Vision Care Market Size, Share, Trends & Forecast | 8.04% CAGR

Global Vision Care Market Size, Share, Analysis Report By Product (Eyewear, Intraocular Lenses, Ocular Health Products), Treatment (Laser Therapy, Surgery, Medication), Indication (Glaucoma, Refractive Error, Diabetic Retinopathy, Dry Eyes, Amblyopia, Other Indications), Distribution Channel (Retail Stores, Online Stores, Hospitals & Clinics) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

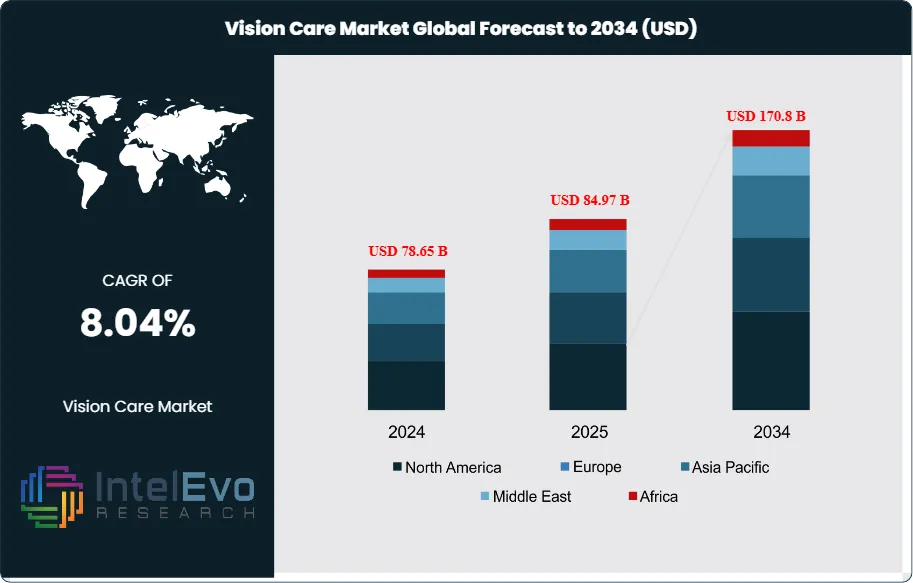

The Vision Care Market size is experiencing robust expansion. It was estimated at USD 78.65 Billion in 2024 and is forecasted to reach approximately USD 170.8 Billion by 2034. This impressive growth trajectory is underpinned by a Compound Annual Growth Rate (CAGR) of 8.04% during the forecast period from 2025 to 2034. This consistent growth rate reflects the sustained demand driven by an aging global population, increasing awareness of eye health, and continuous innovation in vision correction and treatment technologies.

Get More Information about this report -

Request Free Sample ReportThe global vision care industry plays a critical role in public health by addressing the essential need for sight. This market research report offers a detailed overview of the sector, covering current valuation, growth projections, key drivers, challenges, trends, and competitive dynamics. Vision care spans a wide array of products and services, from corrective eyewear and pharmaceuticals to surgical procedures and preventive care, all designed to maintain and enhance visual health.

A defining feature of the market is its fragmentation, with multinational corporations and regional players competing to serve varied consumer needs. This diversity fuels innovation and provides consumers with a broad range of options at different price points and technological levels. Spectacles have evolved beyond corrective use to become popular fashion items, significantly boosting market growth. Simultaneously, the rising global incidence of eye diseases, such as myopia, signals growing demand for vision solutions. Increased awareness about the harmful effects of UVA and UVB rays has also driven the adoption of sunglasses as essential protective gear. These factors combine to shape a dynamic, fast-evolving vision care landscape.

Key Takeaways

- Market Growth: The Vision Care Market is projected to reach USD 170.8 Billion by 2034 from USD 78.65 Billion in 2024, expanding at a CAGR of 8.04% during 2025–2034, driven by aging demographics and rising awareness of ocular health.

- Product Dominance: Eyewear leads the market with a 72% revenue share, supported by high prevalence of refractive errors, fashion-driven demand, and growing adoption of UV-protective and blue-light filtering lenses.

- Treatment Dominance: Laser therapy accounts for 49% of the treatment segment, owing to its precision, minimally invasive nature, faster recovery time, and high clinical success rates.

- Indication Dominance: Glaucoma represents the leading indication segment, fueled by increasing prevalence among the elderly population and the need for long-term disease management.

