Text to Speech Market Size, Trends & Forecast|CAGR 16.60%

Global Text to Speech (TTS) Market Size, Share, Analysis Report By Application (Consumer Electronics, E-learning & Education, Automotive, Healthcare, Customer Service & Enterprise Automation, Others) Platform (Cloud-based, On-premises, Edge) End-Use (Enterprises, Educational Institutions, Healthcare Providers, Individuals) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

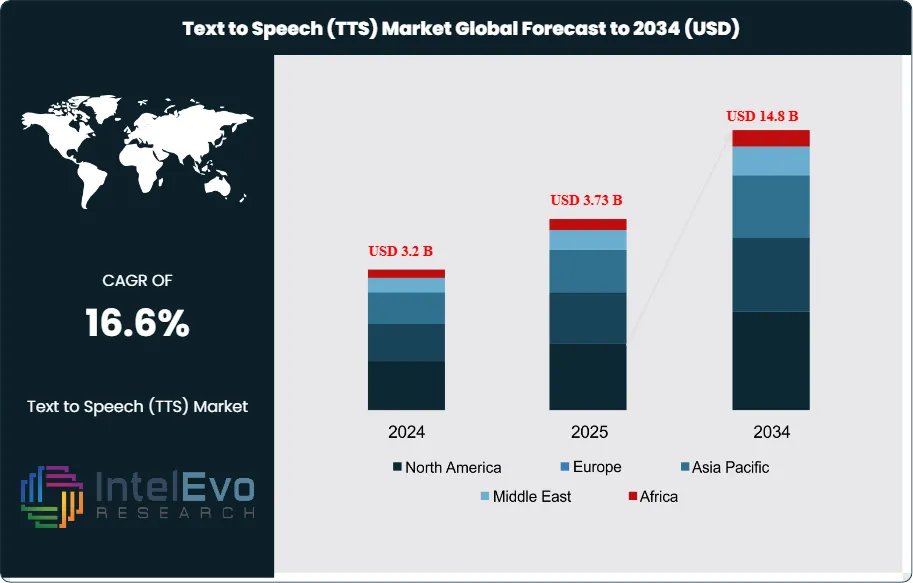

The Text to Speech (TTS) Market size is projected to reach approximately USD 14.8 Billion by 2034, up from USD 3.2 Billion in 2024, growing at a CAGR of around 16.6% during 2025–2034. Rising adoption of AI-powered voice interfaces and multilingual digital communication tools is driving strong market momentum. Businesses across healthcare, education, gaming, and customer engagement are increasingly integrating TTS systems to improve accessibility and user experience. The future of voice technology is shifting rapidly—making TTS one of the most influential digital transformation enablers of the decade.

Get More Information about this report -

Request Free Sample ReportThe text to speech market represents a dynamic and rapidly evolving sector within the broader artificial intelligence and digital accessibility landscape, encompassing software and cloud-based platforms that convert written text into natural-sounding speech. This market has experienced remarkable growth, driven by the proliferation of smart devices, the expansion of digital content, the rise of e-learning, and the increasing demand for assistive technologies for the visually impaired and those with reading difficulties. The integration of neural networks, deep learning, and advanced voice synthesis has significantly improved the quality, expressiveness, and personalization of TTS solutions, making them more accessible and user-friendly than ever before.

Several key factors are shaping the market trajectory, including the global push for digital inclusion, the adoption of TTS in customer service and enterprise automation, and the growing emphasis on multilingual and emotion-aware voice technologies. The market is also influenced by regulatory frameworks such as the Americans with Disabilities Act (ADA) and the European Accessibility Act, which mandate digital accessibility in public and private sectors. Additionally, the COVID-19 pandemic accelerated the adoption of TTS in remote learning, telehealth, and digital customer engagement, highlighting the importance of voice technologies in a contactless world.

