Temperature Data-Loggers Market Size, Share & Forecast | 5.5% CAGR

Global Temperature Data-loggers Market Size, Share & Analysis By Type (Single Use, Reusable), By Product Type (USB, Thermocouple, RTD, Wireless, Thermistor), By End-User Industry (Healthcare and Life Sciences, Food and Beverage, Manufacturing, Agriculture, Logistics), Industry Regions & Key Players – Monitoring Trends & Forecast 2025–2034

Report Overview

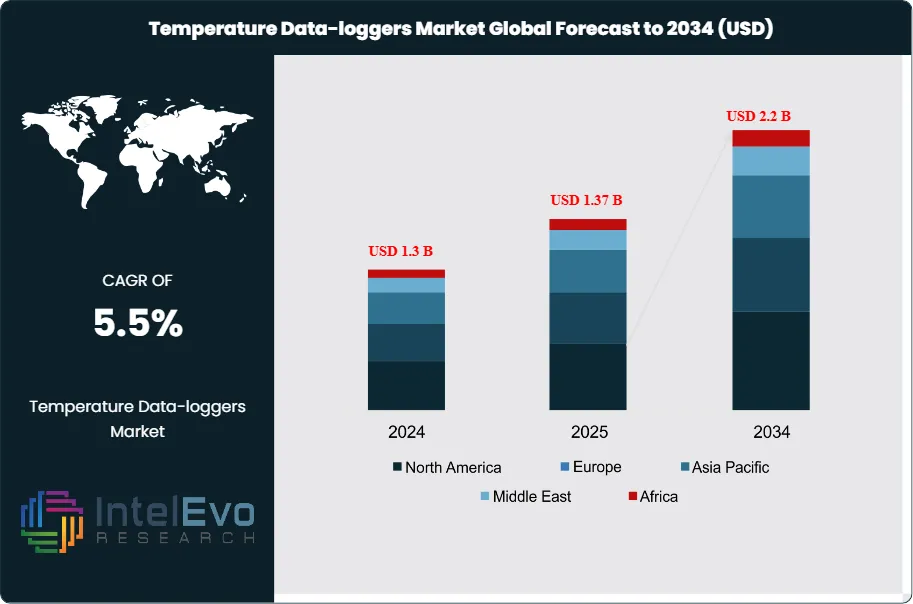

The Temperature Data-loggers Market, valued at USD 1.3 billion in 2024, is projected to reach USD 2.2 billion by 2034, expanding at a CAGR of 5.5% from 2025 to 2034, driven by stricter food safety and pharmaceutical compliance requirements, offering strategic opportunities for technology providers, logistics operators, and cold-chain stakeholders. Temperature data-loggers play a pivotal role in monitoring and recording temperature variations across critical industries, ensuring regulatory compliance, product integrity, and operational efficiency. Their adoption has become increasingly vital in sectors such as pharmaceuticals, food and beverage, biotechnology, and transportation, where even minor temperature deviations can compromise product quality and safety. Rising global emphasis on cold chain logistics, particularly in vaccine distribution and perishable food exports, has further accelerated demand for reliable monitoring systems.

Get More Information about this report -

Request Free Sample ReportMarket growth is fueled by several key drivers. Regulatory authorities such as the FDA, USDA, and WHO continue to enforce stringent guidelines to mitigate risks associated with foodborne illnesses and pharmaceutical spoilage, directly boosting the adoption of advanced temperature monitoring solutions. Additionally, the globalization of supply chains has increased the complexity of storage and transportation networks, creating a greater need for continuous, accurate, and tamper-proof data-logging systems. However, challenges such as high deployment costs in developing markets and data security concerns associated with cloud-enabled devices may limit adoption in certain regions.

Technological advancements are reshaping the competitive landscape. Modern data-loggers now integrate IoT connectivity, cloud storage, real-time alerts, and enhanced data accuracy, enabling proactive decision-making and predictive maintenance. The transition from traditional manual logging systems to automated, smart devices is helping businesses minimize losses, reduce compliance risks, and optimize logistics performance. These innovations are particularly valuable for pharmaceuticals, where maintaining strict temperature thresholds is critical for vaccine efficacy and biologic stability.

Regionally, North America and Europe lead the market due to stringent regulatory frameworks, advanced cold-chain infrastructure, and early adoption of digital monitoring technologies. Meanwhile, Asia-Pacific is emerging as a high-growth region, supported by rising pharmaceutical manufacturing, increasing exports of perishable goods, and rapid investment in cold-chain logistics. Latin America and the Middle East are also witnessing growing adoption, driven by expanding trade flows and greater emphasis on food safety.

Overall, the temperature data-loggers market is poised for steady expansion as industries increasingly prioritize safety, compliance, and real-time visibility in supply chain operations.

Key Takeaways

- Market Growth: The Global Temperature Data-loggers Market is projected to expand from USD 1.3 billion in 2024 to USD 2.2 billion by 2034, advancing at a CAGR of 5.5%. Growth is underpinned by stricter regulatory compliance in food safety and pharmaceuticals, alongside rising demand for cold-chain monitoring.