- Distribution Channel Dominance: Retail stores dominate the distribution landscape, offering in-person eye examinations, personalized consultations, and immediate access to eyewear products.

- Driver: Rising screen exposure, increasing myopia prevalence among children, and growing awareness of UV-related eye damage are accelerating demand for advanced corrective and protective vision solutions.

- Restraint: High cost of advanced surgical procedures and premium vision care products, along with limited accessibility in low-income regions, restrict broader market penetration.

- Opportunity: Expansion in emerging markets, increasing cataract surgical volumes, and innovation in intraocular lenses (multifocal, toric) create significant growth avenues.

- Trend: Technological advancements such as silicone hydrogel contact lenses, smart eyewear, AI-assisted diagnostics, and advanced laser platforms are reshaping the competitive landscape.

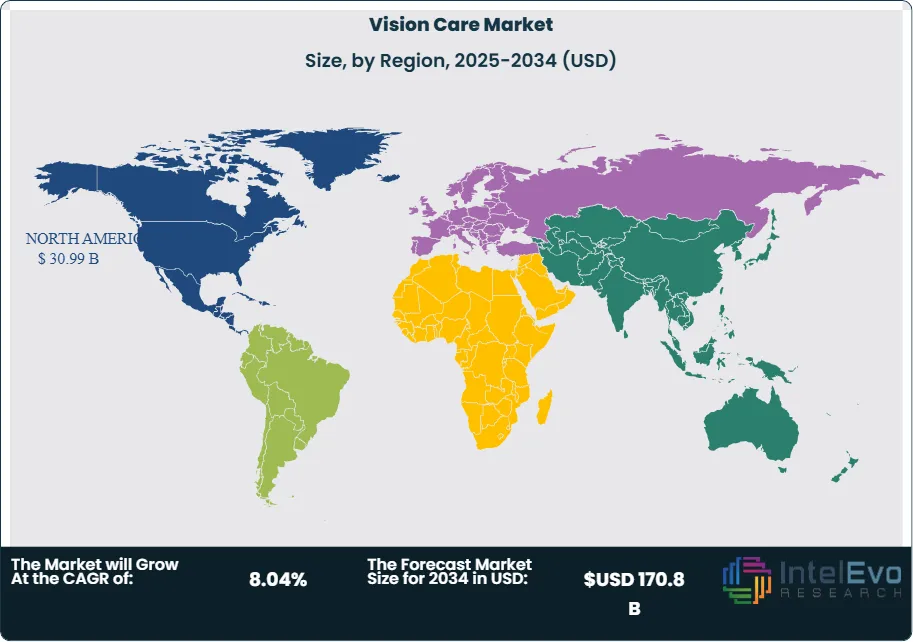

- Regional Analysis: North America leads the market with a 39.4% revenue share due to advanced healthcare infrastructure and favorable reimbursement policies, while Asia-Pacific is expected to register the fastest CAGR supported by large patient pools and rising healthcare investments.

Product Analysis

The global vision care market is meticulously segmented into three primary product categories: Eyewear, Intraocular Lenses, and Ocular Health products.

- Eyewear: This segment, encompassing spectacles, contact lenses, and sunglasses, is the largest and most dynamic. It is estimated to retain its leading position throughout the forecast period, holding a substantial 72% of the total market share.

- Spectacles: Spectacles, once primarily used for correcting refractive errors, have evolved into popular fashion accessories. Manufacturers worldwide innovate with new designs, lightweight and sustainable materials, and advanced lens technologies like progressive and anti-glare coatings. This combination of style, functionality, and affordability maintains their widespread appeal. Additionally, the growing global prevalence of presbyopia and myopia continues to drive strong demand for spectacles, reinforcing their important role in vision care.

- Contact Lenses: Contact lenses offer an alternative to spectacles, providing a wider field of vision and aesthetic benefits. The market is segmented by wear schedule (daily, bi-weekly, monthly, extended) and type (soft, rigid gas permeable, specialty lenses). Growing demand for convenience, comfort, and cosmetic appeal—especially among younger and active users—drives growth. Advances like silicone hydrogel lenses improve oxygen flow and comfort, boosting adoption in regions such as Asia-Pacific and Latin America.

