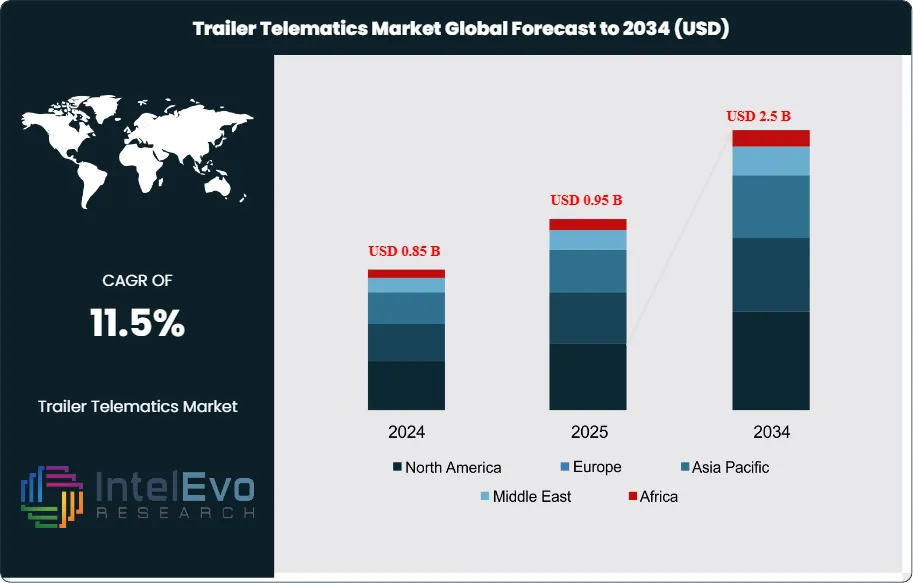

Trailer Telematics Market to Reach USD 2.5 Bn by 2034 | 11.5% CAGR

Global Trailer Telematics Market Size, Share, Analysis Report By Application (Full Trailer, Semi-Trailer), Provider Type (OEM, Aftermarket), Power Source (Self-Contained Battery Operated Devices, Solar Battery Operated Devices, Wired Devices), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

The Global Trailer Telematics Market size is projected to reach approximately USD 2.5 billion by 2034, up from USD 0.85 billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034. The rising adoption of connected vehicle technologies and smart logistics solutions is driving the growth of the trailer telematics market. Fleet operators are increasingly leveraging telematics for real-time tracking, predictive maintenance, and fuel optimization, improving operational efficiency and reducing costs. Additionally, regulatory mandates for safety and compliance, coupled with advancements in IoT, AI, and GPS technologies, are further accelerating market growth and digital transformation in the transportation and logistics sector.

Get More Information about this report -

Request Free Sample ReportTelematics is defined as a technological system that integrates data dashboards, wireless networking, and telecommunication components with vehicle sensors to facilitate the long-distance transfer of data from moving transportation appliances. GPS systems that map and record the car's precise location and offer data on its speed are used by telematics to monitor the vehicle. Telematics lets fleet management identify gasoline leaks and enable them to be promptly fixed. The most efficient route for each driver is aided by telematics, which reduces mileage. By offering a digital blueprint of each vehicle's performance, telematics enables fleet managers to identify areas for improvement in driver safety regulations and accident prevention strategies. As new applications are created to profit from contemporary GPS units and the widespread usage of mobile appliances, telematics is poised for exponential growth. More fleets understand how important it is to keep an eye on fleet activity in order to increase productivity, enhance responsibility, manage costs, and adhere to all legal requirements.

Growth dynamics in the market for trailer telematics are primarily driven by factors like increasing environmental concerns, government regulation and compulsions, consumer preference for sustainable products, etc. Along with this there are several other reasons such as reducing operational cost, stringent government regulations, and increasing demand for e-trailers which helps in boosting the demand for trailer telematics. Technological development in research and development can ensure better and more technologically advanced trailer telematics system such as wireless networking, GPS tracking, etc.. Further, the tie-ups and mergers between different organizations also helps in boosting the market growth.

