Supply Chain Digital Twin Market Size, Share to Reach $8.84 Bn by 2034

Global Supply Chain Digital Twin Market Size, Share, Analysis Report Component (Services, Software), Deployment Mode (Cloud, On-premise), Organization Size (SMEs, Large Enterprises), Technology (Blockchain, IoT, Big Data Analytics, AI), End-User Industry (Consumer Goods, Manufacturing, Automotive, Pharmaceuticals, Aerospace and Defense, Retail) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

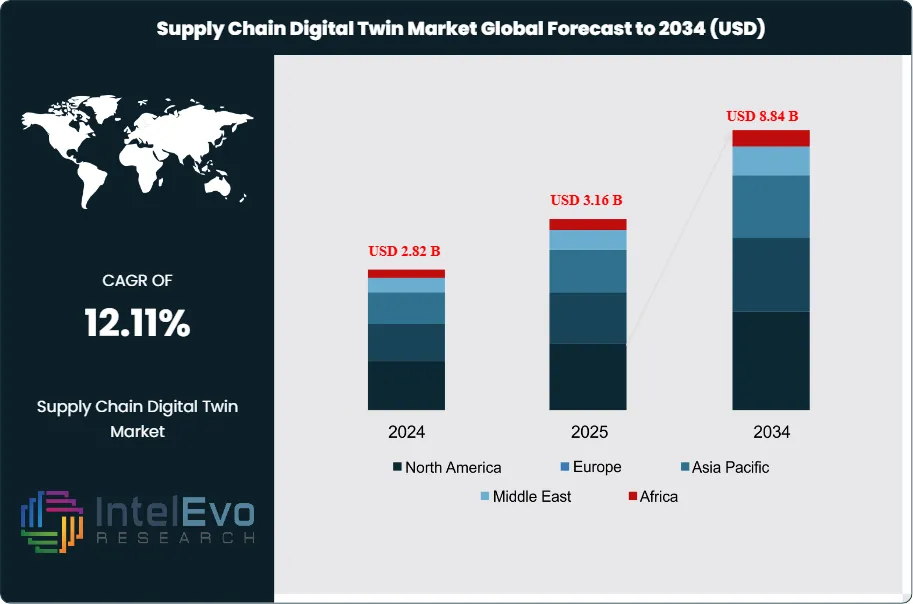

The Supply Chain Digital Twin Market size is expected to be worth around USD 8.84 Billion by 2034, up from USD 2.82 Billion in 2024, growing at a CAGR of 12.11% during the forecast period from 2024 to 2034. This expansion is fueled by increasing demand for real-time supply chain visibility, predictive analytics, and risk mitigation across manufacturing, logistics, and retail sectors. As enterprises accelerate digital transformation initiatives and adopt AI- and IoT-enabled planning platforms, supply chain digital twins are becoming a strategic imperative for enhancing resilience, agility, and cost optimization in global operations.

Get More Information about this report -

Request Free Sample ReportThe Supply Chain Digital Twin Market represents a transformative segment within the broader digital twin ecosystem, leveraging advanced technologies to create virtual replicas of physical supply chain operations. Supply Chain Digital Twin Market is projected to grow from USD 9.39 Billion in 2025 to USD 40.78 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 17.72% during the forecast period (2025 - 2034). The market encompasses sophisticated software solutions and services that enable organizations to simulate, monitor, and optimize their supply chain processes in real-time. Key factors driving this market include increasing demand for supply chain visibility, the need for predictive analytics, rising complexity of global supply chains, and the imperative for operational efficiency enhancement. Organizations are increasingly adopting digital twin technologies to mitigate risks, reduce costs, and improve decision-making capabilities across their supply chain networks.

The market's growth trajectory is significantly influenced by the integration of emerging technologies such as artificial intelligence, machine learning, Internet of Things (IoT), and blockchain. These technologies enhance the capabilities of digital twins by providing real-time data collection, advanced analytics, and improved security features. The COVID-19 pandemic highlighted the vulnerabilities in traditional supply chain models, accelerating the adoption of digital twin solutions as organizations sought to build more resilient and agile supply chains. Additionally, the increasing focus on sustainability and regulatory compliance is driving organizations to implement digital twin technologies that provide comprehensive visibility and control over their supply chain operations.

