies, Inc., Intel Corporation, NVIDIA Corporation, Amazon Web Services Inc., Microsoft Corporation, Mavenir Systems, Inc., Affirmed Networks (Microsoft), Parallel Wireless Inc., Altiostar Networks Inc.

Which segments covered the Standalone 5G Network Market?

Component(Solutions, (5G Radio Access Network (RAN), 5G Core Network, Others (Backhaul and Fronthaul, Switches, Routers)), Services), Spectrum Type (mmWave, Sub-6 GHz - leads), Network Type (Private, Public), Industry Vertical (Automotive and Transportation, Manufacturing, Enterprise/Corporate, Healthcare/Hospitals, Energy & Utilities, Smart Cities, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Standalone 5G Network Market

Published Date : 28 Aug 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date