Vertical Sea Farming Market Size, Share, Forecast | CAGR of 13.1%

Global Vertical Sea Farming Market Size, Share, Analysis Report By Product Type (Fish Farming, Seaweed Farming, Aquatic Plants), Farming Technique (Aquaponics, Mariculture, Integrated Multi-Trophic Aquaculture (IMTA), Recirculating Aquaculture Systems (RAS)), Technology (Automation & Monitoring, Water Filtration, Feeding, Renewable Energy), End User, Application, Region & Key Players – Segment Overview, Dynamics, Strategies, Trends & Forecast 2025–2034

Report Overview

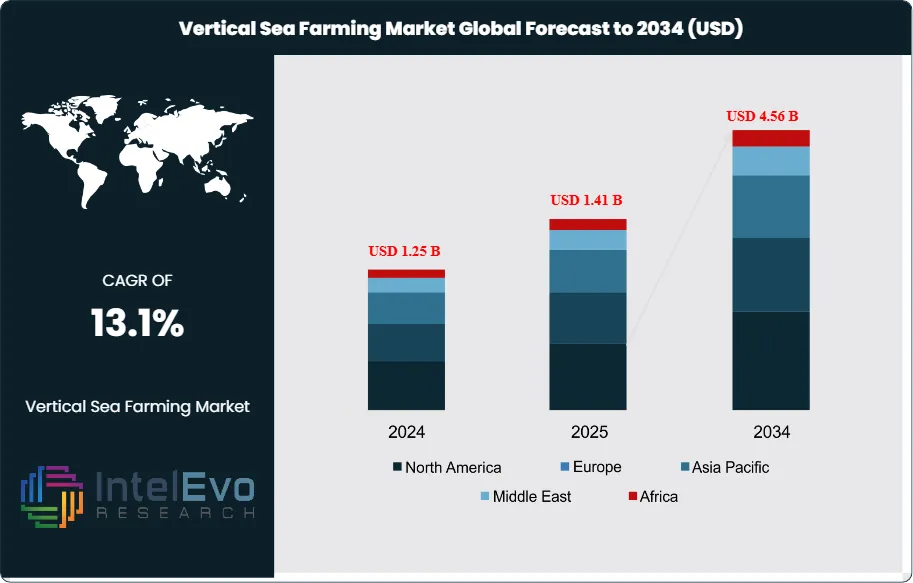

The Vertical Sea Farming Market size is expected to be valued at USD 1.25 billion in 2024 and is projected to reach approximately USD 4.56 billion by 2034, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034. This surge is driven by the rising global demand for sustainable aquaculture, offshore cultivation technologies, and eco-efficient marine food production systems. With increasing focus on reducing land dependency and ensuring food security, vertical sea farming is emerging as a transformative solution in the blue economy, attracting investments from both agri-tech startups and major seafood producers worldwide.

Get More Information about this report -

Request Free Sample ReportThis growth is supported by rising demand for sustainable seafood, technology advances in sea farming infrastructure, and regulatory incentives promoting aquaculture. Regions like Asia-Pacific are likely to show the fastest expansion, while established markets in North America and Europe continue adoption of advanced farming methods.

Vertical sea farming involves the cultivation of aquatic plants and animals using vertically structured farms in oceans and coastal areas. This innovative method maximizes space and productivity, addressing food security and environmental concerns. Market dynamics are shaped by increasing demand for sustainable seafood, advances in aquaculture technology, and growing awareness about oceanic biodiversity conservation. Currently, the market is in its nascent stage, with key players exploring technological integrations to enhance output.

The market’s growth is driven by increasing global population, the demand for sustainable food sources, and declining arable land. Additionally, advancements in automation and renewable energy in vertical sea farming systems are boosting production efficiency. Supportive government policies promoting sustainable aquaculture and environmental concerns about overfishing are further fueling market expansion.

North America and Europe are leading in terms of technological adoption and investments in vertical sea farming. Asia-Pacific, however, is expected to experience the fastest growth due to its vast coastal regions, rising seafood consumption, and favorable government initiatives in countries like China, Japan, and India.

COVID-19 initially disrupted the vertical sea farming supply chain, causing delays in farm development projects and affecting seafood sales. However, the pandemic underscored the importance of sustainable food systems, driving renewed interest in vertical sea farming as a resilient and eco-friendly food source.

Key Takeaways

- Market Growth: The vertical sea farming market is projected to reach USD 4.56 billion by 2034, with a strong CAGR of 13.1%, driven by increasing demand for sustainable aquaculture and advancements in farming technologies.

