Vehicle Insurance Market Size, Share | CAGR 8.26%

Global Vehicle Insurance Market Size, Share, Forecast& Analysis Report By Coverage Type (Liability Insurance, Comprehensive Coverage), By Vehicle Type (Personal Vehicles, Commercial Vehicles), By Vehicle Age (New Vehicles, Used Vehicles), By Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, Others) Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview

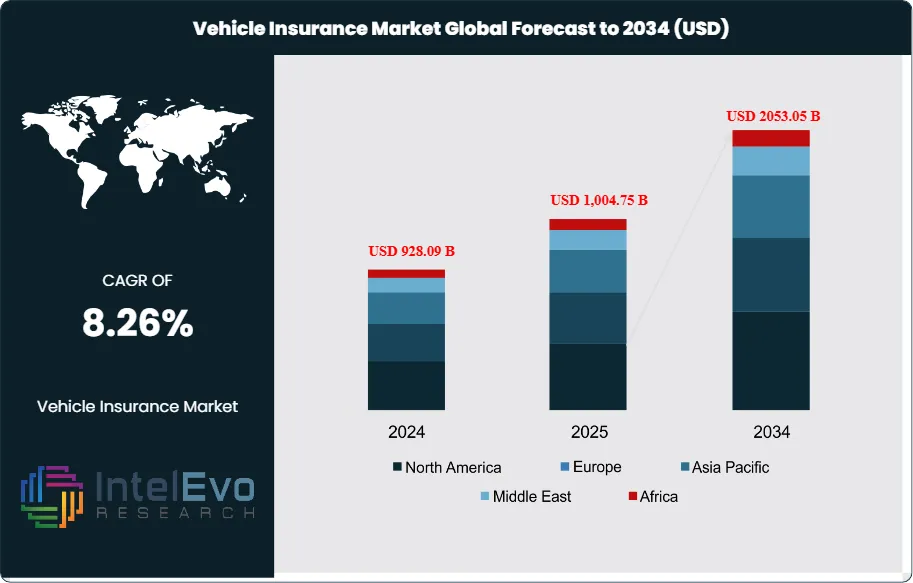

The Vehicle Insurance Market size is expected to be worth around USD 2,053.05 billion by 2034, rising from USD 928.09 billion in 2024, and expanding at a CAGR of 8.26% during the forecast period from 2024 to 2034. This growth is driven by rising global vehicle ownership, increasing regulatory mandates for compulsory insurance, and growing consumer awareness of financial protection against accidents and theft. The rapid adoption of digital insurance platforms, usage-based insurance (UBI), and telematics-enabled policies is further reshaping the market, enhancing customer experience while enabling insurers to deliver more personalized and risk-adjusted coverage models worldwide.

Get More Information about this report -

Request Free Sample ReportThe worldwide vehicle insurance sector represents a sophisticated ecosystem of comprehensive risk management solutions designed to protect automobile, motorcycle, and commercial vehicle owners against diverse financial exposures and operational liabilities. This expansive marketplace encompasses multiple specialized insurance categories, including essential liability protection against third-party claims, comprehensive coverage addressing non-collision perils such as theft and natural disasters, collision insurance for accident-related damages, and specialized automotive insurance products tailored for unique vehicle types and usage patterns. The market serves dual segments through personal vehicle insurance for individual consumers and commercial vehicle insurance for business fleet operations, distributed across traditional agent networks, direct sales channels, and innovative digital platforms.

The vehicle insurance industry exhibits exceptional growth momentum driven by interconnected global trends that sustain demand for comprehensive protection solutions. Increasing vehicle ownership rates, particularly in emerging economies experiencing rising disposable incomes and urbanization, create substantial market expansion opportunities. Stricter regulatory compliance requirements worldwide mandate minimum insurance coverage while encouraging comprehensive protection adoption. Technological integration through telematics systems, artificial intelligence applications, and Internet of Things devices revolutionizes risk assessment capabilities and enables usage-based insurance models that benefit both insurers and policyholders.

Rising consumer awareness about comprehensive coverage benefits drives market sophistication as vehicle owners increasingly recognize the financial protection value of robust insurance policies. Mandatory insurance requirements across most jurisdictions provide stable demand foundations while evolving risk assessment capabilities through advanced analytics enable more precise pricing models and enhanced customer experiences.

