Tattoo Inks Market Size, Share & Growth Forecast | 6.1% CAGR

Global Tattoo Ink Market Size, Share & Analysis By Product Type (Colored Tattoo Inks, Monochrome Tattoo Inks), By Category (Organic, Synthetic), By Distribution Channel (Tattoo Studios, Specialty Stores, Online Retail) Industry Regions & Key Players – Safety Regulations, Consumer Trends & Forecast 2025–2034

Report Overview

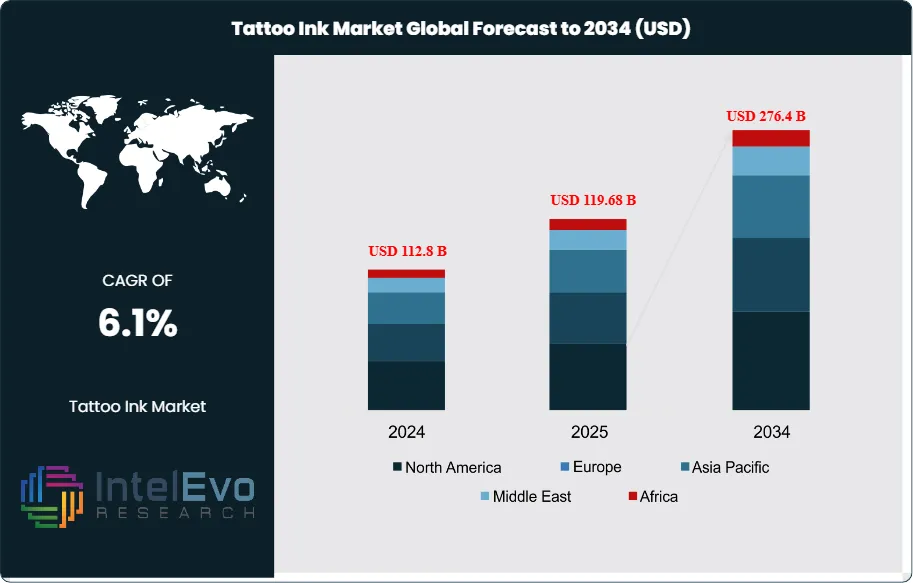

The Tattoo Inks Market is projected to grow from USD 112.8 Billion in 2024 to approximately USD 276.4 Billion by 2034, expanding at a CAGR of around 6.1% during 2025–2034. Rising global tattoo culture, fueled by fashion trends, social media influence, and personal identity expression, is driving strong market expansion. The demand for vegan, organic, and non-toxic tattoo ink formulations is rapidly increasing as consumers prioritize skin safety and ingredient transparency. Growing tattoo studios, influencer-backed designs, and tattoo acceptance in corporate environments are accelerating industry growth worldwide. This growth trajectory is supported by rising tattoo prevalence among younger demographics, the growing adoption of permanent makeup, and innovations in ink formulations that balance safety with artistic performance.

Get More Information about this report -

Request Free Sample ReportTattoo inks are formulated from a mixture of pigments and carrier solutions such as distilled water or ethanol, often combined with surfactants, binders, and preservatives to ensure stability and longevity. Black and gray inks remain foundational for outlining and shading, while the demand for colored inks has risen in tandem with fashion-driven and individualized tattoo styles. The market is also being shaped by increasing interest in organic and vegan inks, developed from natural pigments and animal-free carriers, as consumers seek safer and more sustainable alternatives.

From a cultural standpoint, the acceptance of tattoos continues to widen globally. In Europe, for example, approximately 12% of the population already has tattoos, while in North America, tattoos are deeply embedded in youth and lifestyle culture. Technological improvements—such as inks designed for easier removal and longer-lasting vibrancy—are lowering hesitation among first-time adopters. However, the sector also faces challenges: regulatory restrictions, particularly within the EU, are tightening around ingredients such as heavy metals, creating additional compliance hurdles for manufacturers.

Regionally, Europe and North America remain mature markets characterized by high adoption rates and stringent safety oversight, whereas Asia Pacific is emerging as a growth hotspot, driven by urbanization, rising disposable incomes, and cultural shifts that favor body art. Together, these factors are creating a market landscape where innovation, safety, and personalization will define the competitive edge over the next decade.

