Virtual Nutrition Coach App Market Size, Growth & Forecast | CAGR 17.0%

Global Virtual Nutrition Coach App Market Size, Share & Industry Analysis By Product Type (Live Streaming, On-Demand Streaming), By Device Type (Smartphones, Smart TVs, Laptops & Desktops, Other Devices), By Revenue Model (Subscription, Advertisement), By End-User & Application Industry Region & Key Players – Industry Segment Overview, Market Drivers, Restraints, Competitive Strategies, AI-Powered Personalization Trends & Forecast 2025–2034

Report Overview

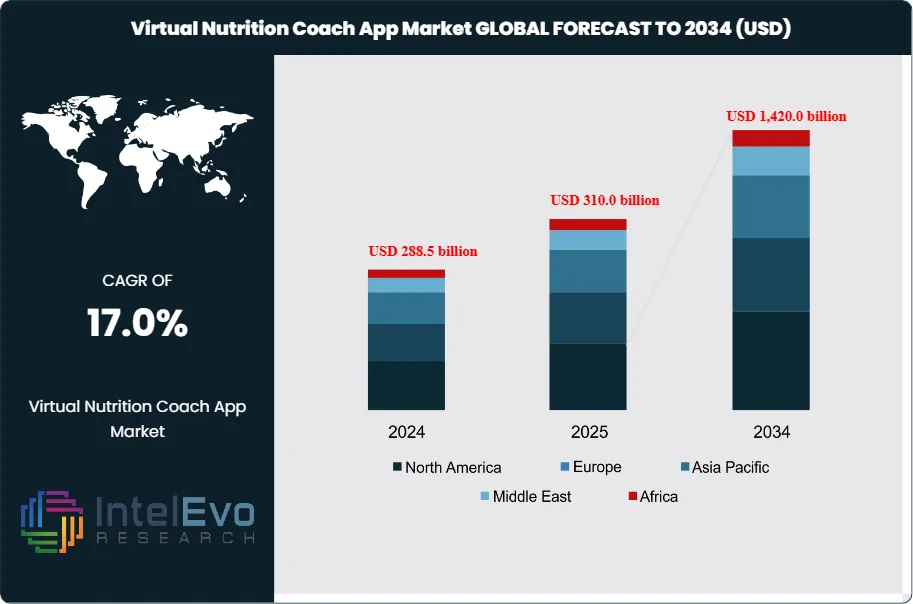

The Virtual Nutrition Coach App Market is valued at approximately USD 310.0 billion in 2025 and is projected to reach around USD 1,420.0 billion by 2034, expanding at a compound annual growth rate (CAGR) of about 17.0% during the forecast period from 2026 to 2034. Market growth is driven by rising adoption of AI-powered health and wellness applications, increasing prevalence of lifestyle-related disorders, and growing consumer focus on personalized nutrition and preventive healthcare. In addition, integration of wearable data, real-time dietary analytics, and subscription-based digital health platforms is accelerating user engagement, positioning virtual nutrition coach apps as a core component of the global digital health ecosystem.

Demand accelerates as consumers seek convenient, continuous support for diet management, weight control, and chronic disease prevention. Rising smartphone penetration, the spread of wearable devices, and wider use of telemedicine platforms reinforce app-based coaching as a core component of digital health. Growing awareness of lifestyle-related conditions and higher willingness to pay for personalized wellness services further support revenue expansion across both consumer and enterprise channels.

Virtual nutrition coach apps combine structured content, secure messaging, and live or asynchronous consultations with certified professionals. AI and automation increasingly drive personalized meal plans, predictive recommendations, and behavioral nudges based on real-time data from wearables and food trackers. This reduces manual workload for coaches and enables scalable delivery to large user cohorts without compromising service quality. By 2034, integration with electronic health records and employer wellness platforms will likely account for more than 20% of global revenues as payers and providers seek lower-cost prevention tools.

