Styrene Monomer Market Size, Share & Forecast 2025–2034 | 5.6% CAGR

Global Styrene Monomer Market Size, Share, Analysis Report By Production Process (Propylene Oxide Styrene Monomer, Ethylbenzene Dehydrogenation), Application (SBR, Polystyrene, ASA, ABS, SAN), End-Use Industry (Automotive, Packaging, Healthcare, Household, Electronics, Construction), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

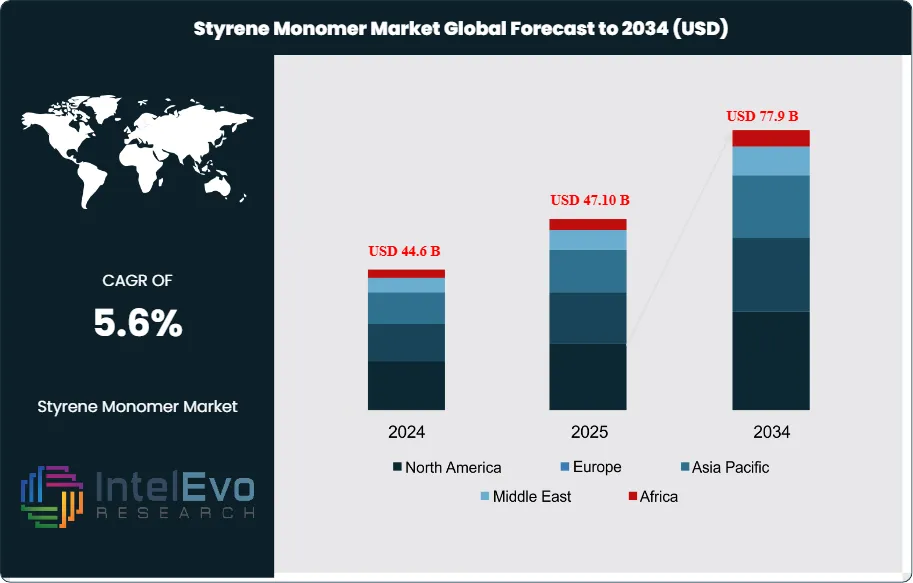

The Styrene Monomer Market size is projected to be worth around USD 77.9 Billion by 2034, up from USD 44.6 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. Rising demand for polystyrene, ABS, and synthetic rubber across packaging, automotive, and construction sectors continues to fuel market expansion. The shift toward lightweight materials and sustainable polymer innovations is also expected to reshape the global styrene value chain. With the Asia-Pacific region leading consumption, key manufacturers are focusing on production efficiency and green chemistry solutions to maintain competitiveness.

Get More Information about this report -

Request Free Sample ReportThe Styrene Monomer (SM) market is a vital segment of the global petrochemical industry, serving as a key raw material for various polymers and resins. Styrene monomer is primarily produced through two processes: Ethylbenzene Dehydrogenation and Propylene Oxide Styrene Monomer (POSM). The market's growth is driven by its applications in producing polystyrene, acrylonitrile butadiene styrene (ABS), styrene-butadiene rubber (SBR), and other derivatives used across industries such as automotive, packaging, electronics, construction, and healthcare.

The availability and cost of raw materials like benzene and ethylene significantly influence the styrene monomer market. Fluctuations in crude oil prices directly affect the prices of these feedstocks, thereby impacting the production cost of styrene monomer. Supply chain disruptions and geopolitical tensions can lead to volatility in raw material supply and pricing.

