Subscription Box Market Size, Share & Forecast | 16.4% CAGR

Global Subscription Box Market Size, Share & Analysis By Product Category (Beauty and Personal Care, Food and Beverages, Fashion and Apparel, Books, Fitness and Wellness, Pet Products, Tech and Gadgets, Kids and Baby Products, Arts and Crafts, Home Goods), By Subscription Model (Replenishment Subscription, Curation Subscription, Access Subscription), By Consumer Demographics Industry Outlook, Retention Strategies & Forecast 2025–2034

Report Overview

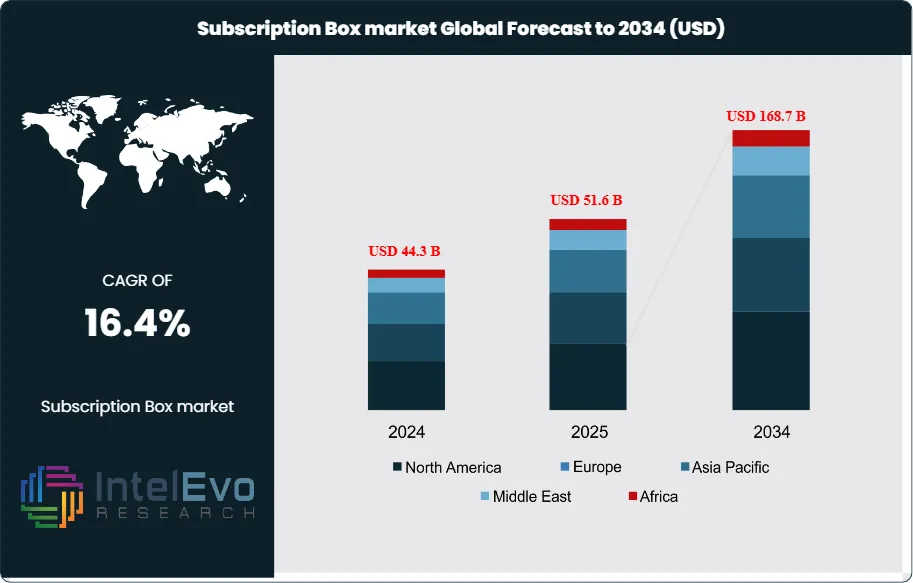

The Subscription Box Market is estimated at USD 44.3 billion in 2024 and is on track to reach approximately USD 168.7 billion by 2034, implying a strong compound annual growth rate of around 16.4% over 2025–2034. Growing demand for hyper-personalized shopping experiences, AI-powered product curation, and convenience-led retail models continues to propel category expansion. Influencer-driven discovery, eco-friendly packaging, and rising adoption across beauty, meal kits, pet care, wellness, and hobby segments are pushing engagement levels to record highs. As subscription commerce becomes a dominant channel for recurring revenue, brands leveraging data-driven personalization and omnichannel marketing are expected to capture disproportionate growth through the next decade.

Get More Information about this report -

Request Free Sample ReportThis recurring delivery model has transformed from a niche concept into a mainstream commerce channel, with businesses curating everything from beauty products to gourmet snacks for millions of subscribers worldwide. The market gained substantial momentum through the early 2010s as pioneering brands like Birchbox and HelloFresh demonstrated the commercial viability of personalized, scheduled deliveries that combine convenience with product discovery experiences.

Consumer behavior shifts drive this expansion as mobile commerce fundamentally reshapes purchasing patterns across demographics. Seventy-six percent of Americans now buy products through smartphones, creating natural pathways for subscription sign-ups and ongoing account management. Mobile commerce sales are projected to exceed $3.1 trillion globally by 2027, providing subscription businesses with expanded digital infrastructure and growing consumer comfort with recurring mobile transactions. The Zuora Subscription Economy Index reveals that subscription businesses have grown 4.6 times faster than the S&P 500 over the past decade, demonstrating superior revenue models and sustained investor appeal compared to traditional retail formats.

Market diversity strengthens the sector's foundation and competitive positioning. The United States currently hosts 400 to 600 subscription box varieties, spanning categories from pet supplies to artisan foods, each targeting specific consumer segments and distinct price points. This specialization strategy allows brands to build dedicated customer bases while avoiding direct competition with mass-market retailers and established e-commerce giants. British consumers spend over £2 billion annually on subscription boxes, with established brands like Graze and Glossybox capturing significant market share through localized product curation and competitive pricing strategies.

Technology integration accelerates adoption as artificial intelligence improves product recommendations and supply chain automation reduces operational fulfillment costs. Companies deploy sophisticated machine learning algorithms to analyze customer preferences, purchase history, and feedback patterns, creating more accurate product matches that reduce subscriber churn rates. Investment activity concentrates in North America and Europe, where established e-commerce infrastructure supports rapid business scaling, though Asia-Pacific markets show increasing investor interest as digital payment systems mature and consumer spending patterns evolve.