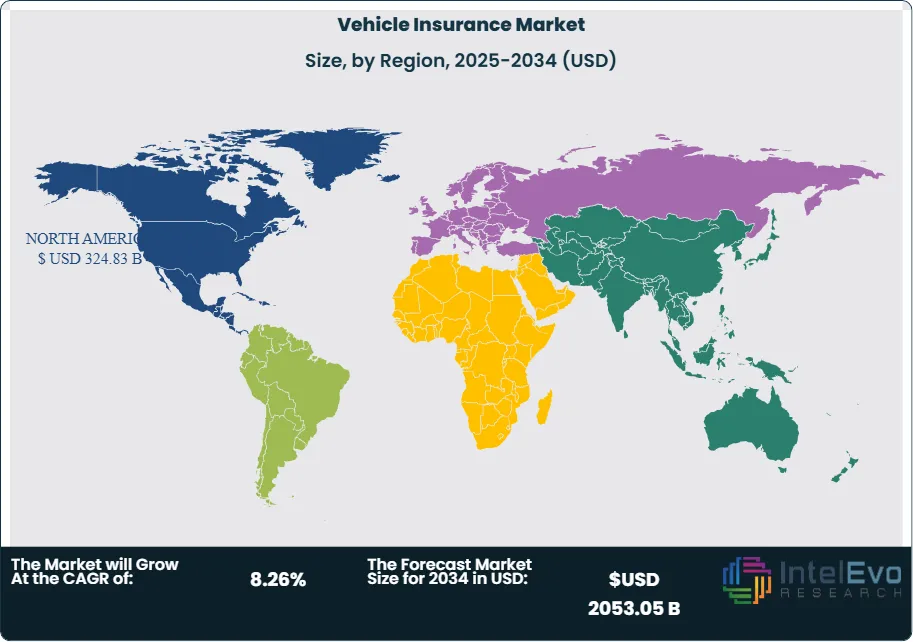

North America maintains dominant market positioning through established insurance infrastructure, mature regulatory frameworks, and high vehicle ownership rates that generate substantial premium volumes across personal and commercial segments. The region benefits from sophisticated distribution networks, advanced technological capabilities, and strong consumer awareness supporting premium pricing models. Asia-Pacific emerges as the fastest-growing regional market, driven by rapid economic development, increasing vehicle adoption, and evolving regulatory environments encouraging insurance participation. Europe represents significant market presence characterized by stringent regulatory standards, consumer protection emphasis, and harmonized frameworks across European Union member states that build consumer trust and market stability.

The global pandemic initially disrupted vehicle insurance markets through altered driving patterns and reduced claim frequencies, necessitating premium adjustments and customer support modifications. However, the industry demonstrated remarkable resilience through accelerated digital transformation, contactless claims processing, and enhanced telematics adoption. Post-pandemic recovery strengthened market fundamentals with normalized driving patterns and increased comprehensive coverage demand.

Global supply chain disruptions affect vehicle manufacturing and repair costs, influencing insurance pricing models, while geopolitical tensions impact international operations and cross-border services. Regulatory harmonization efforts and international agreements continue shaping dynamics, particularly in emerging markets where foreign insurers seek expansion opportunities through strategic partnerships and market entry initiatives.

Key Takeaways

- Market Growth: The Vehicle Insurance Market is expected to reach USD 2053.05 Billion by 2034, Rising consumer awareness about comprehensive vehicle insurance coverage benefits is driving significant market sophistication as vehicle owners increasingly understand the financial protection value provided by robust insurance policies beyond basic mandatory requirements.

- Coverage Type Dominance: Liability insurance leads the coverage segment, driven by mandatory requirements and regulatory compliance.

- Vehicle Type Dominance: The personal vehicle section holds the largest market share and is predicted to advance at a significant CAGR, driven by individual consumer demand and accessibility.

- Vehicle Age Dominance: New vehicle segment is estimated to contribute the highest share, owing to buyers' strong motivation to fully protect their sizeable investments.

- Distribution Channel Dominance: The market is categorized into insurance agents/brokers, direct response, banks and others, with agents/brokers maintaining leadership through personalized service and expertise.

- Drivers: Key drivers accelerating growth include technological integration through telematics and AI, and mandatory insurance regulations, which boost market expansion through enhanced risk assessment and legal compliance requirements.

- Restraints: Growth is hindered by economic uncertainties and rising claim costs, which create challenges such as affordability concerns and margin pressures for insurers.

- Opportunities: The market is poised for expansion due to opportunities like usage-based insurance adoption and emerging market penetration, which enable personalized pricing models and geographic diversification.

- Trends: Emerging trends including GenAI, responsible AI use, omnichannel customer experiences, automation and virtualization are reshaping the market by enhancing operational efficiency and customer engagement.