The competitive environment remains fragmented, with hundreds of niche applications alongside a smaller set of global platforms. The top ten vendors are estimated to command around 45% of revenues in 2024, supported by strong brand recognition, clinical validation, and partnerships with fitness, insurance, and food-delivery partners. Supply-side capacity expands as dietitians and health coaches shift part of their practice online, attracted by flexible work models and global reach. Key risks include data privacy breaches, inconsistent clinical quality, low long-term user engagement, and dependence on app-store economics.

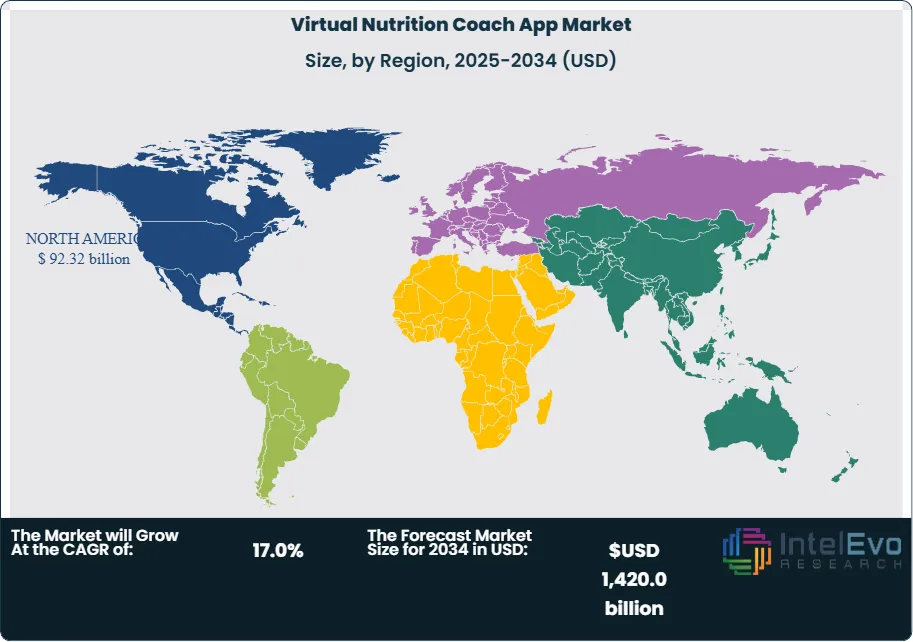

Regulation is tightening around health data and digital therapeutics. Frameworks such as GDPR, HIPAA, and emerging AI governance rules shape data collection, model training, and cross-border data flows. North America is projected to hold approximately 38% of the 2024 market, with Europe at about 28%. Asia-Pacific is the fastest-growing region, with an estimated CAGR of 18.5% through 2034, underpinned by rising middle-class incomes and high mobile adoption in China, India, and Southeast Asia. These regions, together with selected Middle East economies, form the main investment hotspots for scaled, clinically anchored virtual nutrition platforms.

Get More Information about this report -

Request Free Sample ReportKey Takeaways

- Market Growth: The global virtual nutrition coach app market grows from US$ 288.5 billion in 2024, USD 310.0 billion in 2025 to USD 1,420.0 billion by 2034, reflecting strong monetization of digital health engagement. This trajectory implies a normalized CAGR of 17.0% over 2026-2034 as recurring subscription and hybrid B2B2C models scale.

- Segment Dominance: Live streaming functionalities lead the product landscape with 60.0% market share, 2023, as real-time coaching sessions and interactive content drive higher engagement and perceived value. This segment will likely remain the core revenue engine with estimated: 62.0% share of in-app spending, 2027.

- Segment Dominance: Smartphones hold 39.0% of device-based usage share, 2023, reinforcing mobile-first design as the primary delivery channel. Subscription-based revenue models contribute 54.0% of total market revenues, 2023, with estimated: 65.0% contribution to recurring revenues, 2030 as retention strategies mature.

