Tax Preparation Services Market Size Growth & Trends | CAGR of 7.1%

Global Tax Preparation Services Market Size, Share & Analysis By Service Type (Individual, Corporate), By Delivery Mode (Online, Offline), By End-User (Individuals, Small and Medium Enterprises, Large Enterprises) Industry Outlook, Digital Tax Filing Trends & Forecast 2025–2034

Report Overview

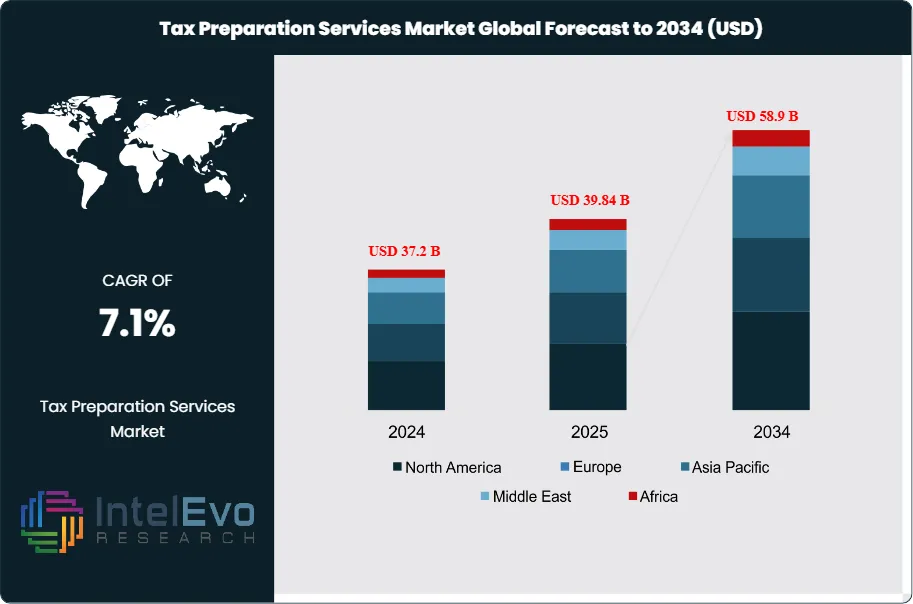

The Tax Preparation Services Market is valued at approximately USD 37.2 billion in 2024 and is projected to reach nearly USD 58.9 billion by 2034, reflecting a steady CAGR of about 7.1% over 2025–2034. Rising global tax complexity, expanding cross-border compliance requirements, and the rapid adoption of AI-enabled tax automation platforms are reshaping the competitive landscape. As digital transformation accelerates, demand for hybrid advisory models—combining human expertise with automated intelligence—is expected to surge, positioning the sector for strong multi-year growth.