- Product Type Dominance: Seaweed farming leads the product type segment, accounting for the highest share due to its wide applications in food, cosmetics, and pharmaceuticals, and its low environmental impact compared to fish farming.

- Farming Technique Growth: Recirculating Aquaculture Systems (RAS) dominate the farming technique segment, offering efficient water reuse and waste management, making it highly sustainable and increasingly popular in large-scale vertical sea farming operations.

- Driver: Growing concerns over food security, climate change, and overfishing are driving the need for sustainable alternatives like vertical sea farming. Governments and investors are actively promoting innovative solutions that balance environmental conservation with food production.

- Restraint: High initial investment costs and technological complexity in setting up vertical sea farms remain key restraints. Small-scale operators may struggle with the capital required to adopt advanced farming techniques.

- Opportunity: Expansion into untapped coastal regions and the integration of renewable energy sources into vertical sea farming systems present significant growth opportunities for companies looking to optimize sustainability and reduce operational costs.

- Trend: Automated monitoring systems are increasingly adopted to enhance farming efficiency and reduce human error.

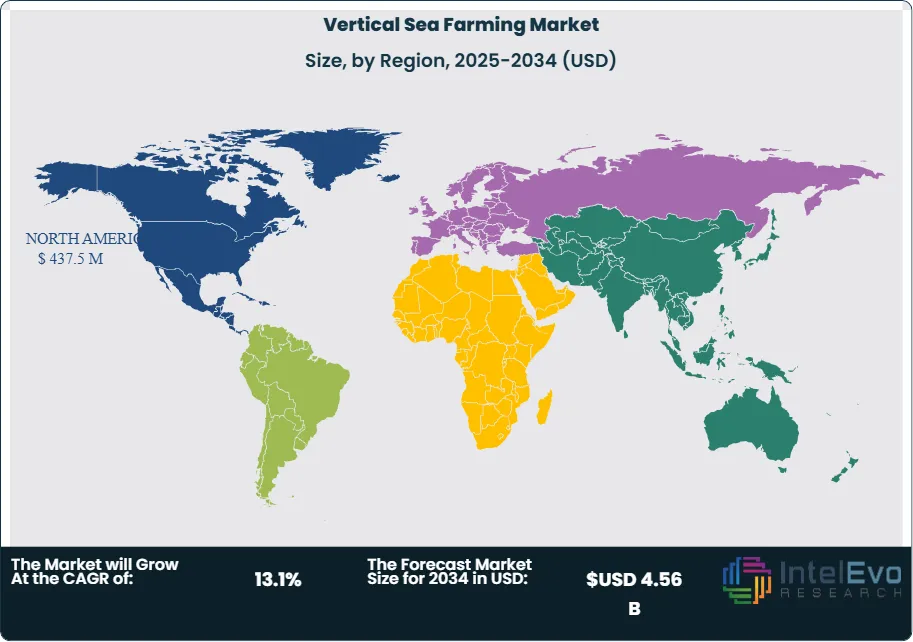

- Regional Analysis: North America leads the market, while Asia-Pacific is the fastest-growing region, driven by rising demand for sustainable seafood and favorable government initiatives.

Product Type:

Vertical sea farming includes fish farming, seaweed farming, and aquatic plants. Fish farming focuses on cultivating finfish, shellfish, and crustaceans, which are essential for human consumption and seafood demand. Seaweed farming is rapidly growing due to its diverse uses in food, pharmaceuticals, and industrial applications. Edible seaweed holds a significant market share, while pharmaceutical and industrial seaweed are also gaining traction. Aquatic plants, including algae and grasses, are integral for ecosystem balance, biofuel production, and bioplastics. Each product type plays a unique role in addressing food security and environmental sustainability, contributing to market expansion.

Farming Technique:

Vertical sea farming employs various techniques, including aquaponics, mariculture, integrated multi-trophic aquaculture (IMTA), and recirculating aquaculture systems (RAS). Aquaponics combines fish farming with hydroponics to create a self-sustaining ecosystem, while mariculture focuses on ocean-based farming. IMTA utilizes multiple species within a farm, optimizing nutrient cycles and ecosystem sustainability. RAS technology involves closed-loop systems for water recycling, minimizing environmental impact and enhancing productivity. Each technique offers unique advantages depending on the region, species cultivated, and production scale, driving innovation and scalability within the vertical sea farming market.

Application:

The applications of vertical sea farming span food and beverages, nutraceuticals, pharmaceuticals, cosmetics, and industrial products. In the food sector, the demand for sustainable seafood is growing, with fish, seaweed, and aquatic plants being essential ingredients. Nutraceuticals benefit from the high nutritional value of seaweed and algae, while pharmaceutical applications focus on bioactive compounds derived from marine species for health treatments. Cosmetics use seaweed extracts for skincare products, while industrial applications involve biofuels and bioplastics. These varied applications ensure vertical sea farming’s relevance across multiple industries, boosting market diversification and growth potential.