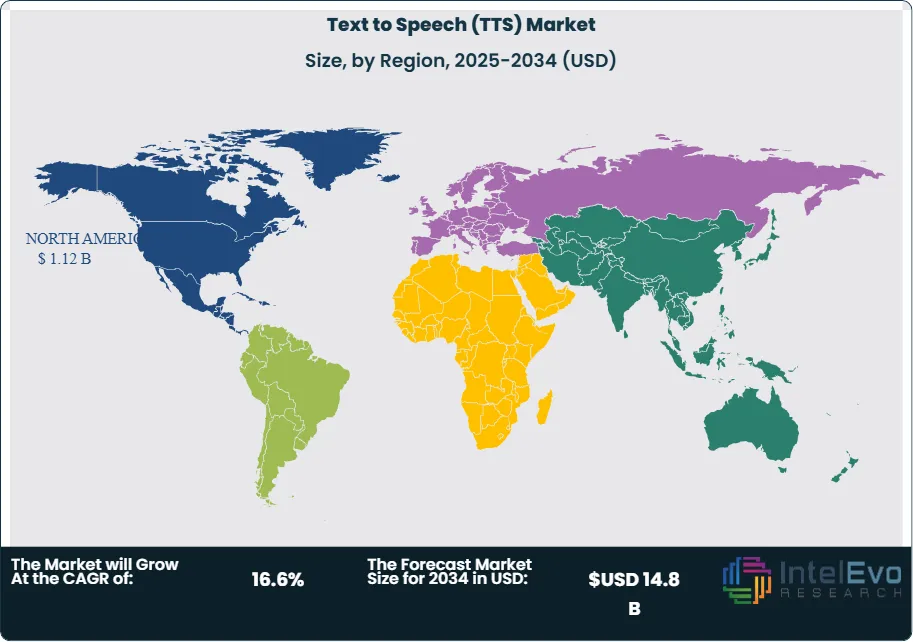

Regional analysis reveals North America as the dominant market with approximately 35-37% market share in 2024, driven by high digital adoption, strong enterprise investment, and a mature ecosystem of TTS providers. Europe follows as the second-largest market, with Asia-Pacific emerging as the fastest-growing region due to rapid digital transformation, language diversity, and increasing smartphone penetration.

The TTS market has shown remarkable resilience and adaptation, with many platforms expanding their offerings to include real-time translation, voice cloning, and emotion-aware speech synthesis. The convergence of TTS with other AI-driven technologies, such as natural language processing (NLP) and conversational AI, is further propelling market growth and innovation.

Key Takeaways

- Market Growth: The Global Text to Speech Market is expected to reach USD 14.8 Billion by 2034, propelled by digital transformation, accessibility mandates, and the growing adoption of voice-enabled applications.

- Application Dominance: Consumer electronics and e-learning remain the dominant segments, supported by the rise of smart devices, digital content, and remote education.

- Platform Dominance: Cloud-based TTS solutions are the preferred platform, driven by scalability, ease of integration, and continuous updates. On-premises and edge deployments are gaining traction for privacy-sensitive and real-time applications.

- End-Use Dominance: Enterprises and educational institutions account for the majority of TTS adoption, with healthcare, automotive, and individual consumers representing significant growth segments.

- Driver: Technological innovation, including neural TTS, multilingual support, and emotion-aware voices, has been a major driver of market adoption and differentiation.

- Restraint: Data privacy concerns, language limitations, and inconsistent voice quality across platforms have constrained market potential in certain regions and applications.

- Opportunity: Emerging markets present lucrative opportunities, as increasing internet access and smartphone adoption fuel demand for localized, affordable TTS solutions across languages and dialects.

- Trend: A notable trend is the convergence of TTS with conversational AI, real-time translation, and voice cloning, enabling more natural, personalized, and interactive user experiences.

- Regional Analysis: North America leads in revenue and innovation, while Europe focuses on regulatory harmonization and multilingual support. Asia-Pacific, propelled by China, India, and Southeast Asia, is the fastest-growing region, offering substantial untapped potential.

Application Analysis

Consumer Electronics Leads With Over 35% Market Share in the Text to Speech Market. Consumer electronics remain the cornerstone of the TTS market. Devices such as smartphones, smart speakers, tablets, wearables, and smart TVs increasingly integrate TTS capabilities to enhance accessibility, user engagement, and hands-free operation. Leading platforms like Amazon Alexa, Google Assistant, and Apple Siri have set new standards for natural, responsive voice output, driving consumer expectations for high-quality TTS across devices.

The e-learning and education segment is the second-largest application, fueled by the global shift to digital and remote learning. TTS solutions enable content accessibility for students with visual impairments, dyslexia, or language barriers, and support personalized, self-paced learning experiences. Platforms such as Duolingo, Coursera, and Khan Academy leverage TTS to deliver interactive lessons, quizzes, and feedback in multiple languages.

The automotive sector is experiencing rapid growth, as TTS is integrated into in-car infotainment systems, navigation, and driver assistance features. Voice-enabled controls and real-time information delivery enhance safety, convenience, and user experience, particularly as vehicles become more connected and autonomous.