Get More Information about this report -

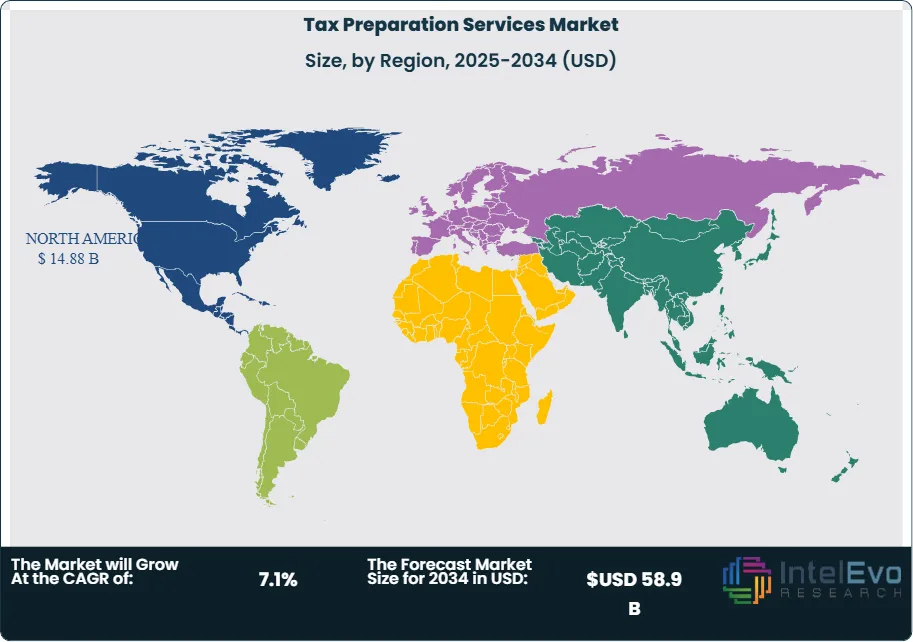

Request Free Sample ReportIn 2023, North America held more than 40% of global market share, generating USD 14.88 billion in revenue, reflecting the region’s mature regulatory framework and high filing volume. Tax preparation services, once reliant on manual processes, have increasingly integrated digital platforms and automated tools, yet this shift has not reduced demand for qualified professionals. Instead, it has reinforced the need for skilled advisors capable of interpreting automated results and managing multi-jurisdictional filings.

The expanding footprint of small and mid-sized enterprises (SMEs), which typically lack internal tax teams, is a major growth driver. In parallel, cross-border business activities and rising global mobility have increased the need for specialized tax planning and reporting. Digital transformation is reshaping service delivery, with AI-enabled tax software, client portals, and real-time compliance tools becoming standard in large firms and gaining traction among independent providers.

However, automation has not eliminated risk. Regulatory bodies continue to revise codes frequently; for example, over 60 tax changes were enacted across OECD countries between 2022 and 2024 alone, making up-to-date knowledge a market imperative. While efficiency gains from software have improved turnaround times by up to 30% in some regions, client reliance on professional guidance remains high during peak seasons.

North America will continue to dominate, but Asia Pacific is emerging as a growth hotspot due to expanding middle-income populations and increasing adoption of formalized tax systems. Meanwhile, the shift to remote work and location-independent employment is creating new compliance challenges for both individuals and employers, particularly in digital services sectors. As the complexity of tax compliance continues to rise, market players equipped with adaptive technology and specialized advisory capabilities are best positioned to capture long-term value.

Key Takeaways

- Market Growth: The global tax preparation services market was valued at USD 37.2 billion in 2024 and is expected to reach USD 58.9 billion by 2034, expanding at a CAGR of 7.1%. Growth is driven by regulatory complexity, digital tax filing mandates, and rising demand from SMEs and global workers.

- Service Type: Individual tax preparation services accounted for over 61% of the market in 2023, reflecting high seasonal demand and widespread outsourcing among U.S. and OECD taxpayers.

- Delivery Mode: Online services held a 57% market share in 2023, fueled by the growing adoption of digital filing platforms and remote tax advisory tools.

- Driver: The increasing complexity of domestic and international tax codes is a core demand driver. Over 60 tax law amendments were introduced across OECD nations between 2022 and 2024, prompting more individuals and businesses to seek professional support.

- Restraint: Data security remains a significant limitation. Concerns over cybersecurity and identity theft have deterred some users from fully adopting online tax services, particularly in developing markets with weaker digital infrastructure.

- Opportunity: Asia Pacific presents a key growth opportunity, driven by expanding formal economies and digital transformation initiatives. The region is projected to grow at a CAGR above 5.5% through 2033.

- Trend: AI-enabled tax platforms and automated compliance tools are reshaping service models. Providers integrating AI into client onboarding and filing workflows have reported up to 30% improvement in turnaround time and accuracy.

- Regional Analysis: North America led the market in 2023, generating USD 14.88 billion in revenue and holding over 40% share. Asia Pacific is gaining momentum due to policy reforms and increased tax reporting compliance, especially in India, China, and Southeast Asia.

Service Analysis

As of 2025, individual tax preparation services continue to dominate the global tax preparation market, holding over 61% of the total share. This dominance reflects the growing need for professional support as personal tax scenarios become increasingly complex due to changing regulations, rising gig economy participation, and global mobility. While software platforms have improved accessibility, the volume and variability of individual income sources—including rental income, stock trading, and freelance work—still require expert oversight to ensure compliance and deduction accuracy.

Business tax preparation services remain the second-largest segment, driven by demand from SMEs and large enterprises seeking structured guidance for corporate filings, multi-state tax exposure, and audit preparedness. This segment has gained traction with the increasing use of outsourced accounting functions, especially among mid-sized firms lacking internal tax teams. Service providers offering advisory around tax-efficient structuring, M&A impacts, and evolving corporate tax codes are seeing higher client retention rates.