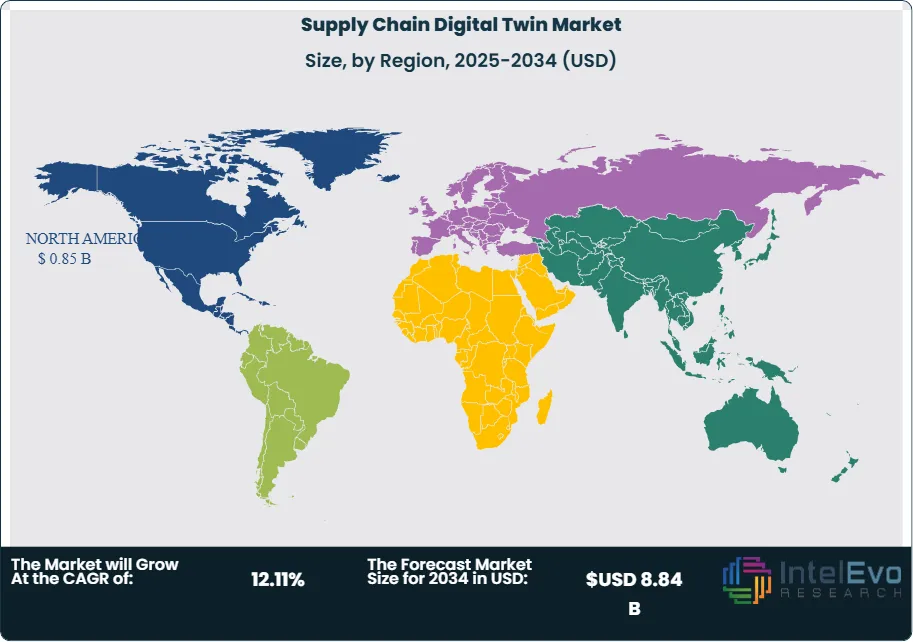

The North America region dominated the Global Supply Chain Digital Twin Market by Region in 2022 The region's leadership is attributed to early technology adoption, presence of major technology vendors, and significant investments in digital transformation initiatives. Europe follows as a significant market, driven by stringent regulatory requirements and focus on supply chain sustainability. The Asia-Pacific region, however, shows the highest growth potential due to rapid industrialization, increasing manufacturing activities, and growing digital infrastructure investments.

The COVID-19 pandemic served as a catalyst for the supply chain digital twin market, exposing critical vulnerabilities in traditional supply chain models and accelerating digital transformation initiatives. Organizations faced unprecedented disruptions including supplier shutdowns, logistics bottlenecks, and demand volatility, which highlighted the need for enhanced visibility and predictive capabilities. The pandemic drove increased investment in digital twin technologies as companies sought to build more resilient, agile, and responsive supply chains. Post-pandemic recovery efforts have further emphasized the importance of digital twin solutions in scenario planning, risk management, and supply chain optimization, leading to sustained market growth and adoption across various industries.

Regional conflicts and trade tensions between major economies have significantly impacted global supply chains, creating additional complexity and uncertainty that digital twin technologies help address. The ongoing trade disputes between the United States and China, geopolitical tensions in Eastern Europe, and various regional conflicts have disrupted traditional supply chain routes and relationships. These challenges have led to supply chain diversification strategies, near-shoring initiatives, and increased focus on supply chain resilience. Digital twin technologies play a crucial role in modeling alternative scenarios, assessing risks associated with different suppliers and routes, and optimizing supply chain configurations in response to changing geopolitical landscapes. Tariffs on goods and trade restrictions have forced organizations to reassess their supply chain strategies, making digital twin solutions essential for evaluating the impact of various trade policies and optimizing supply chain networks for cost efficiency and compliance.

Key Takeaways

- Market Growth: The Supply Chain Digital Twin Market is expected to reach USD 8.84 Billion by 2034, due to increasing digital transformation, focus on operational efficiency, and demand for real-time insights.

- Component Dominance: Software solutions dominate the market as they offer simulation, analytics, and predictive modeling capabilities essential for digital twins.

- Deployment Mode Dominance: Cloud-based deployments lead due to their scalability, flexibility, and lower upfront investment.

- Organization Size Dominance: Large enterprises dominate adoption, leveraging digital twins to manage complex global supply chains and reduce operational risks.

- Technology Dominance: IoT is a key enabler, providing real-time data streams that fuel the accuracy and relevance of digital twin simulations.

- End-User Industry Dominance: The manufacturing sector leads end-user adoption due to its complexity and need for continuous process optimization.

- Driver: Demand for real-time visibility and predictive analytics is driving rapid market adoption.

- Restraint: High implementation costs and integration with legacy systems are significant hurdles.

- Opportunity: High implementation costs and integration with legacy systems are significant hurdles.

- Trend: Shift towards AI-integrated digital twins and cloud-native solutions is redefining supply chain operations.

- Regional Analysis: North America remains the dominant region, with Asia-Pacific emerging as the fastest-growing market due to digital manufacturing trends.

