U.S. Trash Cans and Wastebasket Market Size, Growth | CAGR 6.1%

U.S. Trash Cans and Wastebasket Market Size, Share & Waste Management Analysis By Product Type (Plastic, Metal, Smart Bins), By End User (Residential, Commercial, Municipal), Sustainability Regulations, Smart Waste Collection Technologies, E-Commerce Distribution Trends, Competitive Landscape & Forecast 2025–2034

Report Overview

The U.S. Trash Cans and Wastebasket Market is estimated at USD 418.0 million in 2024 and is projected to reach approximately USD 760.5 million by 2034, registering a compound annual growth rate (CAGR) of about 6.1% during 2025–2034. This growth is supported by rising urbanization, increased residential remodeling activity, and sustained demand from commercial spaces such as offices, healthcare facilities, and educational institutions. In addition, growing emphasis on waste segregation, recycling compliance, and aesthetically designed indoor waste solutions is driving replacement demand. The adoption of smart, touchless, and antimicrobial trash cans—particularly in the post-pandemic environment—is further strengthening market momentum across both residential and institutional end users.

_By_Region.png.png)

The market has expanded steadily over the past decade, supported by consistent household and commercial demand for waste storage solutions. With each American generating an average of 4.9 pounds of waste daily, the need for durable and functional containers remains constant. In 2020, more than 313 million Americans used plastic trash bags and liners, highlighting the scale of residential waste management and the critical role of trash cans and wastebaskets in everyday disposal practices.

Growth is increasingly shaped by sustainability imperatives. Federal initiatives such as the National Strategy for Reducing Food Loss and Waste, launched in 2024, are accelerating the transition toward a circular economy. These policies encourage the adoption of compostable bins, recycling-focused designs, and eco-friendly materials. At the same time, municipalities and businesses are investing in advanced waste management infrastructure. For example, Waste Management, Inc. opened a 45,000-square-foot recycling facility in Florida in late 2024, integrating advanced sorting technologies to improve efficiency and reduce landfill dependency. Such developments create downstream demand for compatible waste storage products that align with evolving recycling systems.

The market faces challenges in balancing cost efficiency with sustainability. Rising raw material prices, particularly for plastics and metals, pressure manufacturers to innovate with alternative materials while maintaining affordability. Regulatory compliance also adds complexity, as state-level recycling mandates and landfill diversion targets vary widely across the US. However, these challenges also create opportunities for suppliers that can deliver compliant, durable, and environmentally responsible solutions.

Technological advances are reshaping product design and adoption. Smart bins equipped with sensors for fill-level monitoring are gaining traction in commercial and municipal settings, enabling more efficient collection routes and reducing operational costs. Digitalization of waste management systems is expected to expand further, creating opportunities for integrated solutions that combine physical containers with data-driven services.

