Video Commerce Market Size, Trends & Forecast 2034 | 31.2% CAGR

Global Video Commerce Market Size, Share, Analysis Report Type(Live Streaming, Interactive Videos, Shoppable Content), Platform (Brand Websites, Social Media Platforms, E-Commerce Platforms), End-User (Food and Beverage, Fashion and Apparel, Beauty and Personal Care, Home and Furniture, Electronics and Gadgets, Others(Automotive, Healthcare,etc.)), Region and Key Players - Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends and Forecast 2025-2034

Report Overview:

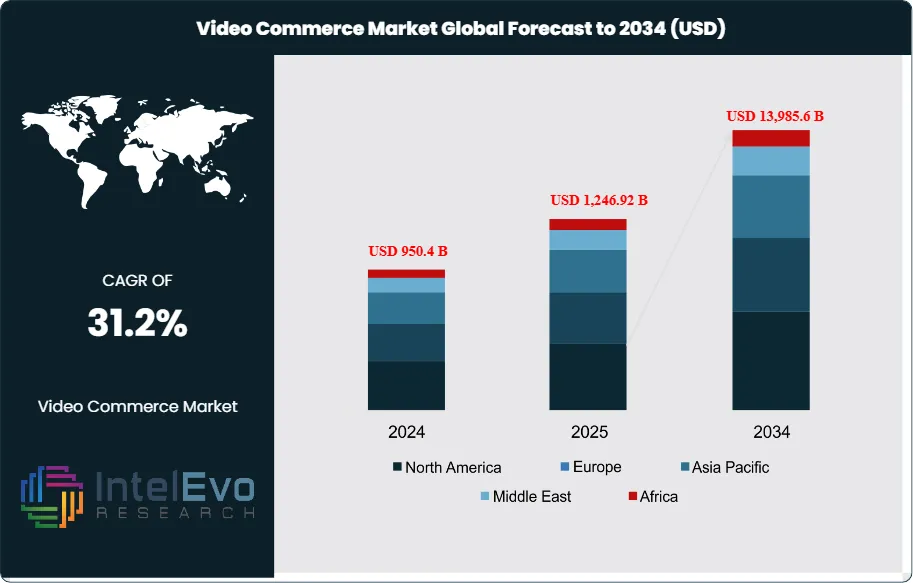

The Video Commerce Market size is projected to reach approximately USD 13,985.6 Billion by 2034, up from USD 950.4 Billion in 2024, growing at a CAGR of 31.2% during the forecast period from 2025 to 2034. The explosive growth of video-driven shopping experiences is transforming global retail as consumers increasingly prefer interactive, shoppable live streams and personalized video marketing. Social media platforms, e-commerce giants, and brands are leveraging AI-powered product recommendations, influencer collaborations, and immersive AR/VR integrations to enhance engagement and conversion rates. As entertainment and retail continue to merge, video commerce is redefining digital shopping behavior — creating new opportunities for real-time interaction, storytelling, and high-impact brand experiences worldwide.

Get More Information about this report -

Request Free Sample ReportVideo commerce represents a revolutionary convergence of digital entertainment and retail technology, fundamentally transforming how consumers discover, evaluate, and purchase products online. This dynamic market encompasses live streaming commerce, interactive video experiences, and shoppable content that seamlessly integrates multimedia presentations with immediate purchasing capabilities. The market's expansion is driven by several critical factors including increased mobile device penetration, enhanced internet infrastructure, evolving consumer preferences toward visual and interactive shopping experiences, and the growing influence of social media platforms as primary discovery channels. Additionally, the integration of artificial intelligence and machine learning technologies has enabled more personalized and targeted video commerce experiences, while advanced analytics provide retailers with unprecedented insights into consumer behavior and engagement patterns.

The video commerce ecosystem continues to evolve rapidly, influenced by technological advancements in augmented reality, virtual reality, and real-time streaming capabilities that create immersive shopping environments. Market growth is further accelerated by the democratization of content creation tools, allowing brands of all sizes to produce professional-quality video content, and the increasing comfort level of consumers with digital payment systems and mobile transactions. The post-pandemic shift toward digital-first shopping behaviors has created a permanent change in consumer expectations, with buyers now demanding more engaging, informative, and interactive online shopping experiences that video commerce uniquely provides through its combination of entertainment value and practical product demonstration.

