Tool Rental Apps Market Size, Share & Forecast | CAGR 14.77%

Global Tool Rental Apps Market Size, Share, Analysis Report Tool Type (Industrial Tools, Construction Tools, Home Improvement Tools, Gardening Tools, Other Tools), Business Model (Business-to-Business, Business-to-Consumer, Peer-to-Peer) Rental Duration (Long-Term Rentals, Short-Term Rentals) End-Use (Businesses & Organizations, Individual Consumers), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

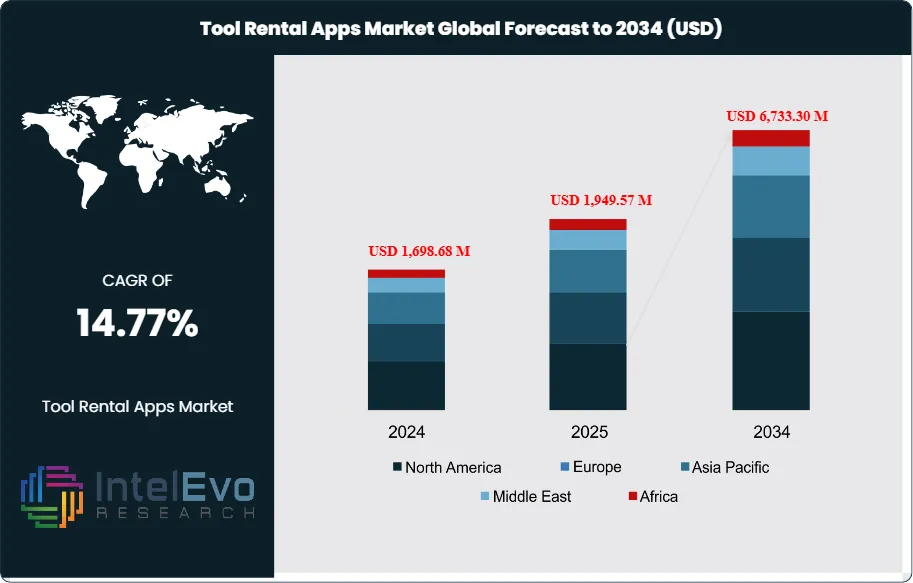

The Tool Rental Apps Market size is expected to be worth around USD 6,733.30 million by 2034, up from USD 1,698.68 million in 2024, growing at a CAGR of 14.77% during the forecast period from 2025 to 2034. This rapid expansion is driven by the rising adoption of on-demand rental platforms across construction, DIY, and industrial maintenance activities, as users increasingly prefer asset-light, cost-efficient access to tools. Growing smartphone penetration, digital payment integration, and the shift toward sharing-economy business models are further accelerating platform usage, making tool rental apps a key enabler of the modern gig and infrastructure economy worldwide.

Get More Information about this report -

Request Free Sample ReportThe Tool Rental Apps Market revolves around digital platforms that connect tool owners with users seeking short- or long-term rentals of equipment. These tools span categories such as industrial tools, construction tools, home improvement tools, gardening tools, and specialized equipment for niche applications. The market has gained momentum due to the rising demand for flexible, cost-effective access to high-quality tools without the burden of ownership. A combination of smartphone penetration, growth in e-commerce ecosystems, and the evolving sharing economy has accelerated this trend. For construction contractors, small businesses, and DIY enthusiasts, digital rental apps offer transparency, convenience, and a wide range of options previously unavailable through traditional rental stores.

Multiple factors influence this market’s evolution. Rapid urbanization in North America and Asia Pacific is fueling demand for construction and home improvement tools. Likewise, growing environmental awareness drives companies and consumers toward rental solutions that promote resource optimization and reduce waste. The Business-to-Consumer (B2C) and Business-to-Business (B2B) segments are expanding as companies integrate artificial intelligence to improve inventory management, pricing algorithms, and predictive maintenance. Nevertheless, logistical challenges such as timely delivery, maintenance costs, and variable rental pricing can impact profitability. The proliferation of players, from established giants like United Rentals and Sunbelt Rentals to emerging platforms like RentMyTool and EquipmentShare, is fostering a dynamic and competitive landscape.

