Vegan Ice Cream Market Size, Trends, Drivers| Forecast CAGR 12.1%

Global Vegan Ice Cream Market Size, Share, Analysis Report Product Type (Almond Milk-Based, Coconut Milk-Based, Soy Milk-Based, Oat Milk-Based, Cashew Milk-Based, Rice Milk-Based), End-Use (Retail, Foodservice), Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

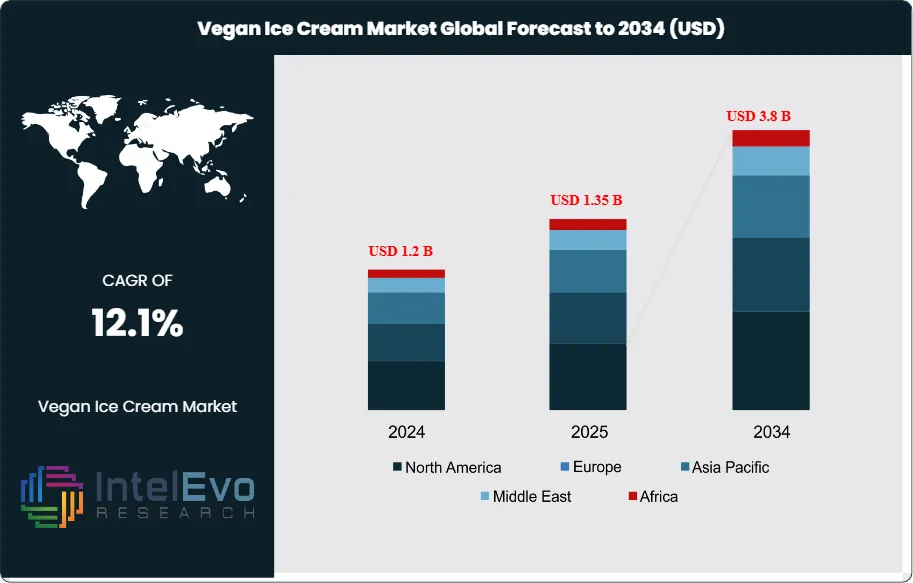

The Vegan Ice Cream Market size is expected to be worth around USD 3.8 Billion by 2034, up from USD 1.2 Billion in 2024, growing at a CAGR of 12.1% during the forecast period from 2024 to 2034. The vegan ice cream market encompasses a diverse range of plant-based frozen desserts formulated without animal-derived ingredients, including dairy, eggs, and honey. This market represents a rapidly expanding segment within the global frozen desserts industry, driven by the rising adoption of veganism, increasing lactose intolerance, and growing consumer awareness of animal welfare and environmental sustainability. Vegan ice cream is produced using a variety of plant-based milk alternatives such as almond, coconut, soy, oat, cashew, and rice, and is available in a wide array of flavors, formats, and packaging options to cater to both retail and foodservice channels.

Get More Information about this report -

Request Free Sample ReportThe vegan ice cream market is experiencing robust growth fueled by shifting consumer preferences toward plant-based diets, the proliferation of specialty and mainstream brands, and ongoing product innovation. Key growth catalysts include the expansion of vegan and flexitarian populations, the influence of social media and celebrity endorsements, and the increasing availability of vegan ice cream in supermarkets, convenience stores, and online platforms. The market benefits from advancements in food technology, which have enabled manufacturers to develop vegan ice creams with improved taste, texture, and nutritional profiles that closely mimic traditional dairy-based products.

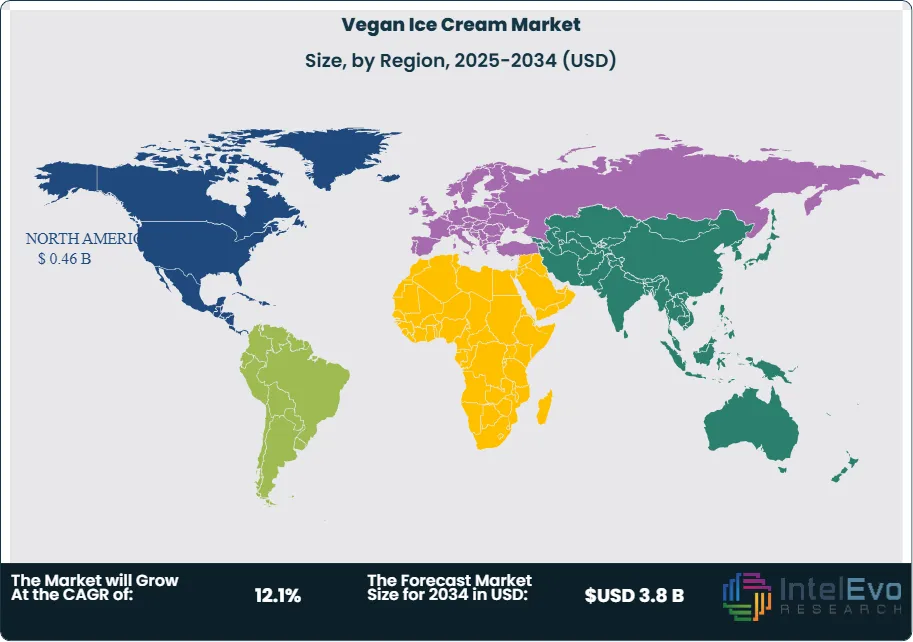

North America and Europe dominate the global vegan ice cream market, with leadership positions stemming from high levels of health consciousness, strong retail infrastructure, and a well-established vegan product ecosystem. Asia-Pacific represents the fastest-growing regional market, driven by rapid urbanization, rising disposable incomes, and the growing popularity of plant-based diets among younger consumers.