- Sunglasses: Sunglasses are increasingly valued for UV protection, helping prevent cataracts and macular degeneration. Public health campaigns have driven adoption, especially in developed markets. However, emerging regions like the Middle East, Africa, and Latin America offer strong growth potential, with local brands enhancing accessibility and affordability.

- Intraocular Lenses (IOLs): The intraocular lens (IOL) segment is vital for cataract surgery, replacing the clouded natural lens. Rising cataract cases, especially among the elderly, and innovations like multifocal and toric IOLs are driving demand. Increased surgical volumes and supportive reimbursement policies in countries like India and the U.S. further boost market growth.

- Ocular Health Products: This segment includes prescription and over-the-counter products for treating eye conditions and promoting ocular health, such as lubricating drops, glaucoma medications, and supplements. Rising screen time, chronic eye diseases, and ongoing R&D drive steady demand and innovation in targeted treatments.

Treatment Analysis

The global vision care market's treatment landscape is broadly categorized into Surgery, Laser Therapy, and Medication.

- Laser Therapy: This segment held the largest share, accounting for 49% in 2024, a testament to its efficacy and growing adoption. Laser therapy encompasses a variety of procedures, primarily for refractive error correction and the management of certain eye diseases.

- Refractive Laser Surgeries: Laser procedures like LASIK, PRK, and SMILE offer precise, long-term correction for myopia, hyperopia, and astigmatism, reducing dependence on glasses or contacts. Advanced technology and skilled professionals continue to drive strong growth in this segment.

- Therapeutic Laser Procedures: Lasers treat glaucoma, diabetic retinopathy, and secondary cataracts with minimally invasive techniques and high success rates, driving widespread adoption.

- Surgery: Traditional eye surgeries remain vital for complex conditions, including cataract removal, glaucoma procedures, retinal repairs, and corneal transplants. Advances in techniques and better post-op care improve outcomes, while government efforts to expand surgical access further boost this segment’s growth.

- Medication: This segment focuses on pharmaceutical treatments for eye diseases, including glaucoma drops, anti-inflammatories, antibiotics, and antivirals. Innovations in drug delivery and targeted therapies are improving treatment effectiveness and boosting patient compliance across a range of ocular conditions.

Indication Analysis

The global vision care market is segmented based on various indications, addressing a wide spectrum of ocular health issues.

- Glaucoma: This leading segment is projected to grow rapidly, driven by the rising prevalence of glaucoma; an irreversible optic nerve condition. Its progression, especially in the elderly, demands early diagnosis, ongoing monitoring, and long-term treatment, fueling demand for diagnostics, medications, and surgeries.

- Refractive Error: Refractive errors like myopia, hyperopia, and astigmatism drive global demand for glasses, contacts, and surgeries, especially as myopia rates rise among youth.

- Diabetic Retinopathy: Diabetic retinopathy, a major cause of blindness, is rising with global diabetes rates, boosting demand for screenings, laser therapy, and injections.

- Dry Eyes: Dry eye syndrome, worsened by screen use, environment, and aging, increases demand for lubricating drops, artificial tears, and therapies.

- Amblyopia (Lazy Eye): Amblyopia, mainly in children, causes reduced vision in one eye; early treatment like patching boosts demand for pediatric eye care products.

- Other Indications: This category covers cataracts, conjunctivitis, retinal detachment, AMD, and infections, driving demand for diagnostics, medications, and surgeries.

Distribution Channel Analysis

The distribution of vision care products and services occurs primarily through Retail Stores, Online Stores, and Hospitals & Clinics.

- Retail Stores: Retail stores dominate vision care revenue by offering in-person exams, personalized consultations, immediate product access, and trusted customer experiences.

- Online Stores: E-commerce vision care grows rapidly, offering convenience, competitive prices, wide selection, and virtual try-ons, boosting sales despite prescription verification challenges.

- Hospitals & Clinics: Hospitals and eye clinics provide essential advanced diagnostics, surgeries, and prescription treatments for complex and chronic eye conditions.

Regional Outlook

The global vision care market exhibits distinct regional dynamics, influenced by healthcare infrastructure, economic development, demographic trends, and awareness levels.

North America: This region is anticipated to maintain its market leadership throughout the forecast period, commanding a substantial 39.4% revenue share. The dominance of North America is attributed to several factors:

- Advanced Healthcare Infrastructure: The presence of highly developed healthcare systems, state-of-the-art eye clinics, and a large pool of skilled ophthalmologists and optometrists.

