Tissue and Organ Transplantation Market Size, Share | CAGR 9.1%

Global Tissue and Organ Transplantation Market Size, Share & Industry Analysis By Product Type (Tissue Products, Solid Organs), By Transplant Type (Kidney, Liver, Heart, Lung, Pancreas, Cornea, Bone, Skin), By Donor Type (Living Donor, Deceased Donor), By End User (Hospitals, Transplant Centers, Research Institutes), By Technology & Preservation Method, Regional Outlook, Key Players, Market Dynamics, Regulatory Landscape, Innovation Trends & Forecast 2025–2034

Report Overview

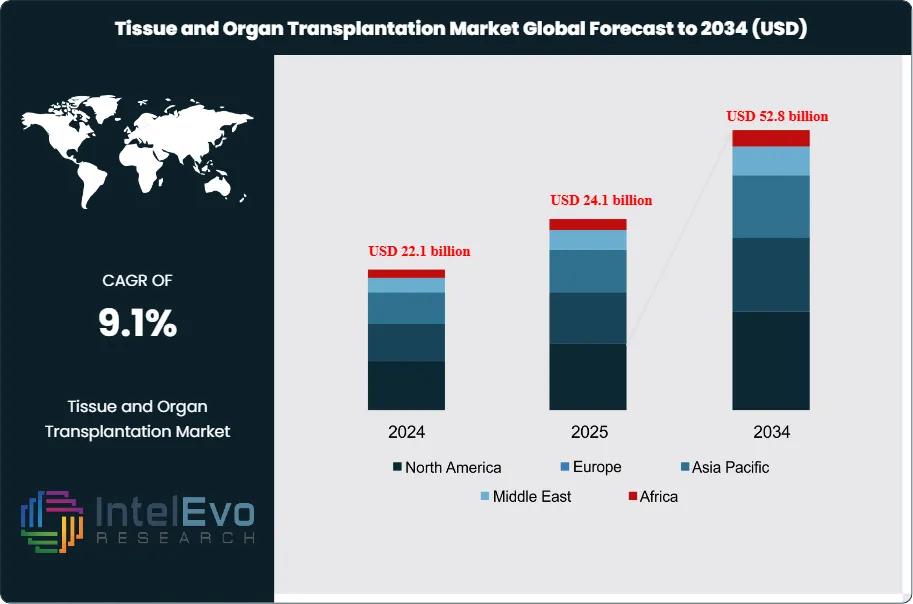

The Tissue And Organ Transplantation Market is estimated at USD 22.1 billion in 2024 and is projected to reach approximately USD 52.8 billion by 2034, registering a compound annual growth rate (CAGR) of 9.1% during 2025–2034. This sustained expansion is driven by the rising prevalence of chronic organ failure, increasing geriatric population, and steady growth in transplant waiting lists worldwide. Advances in immunosuppressive therapies, organ preservation technologies, and surgical techniques are improving transplant success rates and long-term outcomes. In parallel, government initiatives to strengthen organ donation frameworks and growing investments in regenerative medicine and tissue engineering are reinforcing long-term market momentum across both developed and emerging healthcare systems.

Get More Information about this report -

Request Free Sample ReportThis growth reflects both the rising prevalence of chronic diseases that lead to organ failure and the expanding scope of medical technologies that support transplantation. Over the past decade, the market has shifted from a reliance on limited donor availability toward a broader ecosystem that includes advanced preservation techniques, improved surgical outcomes, and research into alternatives such as xenotransplantation and bioengineered tissues.

The demand side is driven by the increasing incidence of kidney, liver, and heart diseases, which together account for the majority of global transplant procedures. According to the World Health Organization, more than 130,000 solid organ transplants are performed annually, yet this meets less than 10% of global demand. The supply side remains constrained by donor shortages, with waiting lists in major economies such as the United States and Europe continuing to grow. This imbalance creates both a humanitarian challenge and a structural driver for investment in artificial organs, regenerative medicine, and digital platforms that improve donor-recipient matching.

Regulatory frameworks play a central role in shaping the market. Stringent oversight ensures ethical procurement and equitable allocation, but it also slows the pace of adoption for experimental approaches. Immunosuppressive therapies, which represent a significant share of post-transplant costs, remain essential but carry risks of infection and long-term complications. Pharmaceutical companies are investing in targeted immunomodulators that could reduce these risks and improve patient outcomes.

Technology is reshaping the sector. Artificial intelligence is being applied to predictive analytics for organ compatibility, while blockchain-based registries are under development to enhance transparency in allocation systems. Advances in cold perfusion and organ preservation are extending viable transport times, opening new opportunities for cross-border collaboration and reducing wastage rates.