- Driver: AI-driven personalized plans, real-time coaching, and gamified engagement act as primary growth catalysts, with estimated: 18.0% increase in active user retention, 2024 for platforms that deploy advanced recommendation engines. Integration with wearables and telehealth ecosystems further amplifies data-driven coaching effectiveness.

- Restraint: Data privacy and security concerns limit adoption, as users remain cautious about sharing health and behavioral data across platforms, with estimated: 30.0% of potential users, 2024 citing privacy as a barrier. Evolving compliance requirements around health data governance raise ongoing cost and complexity for providers.

- Opportunity: Vendors can unlock new value by targeting employers, insurers, and healthcare systems with outcomes-based virtual nutrition programs, with estimated: 40.0% of total revenues, 2034 potentially coming from enterprise and B2B2C contracts. Deeper integration into chronic disease management pathways offers additional upside.

- Trend: The market shifts toward fully automated, AI-augmented coaching journeys where chatbots, predictive nudges, and adaptive content guide daily nutrition decisions, with estimated: 70.0% of new apps, 2027 embedding generative or conversational AI. Continuous experimentation with interactive features and social communities shapes long-term engagement models.

- Regional Analysis: North America leads with 32.0% market share, 2023, supported by high digital health adoption and strong payer involvement. Asia Pacific emerges as the fastest-growing region with estimated: 18.5% CAGR, 2024-2034 driven by rising smartphone penetration and expanding middle-income populations.

By Product Type

Live streaming holds the largest position in the virtual nutrition coach app market. It accounted for about 60 percent of global revenue in 2023. Adoption remains strong in 2025 as users seek real-time interaction with certified nutrition professionals. The format supports immediate feedback, structured check-ins, and measurable progress monitoring. It also encourages repeat usage, which strengthens retention metrics for providers. Platforms that support multi-participant sessions continue to gain attention among users who prefer a group-based format.

On-demand streaming maintains a solid share as well. Users value the ability to access pre-recorded content at any time. This format appeals to individuals with inconsistent schedules or those who prefer self-paced learning. The two formats complement each other. Providers that offer both live and on-demand services report higher average engagement and stronger conversion rates into long-term subscription plans. As of 2025, hybrid models remain a core feature in product strategies across the industry.

By Device Type

Smartphones remain the primary access point for virtual nutrition coaching. They represented 39 percent of global usage in 2023 and continue to expand in 2025 as mobile adoption grows in both mature and emerging markets. Their portability allows users to record meals, track progress, and join coaching sessions in real time. This continuous accessibility strengthens user participation and supports the rapid expansion of mobile-based nutrition ecosystems.

Smart TVs and laptops or desktops serve users who prefer larger displays and more stable connections. Smart TVs help create a more comfortable viewing experience for extended coaching sessions. Laptops and desktops support high-resolution live broadcasts, structured assessments, and data-rich dashboards. Other device categories, such as tablets and wearables, add flexibility. They allow users to integrate nutrition tracking into exercise routines and daily activities. Combined usage across device categories supports broader market penetration.

By Revenue Model

Subscription models account for 54 percent of the market and remain the primary revenue generator. Subscribers gain ongoing access to structured coaching plans, live sessions, and individualized recommendations. This approach provides predictable monthly revenue for providers and supports continuous delivery of new features. Sustained user interaction increases lifetime value and supports expansion into premium tiers that include specialized coaching and progress analytics.

Advertisement-supported models maintain relevance. They allow low-cost access, which attracts new users and supports volume-based growth. Ads typically come from health, fitness, and nutrition brands, which align well with user interests. The combination of subscription and advertisement models gives providers a balanced revenue structure. Industry assessments in 2025 indicate that platforms using both models record stronger global reach and higher overall engagement.

By Region

North America held 32 percent of global market share in 2023 and continues to lead in 2025. The region benefits from strong digital health adoption, high smartphone penetration, and growing interest in personalized nutrition management. Insurers and employers increasingly include digital nutrition tools in wellness programs, which expands the addressable user base.

