Travel and Tourism Apps Market Growth size by 2034 | 11.8% CAGR

Global Travel and Tourism Apps Market Size, Share, Analysis Report By Type (Booking & Reservations, Itinerary Management, Navigation & Maps, Local Experiences & Activities, Language Translation, Real-Time Updates & Alerts), Platform, End-User Industry (Leisure Travel, Business Travel, Adventure Tourism, Family & Group Travel, Solo Travel), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

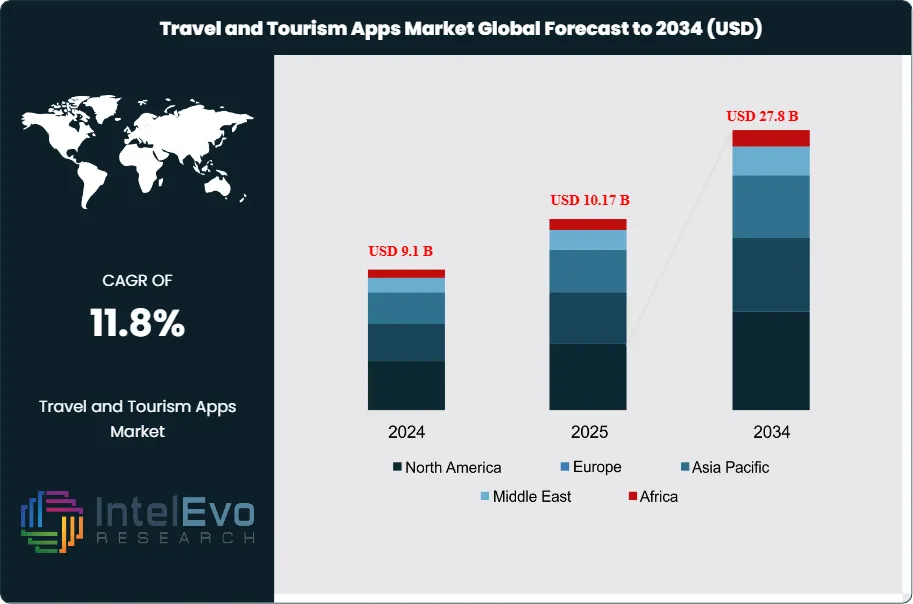

The Travel and Tourism Apps Market size is projected to reach approximately USD 27.8 Billion by 2034, up from USD 9.1 Billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034. The market is gaining momentum as digital transformation reshapes global tourism, with mobile apps becoming essential for booking, navigation, language assistance, and real-time experiences. The integration of AI-driven personalization, AR/VR travel previews, and contactless booking systems is redefining user engagement and convenience. As global travel rebounds post-pandemic and Gen Z travelers increasingly rely on mobile-first planning, travel and tourism apps are transforming into all-in-one digital travel companions, driving innovation and competition across the industry.

Get More Information about this report -

Request Free Sample ReportTravel and tourism apps have become essential digital tools, transforming how consumers plan, book, and experience travel. This market includes mobile applications for booking flights and hotels, itinerary management, local experiences, navigation, language translation, and real-time travel updates. The market’s expansion is driven by increased smartphone penetration, improved internet connectivity, evolving traveler preferences for convenience and personalization, and the growing influence of digital platforms as primary sources for travel discovery and booking. The integration of artificial intelligence, machine learning, and big data analytics has enabled more personalized recommendations, dynamic pricing, and seamless user experiences, while advanced security features ensure safe transactions and data privacy.

The travel and tourism apps ecosystem is rapidly evolving, influenced by advancements in augmented reality (AR), virtual reality (VR), and real-time data integration, which create immersive and interactive travel experiences. Market growth is further accelerated by the democratization of app development, allowing both established brands and startups to launch innovative solutions, and by the increasing comfort of consumers with digital payments and mobile-first travel planning. The post-pandemic shift toward contactless, self-service, and digital-first travel behaviors has permanently changed traveler expectations, with users now demanding more engaging, informative, and flexible app experiences that support every stage of their journey.

