U.S. Fishing Goods Market Size, Share & Growth Forecast 2025–2034

U.S. Fishing Goods Market Size, Share & Outdoor Recreation Analysis By Product Type (Rods, Reels, Lines, Accessories), By Fishing Type (Freshwater, Saltwater, Fly Fishing), E-commerce Impact, Sustainability Trends, Key Brands & Forecast 2025–2034

Report Overview

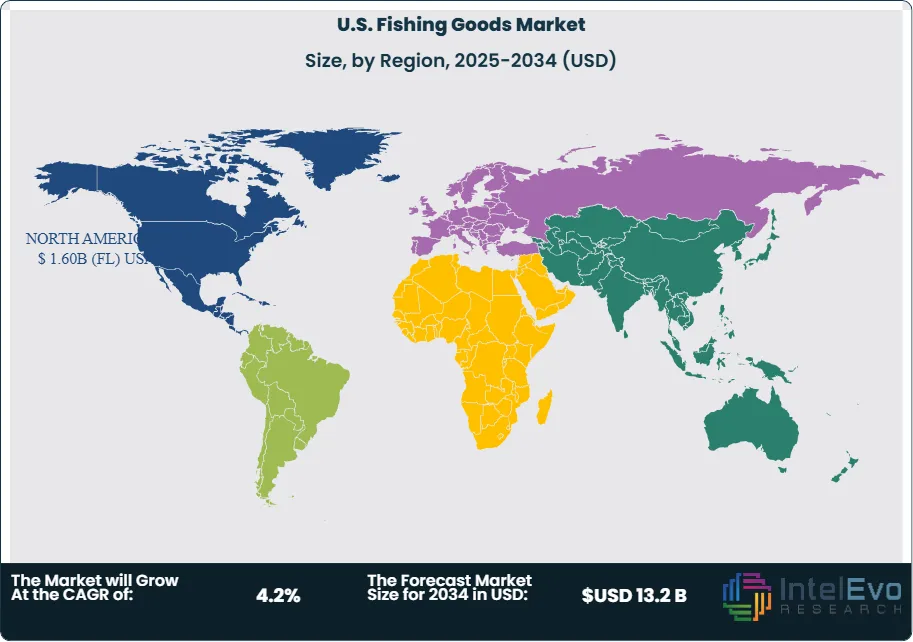

The U.S. Fishing Goods Market is estimated at USD 9.9 billion in 2024 and is on track to reach roughly USD 13.2 billion by 2034, implying a compound annual growth rate (CAGR) of 4.2% over 2025–2034. This steady expansion is supported by rising recreational fishing participation, increased spending on premium and sport-specific equipment, and growing interest in outdoor wellness activities. Strong e-commerce penetration, influencer-led marketing, and sustainability-driven product innovation are further strengthening demand, positioning fishing gear as a resilient segment within the broader outdoor recreation market.

-Size-by-Region.png.png)

This growth reflects both the rising popularity of recreational fishing and the expanding economic footprint of the sector within the broader outdoor sporting goods industry. The market covers a wide spectrum of products, including rods, reels, bait, tackle, and accessories, serving both casual participants and professional anglers. Historical data shows steady participation, but recent years have seen a sharper uptick, with 3.2 million new fishing participants added between 2022 and 2023. By 2023, the number of anglers in the United States reached approximately 74 million, according to the American Sportfishing Association, underscoring a strong demand base that is expected to sustain long-term growth.

The industry’s economic significance extends beyond equipment sales. Recreational fishing generates an estimated USD 16.4 billion annually in state and federal tax revenues, highlighting its role as a contributor to public finances and local economies. Demand-side growth is supported by rising consumer interest in outdoor activities, while supply-side stability is reinforced by global fish production, which reached 186.6 million metric tons in 2023. This ensures consistent availability of bait and related inputs, although fluctuations in global supply chains and raw material costs remain potential risks.

Regulatory frameworks also shape the market trajectory. U.S. government initiatives promoting sustainable fishing practices and conservation of aquatic ecosystems are critical in maintaining fish populations and ensuring long-term industry viability. Investments in wildlife and natural resource management enhance fishing environments, attracting new participants while retaining existing anglers. These measures create favorable conditions for market expansion, though compliance costs and environmental restrictions may pose challenges for manufacturers and distributors.

Technology is increasingly influencing product adoption. Digital platforms for fishing gear sales, smart equipment with integrated sensors, and AI-driven applications for fish tracking are reshaping consumer expectations. These advancements are broadening the appeal of fishing to younger demographics and creating new revenue streams for manufacturers.

Regionally, coastal states remain the largest markets due to strong saltwater fishing activity, while inland regions with freshwater resources are emerging as growth hotspots. For investors, opportunities lie in targeting specialized equipment segments and digital retail channels that align with shifting consumer behavior. The interplay of rising participation, regulatory support, and technological adoption positions the U.S. Fishing Goods Market for steady expansion through 2034.

Key Takeaways

- Market Growth: The U.S. fishing goods market is projected to expand from USD 9.9 billion in 2024 to USD 13.2 billion by 2034, reflecting a CAGR of 4.2%. Growth is supported by rising participation, with 74 million anglers recorded in 2023 and an additional 3.2 million entrants between 2022 and 2023.

- Product Type: Equipment, including rods, reels, and tackle, accounted for 93.1% of total market revenue in 2024. This dominance reflects consistent replacement demand and the broad appeal of multipurpose gear across both freshwater and saltwater fishing.

- Price Range: Mass-market products held 65.7% of sales in 2024, driven by affordability and accessibility for casual anglers. Premium gear continues to grow but remains concentrated among experienced participants and specialty retailers.