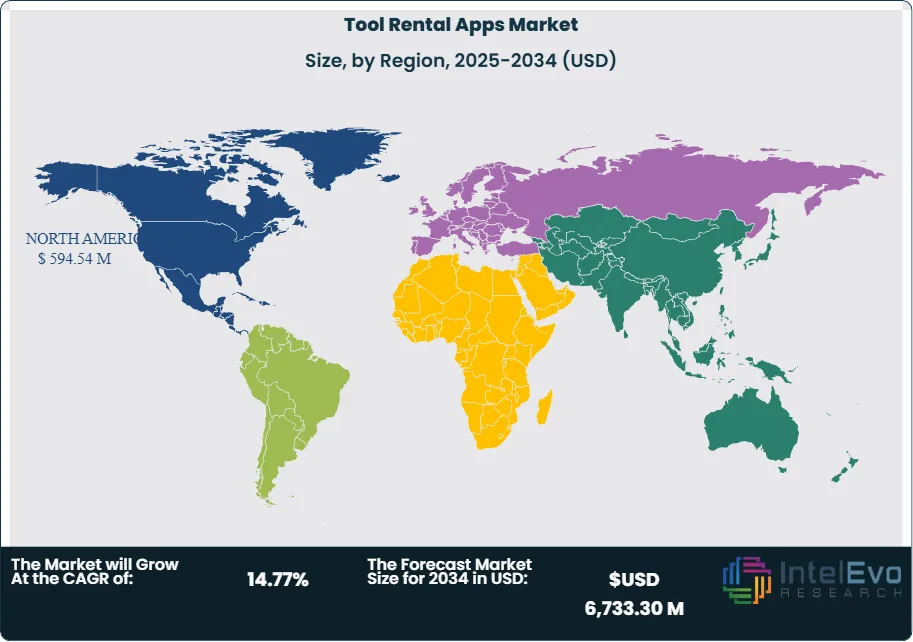

North America is the clear leader in the Tool Rental Apps Market. This region benefits from a mature rental infrastructure, a high concentration of professional contractors, and advanced digital payment systems that simplify transactions. Europe is following closely, buoyed by sustainability initiatives and regulatory incentives for tool reuse. Asia Pacific is witnessing rapid growth, driven by infrastructural investments, smartphone adoption, and rising consumer awareness. Latin America and the Middle East are also gradually adopting rental platforms, although they remain in earlier stages of development.

The COVID-19 pandemic disrupted the Tool Rental Apps Market in several phases. Initially, lockdowns and project cancellations caused a steep decline in rental activity as construction sites were shuttered. However, as restrictions eased, many businesses and individuals turned to rental solutions to avoid capital investments during economic uncertainty. This led to a surge in demand for short-term rentals, particularly for home improvement tools and smaller construction equipment. Many companies also digitized faster, rolling out contactless delivery and pickup, improving app-based scheduling, and investing in fleet sanitization protocols to reassure customers.

Regional conflicts between major economies and tariffs on goods have introduced complexity into the market. Trade tensions between the U.S. and China, Brexit-driven disruptions, and sanctions affecting Russia and parts of Eastern Europe have resulted in higher tariffs on imported tools and spare parts. These cost pressures are directly impacting rental companies, which must decide whether to absorb higher procurement expenses or pass them on to end users. Additionally, unpredictable shipping delays are complicating inventory management. Companies are responding by diversifying suppliers, investing in local sourcing and warehousing, and implementing dynamic pricing models to offset volatility. This geopolitical instability has underlined the importance of resilient supply chains and adaptable business strategies across the Tool Rental Apps Market.

Key Takeaways

- Market Growth: The Tool Rental Apps Market is expected to reach USD 6733.30 Million by 2034, growth is fueled by digitization, increased construction spending, and the affordability of renting over purchasing tools.

- Tool Type Dominance: Construction tools remain the largest revenue contributor due to constant demand from commercial and residential projects. Companies increasingly rely on rentals to access specialized equipment.

- Business Model Dominance: The B2C segment has expanded rapidly as homeowners and hobbyists embrace app-based rentals for DIY and small-scale renovation projects.

- Rental Duration Dominance: Short-term rentals are favored for project-specific needs, allowing customers to optimize costs and avoid long-term commitments.

- End-Use Dominance: Businesses and organizations form the core customer base, leveraging rentals for scalability and operational efficiency.

- Driver: Digital transformation through mobile apps and integration of AI-powered scheduling have enhanced user experiences and operational efficiency.

- Restraint: Logistical complexities and fluctuating rental pricing are significant barriers, potentially affecting customer satisfaction and profitability.