Key Takeaways

- Market Expansion: The tattoo inks market was valued at USD 112.8 Billion in 2024 and is forecast to reach USD 276.4 Billion by 2034, advancing at a 6.1% CAGR, supported by greater cultural acceptance and product innovation.

- Ink Type: Monochrome inks commanded over 62% share in 2023, owing to their essential role in outlining, shading, and universal application across tattoo styles.

- Formulation Preference: Organic inks accounted for more than 55% of global demand in 2023, reflecting a shift toward natural, vegan, and eco-conscious products.

- Distribution Channel: Tattoo studios remain the dominant point of sale, holding nearly 39% of the market, reinforced by consumer trust in professional-grade applications.

- Growth Driver: Rising tattoo adoption among millennials and Gen Z, supported by influencer and celebrity visibility, continues to fuel demand globally.

- Constraint: Heightened regulatory oversight and concerns over chemical additives present compliance challenges, particularly in Western markets.

- Opportunity: The expanding permanent makeup industry and customization-oriented ink formulations open new avenues for revenue diversification.

- Trend: Sustainability and personalization are reshaping the industry, with vegan inks and tech-enabled design tools gaining rapid traction.

- Regional Insights: Europe leads with nearly 39% share, underpinned by cultural penetration and safety regulation, while Asia Pacific is poised for the fastest growth, driven by rising disposable incomes and lifestyle adoption.

Product Type

As of 2025, monochrome tattoo inks continue to dominate the global market, accounting for more than 62% of total share. Primarily comprised of black and gray formulations, these inks remain the backbone of tattoo artistry due to their versatility, durability, and essential role in outlining and shading. Their bold pigmentation, long-lasting quality, and suitability across a wide range of artistic styles ensure sustained preference across demographics. Monochrome inks are widely used in both minimalistic designs and elaborate full-body artwork, reinforcing their status as an industry staple with enduring appeal.

Meanwhile, colored tattoo inks are gaining momentum as consumers increasingly seek vibrant and personalized expressions of body art. Although they currently represent a smaller portion of the market compared to monochrome variants, their growth trajectory is strong, supported by technological advances that have improved pigment stability, color intensity, and safety. Expanding cultural acceptance of colorful tattoos and the influence of fashion trends are expected to accelerate adoption. Over the next decade, as tattoo artists continue to experiment with creative applications and broader color palettes, colored inks are projected to capture a growing share of market revenues.

Category

The organic tattoo ink segment has emerged as the clear leader, representing over 55% of global market share in 2025. These inks are derived from natural sources such as plants, vegetables, and minerals, making them increasingly attractive to health-conscious consumers and those seeking environmentally sustainable options. Rising awareness about the potential health risks of chemical-based inks has reinforced demand for organic alternatives, particularly among younger clients and in regions with strict cosmetic safety regulations. Additionally, organic inks often provide unique, softer tones that appeal to individuals looking for more natural finishes in both body art and permanent makeup applications.

Synthetic inks, while holding a comparatively smaller share, remain important due to their durability, vivid pigmentation, and consistency. Manufactured using chemical compounds and metallic salts, these inks provide sharper colors and long-lasting results, making them popular among professional artists for detailed or high-impact designs. However, tightening regulatory frameworks, particularly in the United States and Europe, present challenges for this segment. As consumer preference continues to shift toward safer, eco-friendly alternatives, synthetic ink producers may need to invest in reformulation and innovation to maintain competitiveness.

Distribution Channel

Tattoo studios represent the leading distribution channel, accounting for approximately 38% of global sales in 2025. Their dominance is linked to consumer trust in professional tattoo artists, who often provide inks directly as part of their services. Studios serve as both points of purchase and application, offering clients reassurance regarding product authenticity, hygiene, and expertise. This direct service model makes studios the most reliable and preferred channel for the majority of consumers.

Specialty stores continue to play a significant role in the market, providing curated selections of tattoo inks and related equipment. Although their market share is smaller compared to studios, these outlets differentiate themselves through expert knowledge and the availability of niche or premium ink brands. For enthusiasts and professional artists, specialty retailers serve as valuable sources for specialized advice and high-quality products.

Online retail is the fastest-growing segment, benefiting from the expansion of e-commerce and consumer demand for convenience. Online platforms offer a wide range of brands, formulations, and price points, enabling both professional artists and individual buyers to compare and purchase inks more easily. While concerns remain around counterfeit or low-quality products in digital marketplaces, strong growth is expected as reputable manufacturers increasingly establish official online sales channels and global shipping networks.