- High Disposable Income: Greater purchasing power among consumers allows for higher adoption rates of premium vision care products and advanced corrective procedures.

- Favorable Reimbursement Policies: Robust insurance coverage and favorable reimbursement policies for eye examinations, cataract surgeries, and other treatments significantly reduce the financial burden on patients, encouraging access to care.

- High Awareness: A strong emphasis on preventive healthcare and widespread awareness campaigns regarding ocular diseases contribute to early diagnosis and treatment.

- Aging Population: A significant aging demographic in the U.S. and Canada drives demand for age-related eye care services and products.

- Technological Adoption: Early and rapid adoption of cutting-edge vision care technologies and innovative products.

- Growing Use of Spectacles: The increasing acceptance of spectacles as a fashion statement further fuels market growth.

Asia Pacific (APAC): Asia Pacific is anticipated to be the second-largest market globally and is expected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is driven by:

- Large and Growing Population: The sheer size of the population, particularly in countries like China and India, presents an enormous customer base.

- High Prevalence of Ocular Diseases: The region faces a disproportionately high burden of ocular diseases, including a rapidly increasing incidence of myopia among children and young adults, and a significant number of cataract cases.

- Rising Disposable Incomes: Economic growth and increasing disposable incomes in developing nations across APAC (e.g., China, India, Indonesia, and Vietnam) are making vision care products and services more affordable and accessible to a larger segment of the population.

- Increasing Accessibility of Affordable Products: The presence of numerous local manufacturers offering cost-effective vision care solutions caters to a broader consumer base.

- Growing Healthcare Expenditure: Governments and private entities are increasing investments in healthcare infrastructure and eye care services.

- High Volume of Cataract Surgeries: Countries in APAC consistently rank among the highest globally for the volume of cataract surgeries performed, directly driving the demand for intraocular lenses.

Europe: Western Europe, including Germany, France, the UK, Italy, and Spain, represents a mature market with a sophisticated healthcare system and an aging population. The market is driven by high awareness, advanced product adoption, and established reimbursement frameworks. Eastern Europe, including Russia and Poland, is experiencing growth driven by improving economic conditions and increasing access to modern vision care.

Latin America: The market for vision care in Latin America is expected to expand steadily. A primary driver in this region is the significant unmet demand for eye care services and products. Increasing awareness, improving economic conditions, and efforts to expand healthcare access are contributing to market growth, though challenges related to affordability and infrastructure remain.

Middle East & Africa (MEA): The MEA market is expected to grow at a slower but consistent rate. While certain GCC countries boast advanced healthcare facilities and high per capita spending, many parts of Africa face significant challenges related to limited access to eye care professionals, lack of awareness, and economic constraints. However, increasing government initiatives to improve healthcare and rising health tourism in some areas offer future growth potential.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

By Product

- Eyewear

- Spectacles

- Contact Lenses

- Sunglasses

- Intraocular Lenses

- Ocular Health Products

By Treatment

- Laser Therapy

- Refractive Laser Surgeries

- Therapeutic Laser Procedures

- Surgery

- Medication

By Indication

- Glaucoma

- Refractive Error

- Diabetic Retinopathy

- Dry Eyes

- Amblyopia (Lazy Eye)

- Other Indications

By Distribution Channel

- Retail Stores

- Online Stores

- Hospitals & Clinics

Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 84.97 B |

| Forecast Revenue (2034) | USD 170.8 B |

| CAGR (2025-2034) | 8.04% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product (Eyewear, Intraocular Lenses, Ocular Health Products); By Treatment (Laser Therapy, Surgery, Medication); By Indication (Glaucoma, Refractive Error, Diabetic Retinopathy, Dry Eyes, Amblyopia (Lazy Eye), Other Indications); By Distribution Channel (Retail Stores, Online Stores, Hospitals & Clinics) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Alcon, American Sunglass Manufacturing, Charlie Victor, Eyeking, Fielmann Ag, Hoya Corporation, Jins Eyewear Us, Inc., Lcon, Inc., Lensmam Co., Ltd., Luxottica Group, Optex Australia, Polytouch, Rodenstock, Seed Co., Ltd., Sightglass Vision, Inc, Sunshades Eyewear, Viewell.Inc, Zeiss International , EssilorLuxottica, CooperVision, Johnson & Johnson Vision, Bausch Health Companies Inc., GrandVision, Menicon Co., Ltd., Safilo Group |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date