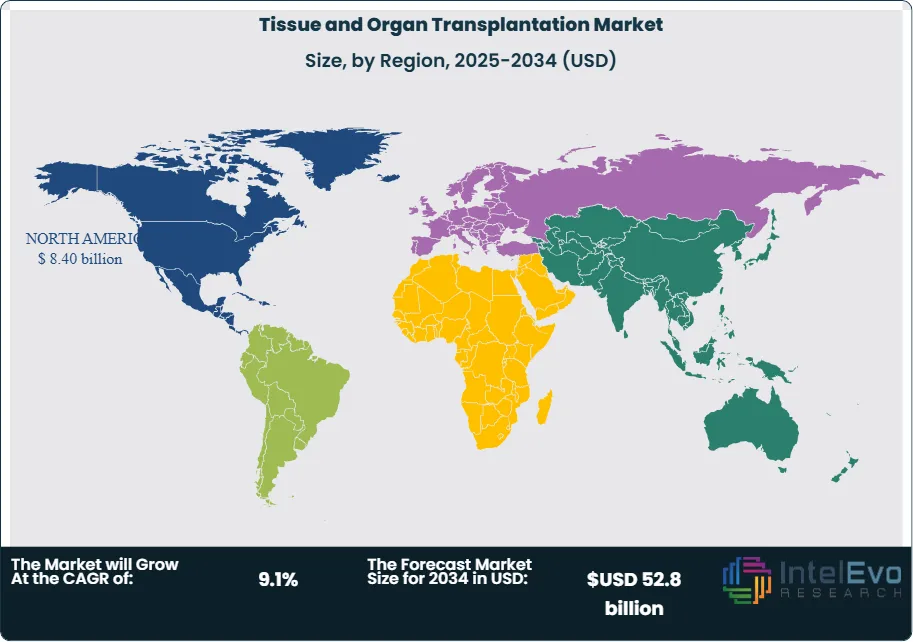

Regionally, North America leads the market, supported by advanced healthcare infrastructure, strong reimbursement systems, and high awareness of organ donation. Europe follows closely, with robust regulatory frameworks and active research programs. Asia-Pacific is emerging as the fastest-growing region, driven by rising healthcare expenditure, government-led awareness campaigns, and expanding transplant centers in countries such as India and China. For investors, the most attractive opportunities lie in technologies that address the donor shortage, including bioartificial organs, 3D bioprinting, and regenerative therapies, which are expected to capture increasing capital flows over the next decade.

Key Takeaways

- Market Growth: The global tissue and organ transplantation market was valued at USD 22.1 billion in 2024 and is projected to reach USD 52.8 billion by 2034, expanding at a CAGR of 9.1% from 2025 to 2034. Growth is driven by rising incidences of chronic organ failure, advancements in surgical techniques, and expanding donor awareness programs.

- Type: Organ transplantation accounted for 71.6% of total revenue in 2023, supported by high demand for kidney, liver, and heart transplants. The segment continues to dominate due to the prevalence of end-stage organ diseases and improved survival rates post-surgery.

- Product: Tissue products represented 43.2% of the market in 2023, with skin grafts for burn and wound management driving adoption. Demand is further supported by applications in reconstructive and orthopedic procedures.

- Driver: Rising global demand for kidney transplants, which represent nearly 60% of all organ transplants performed annually, is a key growth catalyst. Advances in immunosuppressive therapies and organ preservation technologies are improving success rates and expanding patient eligibility.

- Restraint: A persistent shortage of donor organs remains the most significant barrier, with global supply meeting less than 10% of demand. This gap results in extended waiting lists and limits the number of procedures performed each year.

- Opportunity: Tissue transplantation is expected to record the fastest growth, supported by bioengineering research and regenerative medicine. Applications in wound healing and reconstructive surgery are projected to accelerate adoption, particularly in emerging healthcare markets.

- Trend: Adoption of AI-driven donor-recipient matching and blockchain-based organ registries is gaining traction. Companies are investing in 3D bioprinting and bioartificial organ development, signaling a shift toward long-term alternatives to donor dependency.

- Regional Analysis: North America led the market with a 38.6% share in 2023, supported by advanced healthcare infrastructure and strong regulatory oversight. Asia-Pacific is projected to post the highest CAGR through 2033, driven by rising healthcare expenditure, government-led awareness campaigns, and expanding transplant centers in India and China.

