Super Abrasive Market Size, Trends & Forecast 2034 | 6.7% CAGR

Global Super Abrasive Market Size, Share, Analysis Report By Type (Cubic Boron Nitride, Diamond), Bonding Agent (Resin Bond, Electroplated, Metal Bond, Vitrified), Application (Grinding, Polishing, Cutting, Drilling), End-Use (Automotive, Aerospace, Oil and Gas, Electrical and Electronics, Medical), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

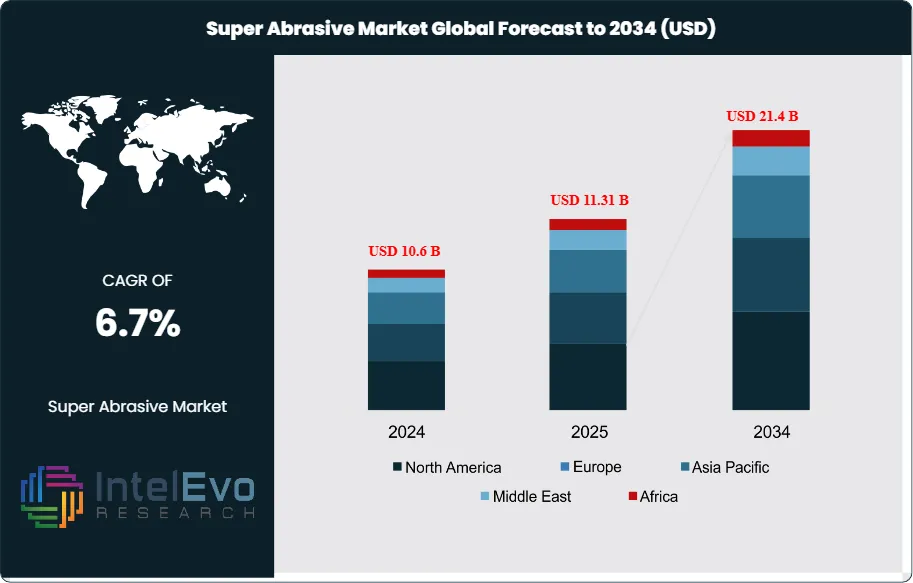

The Super Abrasive Market size is expected to be worth around USD 21.4 billion by 2034, up from USD 10.6 billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. The market is witnessing strong momentum, driven by the increasing demand for precision machining and ultra-hard materials across automotive, aerospace, electronics, and medical sectors. With the global shift toward automation, smart manufacturing, and electric vehicle production, the adoption of super abrasives such as diamond and cubic boron nitride (CBN) tools is accelerating rapidly. As industries focus on enhancing performance, durability, and sustainability, the Super Abrasive Market is emerging as a key enabler of next-generation manufacturing technologies worldwide.

Get More Information about this report -

Request Free Sample ReportSuper abrasives are specialized grinding materials known for their exceptional hardness and durability, primarily comprising diamond and cubic boron nitride (CBN). These materials are integral to precision machining processes across various industries, including automotive, aerospace, electronics, and medical devices. Their superior performance in cutting, grinding, and polishing applications makes them indispensable in modern manufacturing.

The super abrasives market is poised for steady growth, driven by technological advancements, increasing demand for precision tools, and expanding applications across various industries. Emerging trends such as the adoption of electric vehicles, advancements in aerospace engineering, and the miniaturization of electronic components will further propel market growth. However, addressing challenges related to high production costs and environmental regulations will be crucial for sustained development.