Healthcare is an emerging application, with TTS supporting telehealth, patient engagement, and assistive communication for individuals with speech or reading difficulties. TTS is also used in medical devices, electronic health records, and medication reminders.

Platform Analysis

Cloud-Based Solutions Dominate the Market. Cloud-based TTS platforms are the preferred choice for most enterprises and developers, offering scalability, flexibility, and seamless integration with other cloud services. Providers such as Google Cloud Text-to-Speech, Amazon Polly, and Microsoft Azure TTS deliver high-quality, customizable voices with support for multiple languages and dialects. Cloud deployment enables continuous updates, rapid deployment of new features, and access to advanced neural TTS models.

On-premises and edge deployments are gaining traction in privacy-sensitive industries such as healthcare, finance, and government, as well as in applications requiring low latency and offline operation. Edge TTS solutions are increasingly used in automotive, IoT, and embedded systems, where real-time processing and data security are critical.

End-Use Analysis

Enterprises and Educational Institutions Drive TTS Adoption. Enterprises across industries are leveraging TTS to enhance customer service, automate workflows, and improve digital accessibility. Use cases include interactive voice response (IVR) systems, chatbots, virtual assistants, and content localization. TTS enables organizations to deliver consistent, multilingual voice experiences at scale, reducing operational costs and improving customer satisfaction.

Educational institutions are major adopters of TTS, integrating voice technologies into digital classrooms, learning management systems, and accessibility tools. TTS supports inclusive education, personalized learning, and compliance with accessibility regulations.

Healthcare providers are increasingly adopting TTS for patient communication, telehealth, and assistive technologies. TTS solutions help bridge communication gaps, improve patient engagement, and support individuals with speech or reading impairments.

Individual consumers represent a growing segment, using TTS for personal productivity, content consumption, and accessibility. The rise of audiobooks, podcasts, and voice-enabled apps is driving demand for high-quality, customizable TTS voices.

Get More Information about this report -

Request Free Sample ReportRegion Analysis

North America Leads With Over 35% Market Share in the Text to Speech Market. North America is the dominant region, accounting for approximately 35-37% of global TTS revenue in 2024. The region’s leadership is anchored by high digital adoption, strong enterprise investment, and a mature ecosystem of TTS providers. The United States, in particular, benefits from a robust technology sector, early adoption of AI-driven voice technologies, and supportive regulatory frameworks for digital accessibility.

Europe is the second-largest market, with strengths in multilingual support, regulatory harmonization, and public sector adoption. Countries such as the UK, Germany, and France are investing in digital inclusion, e-government, and accessible education. The region’s focus on privacy, data protection, and language diversity is driving demand for customizable, compliant TTS solutions.

Asia-Pacific is the fastest-growing region, propelled by rapid digital transformation, language diversity, and increasing smartphone penetration. China, India, Japan, and Southeast Asian countries are witnessing significant market expansion, driven by government initiatives, local language support, and the rise of digital content consumption.

Latin America and the Middle East & Africa are emerging markets, with growing demand for accessible digital services, e-learning, and voice-enabled applications. Investments in local language support and affordable TTS solutions are unlocking new user bases.

Key Market Segment

Application

- Consumer Electronics

- E-learning & Education

- Automotive

- Healthcare

- Customer Service & Enterprise Automation

- Others

Platform

- Cloud-based

- On-premises

- Edge

End-Use

- Enterprises

- Educational Institutions

- Healthcare Providers

- Individuals

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 3.73 B |

| Forecast Revenue (2034) | USD 14.8 B |

| CAGR (2025-2034) | 16.6% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Application: (Consumer Electronics, E-learning & Education, Automotive, Healthcare, Customer Service & Enterprise Automation, Others) Platform: (Cloud-based, On-premises, Edge) End-Use: (Enterprises, Educational Institutions, Healthcare Providers, Individuals) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Google LLC (Alphabet Inc.), Amazon Web Services, Inc. (Amazon Polly), Microsoft Corporation (Azure Cognitive Services), IBM Corporation (Watson Text to Speech), Apple Inc. (Siri TTS), Baidu, Inc., NeoSpeech, Inc., NextUp Technologies, LLC, Sensory, Inc., TextSpeak, iFLYTEK Co., Ltd., CereProc Ltd., Nuance Communications (a Microsoft company), ResponsiveVoice, Acapela Group, LumenVox LLC, ReadSpeaker Holding B.V., Cepstral LLC, Voicepods Inc., Voxygen, SESTEK, Speechify Inc., Descript Inc., WellSaid Labs |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date