Tennis String Market Size, Growth & Forecast 2025–2034 | CAGR of 4.2%

Global Tennis String Market Size, Share & Sports Equipment Analysis By Type (Natural Gut Strings, Multifilament Strings, Synthetic Gut Strings, Monofilament Strings), By Application (Competitive Play, Training, Recreational / Entertainment), By End Use (Residential, Commercial, Industrial), Player Performance Trends, Sustainability Materials, Regional Demand & Forecast 2025–2034

Report Overview

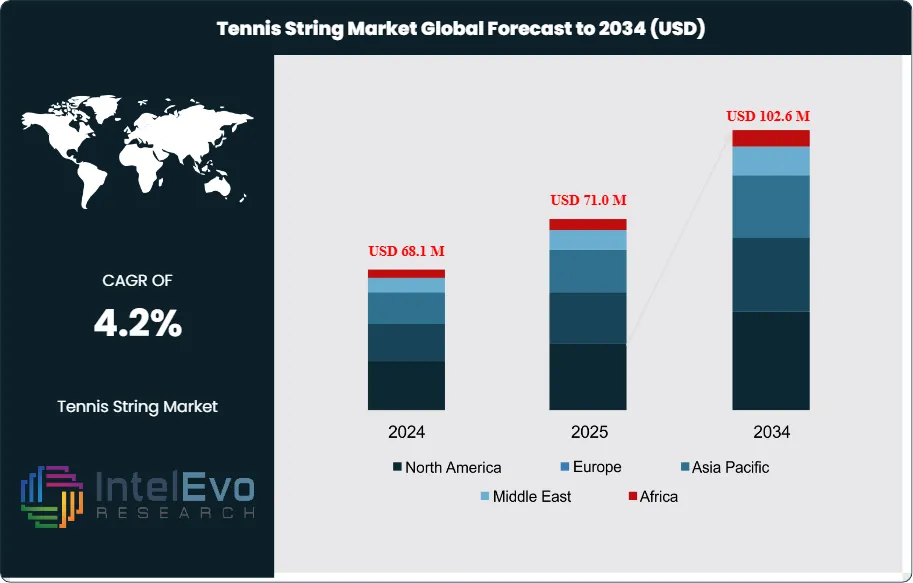

The Tennis String Market is estimated at USD 68.1 million in 2024 and is projected to reach approximately USD 102.6 million by 2034, registering a compound annual growth rate (CAGR) of about 4.2% during 2025–2034. This steady expansion reflects rising global participation in tennis across recreational, collegiate, and professional levels, alongside increasing replacement frequency driven by performance-focused players. Growing preference for polyester and hybrid strings that offer enhanced spin, durability, and control is further supporting value growth. In addition, the influence of professional endorsements, expanding tennis academies in Asia-Pacific, and e-commerce-led accessibility are strengthening demand consistency and keeping the market on a sustainable upward trajectory over the next decade.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects both the resilience of tennis as a global sport and the critical role strings play in performance, customization, and consumer choice. Historically, the market has grown in line with participation rates, with consistent demand from recreational players and professionals alike. The past decade has seen a shift toward premium materials such as polyester and hybrid strings, which now account for a growing share of sales due to their durability and enhanced playability.

Participation trends remain a central driver. In the United States alone, one in thirteen individuals played tennis in 2023, with a net increase of 250,000 players compared with the prior year. This expanding base translates directly into recurring demand for replacement strings, as frequent players restring rackets multiple times per year. Major tournaments also act as demand catalysts. The French Open, for example, attracted over 630,000 attendees in 2023 and generated close to USD 100 million in sponsorship revenues, reinforcing the visibility of the sport and stimulating equipment sales worldwide.

On the supply side, manufacturers are investing in advanced production techniques to improve string resilience and tension retention. Digital platforms are also reshaping distribution, with e-commerce channels accounting for an increasing share of sales, particularly in Asia-Pacific and Europe. Regulatory standards around product safety and sustainability are influencing material choices, with biodegradable and recyclable options gaining traction. However, rising raw material costs and counterfeit products remain notable risks for established brands.

Technology is shaping adoption further. AI-driven performance analytics and smart rackets are influencing consumer expectations, pushing demand for strings that complement data-driven training. Hybrid stringing, combining polyester mains with softer synthetic crosses, is gaining popularity among competitive players seeking both control and comfort.