- Opportunity: Expansion into emerging markets and development of subscription-based rental models present lucrative growth prospects.

- Trend: Integration of IoT-enabled tracking and predictive maintenance is gaining traction, ensuring better uptime and reducing operational costs.

- Regional Analysis: North America leads the market due to established rental infrastructure, high smartphone penetration, and strong demand from construction sectors. Europe and Asia Pacific are experiencing steady growth with digital adoption rising.

Tool Type Analysis:

Construction tools account for the largest market share, as they are indispensable for infrastructure and building projects. Contractors, small firms, and large enterprises often require specialized equipment such as drills, jackhammers, and earth-moving tools that are not economically feasible to purchase outright. Tool rental apps provide convenient access, real-time availability, and transparent pricing. The proliferation of short-term infrastructure projects and the surge in residential renovations have further amplified demand. Additionally, sustainability mandates are encouraging companies to reduce equipment ownership and adopt circular economy practices.

Business Model Analysis:

The B2C segment has transformed the way individual consumers approach tool access. Traditionally dominated by B2B rentals, the market now caters extensively to homeowners, hobbyists, and small contractors seeking flexible, affordable solutions for projects. Apps like RentMyTool and Lowe’s Tool Rental offer intuitive booking, delivery scheduling, and guided tutorials, making rentals accessible to non-professionals. The growth of DIY culture, coupled with remote working trends that inspired home improvement, has significantly boosted this segment’s revenue contribution.

Rental Duration Analysis:

Short-term rentals are the preferred choice for customers with time-bound requirements such as weekend projects, event setups, or specific construction phases. This model provides customers with the flexibility to rent tools only for the duration required, reducing costs and optimizing resource utilization. The segment has expanded alongside on-demand service expectations and app-based scheduling. Short-term rentals also help companies maintain high equipment utilization rates, lowering idle inventory and improving profitability.

End-Use Analysis:

Businesses and organizations represent a substantial share of the market, given their continuous need for reliable, high-quality tools without the capital expenditure of ownership. Large construction firms, maintenance companies, and industrial service providers often depend on rental platforms to access a wide array of equipment efficiently. Tool rental apps streamline procurement and management, reducing administrative burden. The need for scalability during peak periods, as well as compliance with safety and environmental standards, drives businesses toward app-based rentals.

Region Analysis:

North America Leads With 35% Market Share In Tool Rental Apps Market

North America leads the global tool rental apps market due to its advanced technological infrastructure, high smartphone penetration rates, and established sharing economy adoption. The region benefits from strong regulatory frameworks that support digital commerce and equipment rental activities. Major markets include the United States and Canada, where construction activities and infrastructure development drive consistent demand for rental equipment. The presence of major rental companies and technology providers in the region also supports market growth through innovation and service expansion.

Europe represents the second-largest market, characterized by mature construction industries and increasing adoption of digital solutions. Countries like Germany, United Kingdom, and France show strong market potential due to their industrial base and construction activities. The European market emphasizes sustainability and resource efficiency, aligning well with rental model benefits.

Asia-Pacific demonstrates the fastest growth potential, driven by rapid industrialization, urbanization, and increasing construction activities in countries like China, India, and Southeast Asian nations. The region's growing middle class and increasing smartphone adoption create favorable conditions for rental app growth. However, the market faces challenges including varying regulatory environments and the need for localized solutions.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Tool Type

- Industrial Tools

- Construction Tools

- Home Improvement Tools

- Gardening Tools

- Other Tools

Business Model

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Peer-to-Peer (P2P)

Rental Duration

- Long-Term Rentals

- Short-Term Rentals

End-Use

- Businesses & Organizations

- Individual Consumers

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1,949.57 M |

| Forecast Revenue (2034) | USD 6,733.30 M |

| CAGR (2025-2034) | 14.77% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Tool Type (Industrial Tools, Construction Tools, Home Improvement Tools, Gardening Tools, Other Tools), Business Model (Business-to-Business (B2B), Business-to-Consumer (B2C), Peer-to-Peer (P2P)) Rental Duration (Long-Term Rentals, Short-Term Rentals) End-Use (Businesses & Organizations, Individual Consumers) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | EquipmentShare, Home Depot Tool Rental, Point of Rental, Lowe’s Tool Rental, RentMyTool, United Rentals, Bunnings, Herc Rentals, Acme Tools, Sunbelt Rentals |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date