Region

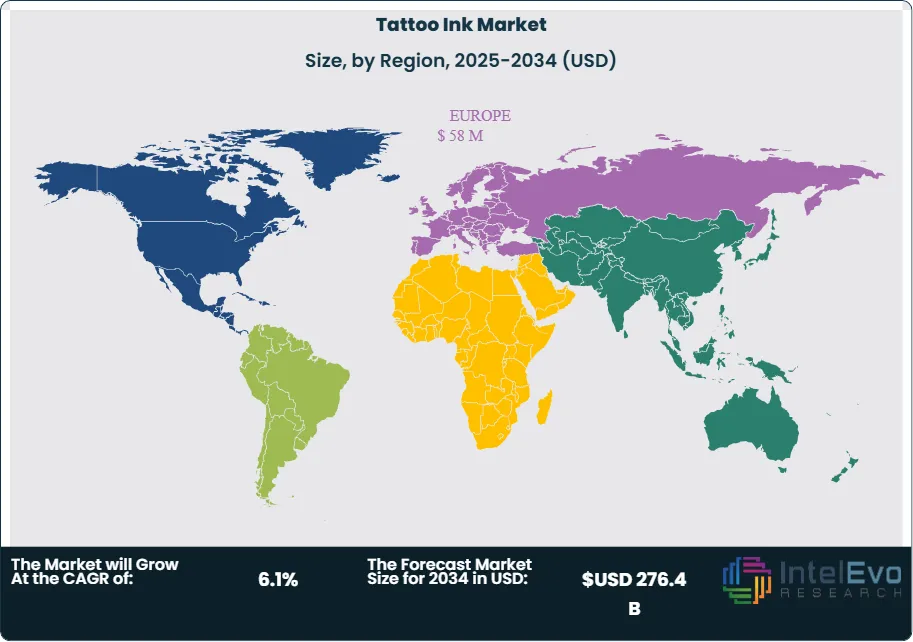

Europe currently leads the global tattoo inks market, holding around 38.5% of share in 2025 with revenues exceeding USD 58 million. The region’s strong position is underpinned by a well-established tattoo culture, especially among younger demographics. According to the Council of Europe, approximately 12% of the EU population has at least one tattoo, highlighting widespread adoption. Strict regulatory frameworks, particularly those addressing ink safety, are also pushing manufacturers toward cleaner and more sustainable formulations, further shaping the market landscape.

North America remains another highly influential region, with the United States serving as a central hub of growth. Roughly 36% of U.S. adults aged 18–29 now have tattoos, with notable adoption among college graduates, military personnel, and even older demographics. The U.S. tattoo industry is expansive, supported by more than 21,000 licensed parlors and annual consumer spending estimated at USD 1.6 billion on tattoos. While upcoming U.S. Food and Drug Administration (FDA) regulations on tattoo ink ingredients could challenge market dynamics, the established cultural relevance of tattoos in the region suggests sustained demand.

Asia Pacific, though still developing as a tattoo market, is showing rapid expansion fueled by rising disposable incomes, shifting cultural norms, and the influence of Western tattoo trends. Urban centers in countries like Japan, South Korea, and India are becoming hotspots for tattoo studios, signaling long-term growth potential. With a younger population base and expanding middle-class lifestyle adoption, Asia Pacific is expected to emerge as one of the most dynamic regions for tattoo inks over the next decade.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Product Type

- Colored Tattoo Inks

- Monochrome Tattoo Inks

By Category

- Organic

- Synthetic

By Distribution Channel

- Tattoo Studios

- Specialty Stores

- Online Retail

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 112.8 B |

| Forecast Revenue (2034) | USD 276.4 B |

| CAGR (2025-2034) | 6.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Colored Tattoo Inks, Monochrome Tattoo Inks), By Category (Organic, Synthetic), By Distribution Channel (Tattoo Studios, Specialty Stores, Online Retail) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Intenze Products Austria GmbH, Eternal Tattoo Supply, Kuro Sumi, Dynamic Tattoo Ink, Bloodline Tattoo Ink, StarBrite Colors Tattoo Ink, Fantasia Tattoo Inks, Panthera Black Tattoo Ink, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date