System on a Chip Market to Reach $355.2B by 2034 | CAGR 10.1%

Global System on a Chip (SoC) Market Size, Share, Analysis By SoC Type (Digital, Analog, Mixed-Signal, Programmable), By Application (Consumer Electronics, Automotive, Industrial, IT & Telecom), By End User (Original Equipment Manufacturers, Original Design Manufacturers, Contract Manufacturers, System Integrators) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

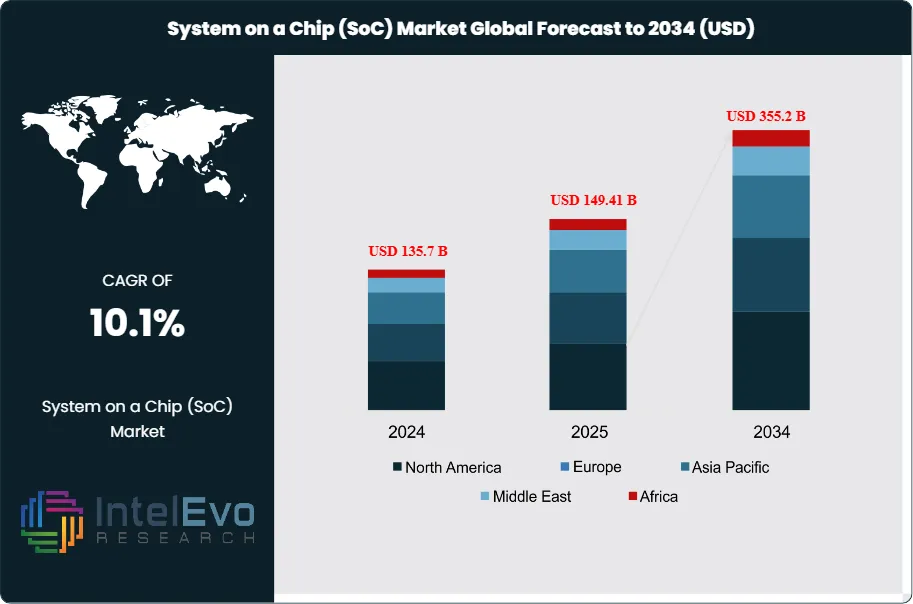

The Global System on a Chip (SoC) Market is projected to reach USD 355.2 Billion by 2034, up from USD 135.7 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2024 to 2034. The System on a Chip (SoC) Market encompasses the global industry for highly integrated semiconductor devices that consolidate multiple electronic components—such as central processing units (CPUs), graphics processing units (GPUs), memory, input/output ports, and often wireless connectivity—onto a single microchip. SoCs are engineered to deliver compact, power-efficient, and high-performance solutions, making them the core of modern electronics including smartphones, tablets, wearables, automotive systems, IoT devices, and increasingly, data center and AI hardware.

Get More Information about this report -

Request Free Sample ReportBy integrating diverse functionalities into a single chip, SoCs reduce system complexity, lower manufacturing costs, and enable the development of smaller, smarter, and more energy-efficient devices. The primary drivers of the global SoC market are the explosive growth in connected devices and the relentless demand for higher performance and energy efficiency in consumer electronics. The proliferation of smartphones, tablets, and wearables has made SoCs indispensable, as manufacturers seek to deliver more features in smaller form factors. The rapid expansion of 5G networks and the Internet of Things (IoT) is further accelerating demand, as SoCs enable real-time data processing and connectivity at the edge. In the automotive sector, the shift toward electric vehicles, advanced driver-assistance systems (ADAS), and in-car infotainment is fueling the adoption of automotive-grade SoCs.

Additionally, the rise of artificial intelligence and machine learning applications is driving the integration of AI accelerators and neural processing units within SoCs, supporting advanced analytics and automation across industries. The need for cost-effective, integrated solutions that reduce power consumption and system complexity continues to propel market growth. The SoC market is segmented by type, application, technology node, end user, and region.

By type, the market includes digital SoCs, analog SoCs, mixed-signal SoCs, programmable SoCs, and RF SoCs. Application segments span consumer electronics (smartphones, tablets, wearables, smart TVs), automotive (ADAS, infotainment, telematics), industrial automation, IT and telecommunications (networking, 5G infrastructure), and healthcare devices. Technology node segmentation reflects the ongoing miniaturization of semiconductor manufacturing, with categories such as 7nm and below, 8–14nm, 15–28nm, and above 28nm. End users include OEMs, ODMs, contract manufacturers, system integrators, and research institutes. This diverse segmentation highlights the broad applicability and innovation within the SoC market.