Key Takeaways

- Market Growth: The Subscription Box Market reached USD 44.3 billion in 2024 and projects to USD 168.7 billion by 2034, registering a 16.4% CAGR. This growth stems from increasing consumer preference for personalized product discovery and the convenience of automated recurring deliveries.

- Subscription Type: Replenishment subscriptions command 40% market share, driven by consumer demand for essential consumables like razors, pet food, and household supplies. This model generates predictable revenue streams and higher customer retention rates compared to discovery-based subscriptions.

- Demographics: Female consumers account for 55% of subscription box purchases, primarily concentrated in beauty, wellness, and lifestyle categories. This demographic shows higher engagement rates and longer subscription durations than male counterparts.

- Product Category: Beauty and Personal Care subscriptions capture 35% of total market revenue, reflecting increased consumer spending on self-care products. Brands like Birchbox and Ipsy have established strong market positions within this segment.

- Driver: Budget-friendly subscription options represent 60% of all subscriptions, making the market accessible to price-conscious consumers. Monthly price points between $10-30 drive mass adoption across diverse income segments.

- Restraint: Subscription fatigue affects 25% of consumers who cancel services within six months due to product redundancy and budget constraints. High churn rates force companies to invest heavily in retention strategies.

- Opportunity: Asia-Pacific markets show 18% annual growth potential as digital payment infrastructure improves and disposable income rises. Countries like India and Southeast Asian nations present untapped consumer bases.

- Trend: AI-powered personalization engines increase customer satisfaction by 35% through improved product matching algorithms. Companies implementing machine learning see 20% lower churn rates than traditional curation methods.

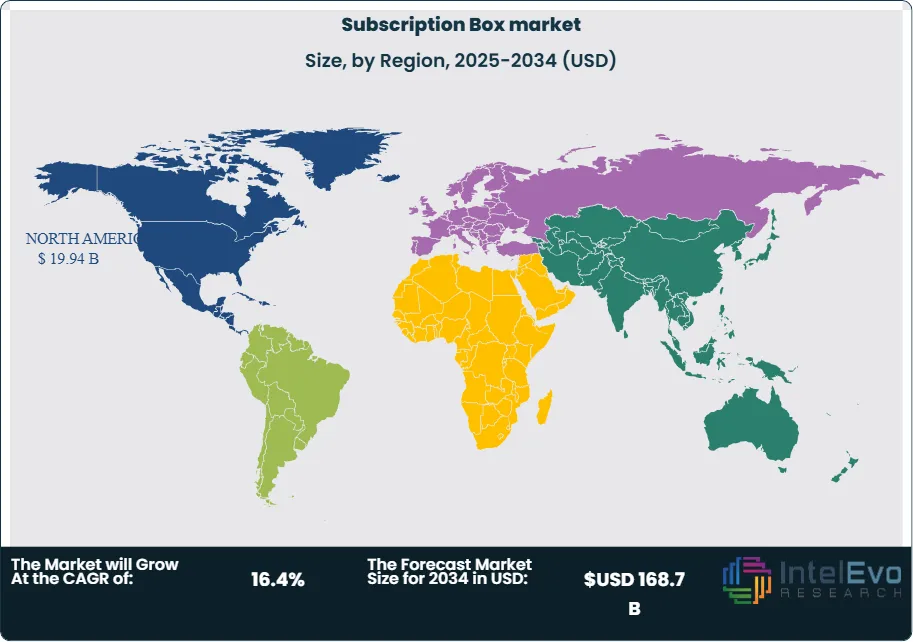

- Regional Analysis: North America maintains market leadership with 45% revenue share, supported by mature e-commerce infrastructure and high consumer adoption rates. Europe follows with 30% share, while Asia-Pacific grows fastest at 15% annually.

By Subscription Type

Replenishment subscriptions maintain market leadership in 2025, capturing 40% of total subscription revenue through automated delivery of consumable essentials. This model addresses fundamental consumer pain points by ensuring continuous supply of personal care items, household products, and daily necessities without manual reordering. Companies operating this model benefit from predictable revenue streams and reduced customer acquisition costs, as subscribers typically maintain longer relationships compared to discovery-based services.

Curation subscriptions serve consumers seeking personalized product discovery experiences, though they command smaller market shares than replenishment services. This segment thrives on algorithmic matching and expert curation to deliver surprise selections tailored to individual preferences. Access subscriptions represent the smallest segment, providing exclusive entry to limited releases, premium services, or member-only experiences that appeal to niche consumer groups seeking exclusivity over convenience.

Box Type Analysis

Monthly delivery boxes dominate subscription preferences in 2025, accounting for approximately 65% of all subscription arrangements due to their balance between anticipation and affordability. Consumers prefer this frequency as it aligns with typical budget cycles while maintaining engagement without overwhelming recipients. Quarterly boxes appeal to premium subscribers willing to pay higher per-shipment costs for curated selections, particularly in categories like seasonal fashion or luxury goods.

