Vitamin B6 Market Size Growth, Trends & Forecast | 11.2% CAGR

Global Vitamin B6 Market Size, Share & Analysis By Product Type (Tablets, Capsules, Others), By Application (Anaemia, Fatigue, Insomnia, Muscle Cramps, Premenstrual Syndrome, Others), By Distribution Channels (Pharmacies & Drug Stores, Supermarkets, Online Channels), Nutritional Demand Trends, Regulatory Framework & Forecast 2025–2034

Report Overview

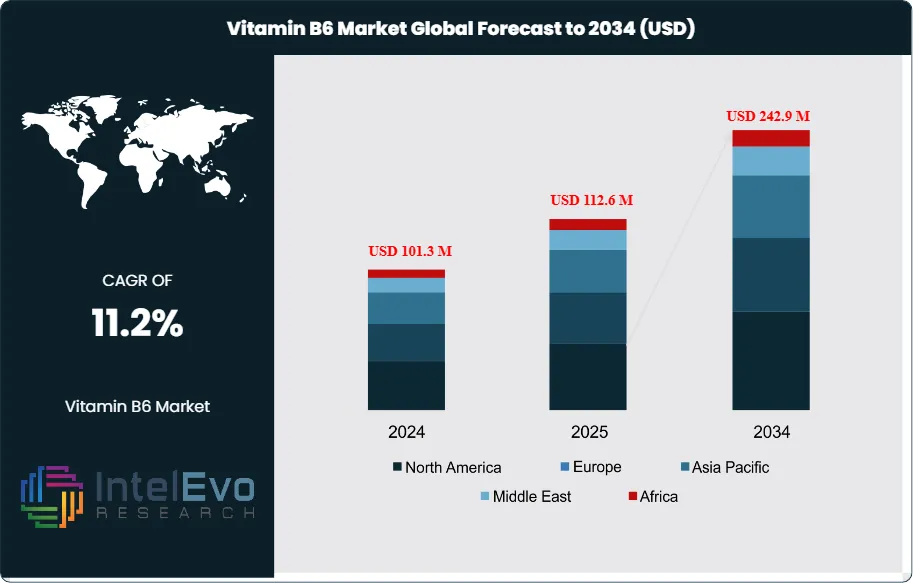

The Vitamin B6 Market is estimated at around USD 101.3 million in 2024 and is projected to reach nearly USD 242.9 million by 2034, growing at an estimated CAGR of about 11.2% during 2025–2034. Growing consumer focus on immunity, cognitive health, and nutritional deficiencies continues to accelerate category adoption. As preventive wellness becomes mainstream globally, Vitamin B6 demand is expanding across supplements, fortified foods, women’s health, and mental well-being. The decade ahead is expected to witness strong innovation in bioavailability-enhanced and clean-label formulations, further lifting the market’s long-term trajectory.

Get More Information about this report -

Request Free Sample ReportBuilding on steady multivitamin adoption, the market continues to scale from early-2020s baselines and is positioned for sustained mid- to high-single-digit expansion. Momentum reflects heightened health awareness and the broad physiological relevance of pyridoxine in amino-acid metabolism, neurotransmitter synthesis, and immune support.

According to U.S. FDA estimates, roughly 28–36% of the general population regularly consumes supplements containing vitamin B6. Therapeutic use cases span anemia, mood disorders, and cognitive decline, where B6 complements broader interventions by supporting hematological and neurological function.

On the demand side, growth is underpinned by aging populations, preventive-health behaviors, and fortified staples in emerging markets. Public-health priorities from organizations such as WHO and FAO—centered on food fortification, micronutrient programs, and nutrition education—are widening access and awareness. Supply-side dynamics are improving as synthesis and fermentation yields rise, supplier qualification tightens, and automation in premix blending enhances quality and consistency; however, input-cost volatility, batch-to-batch variability, and compliance burdens remain material risks.

Innovation is accelerating toward bioavailability-enhanced formats (sustained-release, liposomal, and B-complex co-formulations), clean-label and plant-derived sources, and AI-enabled personalization that matches dosing to biomarkers and lifestyle data. Digital retail and subscription models are compressing route-to-market timelines.