Estate and trust tax preparation services, though a smaller segment, address specialized needs involving intergenerational wealth transfer, estate valuations, and complex inheritance tax rules. These services have seen modest growth, particularly in high-income markets such as North America and Western Europe. Providers that focus on high-net-worth individuals and fiduciary services continue to carve out strong positions in this niche.

Service Channel Analysis

Online services accounted for over 57% of the market in 2025, reflecting a clear shift toward digital engagement. Increasing comfort with digital tools, alongside growing demand for remote service delivery, has positioned online platforms as the preferred channel for both individual and business taxpayers. These platforms offer document upload, electronic filing, and real-time chat support, significantly improving efficiency and user experience.

Advancements in cybersecurity and data privacy have strengthened user trust in online tax platforms. Encryption protocols, two-factor authentication, and regulatory compliance with GDPR and similar standards have reduced barriers to digital adoption. Further, AI-driven features such as automated deduction checks, personalized filing suggestions, and fraud detection are being integrated across leading platforms.

Offline services, while declining in market share, remain important for complex cases requiring in-person consultations. High-net-worth individuals, estate clients, and some SMEs continue to rely on face-to-face tax advisory for strategic planning, especially in jurisdictions where digital infrastructure or trust in online systems remains limited.

End-User Analysis

Individuals remain the largest end-user group, accounting for over 60% of market share in 2025. This segment benefits from both expanding service availability and increased awareness of filing requirements. In particular, workers in freelance, gig economy, and remote employment arrangements require support to manage multiple income streams, calculate deductions, and maintain compliance across jurisdictions.

Technological improvements have made filing faster and more accessible. However, the increasing use of digital tools has not eliminated the need for human oversight. Many individual taxpayers still rely on professionals to validate automated results and navigate changing rules, particularly regarding investment income and retirement planning.

Service providers targeting this segment are leveraging mobile platforms, bilingual support, and simplified interfaces to improve reach and retention. Marketing efforts have also played a role, with firms positioning tax services not just as compliance tools but as enablers of savings and financial efficiency.

Regional Analysis

North America led the global tax preparation services market in 2025, generating over USD 14.88 billion in revenue and holding more than 40% market share. The region’s dominance is largely due to the complexity of its tax systems, including federal, state, and local layers, as well as high individual and corporate filing volumes. Tax professionals in the U.S. and Canada are in continuous demand to interpret frequent legislative updates and ensure regulatory alignment.

The growth of self-employment, gig economy platforms, and small business formation in North America further fuels service demand. More than 33 million sole proprietors and freelancers filed tax returns in the U.S. in 2024, many of whom relied on professional or hybrid tax solutions.

Asia Pacific is emerging as the fastest-growing region, supported by expanding tax base formalization in countries like India, Indonesia, and Vietnam. Government-led digital tax initiatives and increasing financial literacy are broadening the addressable market for both online and offline tax services. Meanwhile, Europe continues to maintain a stable share, with strong demand from SMEs navigating VAT, cross-border reporting, and evolving ESG-related tax disclosures.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type of Service

- Individual Tax Preparation Services

- Business Tax Preparation Services

- Estate and Trust Tax Preparation Services

By Service Channel

- Online Services

- Offline Services

By End-User

- Individuals

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 37.2 B |

| Forecast Revenue (2034) | USD 58.9 B |

| CAGR (2024-2034) | 7.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type of Service (Individual Tax Preparation Services, Business Tax Preparation Services, Estate and Trust Tax Preparation Services), By Service Channel (Online Services, Offline Services), By End-User (Individuals, Small and Medium Enterprises (SMEs), Large Enterprises). |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Intuit Inc., BDO Global, CapActix Business Solutions Pvt. Ltd., Crowe Global, Ernst & Young Global Limited, Jackson Hewitt Tax Service Inc., Deloitte Consulting LLP, Ryan LLC, 415 Group, Invensis Inc., RSM US LLP, H&R Block Inc., Entigrity Solutions LLC, PricewaterhouseCoopers International Limited, KPMG International Limited, Other Key Players |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Tax Preparation Services Market

Published Date : 17 Dec 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date