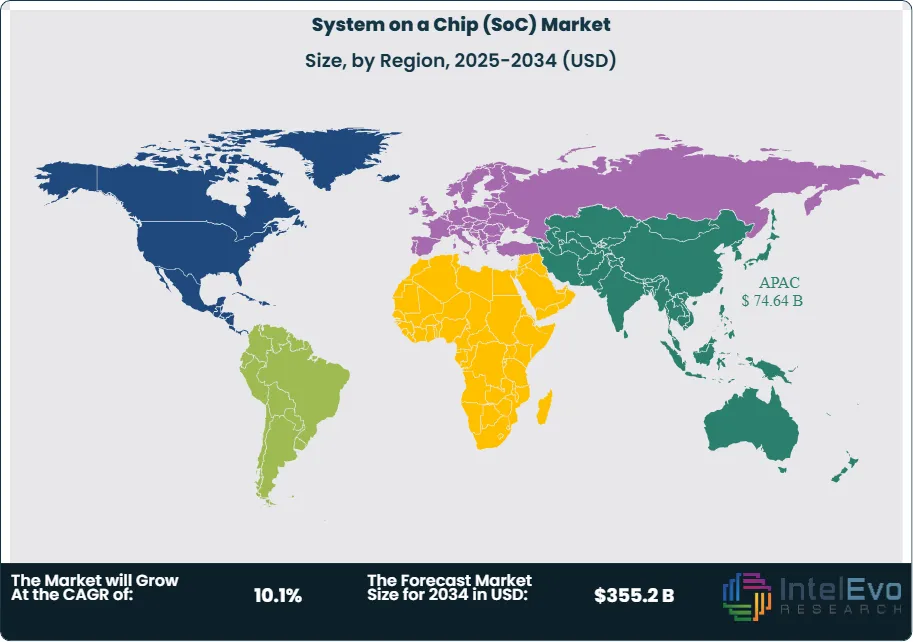

Regionally, the SoC market is led by Asia-Pacific, which accounts for the largest share due to the presence of major semiconductor foundries, electronics manufacturing hubs, and a vast consumer electronics market in countries like China, South Korea, Taiwan, and Japan. North America follows, driven by strong R&D investment, leading fabless semiconductor companies, and early adoption of advanced technologies in sectors such as automotive and data centers. Europe maintains a significant presence, particularly in automotive and industrial automation, supported by robust engineering expertise and a focus on quality and safety standards. Latin America and the Middle East & Africa are emerging markets, with growth fueled by increasing smartphone penetration, digital transformation, and infrastructure development.

The COVID-19 pandemic had a mixed impact on the SoC market. Initially, global supply chain disruptions and factory shutdowns led to production delays and component shortages, affecting the availability of consumer electronics and automotive products. However, the pandemic also accelerated digital transformation, remote work, and e-learning, driving a surge in demand for laptops, tablets, smartphones, and networking equipment—all of which rely on SoCs. The increased focus on healthcare technology and telemedicine further boosted demand for medical devices powered by SoCs. As supply chains stabilized, the market rebounded strongly, with manufacturers investing in supply chain resilience and capacity expansion to meet growing demand. Geopolitical tensions and trade disputes, particularly between major economies such as the U.S. and China, have significantly influenced the SoC market. Export restrictions, tariffs, and technology transfer limitations have prompted companies to diversify supply chains, invest in regional manufacturing, and develop alternative sourcing strategies. The push for semiconductor self-sufficiency in regions like the U.S., China, and the European Union has led to increased government investment in domestic chip manufacturing and R&D. These geopolitical dynamics have added complexity to the global SoC market, driving innovation but also increasing operational risks and costs for multinational companies. Data security, intellectual property protection, and compliance with evolving export controls remain critical considerations for market participants.

Key Takeaways

- Market Growth: The Global System on a Chip (SoC) Market is projected to reach USD 355.2 Billion by 2034, up from USD 135.7 Billion in 2024, fueled by the proliferation of smart devices, rapid 5G rollout, and the integration of AI and edge computing capabilities.

- Type Dominance: Digital and mixed-signal SoCs dominate the market, as they enable high-performance processing, efficient power management, and seamless integration of multiple functionalities for consumer electronics, automotive, and industrial applications.

- Application Dominance: Consumer electronics remain the largest application segment, with smartphones, tablets, and wearables driving demand for advanced SoCs. Automotive applications are rapidly growing, propelled by the adoption of ADAS, infotainment, and electric vehicle technologies.

- Technology Node Leadership: Advanced technology nodes (7nm and below) are gaining market share as manufacturers seek higher transistor density, lower power consumption, and enhanced performance for AI, IoT, and high-end computing devices.

- Regional Analysis: Asia-Pacific leads the market with over 50% share, supported by major semiconductor foundries, electronics manufacturing hubs, and a vast consumer base. North America follows, driven by strong R&D, fabless chip design, and early adoption in automotive and data center sectors. Europe maintains a robust presence in automotive and industrial automation.

- Drivers: Key growth drivers include the surge in connected devices, demand for energy-efficient and compact solutions, expansion of 5G and IoT ecosystems, and the integration of AI accelerators within SoCs.

- Restraints: Market growth is challenged by the high cost and complexity of advanced chip design, ongoing supply chain disruptions, and the need for continuous innovation to keep pace with rapid technological change.

- Opportunities: Significant opportunities exist in AI-enabled SoCs, automotive electronics, healthcare devices, and the expansion of smart infrastructure and industrial automation.

- Trends: Notable trends include the rise of chiplet architectures, heterogeneous integration, advanced packaging technologies, and the increasing adoption of security and connectivity modules within SoCs.