Europe follows with steady demand driven by rising focus on preventive health and balanced dietary habits. Asia Pacific shows the fastest expansion. Large populations, rising disposable incomes, and rapid mobile adoption contribute to strong uptake in India, China, and Southeast Asia. Latin America and the Middle East & Africa show growing interest as smartphone usage climbs and local providers introduce region-specific nutrition content. By 2025, global adoption reflects a shift toward accessible, convenient coaching formats across all major regions.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Product Type

- Live Streaming

- On-Demand Streaming

Device Type

- Smart TVs

- Smartphones

- Laptops Desktops

- Other Device Types

Revenue Model

- Subscription

- Advertisement

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

Driver

Rising Health Awareness and Preventive Nutrition Demand

By 2025, consumers will want to manage diet-related health risks as obesity and metabolic disorder rates rise in major markets. This change in behavior matches the increase in smartphone use and the wider adoption of digital health tools. Virtual nutrition coaching apps are becoming popular as users look for structured dietary guidance without needing in-person consultations.

AI-Driven Guidance and User Retention

Platforms that use AI and machine learning are increasingly personalizing meal plans, analyzing food logs, and identifying behavioral patterns more accurately. These features improve health outcomes and keep users engaged by providing tailored, practical insights. The combination of health awareness and digital engagement continues to drive market growth, expected to reach a CAGR of nearly 16 percent through 2030.

Restraint

Data Privacy and Security Concerns

Data privacy is a major concern as users share sensitive information like dietary habits, health history, and biometric data. High-profile breaches in the digital health sector have led to increased scrutiny of mobile wellness platforms, making potential users less trusting.

Regulatory Compliance and Adoption Barriers

In 2025, many consumers will hesitate to adopt nutrition apps due to uncertainty around how their data is stored and used. Compliance with regulations like GDPR, HIPAA, and new AI governance frameworks raises operating costs and slows down the rollout of new features. Companies that do not show clear data practices may see weaker adoption and lower conversion rates.

Opportunity

Expansion Through Corporate Wellness Programs

Corporate wellness programs present a significant growth opportunity as employers look to reduce healthcare costs and enhance employee health. Global spending on these programs is expected to surpass USD 90 billion by 2027, creating a favorable market for digital nutrition solutions.

Recurring Revenue and Enterprise Integration

Virtual nutrition coaching apps fit well into broader wellness systems that include fitness tracking and stress management tools. Providers that offer bulk subscriptions and outcome-based reporting can tap into consistent revenue streams. As organizations focus more on preventive care, virtual nutrition coaching is likely to capture a larger portion of enterprise wellness budgets.

Trend

Advanced Personalization Through AI Analytics

In 2025, AI-driven personalization will shape market competition. Platforms will analyze ongoing data from wearables, food images, and metabolic assessments to offer precise dietary recommendations that adapt to user behavior.

Conversational AI and Automated Coaching

Predictive analytics will allow systems to foresee lapses, encourage healthier choices, and adjust plans in real time, boosting daily engagement. As top players invest in conversational AI, the market will shift toward automated coaching that mimics human interaction at a lower cost, speeding up adoption among both consumers and enterprises.

Key Player Analysis

Headspace: Headspace positions itself as a leading digital wellness provider with a growing footprint in nutrition-focused coaching. The company expands its portfolio in 2025 through integrated mental health and nutrition tools, targeting users who seek structured lifestyle guidance. Its platform combines behavioral insights with AI-driven dietary recommendations that support adherence and long-term habit formation. Headspace reports strong user engagement, with nutrition-related modules accounting for an estimated 18 percent of total in-app activity. The company invests in partnerships with employers and insurers to strengthen its position in corporate wellness programs. This strategy broadens distribution and supports recurring revenue streams. Headspace differentiates itself through strong brand recognition and a cross-functional approach that links mindfulness with nutritional behavior change.