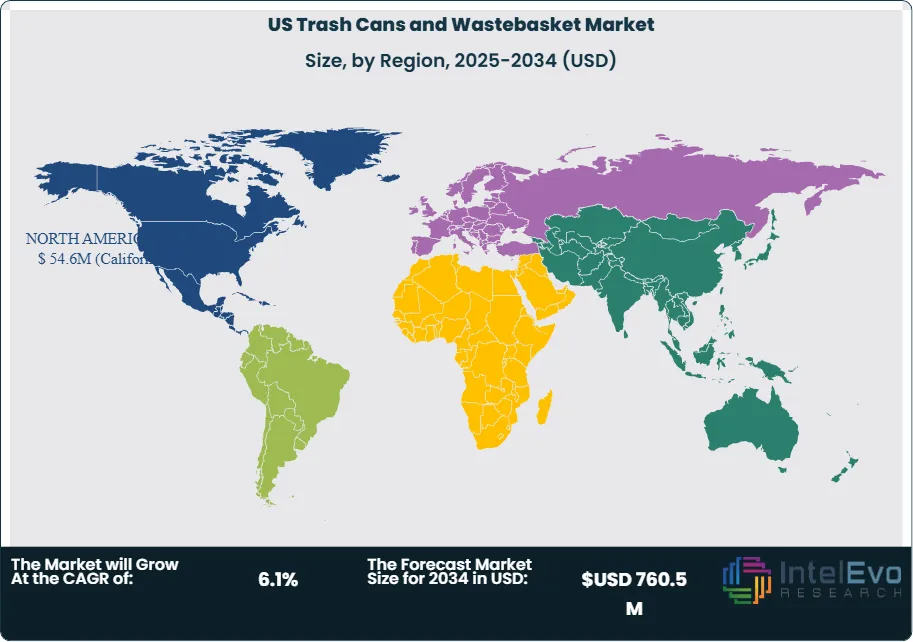

Regionally, urban centers with high population density and stricter recycling mandates represent the most attractive investment hotspots. States such as California and New York lead adoption due to progressive waste reduction policies, while growth in southern and midwestern states is supported by rising urbanization and infrastructure upgrades. For investors, the combination of regulatory momentum, consumer demand for sustainable products, and technological integration positions the US trash cans and wastebasket market for steady expansion through 2034.

Key Takeaways

- Market Growth: The U.S. trash cans and wastebasket market was worth USD 418.0 million in 2024 and is forecast to expand to USD 760.5 million by 2034, registering a CAGR of 6.1%. Market growth is being propelled by increasing household waste generation, tighter recycling regulations, and a rising preference for sustainable disposal products.

- Material: Plastic accounted for 56.2% of market share in 2023, driven by affordability, lightweight properties, and widespread use in both residential and commercial applications. Metal and stainless steel bins are gaining traction in premium and institutional segments.

- Modality: Standalone units represented 71.2% of sales in 2023, reflecting their prevalence in households, offices, and public spaces. Built-in and smart bins remain niche but are expected to expand as urban infrastructure modernizes.

- Capacity: Medium-capacity bins (10–20 gallons) held 47.2% share in 2023, aligning with residential disposal needs. Larger capacities are increasingly adopted in commercial and municipal facilities to reduce collection frequency.

- End Use: Residential applications led with 34.5% share in 2023, supported by consistent household waste generation of 4.9 pounds per person per day. Commercial and institutional demand is rising with stricter compliance requirements in offices, schools, and healthcare facilities.

- Driver: Federal initiatives such as the 2024 National Strategy for Reducing Food Loss and Waste are accelerating adoption of compostable bins and recycling-focused designs, creating new opportunities for manufacturers.

- Restraint: Volatility in raw material prices, particularly plastics and metals, is pressuring margins. Rising input costs could limit affordability and slow replacement cycles in price-sensitive segments.

- Opportunity: Smart bins with sensor-based monitoring are gaining traction in municipalities and large facilities. Adoption of these solutions is expected to grow at double-digit rates as cities invest in digital waste management systems.

- Trend: Companies are investing in advanced recycling infrastructure. Waste Management, Inc. opened a 45,000-square-foot facility in Florida in 2024, signaling a shift toward technology-driven efficiency that will influence product design and compatibility.

- Regional Analysis: The US accounted for 89.4% of market share in 2023, supported by high adoption rates and government-backed recycling initiatives. Growth hotspots include California and New York, where stricter waste reduction policies drive demand, while southern and midwestern states are emerging with rising urbanization and infrastructure upgrades.

Material Type Analysis

Plastic continues to dominate the US trash cans and wastebasket market in 2025, accounting for more than half of total sales with a share of 56.2%. Its widespread use is supported by durability, low production costs, and versatility across residential, commercial, and municipal applications. Lightweight construction and corrosion resistance make plastic bins the preferred choice for households and public facilities, while recyclability aligns with growing sustainability mandates.

Metal bins, while representing a smaller share, remain important in premium and institutional settings. Their sturdiness and aesthetic appeal make them suitable for corporate offices, luxury residences, and high-traffic public spaces where durability and design are equally valued. The “Others” category, including fiberglass and wood, caters to niche demand for decorative or specialized solutions. These materials are increasingly used in hospitality and architectural projects where design integration is a priority.

Modality Analysis

Standalone units remain the leading modality, holding 71.2% of the market in 2025. Their dominance reflects ease of placement, low maintenance, and adaptability across environments ranging from kitchens and offices to outdoor public areas. The segment benefits from consistent household demand and municipal procurement for public waste management.