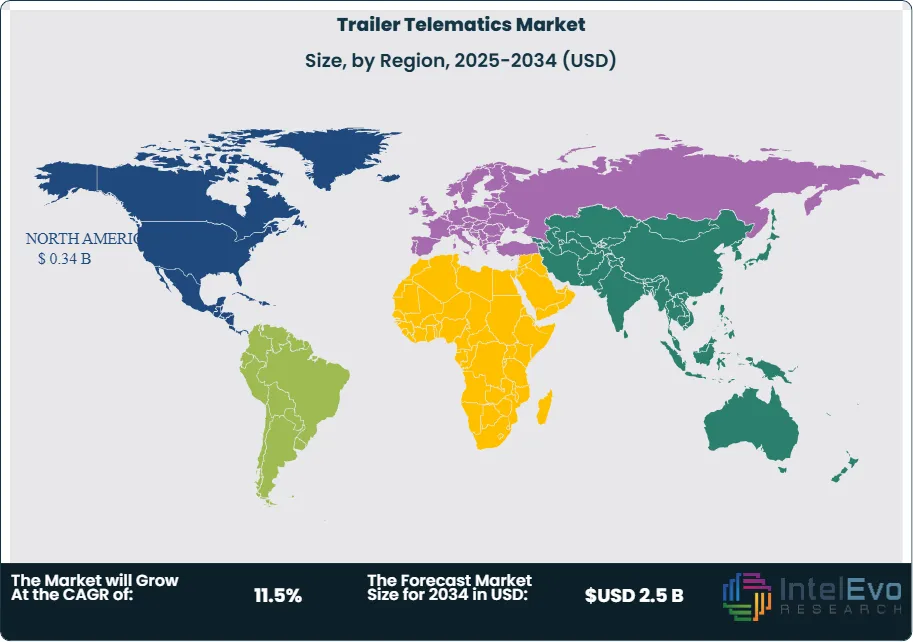

North America is considered to have the highest growth market for trailer telematics mainly due to high regulatory concerns and increasing demand for safety and security. Urbanization along with a shift of consumer preferences and the government policies of the region supporting urbanization also helps in the growth of the market in the region. Furthermore, it is projected that the expanding e-commerce sector, the network of busy roads, and the constantly expanding transportation and logistics sectors in the US and Canada will drive market expansion in this area throughout the course of the forecast period. Additionally, the region's market is anticipated to increase due to the strong presence of manufacturers of automotive systems and components, population expansion, fleet management, and rising disposable income.

COVID 19 has had a mixed effect on the market size of trailer telematics. The transportation and logistics sector was significantly impacted by the COVID-19 epidemic, which changed how businesses run and maintain their fleets, particularly trailers. Telematics and other digital technologies were adopted more quickly as a result of the epidemic in order to meet new issues in a setting that was changing quickly. During the epidemic, logistics operations were robust, safe, and effective thanks in large part to trailer telematics.

Key Takeaways:

- Market Growth: The trailer telematics market is expected to reach USD 2.5 billion by 2034, growing at a robust CAGR of 11.5%, indicating strong market expansion.

- Application Segment Dominance: The application segment is dominated by semi-trailer, accounting for over 47% of the market share. The increasing use of semi-trailers for heavy-duty logistics and transportation is fueling the segment's expansion.

- Provider Type Segment Insights: The aftermarket is anticipated to hold the largest market share, owing to the rising demand for telematics solutions in fleet management.

- Power Source Segment Insights: The solar battery operated devices segment dominated the market with 43% owing to the growing production of flexible electronics, wearable electronics, and implanted medical gadgets.

- Driver: The trailer telematics market is expanding as a result of government rules governing car telematics and the growing use of connection technologies. Furthermore, the market is expected to expand as a result of the increase in inland transportation and infrastructure investments as well as the boom in construction activity.