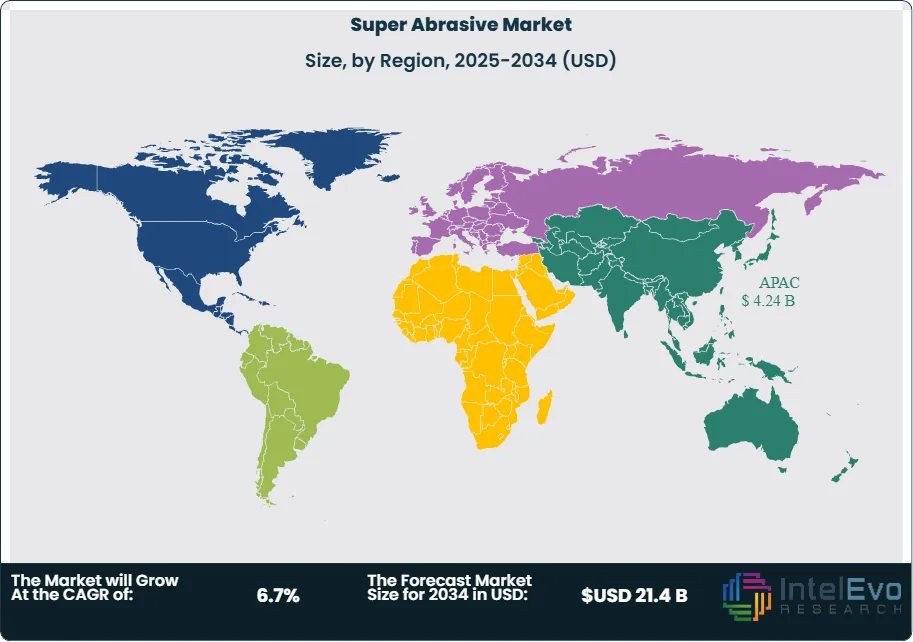

The Asia-Pacific region dominates the super abrasives market, accounting for approximately 45% of the global revenue share. This is attributed to rapid industrialization, growing automotive and electronics sectors, and significant investments in manufacturing infrastructure in countries like China and India. North America holds the second-largest market share, driven by advanced technological capabilities and a strong presence of key industries. Europe follows, with a focus on research and development and stringent quality standards in manufacturing processes.

The COVID-19 pandemic had a significant impact on the super abrasives market. Disruptions in the global supply chain, temporary shutdowns of manufacturing facilities, and reduced demand from end-user industries led to a decline in market growth in 2020. However, as economies gradually reopened and industrial activities resumed, the market began to recover, reaching pre-pandemic levels by late 2021. The pandemic also highlighted the importance of automation and digitalization in manufacturing, leading to increased investments in advanced machining technologies that utilize super abrasives.

Key Takeaways:

- Strong Market Expansion: The Super Abrasive Market is projected to grow from USD 10.6 billion in 2024 to approximately USD 21.4 billion by 2034, exhibiting a CAGR of 6.7% during 2025–2034. This growth reflects rising demand for ultra-precision machining and advanced material processing technologies.

- Dominance of Diamond-Based Super Abrasives: Diamond abrasives hold the largest market share due to their superior hardness, wear resistance, and extensive use in cutting and grinding applications across automotive, aerospace, and electronics sectors.

- Type Dominance: Diamond abrasives dominate the market due to their superior hardness and broad industrial applications, while CBN is gaining traction in metalworking and automotive sectors.

- Bonding Agent Dominance: Resin bond currently leads due to its versatility and cost-effectiveness, while vitrified bonds are poised for significant future growth owing to their strength and thermal resistance.

- Application Dominance: Grinding dominates the market due to its extensive use in manufacturing and precision engineering, while cutting and drilling applications are expected to witness strong growth in advanced material processing and construction sectors.

- End-Use Dominance: Automotive sector leads the market due to high-volume precision manufacturing, while the medical and electronics sectors are projected to grow significantly owing to rising demand for miniaturization and advanced materials.

- Driver: The super abrasive market is primarily driven by the growing demand from the automotive, electronics, and aerospace industries, along with increasing adoption in precision machining and high-performance tools. Technological advancements have also contributed to the widespread use of super abrasives for complex and high-tolerance applications.

- Restraint: High initial investment costs and complex manufacturing processes pose major challenges for widespread adoption of super abrasives. Additionally, limited awareness in emerging markets and reliance on skilled labor restrict market expansion.

- Opportunity: Expansion into emerging markets, particularly in Asia-Pacific and Latin America, offers vast growth potential. Furthermore, the increasing emphasis on sustainability and eco-friendly manufacturing processes is creating demand for energy-efficient and durable abrasive solutions.

- Trend: The market is witnessing a trend toward customization and application-specific abrasive tools, along with the adoption of AI and IoT in machining processes. Furthermore, nanotechnology is becoming a game-changer in enhancing tool performance and wear resistance.

- Regional Analysis: Asia-Pacific leads the market, driven by robust manufacturing sectors in China, Japan, India, and South Korea.

Type Analysis:

Diamond Leads With more than 60% Market Share in Super Abrasive Market, Diamond-based abrasives are the most widely used, owing to their exceptional hardness, thermal conductivity, and versatility in machining non-ferrous materials like ceramics, glass, and composites. They are extensively utilized in industries requiring ultra-precise grinding and polishing, making them the dominant type in the market.

CBN (Cubic Boron Nitride), though slightly less hard than diamond, excels in cutting ferrous materials, where diamond is chemically reactive and degrades quickly. This makes CBN ideal for high-speed steel and hardened alloy machining in automotive and aerospace industries.

The “Others” category includes materials like aluminum oxide and silicon carbide but remains niche due to limited performance compared to diamond and CBN.

Bonding Agent Analysis:

Resin bond abrasives dominate the market because they are adaptable, economical, and can be used in both wet and dry grinding applications. They offer excellent cutting ability and are suitable for precision grinding of materials like carbide tools, ceramics, and glass. Their widespread application across automotive, electronics, and tool manufacturing industries secures their leading market share.

Vitrified bond abrasives, made from a mixture of clays and ceramic materials, are gaining attention due to their rigidity, porosity, and thermal conductivity. They are highly efficient in high-speed and heavy-duty grinding operations, especially for hardened steel components. As manufacturing processes demand greater precision, longer tool life, and thermal resistance, vitrified bonds are expected to grow rapidly, particularly in aerospace and automotive sectors.