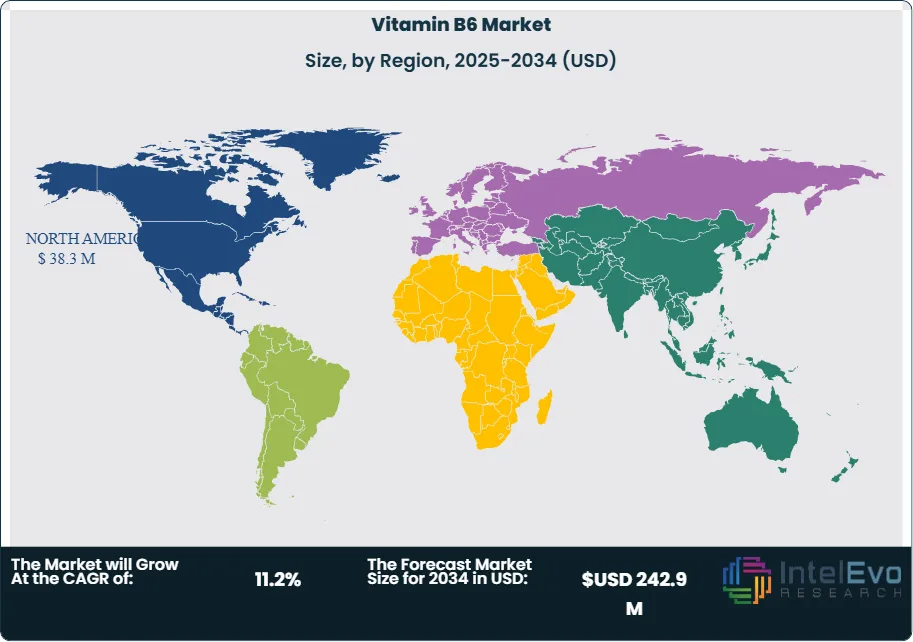

Regionally, North America remains the anchor, accounting for approximately 37.8% of 2024 revenue (about US$ 34.9 million) on the back of high per-capita spend and a sophisticated omnichannel ecosystem. Europe benefits from strong pharmacy channels and a robust clinical evidence base, though claim restrictions can temper marketing velocity. Asia Pacific is the fastest-rising opportunity, propelled by urbanization, middle-class expansion, and fortification mandates; China and India are expected to outpace the global average through 2034 as retail distribution deepens and local contract manufacturing scales. Latin America and the Middle East & Africa offer selective upside as fortification initiatives expand and price points localize.

For investors, near-term hotspots include differentiated delivery technologies, fermentation-based and natural-origin inputs, and B6-rich functional foods aligned with clean-label positioning and personalized wellness programs. Execution will depend on regulatory vigilance—particularly around maximum-permitted levels, labeling, and safety monitoring—and on reliable, diversified sourcing to shield margins against supply shocks.

Key Takeaways

- Market Growth: The global vitamin B6 market totalled USD 101.3 million in 2024 and is projected to reach USD 242.9 million by 2034 at a CAGR of 11.2% (2024–2034), propelled by preventive-health spending, fortified foods, and mainstream supplement adoption. North America anchored demand in 2024, while Asia Pacific is set to outpace the global average through 2034.

- Product Form: Capsules led with 45.7% share in 2024, supported by dose precision, stability in multi-ingredient blends, and the rapid uptake of vegetarian and sustained-release formats that enable premium pricing and adherence.

- Application: Premenstrual syndrome (PMS) accounted for 34.8% of application revenues in 2024, reflecting strong consumer awareness and physician/pharmacist recommendations for symptom management, particularly within combination B-complex and women’s health SKUs.

- Distribution Channel: Pharmacies & drug stores captured 50.4% of 2024 revenue, benefitting from pharmacist counseling, trust in regulated retail, and high conversion on clinically positioned SKUs versus pure-play mass or online channels.

- Driver: Mainstream usage is deepening—28–36% of the U.S. population reports regular consumption of supplements containing vitamin B6—while WHO/FAO-backed fortification and nutrition education programs expand access and awareness in emerging markets.

- Restraint: Regulatory dosage caps and claim scrutiny constrain high-dose innovation and labeling flexibility (e.g., U.S. adult UL ≈100 mg/day; EU’s UL is materially lower), increasing compliance costs and extending time-to-market for new formulations.

- Opportunity: Asia Pacific represents the clearest upside, with anticipated double-digit CAGR driven by urbanization, retail penetration in China and India, and local contract manufacturing; targeted women’s health and cognitive-support SKUs can unlock incremental premium mix.

- Trend: Product development is shifting to clean-label, plant-derived inputs and bioavailability-enhanced formats (e.g., sustained-release, liposomal), alongside personalized nutrition programs; leading suppliers (e.g., DSM-Firmenich, BASF, Lonza) are bundling premix, capsule technology, and data-enabled services to accelerate innovation.

- Regional Analysis: North America led with 37.8% share in 2024 on high per-capita spend and omnichannel maturity; Europe remains sizable but conservative due to claim restrictions, while Asia Pacific is the investment hotspot given policy support for fortification and faster category formalization relative to Latin America and the Middle East & Africa.