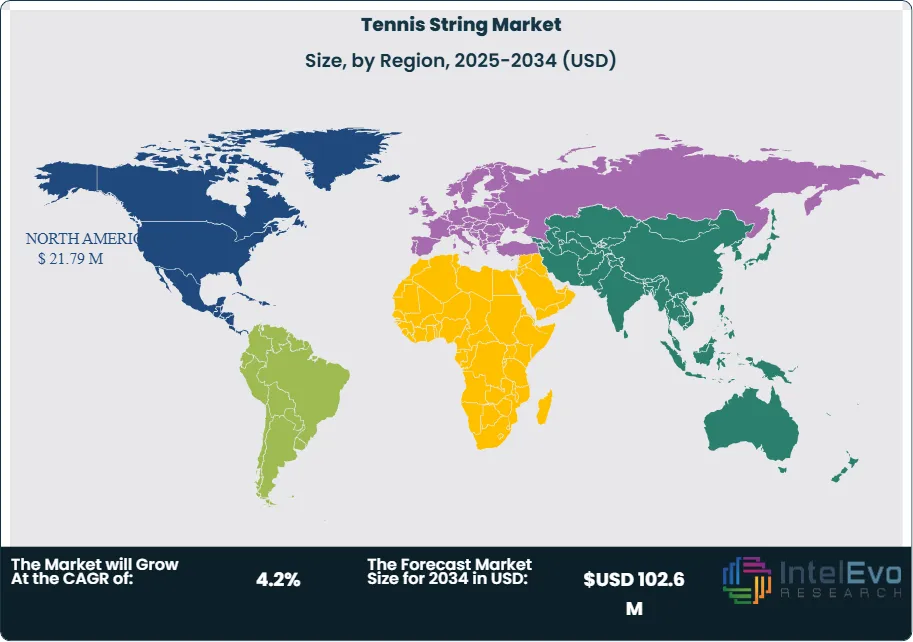

Regionally, North America and Europe remain the largest markets due to high participation and established retail networks. Asia-Pacific is emerging as the fastest-growing region, supported by rising incomes, expanding sports infrastructure, and government-backed programs to promote tennis. Investors should monitor growth in China and India, where participation rates are climbing and online retail penetration is accelerating.

Overall, the market outlook is positive. Stable participation, technological advances, and the promotional pull of global tournaments provide a strong foundation for sustained growth, making tennis strings a niche but resilient segment within the broader sports equipment industry.

Key Takeaways

- Market Growth: The global tennis string market is valued at USD 68.1 million in 2024 and is projected to reach USD 102.6 million by 2034, expanding at a CAGR of 4.2%. Growth is supported by rising participation in tennis, increasing replacement demand, and the influence of professional tournaments on consumer spending.

- By Type: Natural gut strings account for 38.6% of global revenue, maintaining leadership due to superior elasticity, tension stability, and playability. Despite higher costs, they remain the preferred choice among professionals and advanced players.

- By Application: Competitive play represents 51.6% of total demand, driven by frequent restringing cycles and the need for premium performance. Training and recreational use follow, supported by growing participation at grassroots and amateur levels.

- Driver: Rising global tennis participation, with more than 90 million players worldwide, is fueling consistent demand. Major tournaments such as Wimbledon and the US Open amplify visibility, boosting sales of premium strings endorsed by top athletes.

- Restraint: High product costs and inconsistent tournament regulations on string materials limit adoption. Price sensitivity among amateur players and restrictions on advanced string technologies reduce market penetration in some regions.

- Opportunity: Sustainable and customizable strings present strong growth potential. Biodegradable and recyclable materials are expected to grow at a CAGR above 5% through 2030, while personalization options are gaining traction among younger players.

- Trend: Manufacturers are expanding color and texture variations to meet rising demand for personalized equipment. Partnerships with professional players continue to influence consumer preferences, with endorsed products often experiencing immediate sales spikes.

- Regional Analysis: North America leads with a 32.6% share, supported by strong retail networks and high participation rates. Europe follows with demand concentrated in advanced polyester strings. Asia Pacific is the fastest-growing region, projected to expand at over 5% CAGR, driven by rising participation in China, India, and Japan. Latin America and the Middle East & Africa remain emerging markets with untapped potential.