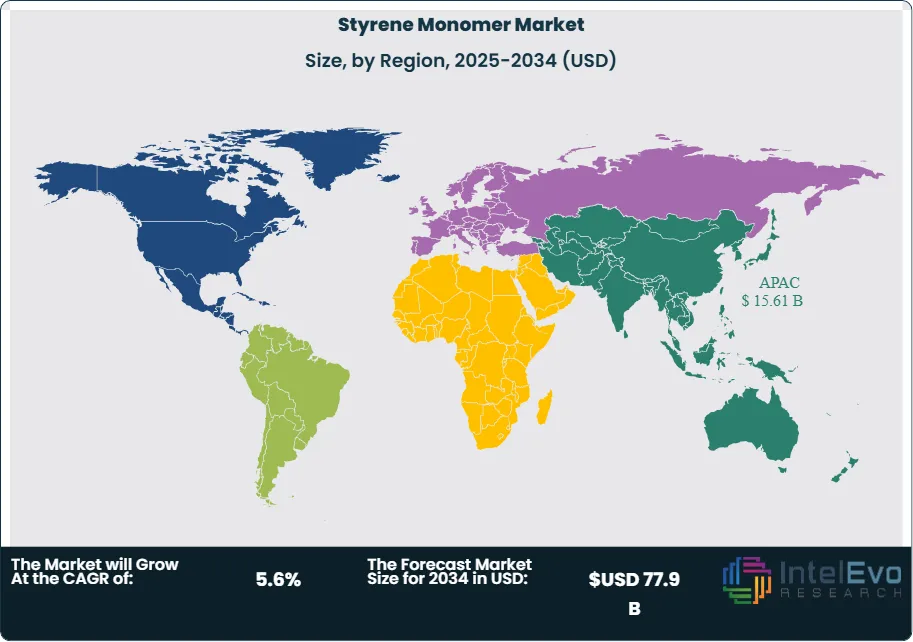

The Asia-Pacific region dominates the global styrene monomer market, accounting for approximately 65.9% of the market share. This dominance is attributed to rapid industrialization, urbanization, and the presence of major manufacturing hubs in countries like China, India, and South Korea. The region's demand is driven by the automotive, packaging, and construction industries. North America and Europe follow, with significant consumption in automotive and electronics sectors. Latin America and the Middle East & Africa are emerging markets, with growth driven by infrastructure development and increasing industrial activities.

The COVID-19 pandemic disrupted the styrene monomer market through supply chain interruptions, reduced industrial activities, and fluctuating demand. Lockdowns and restrictions led to decreased consumption in automotive and construction sectors, while the packaging industry saw increased demand due to the rise in e-commerce and food packaging needs. The market is gradually recovering as industries resume operations and adapt to the new normal, with a focus on sustainability and resilience in supply chains.

Key Takeaways:

- Market Growth: The Styrene Monomer Market is expected to reach USD 77.9 Billion by 2034, growing at a robust CAGR of 5.6% from 2024, growing demand from the packaging industry, especially for polystyrene, due to its lightweight and insulating properties is fueling the market.

- Production Process Dominance: Ethylbenzene Dehydrogenation remains the leading production method for styrene due to its cost efficiency, high yield, and industrial reliability. While the Propylene Oxide route offers valuable co-products, its complexity limits widespread adoption, though sustainability concerns may drive future innovation.

- Application Dominance: Polystyrene holds the largest share in styrene applications, especially in packaging and insulation. However, ABS is rapidly gaining traction due to its growing use in automotive, electronics, and 3D printing, marking a shift toward more versatile, high-performance plastics.

- End-Use Industry Dominance: Packaging continues to dominate as the primary end-use industry due to the high consumption of polystyrene-based products. Meanwhile, the automotive and electronics sectors are poised for strong growth, fueled by rising demand for lightweight and durable polymer components.

- Driver: Driving factors include strong demand across packaging, automotive, and construction sectors, where its derivatives like polystyrene and ABS are valued for their durability, insulation properties, and ease of molding. Additionally, industrial growth in emerging economies and innovations in polymerization technology are enhancing production efficiency, supporting global market expansion.

- Restraint: Health concerns surrounding styrene exposure, along with strict environmental regulations from global authorities, have increased compliance costs and operational complexity. Moreover, fluctuating raw material prices and a gradual industry shift toward eco-friendly alternatives are challenging long-term market stability.

- Opportunity: The rise of electric vehicles and infrastructure development in developing countries is creating new applications for lightweight, high-performance styrene-based materials. There is also growing momentum in circular economy efforts, including polystyrene recycling and the development of bio-based monomers, offering companies a chance to tap into sustainable growth markets.

- Trend: Technological advancements in chemical recycling are enabling efficient reuse of styrene plastics, promoting closed-loop systems that align with global sustainability goals. At the same time, digitalization and a strategic shift in manufacturing to cost-effective regions are transforming supply chains and driving greater efficiency and competitiveness across the industry.

- Regional Analysis: Asia-Pacific leads the Styrene Monomer market due to robust manufacturing sectors in China, India, and Southeast Asia, alongside strong demand from packaging, construction, and automotive industries. North America maintains a significant market share driven by established automotive and electronics industries, coupled with advanced polymer R&D.