Weekly subscriptions serve specific niches, primarily food and perishable categories where freshness drives purchasing decisions. This model requires sophisticated logistics and cold-chain management but generates higher lifetime values per customer. Bi-annual and annual subscriptions cater to gift purchasers and budget-conscious consumers, though they represent smaller market segments due to reduced engagement frequencies.

Product Category Analysis

Beauty and personal care subscriptions command 35% market share in 2025, driven by continuous product innovation and social media influence on consumer purchasing behavior. This category benefits from high product trial rates and strong brand discovery potential, with average monthly values ranging from $15-45. The skincare segment within this category shows particular strength as consumers prioritize wellness and self-care routines.

Food and beverage subscriptions capture significant market attention through specialized dietary preferences and gourmet discovery experiences. Health and wellness boxes target growing consumer awareness of organic, plant-based, and functional food products. Fashion and apparel face unique challenges with sizing accuracy and return rates, limiting growth compared to consumable categories. Technology and gadgets remain niche but show steady expansion as consumers seek early access to innovative products.

Gender Analysis

Female consumers represent 55% of subscription box purchasers in 2025, demonstrating higher engagement rates and longer subscription durations across beauty, wellness, and lifestyle categories. This demographic shows willingness to pay premium prices for personalized experiences and maintains an average of 2.3 active subscriptions per person. Women's intimate care and wellness subscriptions show particularly strong growth as brands address previously underserved market needs.

Male subscribers, while representing a smaller segment, exhibit growing participation in grooming, fitness, and hobby-focused subscriptions. Men demonstrate more selective subscription behavior, typically maintaining fewer simultaneous services but showing higher tolerance for premium pricing in categories aligned with their interests. Unisex and family-oriented subscriptions expand market reach by appealing to household decision-makers and gift purchasers seeking broader appeal.

Price Range Analysis

Budget-friendly subscriptions under $25 monthly capture 60% of the subscriber base in 2025, reflecting consumer price sensitivity and desire for accessible product discovery. This segment attracts younger demographics and families seeking variety without significant financial commitment. Companies succeed in this range through volume purchasing, efficient packaging, and streamlined operations that maintain margins despite lower price points.

Mid-range subscriptions between $25-60 balance cost and perceived value, appealing to consumers willing to invest more for higher-quality products or larger quantities. Premium subscriptions above $60 serve affluent consumers seeking exclusive access to luxury goods, limited editions, or comprehensive product assortments. This high-end segment maintains strong margins but requires exceptional curation and customer service to justify pricing premiums.

Regional Analysis

North America maintains subscription box market leadership in 2025 with 45% global revenue share, supported by mature e-commerce infrastructure, high disposable incomes, and established consumer acceptance of recurring billing models. The United States alone hosts over 600 active subscription services across diverse categories, with companies like HelloFresh and Birchbox establishing market benchmarks for operational efficiency and customer retention.

Europe represents the second-largest market with 30% share, driven by strong adoption in the United Kingdom, Germany, and Scandinavia where consumers embrace convenience-focused shopping models. Asia-Pacific emerges as the fastest-growing region with 18% annual expansion rates as digital payment systems improve and middle-class purchasing power increases. Countries including India, Singapore, and Australia show particular promise for international expansion as local logistics networks mature and consumer preferences shift toward subscription-based purchasing models.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Subscription Type

- Replenishment Subscription

- Curation Subscription

- Access Subscription

By Box Type

- Personalized Boxes

- Standard Boxes

By Product Category

- Beauty and Personal Care

- Food and Beverages

- Fashion and Apparel

- Books

- Fitness and Wellness

- Pet Products

- Tech and Gadgets

- Kids and Baby Products

- Arts and Crafts

- Home Goods

By Gender

- Male

- Female

- Unisex

By Price Range

- Budget-Friendly

- Mid-Range

- Premium/Luxury

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 44.3 B |

| Forecast Revenue (2034) | USD 168.7 B |

| CAGR (2024-2034) | 16.4% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Subscription Type (Replenishment Subscription, Curation Subscription, Access Subscription), By Box Type (Personalized Boxes, Standard Boxes), By Product Category (Beauty and Personal Care, Food and Beverages, Fashion and Apparel, Books, Fitness and Wellness, Pet Products, Tech and Gadgets, Kids and Baby Products, Arts and Crafts, Home Goods), By Gender (Male, Female, Unisex), By Price Range (Budget-Friendly, Mid-Range, Premium/Luxury) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Stitch Fix, The Honest Company, Birchbox, Dollar Shave Club, KiwiCo, HelloFresh, Scentbird, BarkBox, Loot Crate, Blue Apron, FabFitFun, Book of the Month, Bespoke Post |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date