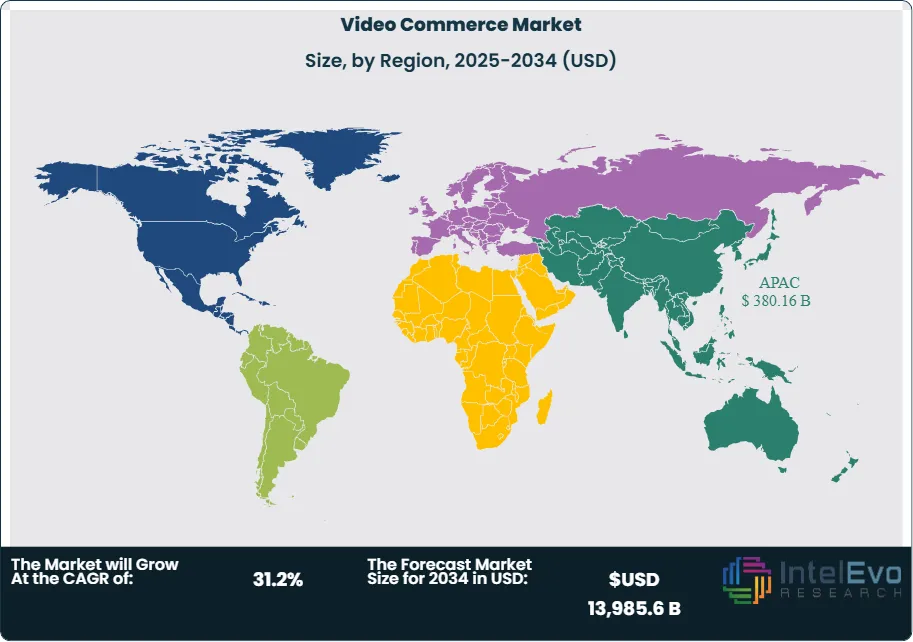

The Asia Pacific region dominates the global video commerce market, accounting for the largest market share due to its advanced mobile commerce infrastructure, high smartphone adoption rates, and cultural acceptance of live streaming as a primary form of entertainment and shopping. Countries like China, South Korea, and Japan have pioneered many video commerce innovations, with platforms like Taobao Live and Douyin establishing the foundational models that are now being adopted globally. The region benefits from supportive regulatory frameworks, robust digital payment systems, and a consumer base that readily embraces new shopping technologies.

The COVID-19 pandemic served as a significant catalyst for video commerce market expansion, accelerating adoption rates by approximately 3-5 years as traditional retail channels faced unprecedented disruptions. Lockdowns and social distancing measures forced both consumers and retailers to rapidly embrace digital alternatives, with video commerce emerging as a crucial bridge between physical and online shopping experiences. The pandemic highlighted the importance of human connection in commerce, making live streaming and interactive video formats particularly appealing as they provided social interaction and real-time engagement that traditional e-commerce lacked, resulting in sustained growth momentum that continues post-pandemic.

Key Takeaways:

- Market Growth: The Video Commerce Market is expected to reach USD 13,985.6 Billion by 2034, as brands and platforms recognize the compelling ROI of video-driven engagement. The confluence of social media adoption, influencer marketing, and technological innovation is creating sustained growth momentum across regions and sectors.

- Type Dominance: Live streaming dominates the video commerce market due to its ability to deliver real-time interaction, urgency, and authenticity. Consumers are highly responsive to live demonstrations, Q&A sessions, and limited-time offers, making this format the most powerful sales driver.

- Platform Dominance: Social media platforms are the primary channel for video commerce, enabling brands to tap into vast audiences where consumers already spend their time. Platforms like TikTok, Instagram, and Facebook blend entertainment and shopping, driving higher conversion rates.

- End-User Industry Dominance: Fashion and apparel lead end-user adoption as visual storytelling and real-time try-ons significantly impact buying decisions. Influencers and brands frequently leverage live and shoppable videos to showcase products and drive impulse purchases.

- Driver: The surge in smartphone penetration and high-speed connectivity has made video streaming accessible to billions, fueling rapid adoption. Simultaneously, the rise of influencer marketing has created new ways to build trust and drive sales through authentic video content.

- Restraint: Data privacy concerns and complex logistics integration present barriers to seamless video commerce execution. Regulatory scrutiny and consumer hesitation about sharing personal data further complicate the environment.

- Opportunity: The emergence of AI-powered personalization and AR/VR integration offers significant opportunities to enhance customer engagement and boost conversion rates. Cross-border live commerce is also expanding, unlocking access to international markets.

- Trend: Short-form shoppable videos and micro-influencer live streaming are redefining how brands connect with consumers. Gamification elements and limited-time promotions embedded in video experiences are increasing retention and purchase likelihood.

- Regional Analysis: Asia Pacific remains the dominant region, driven by China’s mature live commerce infrastructure and cultural affinity for video shopping. North America and Europe are evolving rapidly as brands scale omnichannel strategies. Latin America and the Middle East are emerging as promising markets with rising mobile commerce adoption.

Type Analysis:

Live streaming has emerged as the cornerstone of the video commerce market, accounting for the largest share among video formats. This dominance is rooted in its ability to create real-time connections between sellers and buyers. Live streaming enables brands and influencers to demonstrate products, answer audience questions instantly, and build urgency through time-sensitive offers and scarcity tactics. Viewers are more likely to trust live content over pre-recorded videos because it feels transparent and spontaneous. As a result, conversion rates for live shopping events often exceed traditional e-commerce by a significant margin.