Product Type Analysis

Capsules remain the anchor format as of 2025, building on their 45.7% share in 2024 and benefiting from dose precision, rapid disintegration, and strong compatibility with B-complex co-formulations. The shift toward plant-based, gelatin-free, and sustained-release capsules is widening appeal among vegetarian and clean-label consumers while supporting premium pricing. Contract manufacturers are scaling high-speed encapsulation lines and tighter in-process controls, improving uniformity and reducing batch rejects—key for global brands targeting regulated pharmacy channels.

Tablets retain relevance on cost efficiency and shelf stability, especially for large-volume SKUs and fortified staples in price-sensitive markets. Innovation is moving toward microencapsulation and direct compression blends that improve bioavailability and reduce excipient load, narrowing performance gaps with capsules. The “Others” category—powders, liquids, and gummies—expands through sports, maternal, and pediatric use cases; flavored liquids and stick packs are gaining traction in e-commerce and convenience formats, though they face higher logistics and shelf-life constraints.

Application Analysis

Women’s health continues to set the pace: premenstrual syndrome (PMS) accounted for 34.8% of application revenue in 2024 and remains the leading indication in 2025 as consumers seek non-prescription symptom relief. Evidence-backed positioning around mood, bloating, and fatigue—often paired with magnesium or chasteberry—sustains pharmacist recommendations and repeat purchases. Adjacent segments in perinatal care and post-partum support are emerging as brands expand evidence summaries and clinical claims within local regulations.

Beyond PMS, demand is diversifying across anemia support, fatigue, and cognition. B6’s role in amino-acid metabolism and neurotransmitter synthesis underpins growth in energy and neuro-support SKUs, frequently bundled with B12, iron, and folate. Sports recovery (muscle cramps) and sleep hygiene (insomnia) remain niche but rising, especially in markets with high digital-health engagement. As clinical substantiation matures and dosing is personalized, multi-benefit formulations are expected to outgrow single-claim products through 2034.

Distribution Channels Analysis

Pharmacies & drug stores commanded 50.4% of revenue in 2024 and continue to lead in 2025, supported by pharmacist counseling, higher trust in regulated retail, and insurance-adjacent traffic. Leading chains leverage private labels and evidence-led shelf sets to drive mix toward premium capsule formats and women’s health bundles.

Supermarkets broaden reach through fortified foods and value SKUs, while online channels post the fastest growth on subscription economics, influencer-led education, and rapid NPD cycles. Marketplaces and brand.com sites are using quiz-based personalization and compliance-aware content to increase conversion and retention; however, the online shift intensifies scrutiny on quality certificates and adverse-event monitoring, favoring suppliers with robust traceability.

Regional Analysis

North America remained the largest market with 37.8% share in 2024, and as of 2025 it retains leadership on high per-capita supplement spend, mature omnichannel distribution, and sustained consumer adoption (U.S. supplement usage ~75% of adults). Europe is sizable but more conservative, where stringent health-claim frameworks slow marketing velocity yet support premiumization in pharmacy-led formats.

Asia Pacific is the primary growth engine through 2034, underpinned by urbanization, rising disposable incomes, and government support for fortification in China, India, and Southeast Asia. E-commerce penetration and local contract manufacturing are accelerating access, making APAC the focal point for new product launches and value-engineered SKUs. Latin America and the Middle East & Africa present selective upside as pharmacy networks expand and affordability improves, with multinational–local partnerships critical to navigating pricing, labeling, and registration pathways.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Tablets

- Capsules

- Others

By Application

- Anaemia

- Fatigue

- Insomnia

- Muscle Cramps

- Premenstrual Syndrome

- Others

By Distribution Channels

- Pharmacies & Drug Stores

- Supermarkets

- Online Channels

By Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 101.3 M |

| Forecast Revenue (2034) | USD 242.9 M |

| CAGR (2024-2034) | 11.2% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Tablets, Capsules, Others), By Application (Anaemia, Fatigue, Insomnia, Muscle Cramps, Premenstrual Syndrome, Others), By Distribution Channels (Pharmacies & Drug Stores, Supermarkets, Online Channels) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | DSM-Firmenich, BASF SE, Zhejiang Tianxin Pharmaceutical Co., Ltd., Hubei Yuancheng Pharmaceutical Co., Ltd., Zhejiang Hangzhou Xinfu Pharmaceutical Co., Ltd., Emperor Chemical Co., Ltd., Jubilant Life Sciences, Shanghai Hegno Pharmaceutical Co., Ltd., Pride Chemical Inc., Lonza Group AG, Vertellus Holdings LLC, Foodchem International Corporation, Hexon Laboratories Pvt. Ltd., GlaxoSmithKline (GSK) – Vitamin Supplement Segment, Nature’s Bounty Co. (Nestlé Health Science), Jiangxi Tianxin Pharmaceutical Co., Ltd., HuiSheng Pharma |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date