Type Analysis

The SoC market is categorized by type into Digital SoC, Analog SoC, Mixed-Signal SoC, and Programmable SoC. Digital SoCs hold the largest share, accounting for approximately 55% of the global market. This dominance is due to their widespread use in high-volume consumer electronics such as smartphones, tablets, and laptops, where digital processing, memory, and connectivity are integrated onto a single chip. Mixed-signal SoCs are also gaining traction, especially in applications requiring both analog and digital functionalities, such as IoT devices and automotive electronics. Analog and programmable SoCs serve niche markets, including industrial automation and specialized embedded systems, but their overall market share remains smaller compared to digital SoCs.

Application Analysis

By application, the market is segmented into Consumer Electronics, Automotive, Industrial, and IT & Telecommunication. Consumer Electronics is the leading application segment, commanding over 60% of the total market share. The proliferation of smartphones, tablets, wearables, and smart TVs has driven massive demand for advanced SoCs that deliver high performance, energy efficiency, and compact form factors. Automotive applications are the fastest-growing segment, fueled by the adoption of advanced driver-assistance systems (ADAS), infotainment, and telematics, but they still trail consumer electronics in overall share. Industrial and IT & Telecommunication applications are expanding steadily, driven by automation, robotics, and the rollout of 5G infrastructure, yet they represent a smaller portion of the market compared to consumer devices.

End User Analysis

The end user segment includes OEMs (Original Equipment Manufacturers), ODMs (Original Design Manufacturers), Contract Manufacturers, and System Integrators. OEMs dominate this segment, holding approximately 50% of the market share. OEMs are the primary customers for SoC suppliers, as they design and assemble finished products such as smartphones, vehicles, and industrial equipment that rely on integrated SoC solutions. ODMs and contract manufacturers play important roles in the supply chain, particularly for brands that outsource design or production, but their market share is less than that of OEMs. System integrators, while crucial for specialized and industrial deployments, account for a smaller share of the overall market.

Region Analysis

Regionally, the SoC market is led by Asia-Pacific, which captures more than 55% of the global market share. This region’s dominance is attributed to the presence of major semiconductor foundries, electronics manufacturing hubs, and a vast consumer base in countries like China, South Korea, Taiwan, and Japan. North America is the second-largest market, driven by strong R&D, leading fabless chip companies, and early adoption in automotive and data center sectors. Europe maintains a significant share, particularly in automotive and industrial automation, while Latin America and the Middle East & Africa are emerging markets with growing demand for consumer electronics and digital infrastructure.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Digital SoC

- Analog SoC

- Mixed-Signal SoC

- Programmable SoC

By Application

- Consumer Electronics (smartphones, tablets, wearables, smart TVs)

- Automotive (ADAS, infotainment, telematics)

- Industrial (automation, robotics, smart manufacturing)

- IT & Telecommunication (networking, data centers, 5G infrastructure)

By End User

- OEMs (Original Equipment Manufacturers)

- ODMs (Original Design Manufacturers)

- Contract Manufacturers

- System Integrators

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 149.41 B |

| Forecast Revenue (2034) | 355.2 B |

| CAGR (2025-2034) | 10.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Digital SoC, Analog SoC, Mixed-Signal SoC, Programmable SoC), By Application (Consumer Electronics (smartphones, tablets, wearables, smart TVs), Automotive (ADAS, infotainment, telematics), Industrial (automation, robotics, smart manufacturing), IT & Telecommunication (networking, data centers, 5G infrastructure)), By End User (OEMs (Original Equipment Manufacturers), ODMs (Original Design Manufacturers), Contract Manufacturers, System Integrators) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Qualcomm Incorporated, Intel Corporation, Samsung Electronics Co., Ltd., Broadcom Inc., MediaTek Inc., Texas Instruments Incorporated, Apple Inc., NVIDIA Corporation, STMicroelectronics N.V., NXP Semiconductors N.V. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the System on a Chip (SoC) Market?

The Global System on a Chip (SoC) Market is set to grow from $135.7B in 2024 to $355.2B by 2034, expanding at a 10.1% CAGR. Explore trends, drivers, and forecasts.

Who are the major players in the System on a Chip (SoC) Market?

Qualcomm Incorporated, Intel Corporation, Samsung Electronics Co., Ltd., Broadcom Inc., MediaTek Inc., Texas Instruments Incorporated, Apple Inc., NVIDIA Corporation, STMicroelectronics N.V., NXP Semiconductors N.V.

Which segments covered the System on a Chip (SoC) Market?

By Type (Digital SoC, Analog SoC, Mixed-Signal SoC, Programmable SoC), By Application (Consumer Electronics (smartphones, tablets, wearables, smart TVs), Automotive (ADAS, infotainment, telematics), Industrial (automation, robotics, smart manufacturing), IT & Telecommunication (networking, data centers, 5G infrastructure)), By End User (OEMs (Original Equipment Manufacturers), ODMs (Original Design Manufacturers), Contract Manufacturers, System Integrators)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

System on a Chip (SoC) Market

Published Date : 02 Sep 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date