- Regional Analysis: North America leads owing to mature market infrastructure and regulatory stability. Emerging Regions: Asia-Pacific shows high promise due to rapid vehicle adoption and economic growth

Coverage Type Analysis:

The coverage type segment represents the core foundation of vehicle insurance offerings, with liability insurance maintaining dominant market positioning. This segment encompasses mandatory liability coverage, comprehensive protection, and collision insurance, each serving distinct consumer needs and regulatory requirements. Liability insurance leads due to universal legal mandates across most jurisdictions, creating a stable revenue base for insurers. Comprehensive and collision coverages represent value-added services that appeal to consumers seeking enhanced protection for their vehicle investments, particularly in new vehicle purchases where financing requirements often necessitate full coverage.

Vehicle Type Analysis:

Personal Vehicles Leads With more than 60% Market Share In Vehicle Insurance Market. The vehicle type segmentation distinguishes between personal and commercial vehicle insurance markets, with personal vehicles commanding the largest market share. Personal vehicle insurance benefits from mass market appeal, higher consumer volumes, and standardized risk assessment models that enable efficient underwriting processes. Commercial vehicle insurance, while smaller in volume, offers higher premium values and specialized coverage requirements, particularly for fleet operations and specialized transportation services. The segment dynamics reflect broader automotive industry trends, including the growing popularity of SUVs and electric vehicles, which require adapted coverage solutions.

Vehicle Age Analysis:

Vehicle age segmentation reveals consumer behaviour patterns and risk assessment considerations that significantly influence insurance demand. New vehicles dominate market share due to stronger consumer motivation to protect substantial investments, often driven by financing requirements and comprehensive coverage mandates from lenders. New vehicle insurance typically commands higher premiums reflecting replacement values and comprehensive coverage needs. Used vehicle insurance represents a cost-conscious market segment where consumers often opt for basic liability coverage, though this segment shows potential for growth through affordable comprehensive coverage options and improved risk assessment technologies.

Distribution Channel Analysis:

Distribution channel segmentation highlights the evolving landscape of insurance sales and customer engagement models. Traditional insurance agents and brokers maintain market leadership through personalized service delivery, professional expertise, and established customer relationships that foster trust and retention. Direct response channels gain momentum through cost efficiency and convenience, particularly among tech-savvy consumers seeking streamlined purchase experiences. Digital transformation accelerates the growth of online channels, while bank partnerships provide cross-selling opportunities that leverage existing customer relationships for insurance product distribution.

Regional Analysis:

North America leads with nearly 35% Market Share In Vehicle Insurance Market: North America sustains its commanding position as the global vehicle insurance market leader through a combination of mature regulatory frameworks, extensive vehicle ownership penetration, and sophisticated insurance infrastructure that facilitates comprehensive coverage adoption. The region's dominance stems from advanced telematics integration capabilities, well-established distribution networks spanning agents and digital platforms, and heightened consumer awareness that drives demand for premium insurance products. This comprehensive ecosystem supports both personal and commercial vehicle insurance segments while maintaining competitive pricing and service quality standards.

Asia-Pacific demonstrates exceptional expansion momentum as the fastest-growing regional market, propelled by rapid economic development, increasing vehicle ownership rates, and progressively evolving insurance regulations that mandate coverage while encouraging foreign participation. Key markets including China, India, and Southeast Asian countries contribute substantially to this growth trajectory through expanding middle-class demographics and government initiatives actively promoting insurance adoption. The region offers significant opportunities for international insurers pursuing expansion strategies, though success requires careful adaptation to diverse local regulatory requirements and varied consumer preferences across different cultural contexts.

Europe maintains its position as a mature but stable market distinguished by stringent regulatory standards, comprehensive consumer protection frameworks, and exceptionally high insurance penetration rates that reflect sophisticated risk management awareness. The region increasingly emphasizes sustainable transportation initiatives and electric vehicle adoption trends, creating emerging opportunities for specialized coverage products addressing new technologies and environmental considerations.

Latin America and emerging markets across other regions demonstrate promising growth potential as economic development increases vehicle ownership levels while regulatory reforms enhance insurance market structures and foreign participation opportunities.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

Coverage Type

- Liability Insurance

- Comprehensive Coverage

Vehicle Type

- Personal Vehicles

- Commercial Vehicles

Vehicle Age

- New Vehicles

- Used Vehicles

Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1,004.75 B |

| Forecast Revenue (2034) | USD 2053.05 B |

| CAGR (2025-2034) | 8.26% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Coverage Type (Liability Insurance, Comprehensive Coverage), Vehicle Type (Personal Vehicles, Commercial Vehicles), Vehicle Age (New Vehicles, Used Vehicles), Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | State Farm, Progressive, Berkshire Hathaway (GEICO), Allstate, USAA, Farmers Insurance, The Hartford, American Family Insurance, Cincinnati Financial, Nationwide |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date