In Asia Pacific, particularly China, platforms like Taobao Live pioneered live commerce, setting new standards for engagement and revenue generation. Influencers and Key Opinion Leaders (KOLs) have become integral to live commerce success, blending entertainment with shopping in a seamless experience. Western markets are catching up, with Amazon Live, Facebook Live Shopping, and Instagram Live Shopping driving increasing adoption. The format is especially popular in fashion and beauty categories where visual detail and demonstration are critical to purchase confidence.

Platform Analysis:

Social Media Platforms Leads With over 45% Market Share In Video Commerce Market. Social media platforms have become the dominant channels for video commerce distribution. Their massive user bases, sophisticated targeting capabilities, and content consumption habits make them ideal environments for shoppable video integration. Consumers already engage with influencers, discover trends, and interact with branded content on social media, reducing friction in the path to purchase. TikTok, Instagram, Facebook, and YouTube have each developed native shopping features, enabling seamless transactions directly within their ecosystems.

The strength of social media platforms lies in their blended approach—combining entertainment, community, and commerce. Features like live shopping tabs, product tagging, and one-click checkout make it easy for brands to turn engagement into revenue. For small businesses and independent creators, social platforms provide a low-barrier entry point to reach audiences without extensive technical infrastructure. As consumers spend increasing time on social media, this segment is expected to see continued investment and innovation.

End-User Industry Analysis:

Fashion and apparel have emerged as the leading end-user industry in video commerce, driven by the inherently visual nature of clothing and accessories. Shoppers are drawn to seeing how garments fit and move in real time, making live and shoppable videos highly persuasive. Influencers and stylists frequently host live sessions showcasing collections, sharing styling tips, and answering questions to build rapport and drive conversion.

For brands, video commerce offers an opportunity to reduce return rates by setting realistic expectations around sizing, color, and fit. It also creates a sense of urgency and exclusivity through time-limited product drops and behind-the-scenes content. The combination of visual storytelling and influencer credibility has made fashion one of the most lucrative categories for video commerce adoption globally.

Region Analysis:

Asia Pacific Leads With nearly 40% Market Share In Video Commerce Market. Asia Pacific leads the global video commerce market, commanding the largest market share due to its advanced mobile commerce infrastructure, high smartphone adoption rates, and cultural acceptance of live streaming as both entertainment and shopping medium. China dominates this regional leadership through platforms like Taobao Live and Douyin, which have established the foundational models for video commerce that are now being replicated globally. The region benefits from supportive regulatory frameworks, robust digital payment systems, and a consumer base that readily embraces new shopping technologies. Countries like South Korea and Japan contribute significantly through their innovative approach to integrating technology with retail experiences.

North America represents the second-largest market, driven by significant investments from major technology companies and established e-commerce platforms. The region shows rapid growth as consumer behavior shifts toward more interactive and engaging shopping experiences, accelerated by pandemic-driven digital adoption. Europe follows closely, with strong growth in markets like the United Kingdom, Germany, and France, where retailers are increasingly recognizing video commerce's potential to differentiate their offerings and improve customer engagement.

The live streaming segment is expected to see the most significant growth in emerging markets across Latin America, Africa, and Southeast Asia, where mobile-first internet adoption creates ideal conditions for video commerce expansion. These regions benefit from leapfrogging traditional e-commerce infrastructure and adopting video commerce as a primary digital shopping format, supported by improving internet connectivity and increasing smartphone penetration rates.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

By Type

- Live Streaming

- Interactive Videos

- Shoppable Content

By Component

- Platform

- Software

- Services

By Device Type

- Smartphones and Tablets

- Laptops and Desktops

- Smart TVs

- Others (Wearables, AR Glasses)

By Business Model

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Consumer-to-Consumer (C2C)

By Platform Type

- Social Media Platforms (Instagram, TikTok, YouTube)

- E-commerce Marketplaces

- Brand-Owned Websites and Apps

- OTT Platforms

By End User

- Fashion & Apparel

- Beauty & Cosmetics

- Electronics & Gadgets

- Home Décor & Furniture

- Food & Beverage

- Others (Luxury, Sports, Automotive)

By Region:

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 1,246.92 B |

| Forecast Revenue (2034) | USD 13,985.6 B |

| CAGR (2025-2034) | 31.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Live Streaming, Interactive Videos, Shoppable Content), By Component (Platform, Software, Services), By Device Type (Smartphones and Tablets, Laptops and Desktops, Smart TVs, Others (Wearables, AR Glasses)), By Business Model (Business-to-Consumer (B2C), Business-to-Business (B2B), Consumer-to-Consumer (C2C)), By Platform Type (Social Media Platforms (Instagram, TikTok, YouTube), E-commerce Marketplaces, Brand-Owned Websites and Apps, OTT Platforms), By End User (Fashion & Apparel, Beauty & Cosmetics, Electronics & Gadgets, Home Décor & Furniture, Food & Beverage, Others (Luxury, Sports, Automotive)) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | TalkShopLive, Alibaba Group, LiveScale, Shopify Inc., ShopShops, Amazon.com, Inc., BuyWith, YouTube, Wayfair Inc., LiSA, Meta, TikTok, Firework, Bambuser, Channelize.io |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date