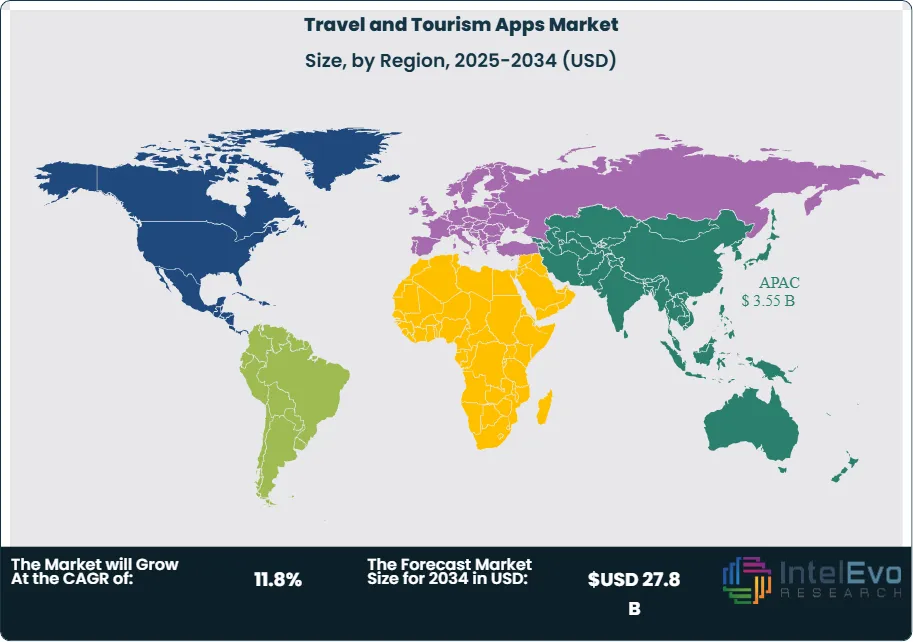

The Asia Pacific region dominates the global travel and tourism apps market, accounting for the largest market share due to its high smartphone adoption, robust digital infrastructure, and a large, tech-savvy population. Countries like China, India, and Japan have pioneered many innovations in travel tech, with super-apps and integrated platforms setting new standards for convenience and user engagement. The region benefits from supportive government policies, rapid urbanization, and a growing middle class eager to explore both domestic and international destinations.

The COVID-19 pandemic served as a significant catalyst for the travel and tourism apps market, accelerating digital adoption as travelers and providers sought safe, flexible, and contactless solutions. Lockdowns and travel restrictions forced the industry to innovate rapidly, with apps emerging as critical tools for health documentation, real-time updates, and virtual experiences. The pandemic highlighted the importance of agility and digital readiness in travel, resulting in sustained growth momentum for travel and tourism apps in the post-pandemic era.

Key Takeaways:

- Market Growth: The Travel and Tourism Apps Market is projected to reach USD 27.8 Billion by 2034, as brands and platforms recognize the compelling ROI of digital engagement. The convergence of mobile adoption, personalization, and integrated travel services is creating sustained growth momentum across regions and sectors.

- Type Dominance: Booking and itinerary management apps dominate the market, accounting for over 48% share in 2024, due to their ability to deliver convenience, real-time updates, and seamless integration with travel providers.

- Platform Dominance: Mobile platforms are the primary channel for travel and tourism apps, enabling brands to reach travelers wherever they are. Super-apps and integrated platforms in Asia Pacific, as well as specialized apps in North America and Europe, drive higher engagement and conversion rates.

- End-User Industry Dominance: Leisure travel leads end-user adoption, representing 54% of the market in 2024, as consumers seek personalized recommendations, local experiences, and easy booking. Business travel apps are also growing, offering expense management, policy compliance, and real-time support.

- Driver: The surge in smartphone penetration and high-speed connectivity has made travel apps accessible to billions, fueling rapid adoption. Simultaneously, the rise of digital payments and contactless solutions has created new ways to build trust and drive bookings.

- Restraint: Data privacy concerns and fragmented regulatory environments present barriers to seamless app adoption. Security, compliance, and interoperability challenges further complicate the landscape.

- Opportunity: The emergence of AI-powered personalization, AR/VR integration, and super-app ecosystems offers significant opportunities to enhance traveler engagement and boost conversion rates. Cross-border travel and multi-language support are also expanding, unlocking access to international markets.

- Trend: In-app experiences such as virtual tours, real-time translation, and social sharing are redefining how travelers plan and enjoy their journeys. Gamification, loyalty programs, and dynamic pricing embedded in apps are increasing retention and spend.

- Regional Analysis: Asia Pacific remains the dominant region, holding 39% market share in 2024, driven by China and India’s mature travel tech infrastructure and cultural affinity for mobile-first solutions. North America and Europe are evolving rapidly as brands scale omnichannel strategies. Latin America and the Middle East are emerging as promising markets with rising mobile adoption and outbound travel.

Type Analysis:

Booking and itinerary management apps have emerged as the cornerstone of the travel and tourism apps market, accounting for the largest share among app types. Their dominance is rooted in their ability to centralize travel planning, provide real-time updates, and integrate with airlines, hotels, and local services. These apps enable travelers to manage bookings, receive alerts, and access digital boarding passes and vouchers, enhancing convenience and reducing stress.