Technology:

Technological advancements are key drivers in vertical sea farming. Automation and monitoring systems allow farmers to optimize production efficiency by tracking water quality, feed, and growth rates. Water filtration systems play a crucial role in maintaining the health of aquatic species, ensuring sustainable farming practices. Feeding systems reduce labor costs and maximize food utilization, while renewable energy integration, such as solar and wind power, reduces operational costs and minimizes the environmental footprint. The use of advanced technology enables higher yields, cost efficiency, and sustainability, positioning technology as a crucial pillar in market development.

End User:

Vertical sea farming caters to various end users, including commercial farming operations, research institutes, government organizations, NGOs, and private farmers. Commercial farming operations are key players in the market, scaling production to meet rising seafood and plant-based product demand. Research institutes focus on innovations in aquaculture practices and sustainability. Government and NGOs invest in sea farming initiatives to address food security and environmental concerns. Private farmers, though smaller in scale, contribute to localized production and innovation. Each end user group plays a vital role in driving market growth and fostering sustainable aquaculture practices globally.

Region Analysis:

North America Dominates Vertical Sea Farming Market with 35% Share, Driven by Technological Advancements and Sustainability Initiatives. North America currently holds the highest market share in the vertical sea farming market, driven by advanced aquaculture technologies and a strong emphasis on sustainability. The United States and Canada are leading innovators, investing in research and development to optimize farming techniques. The region's affluent consumer base shows increasing demand for sustainably sourced seafood, encouraging investment in vertical farming systems. Government support for eco-friendly practices and grants for sustainable farming technologies contribute to the market's growth. Meanwhile, Europe also boasts a significant share, with countries like Norway and the Netherlands focusing on marine aquaculture, enhancing production capacities and regulatory frameworks.

Asia-Pacific is emerging as the fastest-growing region in the vertical sea farming market, fueled by increasing seafood consumption and population growth. Countries like China, Japan, and India are leveraging their vast coastal areas and traditional aquaculture practices to enhance productivity through vertical farming techniques. The rising demand for sustainable food sources and government initiatives promoting aquaculture development are significant growth drivers. In Latin America, markets are gradually evolving, with Brazil exploring marine farming to diversify its agricultural sector. The Middle East and Africa, while currently smaller in market share, are witnessing growing interest in aquaculture driven by food security concerns, particularly in nations like Egypt and South Africa, setting the stage for future expansion.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Product Type

- Fish Farming

- Finfish

- Shellfish

- Crustaceans

- Seaweed Farming

- Edible Seaweed

- Industrial Seaweed

- Pharmaceutical Seaweed

- Aquatic Plants

- Algae

- Aquatic Grasses

By Farming Technique

- Aquaponics

- Mariculture

- Integrated Multi-Trophic Aquaculture (IMTA)

- Recirculating Aquaculture Systems (RAS)

By Technology

- Automation and Monitoring Systems

- Water Filtration Systems

- Feeding Systems

- Renewable Energy Integration

By End User

- Commercial Aquaculture Operators

- Research & Development Institutes

- Government & NGOs

- Private Farmers

- Others

By Application

- Food Production

- Biofuels & Bioproducts

- Nutraceuticals & Pharmaceuticals

- Others

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1.41 B |

| Forecast Revenue (2034) | USD 4.56 B |

| CAGR (2025-2034) | 13.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Fish Farming, Seaweed Farming, Aquatic Plants), By Farming Technique (Aquaponics, Mariculture, Integrated Multi-Trophic Aquaculture (IMTA), Recirculating Aquaculture Systems (RAS)), By Technology (Automation and Monitoring Systems, Water Filtration Systems, Feeding Systems, Renewable Energy Integration), By End User (Commercial Aquaculture Operators, Research & Development Institutes, Government & NGOs, Private Farmers, Others), By Application (Food Production, Biofuels & Bioproducts, Nutraceuticals & Pharmaceuticals, Others) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Aquabyte, Cargill, Grieg Seafood ASA, Cermaq Group AS, Mowi ASA, AquaBounty Technologies, Aker BioMarine, SalMar ASA, Cooke Aquaculture Inc, Thai Union Group PCL, Ocean Harvest Technology, Kvarøy Arctic, Norwegian Royal Salmon ASA, Hofseth BioCare ASA, BioMar Group, Blue Ocean Mariculture, Kagome Co, Calyst, Tassal Group Ltd., Leroy Seafood Group ASA |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date