Production Process Analysis:

Ethylbenzene Dehydrogenation Leads with over 75% Market Share in Styrene Monomer Market. Ethylbenzene Dehydrogenation dominates due to its maturity, cost-effectiveness, and widespread industrial integration. This method offers high yield and is widely adopted by major manufacturers. On the other hand, the Propylene Oxide process, while producing valuable co-products like propylene glycol, is comparatively more complex and less prevalent. The dominance of ethylbenzene dehydrogenation is expected to persist due to its scalability and proven efficiency in large-scale operations. However, environmental regulations and innovations may encourage gradual shifts toward cleaner, integrated processes.

Application Analysis:

Polystyrene leads in market share due to its vast application in packaging, insulation, and consumer goods. However, ABS is expected to grow rapidly, driven by increasing use in automotive interiors, electronics, and 3D printing. SBR also maintains a strong presence in tire and footwear manufacturing. As industries seek materials that balance cost, durability, and lightweight properties, engineered plastics like ABS and SAN are becoming increasingly attractive. This trend will likely reshape the application dynamics in the near future.

End-Use Industry Analysis:

Packaging is the dominant end-use sector due to high consumption of PS for food containers, disposable cutlery, and insulation materials. However, the Automotive and Electronics sectors are emerging as high-growth areas, fueled by demand for lightweight and durable components. With electric vehicles and smart devices on the rise, the need for advanced polymers like ABS and ASA is accelerating. Meanwhile, the Healthcare and Construction sectors continue to use styrene-based materials for medical tools and insulation, contributing to steady demand.

Region Analysis:

Asia-Pacific Leads With over 45% Market Share In Styrene Monomer Market. Asia-Pacific dominates the global Styrene Monomer market due to its massive production capacity, lower labor costs, and increasing demand from end-use sectors such as packaging, automotive, and construction. China remains a major consumer and producer, while India is rapidly emerging due to industrialization and growing urban infrastructure. The region benefits from favorable government policies and rising middle-class consumption of electronics and packaged goods. North America, while mature, maintains demand stability through innovation, especially in high-performance applications like ABS in the automotive sector. Europe, though affected by environmental restrictions, is investing heavily in sustainable alternatives and recycling technologies, reshaping long-term growth potential. Latin America is witnessing moderate but steady expansion due to growing urban development and increasing consumer demand. The Middle East & Africa are at the early stages of development but offer significant future opportunities as infrastructure projects and industrialization pick up pace.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Production Process

- Ethylbenzene Dehydrogenation

- Catalytic Dehydrogenation

- Oxidative Dehydrogenation

- Others

By End-Use Industry

- Automotive & Transportation

- Construction & Building Materials

- Packaging

- Consumer Goods & Appliances

- Electrical & Electronics

- Marine & Aerospace

- Others

By Application

- Polystyrene

- Acrylonitrile Butadiene Styrene (ABS)

- Styrene-Butadiene Rubber (SBR)

- Unsaturated Polyester Resin (UPR)

- Expanded Polystyrene (EPS)

- Acrylonitrile Styrene Acrylate (ASA)

- Styrene-acrylonitrile (SAN)

- Others (Latex, Coatings, etc.)

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 47.10 B |

| Forecast Revenue (2034) | USD 77.9 B |

| CAGR (2025-2034) | 5.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Production Process (Ethylbenzene Dehydrogenation, Catalytic Dehydrogenation, Oxidative Dehydrogenation, Others), By End-Use Industry (Automotive & Transportation, Construction & Building Materials, Packaging, Consumer Goods & Appliances, Electrical & Electronics, Marine & Aerospace, Others), By Application (Polystyrene, Acrylonitrile Butadiene Styrene (ABS), Styrene-Butadiene Rubber (SBR), Unsaturated Polyester Resin (UPR), Expanded Polystyrene (EPS), Acrylonitrile Styrene Acrylate (ASA), Styrene-acrylonitrile (SAN), Others (Latex, Coatings, etc.)) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | SABIC, LG Chemical, INEOS, Shell plc, Lyondell Basell, Styrenix Performance Materials Ltd (SPM), KR Chemicals, Styrolution, Qingdao Haiwan Group Co. Ltd, Denka Company Limited, The Kuwait Styrene Company, Chevron Phillips Chemical Company LLC, KH Chemicals, Equate Petrochemical Company, LOTTE Chemical CORPORATION, Repsol, Westlake Corporation, Hanwha TotalEnergies Petrochemical Co Ltd, Americas Styrenics LLC |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Styrene Monomer Market Growth Outlook 2024–2034

Published Date : 24 Jun 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date