Type Analysis

Organ transplantation continues to dominate the global transplantation market in 2025, accounting for more than 70% of total revenue. The segment’s strength is linked to the rising prevalence of chronic kidney, liver, and heart diseases, which together represent the majority of global transplant demand. According to the Global Observatory on Donation and Transplantation, over 150,000 solid organ transplants are now performed annually, yet this still meets less than 15% of global need. Advances in surgical techniques, organ preservation, and donor-recipient matching have expanded eligibility and improved survival rates, reinforcing the segment’s leadership.

Tissue transplantation, while smaller in absolute value, is projected to grow at a faster pace through 2033. Applications in wound healing, reconstructive surgery, and orthopedic procedures are driving adoption. Skin grafts and bone grafts remain the most widely used, but research in bioengineered tissues and 3D bioprinting is accelerating. Clinical trials in Europe and Asia-Pacific are testing bioprinted cartilage and corneal tissues, signaling a shift toward scalable alternatives to donor-derived grafts. This segment is expected to capture a rising share of investment as regenerative medicine advances.

Product Type Analysis

Tissue products accounted for more than 43% of global revenue in 2025, supported by high demand for skin, bone, corneal, and vascular grafts. Burn treatment and reconstructive procedures remain the largest applications, particularly in Asia-Pacific where trauma-related cases are rising. The segment benefits from established clinical use and relatively lower regulatory hurdles compared to organ transplantation.

Immunosuppressive drugs are expected to record the fastest growth over the forecast period. Every organ transplant requires lifelong immunosuppression, and the global patient base continues to expand. Newer therapies, such as calcineurin inhibitor alternatives and biologics, are reducing infection risks and improving long-term graft survival. Companies including Novartis and Astellas are investing heavily in next-generation immunomodulators, positioning this segment for sustained double-digit growth.

Preservation solutions remain a critical enabler of successful transplantation. Advances in hypothermic and normothermic perfusion technologies are extending organ viability from hours to days, reducing wastage and enabling cross-border sharing. The segment is forecast to grow steadily as adoption of machine perfusion systems increases in North America and Europe.

End-Use Analysis

Hospitals remain the primary end-users, accounting for nearly 39% of global revenue in 2025. They serve as the central hubs for transplant surgeries, post-operative care, and long-term patient monitoring. Large academic hospitals in the United States, Germany, and Japan continue to lead in procedure volumes and clinical outcomes.

Transplant centers are gaining prominence, particularly in emerging markets. Dedicated facilities in India, China, and Brazil are expanding capacity to address growing demand, supported by government initiatives and international collaborations. These centers are expected to capture a rising share of procedures as specialized infrastructure improves.

Other healthcare providers, including specialty clinics and research institutions, contribute to the ecosystem by supporting tissue banking, donor screening, and experimental therapies. Their role is expanding as clinical trials in regenerative medicine and bioartificial organs move closer to commercialization.

Regional Analysis

North America remains the largest regional market, representing more than 38% of global revenue in 2025. The region benefits from advanced healthcare infrastructure, high donor registration rates, and strong reimbursement frameworks. The United States alone performs over 40,000 organ transplants annually, supported by organizations such as UNOS and OPTN.

Europe follows closely, with Germany, Spain, and the UK leading in transplant volumes. Spain continues to report the world’s highest organ donation rate at over 45 donors per million population. The region’s strong regulatory framework and cross-border organ sharing through Eurotransplant enhance efficiency and outcomes.

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 11% through 2033. Rising healthcare expenditure, government-led awareness campaigns, and expanding transplant centers in China and India are driving growth. However, donor shortages remain a constraint, creating opportunities for bioengineered tissues and artificial organ research.

Latin America and the Middle East & Africa represent smaller shares but are gradually expanding. Brazil leads in Latin America with a well-established public transplant system, while Saudi Arabia and South Africa are emerging hubs in their respective regions. These markets are expected to attract investment as healthcare infrastructure strengthens and awareness of organ donation increases.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

Type

- Organ Transplantation

- Tissue Transplantation

Product Type

- Tissue Products

- Immunosuppressive Drugs

- Preservation Solutions

End-User

- Hospital

- Transplant Centers

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 22.1 billion |

| Forecast Revenue (2034) | USD 52.8 billion |

| CAGR (2024-2034) | 9.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Type, (Organ Transplantation, Tissue Transplantation), Product Type, (Tissue Products, Immunosuppressive Drugs, Preservation Solutions), End-User, (Hospital, Transplant Centers, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Medtronic PLC, Cryolife Inc., Teva Pharmaceuticals, Stryker Corporation, Abbvie Inc., BiolifeSolutions Inc., Zimmer Biomet, Folio Biosciences, Novartis AG, Atthrex |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Tissue and Organ Transplantation Market

Published Date : 07 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date