Component Analysis:

Software Leads With more than 60% Market Share In Supply Chain Digital Twin Market

Software remains the backbone of the Supply Chain Digital Twin market. These solutions enable real-time modeling, simulation, and analytics. Companies leverage software tools to create digital replicas of their entire supply chains and apply predictive analytics for informed decision-making. Software solutions offer integration with ERP, WMS, and TMS systems, ensuring seamless flow of data. Vendors are focusing on enhancing user interfaces, dashboard functionalities, and interoperability, further pushing software adoption across industries.

Deployment Mode Analysis:

Cloud deployment has gained traction due to its cost efficiency, flexibility, and real-time data processing capabilities. Organizations favor cloud-based digital twins for their ease of deployment, minimal hardware requirements, and remote access capabilities. Cloud models also offer scalability, allowing enterprises to adjust capacity based on dynamic business needs. Furthermore, vendors like IBM and SAP are offering SaaS-based digital twin platforms to facilitate smoother adoption among enterprises of all sizes.

Organization Size Analysis:

Large enterprises lead the adoption curve owing to their complex operations and need for end-to-end supply chain visibility. These organizations have the capital and technological readiness to implement and benefit from advanced simulation tools. Large enterprises also face greater risk from global disruptions, making digital twins critical for scenario planning, capacity forecasting, and contingency management.

Technology Analysis:

IoT plays a pivotal role by collecting real-time data from various nodes in the supply chain—factories, warehouses, transportation, and distribution. The integration of IoT sensors allows digital twins to reflect real-world conditions more accurately, enabling faster decision-making. With growing investments in smart sensors and edge computing, IoT is set to be the foundational technology layer supporting digital twins across sectors.

End-User Industry Analysis:

Manufacturing is at the forefront of digital twin adoption due to its process-intensive and capital-heavy nature. Manufacturers utilize digital twins to optimize production scheduling, monitor machine health, and streamline inventory. The integration of operational technologies (OT) and information technologies (IT) allows manufacturers to create synchronized models of physical assets and workflows, resulting in higher efficiency and lower downtime.

Region Analysis:

North America Leads With over 30% Market Share In Supply Chain Digital Twin Market

North America leads the global supply chain digital twin market, maintaining its dominant position due to several key factors including early technology adoption, presence of major technology vendors, and significant investments in digital transformation initiatives. The region benefits from a mature technology ecosystem, advanced infrastructure, and strong regulatory support for digital innovation. Major companies in the region have been early adopters of digital twin technologies, driving market growth through successful implementation and demonstration of value. The United States, in particular, has a large concentration of technology companies and manufacturing organizations that are actively investing in digital twin solutions.

Europe represents the second-largest market, driven by stringent regulatory requirements, focus on sustainability, and emphasis on supply chain transparency. European organizations are increasingly adopting digital twin technologies to comply with regulations and meet sustainability goals. The region's strong manufacturing base and focus on operational efficiency further contribute to market growth.

The Asia-Pacific region shows the highest growth potential, driven by rapid industrialization, increasing manufacturing activities, and growing digital infrastructure investments. Countries like China, India, and Japan are witnessing significant adoption of digital twin technologies as organizations seek to modernize their supply chain operations and improve competitiveness in global markets.

Get More Information about this report -

Request Free Sample ReportMarket Segment

Component

- Services

- Software

Deployment Mode

- Cloud

- On-premise

Organization Size

- Small and Medium Size Enterprises (SMEs)

- Large Enterprises

Technology

- Blockchain

- Internet of Things (IoT)

- Big Data Analytics

- Artificial Intelligence (AI)

- Other Technologies

End-User Industry

- Consumer Goods

- Manufacturing

- Automotive

- Pharmaceuticals

- Aerospace and Defense

- Retail

- Others

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 2.82 B |

| Forecast Revenue (2034) | USD 8.84 B |

| CAGR (2025-2034) | 12.11% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Component (Services, Software), Deployment Mode (Cloud, On-premise), Organization Size (Small and Medium Size Enterprises (SMEs), Large Enterprises), Technology (Blockchain, Internet of Things (IoT), Big Data Analytics, Artificial Intelligence (AI), Other Technologies), End-User Industry (Consumer Goods, Manufacturing, Automotive, Pharmaceuticals, Aerospace and Defense, Retail, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | PTC Inc., Siemens AG, Huawei Technologies Co., Ltd., IBM Corporation, Cisco Systems, Inc., SAP SE, Dassault Systèmes, Oracle Corporation, General Electric Company, Accenture plc, PTC Inc., Ansys Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Supply Chain Digital Twin Market

Published Date : 16 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date