Type Analysis

Natural gut strings continue to hold a leading position in the global tennis string market in 2025, accounting for close to 39% of total revenue. Their dominance is supported by unmatched elasticity, tension stability, and responsiveness, which remain critical for professional and advanced players seeking maximum performance. Despite their higher cost, demand for natural gut strings is sustained by endorsements from elite athletes and their proven impact on precision and control during competition.

Multifilament strings represent the second-largest category, appealing to a broad base of amateur and intermediate players. Designed to replicate the feel of natural gut at a lower price point, this segment has expanded steadily, supported by a CAGR of nearly 4% between 2023 and 2025. Their balance of comfort, playability, and affordability makes them a preferred choice for players who prioritize value without compromising on quality.

Synthetic gut strings remain a significant contributor, particularly in recreational markets. Their durability and cost-effectiveness make them attractive to casual players who restring less frequently. Monofilament strings, while representing a smaller share, are gaining traction among advanced players who prioritize spin and control. Their stiff construction appeals to competitive athletes capable of handling higher string tension, positioning this segment as a niche but resilient category.

Application Analysis

Competitive play continues to dominate the market, representing more than half of global demand in 2025. Professional tournaments and high-level amateur competitions drive this segment, with players consistently seeking premium strings that deliver superior control, power, and durability. The segment benefits from frequent restringing cycles, as competitive players often replace strings multiple times per season to maintain peak performance.

Training applications account for a substantial share, supported by the steady influx of new players worldwide. With tennis participation rising in both developed and emerging markets, demand for durable and moderately priced strings has grown. Training strings are designed to withstand repeated use, making them essential for academies, schools, and recreational clubs.

Recreational or entertainment use remains the smallest segment but plays a vital role in expanding the sport’s grassroots base. Strings in this category emphasize comfort and ease of play, catering to casual users who prioritize enjoyment over technical performance. While smaller in size, this segment supports long-term market sustainability by introducing new players to the sport.

End-Use Analysis

Residential demand for tennis strings is expanding as more households invest in personal sports equipment. Rising disposable incomes and the growth of home-based recreational activities have supported this trend, particularly in urban markets.

Commercial facilities, including tennis clubs, academies, and sports complexes, remain the largest end-use segment. These institutions account for a significant share of string consumption due to high player turnover and frequent restringing requirements. The segment is further supported by partnerships with equipment manufacturers and sponsorship agreements with professional tournaments.

Industrial end-use, though limited, is emerging in specialized contexts such as sports training centers and institutional programs. These facilities require bulk procurement of strings for structured training, contributing to steady but smaller-scale demand.

Regional Analysis

North America continues to lead the global tennis string market, holding more than 32% of total revenue in 2025. The region benefits from high participation rates, strong retail distribution, and the presence of leading manufacturers. Frequent professional tournaments in the United States further stimulate demand, reinforcing its dominance.

Europe remains a mature but stable market, supported by a strong tennis culture in countries such as France, Germany, and the UK. Demand is concentrated among intermediate and advanced players, with polyester-based strings gaining popularity for their durability and control.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR above 5% through 2030. Rising participation in China, Japan, and India, combined with government-backed sports initiatives, is driving adoption. The region’s younger demographic and expanding middle class are expected to reshape global demand patterns over the next decade.

Latin America and the Middle East & Africa remain emerging markets with untapped potential. Growth is supported by increasing investments in sports infrastructure and grassroots programs. While current penetration is lower than in developed regions, these markets present long-term opportunities for manufacturers seeking expansion beyond traditional strongholds.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Type

- Natural Gut String

- Multifilament String

- Synthetic Gut String

- Monofilament String

By Application

- Competition

- Training

- Entertainment

By End Use

- Residential

- Commercial

- Tennis clubs

- Academies

- Sports complexes

- Industrial

- Institutional programs

- Professional training centers

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 68.1 M |

| Forecast Revenue (2034) | USD 102.6 M |

| CAGR (2024-2034) | 4.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Natural Gut Strings, Multifilament Strings, Synthetic Gut Strings, Monofilament Strings), By Application (Competitive Play, Training, Recreational / Entertainment), By End Use (Residential, Commercial, Industrial) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Solinco Sports LLC, HEAD Sport GmbH, Pacific Holding GmbH, Yonex Co., Ltd., Société Nouvelle Télésiège, Gamma Sports, Babolat VS S.A., Völkl Tennis GmbH, Prince Sports, Inc., Ashaway Line & Twine Mfg. Co., Amer Sports, Luxilon Industries NV |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date