- Type: Reusable temperature data-loggers account for 63.4% of the market, favored for their cost-effectiveness and durability in long-term monitoring applications, particularly in logistics and healthcare supply chains.

- Product Type: Thermocouple-based data-loggers lead with 26.3% market share, supported by their broad temperature range, high precision, and suitability for diverse industrial applications, including biopharma and food storage.

- End Use: The healthcare and life sciences sector represents 31.2% of market demand, driven by stringent regulatory frameworks for vaccines, biologics, and sensitive pharmaceuticals requiring continuous temperature tracking.

- Driver: Increasing global trade of perishable goods and vaccines is fueling investments in advanced data-loggers, with real-time monitoring solutions becoming standard across cold-chain logistics operations.

- Restraint: High initial costs of advanced data-logging systems and limited adoption in cost-sensitive emerging markets continue to restrain wider deployment.

- Opportunity: Integration of IoT, cloud analytics, and wireless connectivity in data-loggers presents high growth potential, enabling predictive insights and proactive interventions in supply chain management.

- Trend: Rising adoption of smart, connected data-loggers with real-time alerts and automated reporting is transforming compliance management, reducing spoilage risks, and enhancing operational efficiency.

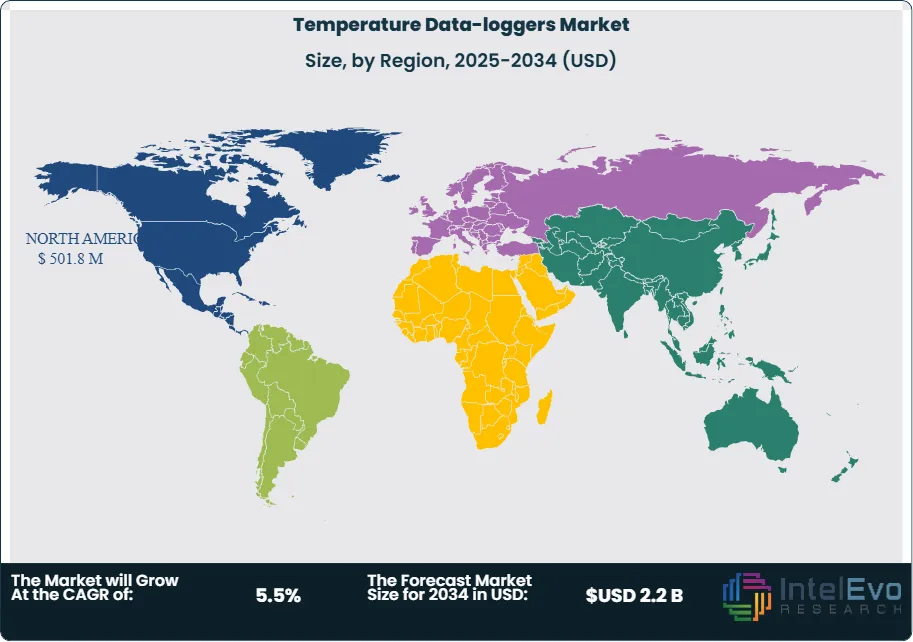

- Regional Analysis: North America leads with 38.6% share, supported by advanced cold-chain infrastructure and stringent FDA/USDA guidelines. Europe, holding 29.8%, is emerging as a high-growth region due to rising pharmaceutical production and strong food export markets, while Asia-Pacific shows accelerating adoption fueled by expanding logistics and healthcare sectors.

Type Analysis

The temperature data-loggers market is primarily segmented into single-use and reusable devices, with reusable models commanding a clear lead. In 2025, reusable loggers represent over 63% of the global market, a dominance reinforced by their long lifecycle, cost efficiency, and ability to withstand demanding operating conditions. These devices are widely adopted across industries requiring long-term monitoring, such as pharmaceuticals, food transportation, and biotechnology, where continuous and accurate data collection is critical for compliance and product integrity. Their programmable nature and durability make them a preferred choice for enterprises seeking scalable, reliable monitoring solutions.

Single-use data-loggers, while less prevalent, continue to play a crucial role in time-sensitive and one-way logistics operations. These devices are especially valuable for the shipment of pharmaceuticals, clinical trial samples, and perishable goods where recovery of the device is impractical or uneconomical. Though positioned as a secondary segment, demand for disposable loggers is sustained by the rising complexity of global supply chains and the growing focus on preventing temperature-related spoilage. Collectively, both categories highlight the market’s versatility in addressing diverse operational needs across industries.

Product Type Analysis

By product type, thermocouple-based data-loggers remain the largest segment, accounting for approximately 26% of market share in 2025. Their popularity stems from exceptional accuracy, broad temperature range coverage, and fast response times, making them suitable for extreme industrial environments such as metal processing, chemical manufacturing, and heat treatment. These features enable thermocouples to meet stringent performance requirements in mission-critical applications where precision is non-negotiable.