- Restraint: One of the challenges impeding the growth of the trailer telematics market is the high upfront and maintenance costs. Stricter emission regulations, a shortage of truck drivers, and decreased free trade are also anticipated to impede market expansion throughout the course of the projection year.

- Opportunity: The opportunity aspect for market expansion is the growing need for safe and crash-free transportation as well as the need to maximize fleet management. Additionally, the market is anticipated to increase throughout the forecast period due to the high rates of advanced technology adoption, the acceptance of commercial vehicle telematics technology, and government regulations requiring various commercial vehicle telematics applications.

- Trend: The increasing focus on circular economy practices is shaping the market, with brands investing in trailer telematics for reuse and recyclability, enhancing sustainability efforts.

- Regional Analysis: North America leads the market share due to rising safety and security concerns. Furthermore, it is projected that the expanding e-commerce sector, the network of busy roads, and the constantly expanding transportation and logistics sectors in the US and Canada will drive market expansion in this area throughout the course of the forecast period.

Component:

The component segment of the trailer telematics market includes hardware, software, and services that form the backbone of effective fleet management. Hardware like GPS trackers, sensors, and onboard computers allows for real-time data collection and monitoring of trailer performance. Software platforms offer fleet management tools, analytics, and reporting that improve route planning, fuel use, and operational efficiency. Additionally, installation, integration, and maintenance services ensure smooth deployment and dependable performance. The rising demand for predictive maintenance, remote diagnostics, and smart fleet solutions is driving investment in high-quality telematics components. This makes the segment a major factor in market growth from 2025 to 2034.

Application Analysis:

Trailer telematics applications are essential for improving fleet efficiency, safety, and cost-effectiveness. Key applications include real-time fleet monitoring and tracking, predictive maintenance to avoid breakdowns, fuel management and optimization, safety and compliance monitoring, and route planning and logistics optimization. These applications use IoT, AI, and GPS technologies to deliver actionable insights, lower operational costs, and boost fleet productivity. The growing adoption of connected vehicle solutions and regulations for transportation safety are increasing demand. The ongoing integration of analytics and AI-driven insights will change fleet operations, making the application segment a key growth driver in the trailer telematics market.

Provider Type Analysis:

There are two categories of providers for trailer telematics: aftermarket and OEM. From the ground up, operating efficiency and safety are improved by directly integrating cutting-edge technologies into the trailer system through the OEM level. OEM-fitted systems are designed to carry out particular duties or operations, frequently with great dependability and efficiency. General-purpose systems, on the other hand, are capable of running a variety of applications. Compared to aftermarket alternatives, these systems offer more precise and dependable data since they have direct access to trailer data streams.

Power Source Analysis:

Power source segments in the case of the market segmentation of the trailer telematics include solar battery operated devices, wired devices, and self-contained battery operated devices. The growing production of flexible electronics, wearable electronics, and implanted medical gadgets is expected to drive the segment's growth during the forecast period.

Vehicle Type:

The vehicle type segment of the trailer telematics market is divided into heavy-duty trailers, light-duty trailers, refrigerated trailers, tanker trailers, and flatbed or specialized trailers. Each vehicle type uniquely benefits from telematics solutions, such as real-time tracking, predictive maintenance, and improved safety measures. Heavy-duty trailers, often used in logistics and long-haul operations, are major adopters due to their operational complexity and high maintenance costs. Refrigerated and tanker trailers depend on telematics to monitor temperature and hazardous material compliance, ensuring safety. Growing digitization, fleet modernization, and regulatory compliance across vehicle types are driving the use of telematics solutions, making this segment vital for market growth between 2025 and 2034.