The COVID-19 pandemic accelerated the adoption of vegan ice cream as consumers sought comfort foods that align with health, ethical, and environmental values. The crisis also highlighted the importance of resilient supply chains and the need for manufacturers to diversify sourcing and distribution strategies. As a result, the market has seen increased investment in e-commerce, direct-to-consumer models, and innovative packaging solutions.

Rising concerns about climate change, animal welfare, and personal health have significantly influenced the vegan ice cream market, creating opportunities for manufacturers to develop new flavors, formats, and functional products that address evolving consumer preferences. The market is also witnessing increased demand for premium, artisanal, and regionally inspired vegan ice creams that offer unique sensory experiences and clean label credentials.

Key Takeaways

- Market Growth: The Vegan Ice Cream Market is expected to reach USD 3.8 Billion by 2034, fueled by the plant-based food trend, health and environmental awareness, and ongoing product innovation.

- Product Type Dominance: Almond milk and coconut milk-based ice creams lead market share due to their creamy texture and widespread consumer acceptance.

- End-Use Dominance: The retail segment, including supermarkets, hypermarkets, and online stores, dominates demand, but the foodservice sector is growing rapidly.

- Distribution Channel Dominance: Supermarkets and hypermarkets remain the primary distribution channels, but online retail and specialty stores are experiencing the fastest growth.

- Driver: Key drivers accelerating growth include the demand for plant-based alternatives, rising lactose intolerance, and the expansion of vegan and flexitarian populations.

- Restraint: Growth is hindered by higher production costs, limited shelf life, and competition from traditional dairy and other plant-based desserts.

- Opportunity: The market is poised for expansion due to opportunities like clean label innovation, emerging market penetration, and the development of functional and fortified vegan ice creams.

- Trend: Emerging trends including high-protein, low-sugar, and allergen-free vegan ice creams are reshaping the market by enabling new product launches and catering to health-conscious consumers.

- Regional Analysis: North America and Europe lead owing to high vegan adoption and advanced retail infrastructure. Asia-Pacific shows high promise due to rapid urbanization and changing dietary habits.

Product Type Analysis

Almond and Coconut Milk-Based Ice Creams Lead With Over 50% Market Share in the Vegan Ice Cream Market. Almond and coconut milk-based ice creams remain the cornerstone of the vegan ice cream market. These products are widely used in both commercial and household settings for their creamy texture, neutral flavor, and ability to deliver a satisfying sensory experience. Almond milk-based ice creams are popular for their lightness and subtle nutty flavor, while coconut milk-based varieties are favored for their rich, creamy mouthfeel and tropical notes.

Soy, oat, cashew, and rice milk-based ice creams are also gaining traction, particularly among consumers seeking allergen-free or regionally inspired options. The segment’s leadership is reinforced by several factors. Firstly, the growing demand for dairy-free and lactose-free desserts drives consistent usage of almond and coconut milk bases. Secondly, ongoing innovation in flavor development, inclusions (such as nuts, fruits, and chocolate), and functional ingredients (such as protein and fiber) is attracting health-conscious and adventurous consumers.

However, the segment is not without constraints. The higher cost of plant-based ingredients, supply chain complexities, and the need for specialized production facilities can limit scalability and profitability. Nevertheless, growth prospects remain strong, with the proliferation of premium, artisanal, and functional vegan ice creams demonstrating continued diversification and innovation within the category.

End-Use Analysis

Retail Segment Dominates, But Foodservice Is Rising: The retail segment—including supermarkets, hypermarkets, convenience stores, and online platforms—remains the largest end-user of vegan ice cream, accounting for a significant share of global demand. These channels offer consumers a wide selection of brands, flavors, and formats, and benefit from high foot traffic, established supply chains, and the ability to promote new products through in-store displays and digital marketing.

The foodservice sector, including restaurants, cafes, hotels, and ice cream parlors, is experiencing rapid growth, driven by the increasing popularity of vegan and plant-based menu options. Foodservice operators are expanding their offerings to include vegan ice cream sundaes, shakes, and desserts, catering to a broader customer base and capitalizing on the growing demand for inclusive dining experiences.

Distribution Channel Analysis

Supermarkets and Hypermarkets Lead, Online Retail Surges: Supermarkets and hypermarkets remain the primary distribution channels for vegan ice cream, offering consumers convenience, variety, and competitive pricing. These outlets are critical for mainstream adoption, as they provide broad access to both established and emerging brands.