Other bond types like metal bond (for ultra-fine grinding) and electroplated (for aggressive stock removal) serve niche markets but remain secondary in volume.

Application Analysis:

Grinding is the leading application for super abrasives, primarily because of its critical role in finishing processes across industries like automotive, aerospace, and tooling. Super abrasives like diamond and cubic boron nitride (CBN) are essential in grinding operations for their durability, hardness, and ability to retain sharpness over extended use. These abrasives help achieve ultra-smooth finishes, tight tolerances, and efficient material removal making them indispensable for high-precision parts and components.

Polishing and cutting also account for a notable share of the market. While polishing is vital in electronics, optics, and decorative applications, cutting is growing in importance with the rise of advanced composite materials, ceramics, and high-strength metals in construction, energy, and aerospace. Diamond-coated super abrasives provide fast, clean cuts with minimal material damage.

Drilling applications, particularly in oil & gas, mining, and construction, are also on the rise, with super abrasives enabling deeper, faster drilling into hard rock and metals.

End-Use Analysis:

The automotive industry is the largest consumer of super abrasives, primarily for grinding and finishing critical components like crankshafts, camshafts, engine blocks, and transmission parts. The demand for high precision, surface quality, and durability has led to widespread use of diamond and CBN-based abrasives. The growth of electric vehicles (EVs) further amplifies demand due to the complexity and precision required in battery and motor component manufacturing.

The aerospace sector also significantly contributes to market growth, driven by its need for precision machining of high-strength materials like titanium, nickel alloys, and composites.

Meanwhile, the medical industry is emerging as a high-growth segment. With the increasing production of surgical tools, implants, and diagnostic devices, there is a rising need for ultra-precise finishing and cutting capabilities well supported by super abrasives. The electronics industry is also witnessing growth as demand rises for semiconductor wafers, microcomponents, and optical lenses—where surface smoothness and dimensional accuracy are critical.

Region Analysis:

Asia-Pacific Leads With over 40% Market Share in Super Abrasive Market. Asia-Pacific holds the largest share of the super abrasive market due to the presence of well-established manufacturing hubs and significant demand from end-use industries like automotive, electronics, and metal fabrication. Countries like China, Japan, and South Korea have heavily invested in precision machining and high-volume manufacturing, which necessitates the use of diamond and CBN super abrasives. Moreover, the rapid growth of the electric vehicle (EV) market in this region further fuels the demand for high-performance grinding and cutting tools.

North America, particularly the U.S., is witnessing strong growth owing to its technologically advanced aerospace and medical sectors. The demand for super abrasives in surgical instruments, orthopedic implants, and aerospace components is rising due to their precision and durability.

Europe also maintains a substantial market share, driven by Germany’s advanced automotive and industrial machining sectors. Meanwhile, Latin America and the Middle East & Africa represent emerging markets with growing infrastructure and manufacturing development.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Product Type

- Diamond

- Cubic Boron Nitride (CBN)

- Others (Ceramic, Composite Abrasives)

By Application

- Precision Grinding

- Cutting and Polishing

- Tool Grinding

- Drilling and Boring

- Others

By Industry Vertical

- Automotive

- Aerospace & Defense

- Electronics & Semiconductor

- Metal Fabrication

- Medical Devices

- Oil & Gas

- Others

By Form

- Wheels

- Belts

- Discs

- Blades

- Others

By Bonding Agent

- Resin Bond

- Electroplated

- Metal Bond

- Vitrified

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 10.6 B |

| Forecast Revenue (2034) | USD 21.4 B |

| CAGR (2025-2034) | 6.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Diamond, Cubic Boron Nitride (CBN), Others (Ceramic, Composite Abrasives)), By Application (Precision Grinding, Cutting and Polishing, Tool Grinding, Drilling and Boring, Others), By Industry Vertical (Automotive, Aerospace & Defense, Electronics & Semiconductor, Metal Fabrication, Medical Devices, Oil & Gas, Others), By Form (Wheels, Belts, Discs, Blades, Others), By Bonding Agent (Resin Bond, Electroplated, Metal Bond, Vitrified, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | 3M Company, Asahi Diamond Industrial Co. Ltd., Tyrolit Group, Noritake Co. Limited, Saint-Gobain, VSM AG, CUMI, Heger GmbH Excellent Diamond Tools, Gunter Effgen GmbH, Super Abrasives, Hyperion Materials & Technologies, Continental Diamond Tool Corporation, White Dove Abrasives Co. Ltd, Luoyang Runbao Super Abrasives Co. Ltd., Norton Abrasives, Zhuhai Elephant Abrasives Co. Ltd, Protech Diamond Tools Inc., Zhengzhou Hongtuo Super Abrasive Products Co. Ltd, Radiac Abrasives Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Super Abrasive Market Growth Forecast 2024–2034

Published Date : 24 Jun 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date