- Distribution Channel: Sporting goods retailers captured 55.6% of the market in 2024, supported by strong in-store product availability and brand partnerships. Online channels are expanding rapidly, with double-digit growth rates, as younger consumers shift toward digital purchasing.

- Driver: Recreational fishing contributes USD 16.4 billion annually in state and federal tax revenues, underscoring its economic importance. Rising outdoor recreation participation is directly fueling demand for fishing equipment and accessories.

- Restraint: Regulatory restrictions on fishing seasons and catch limits, designed to protect fish populations, can dampen short-term demand. Compliance costs for manufacturers and distributors also add pressure to margins.

- Opportunity: Freshwater fishing gear represents a high-growth segment, supported by expanding participation in inland states. Digital retail platforms and smart fishing devices are expected to generate incremental revenue streams through 2034.

- Trend: Technology adoption is reshaping consumer behavior. Smart rods with integrated sensors, AI-based fish tracking apps, and e-commerce platforms are gaining traction, with leading brands investing in connected gear to attract younger demographics.

- Regional Analysis: Coastal states remain the largest revenue contributors due to strong saltwater fishing activity. Inland regions, particularly the Midwest and Southeast, are emerging growth hotspots, with above-average CAGR projections supported by rising freshwater participation.

Product Analysis

In 2025, equipment continues to dominate the U.S. fishing goods market, accounting for more than 93% of total sales. This category includes rods, reels, lures, artificial baits, lines, and other essential gear that form the foundation of both recreational and professional fishing. The segment’s scale reflects the indispensable role of equipment in the angling experience, where performance and reliability directly influence outcomes.

The strength of this category is reinforced by consistent replacement demand and the growing participation base, which reached nearly 75 million anglers in 2024. Apparel and footwear remain secondary contributors, serving a narrower consumer base focused on comfort, safety, and mobility. While smaller in share, these categories are expected to grow steadily as specialized clothing and protective gear gain traction among younger and more safety-conscious participants.

Looking ahead, equipment will remain the anchor of market revenues, but incremental growth opportunities are likely to emerge in apparel and footwear. Sustainability-focused product lines, such as eco-friendly waders and recycled-material footwear, are expected to attract environmentally aware consumers, adding new dimensions to the market mix.

Price Range Analysis

The mass-market segment accounted for 65.7% of sales in 2025, reflecting strong demand for affordable fishing gear that appeals to casual and entry-level anglers. This dominance is supported by broad distribution networks, competitive pricing, and the appeal of multipurpose products that meet the needs of a wide consumer base.

Premium products, while smaller in share, are expanding at a faster pace. Rising disposable incomes and the professionalization of recreational fishing are encouraging consumers to invest in high-performance rods, reels, and specialized accessories. Brands that emphasize durability, advanced materials, and precision engineering are capturing a growing share of this segment.

The outlook suggests that mass-market products will continue to anchor volumes, but premium categories will drive margin expansion. Companies that balance affordability with performance differentiation are best positioned to capture both ends of the consumer spectrum.

Distribution Channel Analysis

Sporting goods retailers retained their leadership in 2025, accounting for 55.6% of total sales. These outlets remain the preferred choice for anglers due to their wide product assortments, immediate availability, and in-person service. The ability to physically test equipment before purchase continues to be a decisive factor for many buyers.

Online channels are expanding rapidly, supported by convenience, competitive pricing, and the rise of digital-native consumers. E-commerce platforms are recording double-digit growth, although they still trail physical stores in overall share. Hypermarkets and supermarkets contribute modestly, as their broader product focus limits specialization.

Exclusive brand outlets and niche channels remain small but strategically important for brand positioning and customer loyalty. Over the next decade, hybrid models that integrate online convenience with in-store experiences are expected to reshape distribution strategies, particularly as younger anglers increasingly rely on digital platforms for product discovery and purchase.

Regional Analysis

North America remains the largest market for fishing goods, driven by high participation rates and strong recreational fishing culture in the United States. The region benefits from well-developed retail infrastructure and consistent consumer spending on outdoor activities. Europe follows, with steady demand supported by regulatory emphasis on sustainable fishing practices and growing interest in eco-friendly equipment.

Asia Pacific is emerging as the fastest-growing region, supported by rising middle-class incomes, expanding coastal tourism, and government initiatives promoting recreational fishing in countries such as China, Japan, and Australia. Latin America is also gaining traction, particularly in Brazil and Mexico, where freshwater fishing is expanding alongside tourism-driven demand.

The Middle East and Africa remain smaller markets but present long-term opportunities as governments invest in aquaculture and recreational fishing infrastructure. For investors, Asia Pacific and Latin America represent the most attractive growth frontiers, while North America will continue to anchor global revenues through 2035.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product

- Equipment

- Rods, Reels and Components

- Lures, Flies, and Artificial Baits

- Lines and Leaders

- Creels, Strings

- Others

- Apparel

- Footwear

By Price Range

- Mass

- Premium

By Distribution Channel

- Sporting Goods Retailer

- Online

- Hypermarkets & Supermarkets

- Exclusive Brand Outlets

- Others

Regions

- USA

| Report Attribute | Details |

| Market size (2024) | USD 9.9 B |

| Forecast Revenue (2034) | USD 13.2 B |

| CAGR (2024-2034) | 4.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Equipment, Apparel, Footwear), By Price Range (Mass, Premium), By Distribution Channel (Sporting Goods Retailer, Online, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Johnson Outdoors Inc., Daiwa Corporation, St. Croix Rods, Rapala USA, Zebco, Shimano North America Fishing, Inc., Plano Synergy Holdings, Inc., Pure Fishing, Inc., Lew’s Fishing, Eagle Claw Fishing Tackle Co. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date