In Asia Pacific, super-apps like WeChat and Alipay integrate travel services with payments, social media, and local experiences, setting new standards for engagement and revenue generation. Western markets are catching up, with apps like Expedia, Booking.com, and TripIt driving increasing adoption. The format is especially popular among leisure travelers and millennials who value flexibility and personalization.

Platform Analysis:

Mobile Platforms Lead With Over 67% Market Share in Travel and Tourism Apps Market. Mobile platforms have become the dominant channels for travel and tourism app distribution. Their massive user bases, location-based services, and push notification capabilities make them ideal environments for real-time engagement and personalized offers. Consumers already use mobile devices for discovery, booking, and navigation, reducing friction in the travel journey.

The strength of mobile platforms lies in their ability to blend planning, booking, and in-destination experiences. Features like mobile check-in, e-tickets, and instant translation make it easy for travelers to manage their trips on the go. For small businesses and independent providers, app stores and digital platforms provide a low-barrier entry point to reach global audiences. As travelers spend increasing time on mobile, this segment is expected to see continued investment and innovation.

Application:

Leisure travel has emerged as the leading end-user industry in travel and tourism apps, representing 54% of the market in 2024, driven by the desire for personalized recommendations, local experiences, and seamless booking. Travelers are drawn to apps that offer curated itineraries, real-time updates, and social sharing features. Influencers and travel bloggers frequently partner with app providers to showcase destinations and drive downloads.

For brands, travel apps offer an opportunity to reduce friction, increase loyalty, and capture valuable data on traveler preferences. Business travel apps are also gaining traction, offering features like expense tracking, policy compliance, and 24/7 support. The combination of convenience, personalization, and real-time engagement has made travel and tourism apps indispensable for modern travelers.

Region Analysis:

Asia Pacific Leads With 39% Market Share in Travel and Tourism Apps Market, Asia Pacific leads the global travel and tourism apps market, commanding the largest market share due to its advanced mobile infrastructure, high smartphone adoption, and a large, tech-savvy population. China and India dominate this regional leadership through super-apps and integrated platforms that offer end-to-end travel solutions. The region benefits from supportive government policies, rapid urbanization, and a growing middle class eager to explore new destinations.

North America represents the second-largest market, driven by significant investments from major technology companies and established travel brands. The region shows rapid growth as consumer behavior shifts toward digital-first travel planning and contactless experiences. Europe follows closely, with strong growth in markets like the United Kingdom, Germany, and France, where travelers increasingly rely on apps for planning and booking.

Emerging markets in Latin America, Africa, and Southeast Asia are expected to see the most significant growth, as mobile-first internet adoption and rising outbound travel create ideal conditions for app expansion. These regions benefit from leapfrogging traditional travel infrastructure and adopting digital solutions as primary tools for travel planning and booking.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Travel Booking Apps

- Transportation and Navigation Apps

- Hotel and Accommodation Apps

- Tour and Activity Booking Apps

- Travel Review and Recommendation Apps

- Others (Currency Conversion, Translation, Local Guide Apps)

By Platform

- Android

- iOS

- Web-Based

By Service Type

- Online Booking and Reservations

- Travel Planning and Management

- Payment and Currency Exchange

- Real-Time Travel Assistance

- Social Networking and Reviews

By End User

- Individual Travelers

- Business Travelers

- Travel Agencies and Operators

- Hospitality Providers

By Application

- Leisure Travel

- Business Travel

- Adventure & Eco-Tourism

- Family & Group Travel

- Solo Travel

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 10.17 B |

| Forecast Revenue (2034) | USD 27.8 B |

| CAGR (2025-2034) | 11.8% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Travel Booking Apps, Transportation and Navigation Apps, Hotel and Accommodation Apps, Tour and Activity Booking Apps, Travel Review and Recommendation Apps, Others (Currency Conversion, Translation, Local Guide Apps)), By Platform (Android, iOS, Web-Based), By Service Type (Online Booking and Reservations, Travel Planning and Management, Payment and Currency Exchange, Real-Time Travel Assistance, Social Networking and Reviews), By End User (Individual Travelers, Business Travelers, Travel Agencies and Operators, Hospitality Providers), By Application (Leisure Travel , Business Travel, Adventure & Eco-Tourism, Family & Group Travel, Solo Travel) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Booking Holdings Inc., Expedia Group Inc., Trip.com Group Limited, Airbnb Inc., Google, TripAdvisor LLC, MakeMyTrip Limited, Hopper Inc., Skyscanner Ltd., Agoda Company Pte. Ltd., Trivago N.V., Traveloka, Tuniu Corporation, Despegar.com Corp., Cleartrip Pvt. Ltd. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Travel and Tourism Apps Market

Published Date : 09 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date