Online retail is the fastest-growing channel, driven by the rise of e-commerce, direct-to-consumer (DTC) brands, and the convenience of home delivery. The pandemic accelerated online grocery shopping, with consumers increasingly purchasing vegan ice cream and other plant-based products through digital platforms. Manufacturers are investing in e-commerce capabilities, subscription services, and digital marketing to capture this growing segment.

Specialty stores, health food stores, and foodservice distributors also play important roles in the distribution of vegan ice cream, particularly for premium, artisanal, and regionally inspired products.

Region Analysis

North America and Europe Lead, Asia-Pacific Is Fastest-Growing: North America and Europe dominate the global vegan ice cream market, accounting for a combined market share of over 60% in 2024. These regions benefit from high levels of health consciousness, advanced retail infrastructure, and a strong presence of leading vegan and plant-based brands. The United States, Canada, Germany, the United Kingdom, and France are key markets, with consumers exhibiting strong preferences for ethical, sustainable, and innovative frozen desserts.

Asia-Pacific is the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and the westernization of dietary habits. Countries such as China, India, Japan, and Australia are witnessing significant market expansion, driven by the growth of the foodservice sector, increasing vegan and flexitarian populations, and the introduction of innovative, locally inspired vegan ice creams. The region’s young, tech-savvy population and growing middle class represent substantial growth opportunities for manufacturers.

Latin America and the Middle East & Africa are emerging markets, with growing demand for convenient, affordable, and high-quality plant-based desserts. Investments in local production, distribution networks, and marketing are unlocking new opportunities for vegan ice cream brands.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Product Type

- Almond Milk-Based

- Coconut Milk-Based

- Soy Milk-Based

- Oat Milk-Based

- Cashew Milk-Based

- Rice Milk-Based

- Others

End-Use

- Retail (Supermarkets, Hypermarkets, Online Stores)

- Foodservice (Restaurants, Cafes, Hotels, Ice Cream Parlors)

Distribution Channel

- Supermarkets & Hypermarkets

- Online Retail

- Specialty Stores

- Convenience Stores

- Foodservice Distributors

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.35 B |

| Forecast Revenue (2034) | USD 3.8 B |

| CAGR (2025-2034) | 12.1% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Almond Milk-Based, Coconut Milk-Based, Soy Milk-Based, Oat Milk-Based, Cashew Milk-Based, Rice Milk-Based, Others), End-Use (Retail (Supermarkets, Hypermarkets, Online Stores), Foodservice (Restaurants, Cafes, Hotels, Ice Cream Parlors)), Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Unilever plc (Ben & Jerry’s, Magnum), So Delicious Dairy Free (Danone), General Mills Inc., Tofutti Brands Inc., Breyers (Unilever), Nadamoo!, Oatly Group AB, Arctic Zero Inc., Eclipse Foods, Coconut Bliss, Trader Joe’s, Van Leeuwen Ice Cream, Nestlé, Booja-Booja, Frankie & Jo’s, Snow Monkey, Halo Top Creamery (Wells Enterprises), The Urgent Company (Brave Robot), Ripple Foods, Koku Moringa Ice Cream, Dream Pops |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Frequently Asked Questions

How big is the Vegan Ice Cream Market?

Global vegan ice cream market is projected to grow from USD 1.2 Bn in 2024 to USD 3.8 Bn by 2034, expanding at a CAGR of 12.1%. Discover key trends and growth drivers.

Who are the major players in the Vegan Ice Cream Market?

Unilever plc (Ben & Jerry’s, Magnum), So Delicious Dairy Free (Danone), General Mills Inc., Tofutti Brands Inc., Breyers (Unilever), Nadamoo!, Oatly Group AB, Arctic Zero Inc., Eclipse Foods, Coconut Bliss, Trader Joe’s, Van Leeuwen Ice Cream, Nestlé, Booja-Booja, Frankie & Jo’s, Snow Monkey, Halo Top Creamery (Wells Enterprises), The Urgent Company (Brave Robot), Ripple Foods, Koku Moringa Ice Cream, Dream Pops

Which segments covered the Vegan Ice Cream Market?

Product Type (Almond Milk-Based, Coconut Milk-Based, Soy Milk-Based, Oat Milk-Based, Cashew Milk-Based, Rice Milk-Based, Others), End-Use (Retail (Supermarkets, Hypermarkets, Online Stores), Foodservice (Restaurants, Cafes, Hotels, Ice Cream Parlors)), Distribution Channel (Supermarkets & Hypermarkets, Online Retail, Specialty Stores, Convenience Stores, Foodservice Distributors)

How can this market research report help my business make strategic decisions?

Our market research reports provide actionable intelligence, including verified market size data, CAGR projections, competitive benchmarking, and segment-level opportunity analysis. These insights support strategic planning, investment decisions, product development, and market entry strategies for enterprises and startups alike.

How frequently is the data updated?

We continuously monitor industry developments and update our reports to reflect regulatory changes, technological advancements, and macroeconomic shifts. Updated editions ensure you receive the latest market intelligence.

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date