End User:

The end-user segment of the trailer telematics market consists of logistics and transportation companies, retail and e-commerce firms, food and beverage industries, automotive and manufacturing sectors, cold chain and pharmaceutical logistics, and other specialized users. These stakeholders use telematics to improve fleet operations, cut fuel costs, ensure safety, and follow transportation regulations. Large logistics providers are early adopters because of their complex fleet needs, while e-commerce and cold chain sectors are quickly integrating telematics for efficient delivery management. As businesses focus more on operational efficiency and digital transformation, the end-user segment remains a key driver of market growth, highlighting the important role of telematics solutions in modern supply chains.

Region Analysis:

North America Leads With 40% Market Share in the Trailer Telematics Market: North America holds approximately 40% of the market share, supported by the increasing demand for safety and security concerns among consumers. Higher telematics adoption is made possible by the region's robust logistics and transportation infrastructure, which also facilitates operational optimization and efficient fleet management. Businesses need sophisticated telematics systems to manage the efficiency of their fleet, track shipments in real-time, and guarantee timely deliveries to meet consumer expectations, especially in the US and Canada, where e-commerce sales are still on the rise. The US has a large fleet of trailers with refrigeration units to transport perishable and frozen goods for intra- and interstate deliveries; Walmart (US) has been a major user of these trailers for the delivery of goods from their warehouses to various locations. FleetPulse announced its entry into the Canadian market in November 2024, offering fleets cutting-edge solutions to optimize operations and boost efficiency and safety nationwide.

Due to rising demand for car telematics, Asia Pacific is anticipated to experience growth at the quickest rate throughout the forecast period. Additionally, during the forecast period, market expansion in this region is anticipated to be driven by growing economies like China and India, which are home to extensive supply chains and logistical networks. Furthermore, the government's stringent car safety laws and public awareness of traffic safety are contributing to the region's market expansion over the projection period.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Component

- Hardware

- GPS Trackers

- Sensors

- Onboard Computers

- Software

- Fleet Management Software

- Telematics Platforms

- Analytics and Reporting Tools

- Services

- Installation & Integration

- Maintenance & Support

By Application

- Fleet Monitoring & Tracking

- Predictive Maintenance

- Fuel Management & Optimization

- Safety & Compliance

- Route Planning & Logistics Optimization

By Vehicle Type

- Heavy-Duty Trailers

- Light-Duty Trailers

- Refrigerated Trailers

- Tanker Trailers

- Flatbed & Specialized Trailers

By Provider Type

- OEM

- Aftermarket

By Power Source

- Self-Contained Battery Operated Devices

- Solar Battery Operated Devices

- Wired Devices

By End User

- Logistics & Transportation Companies

- Retail & E-commerce

- Food & Beverage Industry

- Automotive & Manufacturing

- Cold Chain & Pharmaceutical Logistics

- Others

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 0.95 B |

| Forecast Revenue (2034) | USD 2.5 B |

| CAGR (2025-2034) | 11.5% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Component (Hardware, (GPS Trackers, Sensors, Onboard Computers), Software, (Fleet Management Software, Telematics Platforms, Analytics and Reporting Tools), Services, (Installation & Integration, Maintenance & Support)), By Application (Fleet Monitoring & Tracking, Predictive Maintenance, Fuel Management & Optimization, Safety & Compliance, Route Planning & Logistics Optimization), By Vehicle Type (Heavy-Duty Trailers, Light-Duty Trailers, Refrigerated Trailers, Tanker Trailers, Flatbed & Specialized Trailers), By Provider Type (OEM, Aftermarket), By Power Source (Self-Contained Battery Operated Devices, Solar Battery Operated Devices, Wired Devices), By End User (Logistics & Transportation Companies, Retail & E-commerce, Food & Beverage Industry, Automotive & Manufacturing, Cold Chain & Pharmaceutical Logistics, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Tirsan, Astrata Group, Descartes, Qualcomm, Schmitz Cargobull, Microlise, WABCO, Trendfire Technologies, BPW, Star Leasing, Spireon, EROAD, Truck-Lite, CalAmp, Masternaut, Fleetmatics, Intel, Philips, ORBCOMM, FleetGO, CLS, MiX Telematics |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date