Wheeled bins, while less common, are gaining traction in industrial and large-scale commercial facilities. Their mobility is critical for efficient handling of heavy waste volumes, particularly in warehouses, manufacturing plants, and large campuses. With urban waste generation rising, wheeled bins are expected to expand at a faster pace than standalone units, supported by city-level investments in organized collection systems.

Capacity Analysis

Medium-capacity bins, typically 10–20 gallons, lead the market with a 47.2% share in 2025. Their balance between storage volume and convenience makes them the preferred option for households and small businesses. They are large enough to manage daily waste without frequent emptying, yet compact enough to fit into kitchens, offices, and outdoor corners.

Small-capacity bins remain essential for bathrooms, desks, and compact spaces, while large-capacity bins are increasingly adopted in commercial complexes, schools, and industrial facilities. The demand for larger bins is expected to rise steadily as urban centers expand and commercial waste volumes grow, particularly in high-density metropolitan areas.

End-User Analysis

Residential households account for 34.5% of total demand in 2025, reflecting the essential role of trash cans in daily waste management. With each US resident generating nearly 5 pounds of waste per day, the need for multiple bins per household sustains consistent sales. Kitchens, bathrooms, and garages remain the primary points of use.

Commercial offices and public facilities represent the next largest segments. Offices prioritize durable and aesthetically aligned solutions, while public facilities require high-capacity bins to manage heavy foot traffic. Industrial facilities, though smaller in share, demand specialized containers for non-standard waste streams, including hazardous and recyclable materials. This segment is expected to grow as regulatory compliance in industrial waste handling becomes stricter.

Distribution Channel Analysis

Supermarkets and hypermarkets remain the leading distribution channel, accounting for 34.4% of sales in 2025. Their dominance is supported by accessibility, wide product assortments, and consumer preference for physical inspection before purchase. These outlets continue to attract bulk buyers, including households and small businesses.

Online retail is expanding rapidly, driven by convenience, broader product availability, and competitive pricing. Specialty bins, including compostable and smart-enabled models, are increasingly purchased online. Home improvement stores also play a significant role, particularly for consumers seeking products that align with renovation projects or specific design requirements.

Regional Analysis

California continues to lead the US market in 2025, supported by its large population, strict environmental regulations, and advanced recycling infrastructure. The state’s emphasis on sustainability and adoption of smart waste bins positions it as a key growth hub.

The Northeast, anchored by New York and Boston, holds a significant share due to high population density and stringent waste disposal mandates. Infrastructure upgrades and recycling programs are driving steady demand. The Midwest remains stable, with growth opportunities tied to modernizing outdated systems and expanding municipal recycling initiatives.

The South is experiencing the fastest growth, supported by population expansion, rising construction activity, and increasing environmental awareness. States such as Texas and Florida are emerging as strong markets. Beyond California, other Western states including Washington are investing in smart waste technologies and sustainable practices, further strengthening regional demand.

Get More Information about this report -

Request Free Sample ReportKey Market Segments

By Material Type

- Metal

- Plastic

- Others

By Modality

- Wheeled

- Standalone

By Capacity

- Small

- Medium

- Large

By End-User

- Residential

- Public Facilities

- Commercial Offices

- Industrial Facilities

- Others

By Distribution Channel

- Home Improvement Stores

- Supermarkets/Hypermarkets

- Online Retail

- Others

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 418.0 M |

| Forecast Revenue (2034) | USD 760.5 M |

| CAGR (2024-2034) | 6.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material Type (Metal, Plastic, Others), By Modality (Wheeled, Standalone), By Capacity (Small, Medium, Large), By End-User (Residential, Public Facilities, Commercial Offices, Industrial Facilities, Others), By Distribution Channel (Home Improvement Stores, Supermarkets/Hypermarkets, Online Retail, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Carlisle FoodService Products, Otto Environmental Systems North America, Inc., United Solutions Inc., Toter LLC, Abco Safety, Newell Brands Inc., Wabash Valley Manufacturing Inc., Continental Commercial Products, Safco Products Company, Suncast Corporation, |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

US Trash Cans and Wastebasket Market

Published Date : 05 Jan 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date