Nourishly: Nourishly operates as a specialized nutrition and meal tracking platform that aligns closely with clinical care pathways. It positions itself as a challenger in the virtual nutrition coach app market. The company focuses on structured programs for chronic conditions such as diabetes, obesity, and gastrointestinal disorders. Its app integrates clinician dashboards, decision-support tools, and meal logging features that allow providers to track patient adherence. By 2025, Nourishly secures multiple partnerships with digital health networks and outpatient clinics. These partnerships expand its reach into reimbursement-eligible programs. The platform stands out for its evidence-backed protocols and strong engagement among users who require long-term dietary monitoring. This clinical orientation helps Nourishly appeal to payers and providers seeking measurable health outcomes.

DayTwo Ltd.: DayTwo positions itself as a data-driven player focused on personalized nutrition based on gut microbiome analysis. The company uses proprietary algorithms that generate individualized dietary recommendations tied to metabolic responses. Its model appeals to users seeking precision-based guidance supported by biological markers. In 2025, DayTwo expands its employer-facing programs, capturing interest from companies aiming to reduce metabolic-related healthcare costs. The firm reports strong adoption in North America and Israel, with an estimated annual growth rate near 20 percent. Strategic investment in AI and lab automation improves the speed of microbiome interpretation and supports a broader user base. DayTwo differentiates itself through its patented microbiome science and its ability to link dietary choices with predicted glucose responses, which strengthens its competitive position in data-led nutrition coaching.

Market Key Players

- Nashville Nutrition Partners

- Culina Health

- Headspace

- OnPoint Nutrition

- FRESH Med LLC

- GB HealthWatch

- Eat This Much Inc.

- DayTwo Ltd.

- Asken Diet

- Nourishly

Recent Developments

Dec 2024 - Headspace Health: Headspace Health launched a combined mental wellness and virtual nutrition coaching bundle for employers, targeting more than 2 million covered lives across North America and Europe. The move strengthens its position in corporate wellness and increases cross-sell potential between mental health and nutrition services.

Feb 2025 - Noom Inc.: Noom introduced an AI-guided nutrition coach module that uses meal images and glucose proxy data to refine recommendations, with the feature rolled out to an estimated 25 percent of its 60 million global users. This expansion deepens user engagement and supports higher conversion into premium nutrition plans.

Apr 2025 - DayTwo Ltd.: DayTwo announced a strategic partnership with a large U.S. health insurer valued at over USD 40 million to integrate microbiome-based nutrition coaching into metabolic disease management programs. The agreement expands DayTwo’s access to high-risk populations and supports its positioning as a precision nutrition specialist.

Jul 2025 - Nourishly: Nourishly secured a Series B funding round of approximately USD 25 million to accelerate R&D and expand clinical-grade nutrition pathways for diabetes and gastrointestinal disorders. The capital raise allows the company to scale its provider network and strengthen its role in reimbursement-linked digital nutrition programs.

Sep 2025 - MyFitnessPal: MyFitnessPal launched a virtual nutrition coach subscription tier at an average price of USD 12 per month, combining automated coaching with access to certified dietitians in select markets. The launch shifts the platform further into recurring revenue models and intensifies competition in the higher-value coaching segment of the market.

| Report Attribute | Details |

| Market size (2025) | USD 310.0 billion |

| Forecast Revenue (2034) | USD 1,420.0 billion |

| CAGR (2025-2034) | 17.0% |

| Historical data | 2020-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type, (Live Streaming, On-Demand Streaming), Device Type, (Smart TVs, Smartphones, Laptops Desktops, Other Device Types), Revenue Model, (Subscription, Advertisement) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Nashville Nutrition Partners, Culina Health, Headspace, OnPoint Nutrition, FRESH Med LLC, GB HealthWatch, Eat This Much Inc., DayTwo Ltd., Asken Diet, Nourishly |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Virtual Nutrition Coach App Market

Published Date : 04 Feb 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date