Other product categories collectively contribute to market diversity. USB loggers are widely used for their ease of deployment and direct data retrieval, while RTD loggers are favored for stability and accuracy in moderate temperature ranges, particularly in healthcare and life sciences. Wireless devices, increasingly integrated with IoT ecosystems, provide remote monitoring capabilities essential for modern logistics and cold-chain management. Thermistors, though limited to narrower ranges, offer high accuracy for specialized applications. The presence of these varied product types reflects ongoing technological innovation, ensuring that the market continues to meet the specialized needs of both traditional industries and emerging digital supply chains.

End-User Industry Analysis

The healthcare and life sciences industry leads end-user adoption, representing over 31% of global revenue in 2025. This dominance is driven by stringent regulatory frameworks and the critical importance of temperature stability in pharmaceuticals, vaccines, and biologics. With the expansion of biologic therapies, global vaccination programs, and clinical research, reliable data-logging solutions have become indispensable for safeguarding product efficacy and patient safety. The sector’s heavy investment in automated, connected monitoring systems continues to fuel demand.

Beyond healthcare, adoption is broadening across food and beverage, logistics, manufacturing, and agriculture. The food sector relies on data-loggers to maintain safety and freshness across cold-chain networks, while logistics providers use them to ensure real-time visibility and compliance with international shipping standards. Manufacturers deploy these tools for process optimization and equipment monitoring, whereas agriculture uses them to manage environmental conditions for crops and livestock. This multi-industry reliance underscores the cross-sectoral importance of data-loggers as a backbone for quality assurance and regulatory compliance.

Regional Analysis

North America continues to dominate the global temperature data-loggers market in 2025, holding a 38.6% share. The region’s leadership is supported by robust healthcare infrastructure, strict FDA and USDA regulations, and advanced adoption of IoT- and cloud-enabled monitoring technologies. The strong presence of industry leaders such as Sensitech, Dickson, and Berlinger further strengthens the region’s competitive edge. High awareness of food safety and pharmaceutical quality control, combined with well-developed cold-chain logistics, drives sustained investment in monitoring technologies.

Europe follows closely, supported by the region’s expanding pharmaceutical manufacturing base and rising demand for perishable food exports. Stringent EU compliance standards reinforce adoption across healthcare, food safety, and logistics operations. Meanwhile, Asia-Pacific is emerging as a high-growth region, underpinned by expanding pharmaceutical exports from India and China, rising cold-chain investments in Southeast Asia, and the scaling of agricultural exports. Latin America and the Middle East also present increasing opportunities as global trade flows intensify and governments strengthen food safety and healthcare regulations. Collectively, these regional dynamics highlight a balanced mix of mature markets and emerging growth hubs, setting the stage for steady global expansion.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Single Use

- Reusable

By Product Type

- USB

- Thermocouple

- RTD

- Wireless

- Thermistor

- Others

By End-User Industry

- Healthcare and Life Sciences

- Food and Beverage

- Manufacturing

- Agriculture

- Logistics

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.3 B |

| Forecast Revenue (2034) | USD 2.2 B |

| CAGR (2025-2034) | 5.5% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Single Use, Reusable), By Product Type (USB, Thermocouple, RTD, Wireless, Thermistor, Others), By End-User Industry (Healthcare and Life Sciences, Food and Beverage, Manufacturing, Agriculture, Logistics, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | MadgeTech Inc., Rotronic AG, Cryopak, Onset Computer Corporation, TMI-Orion SA, Thermoworks Inc., NOVUS Automation Inc., Protimeter, Hioki EE Corporation, Softbox Systems Limited, Elpro-Buchs AG, Global Cold Chain Solutions Pty Limited, OMEGA Engineering Inc., Kimo Instruments, Testo SE & Co. KGaA, Lascar Electronics Limited |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Temperature Data-loggers Market?

The Temperature Data-Loggers Market is projected to grow from USD 1.3 Billion in 2024 to USD 2.2 Billion by 2034, at a CAGR of 5.5%. Rising regulatory compliance in food safety and pharmaceuticals is driving adoption across logistics, cold-chain operations, and monitoring applications.

Who are the major players in the Temperature Data-loggers Market?

MadgeTech Inc., Rotronic AG, Cryopak, Onset Computer Corporation, TMI-Orion SA, Thermoworks Inc., NOVUS Automation Inc., Protimeter, Hioki EE Corporation, Softbox Systems Limited, Elpro-Buchs AG, Global Cold Chain Solutions Pty Limited, OMEGA Engineering Inc., Kimo Instruments, Testo SE & Co. KGaA, Lascar Electronics Limited

Which segments covered the Temperature Data-loggers Market?

By Type (Single Use, Reusable), By Product Type (USB, Thermocouple, RTD, Wireless, Thermistor, Others), By End-User Industry (Healthcare and Life Sciences, Food and Beverage, Manufacturing, Agriculture, Logistics, Others)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Temperature Data-loggers Market

Published Date : 10 Nov 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date