Vitamins and Supplements Market Size, Trends & Forecast | 8.7% CAGR

Global Vitamins and Supplements Market Size, Share, Analysis Report By Type (Multivitamins & Single Vitamins, Minerals, Botanicals & Herbal Supplements, Specialty Supplements, Probiotics), Platform (E-commerce & Online Pharmacies, Retail & Specialty Stores, Direct Sales), End-User (Adults 35+, Children, Athletes, Pregnant Women) Industry Region & Key Players-Industry Segment Overview, Market Dynamics, Competitive Strategies, Trends & Forecast 2025-2034

Report Overview

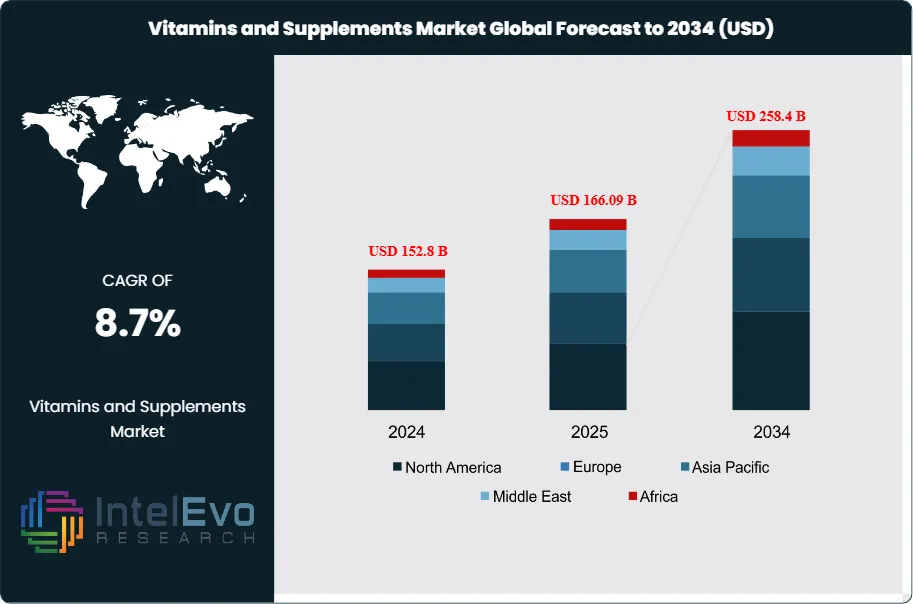

The Vitamins and Supplements Market size is projected to reach USD 258.4 billion by 2034, up from USD 152.8 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. This growth is driven by rising consumer awareness of preventive healthcare, increased adoption of nutraceuticals, and a growing shift toward plant-based and personalized nutrition solutions.

Get More Information about this report -

Request Free Sample ReportThe market is also witnessing strong momentum from e-commerce platforms, digital health tracking, and innovation in functional food formulations. As global lifestyles evolve, the demand for natural, immunity-boosting, and sustainable supplements continues to shape the next decade of the health and wellness industry.

As per analysts at Wissen Market Research, the COVID-19 pandemic significantly accelerated demand for vitamins and supplements, as consumers worldwide prioritized immunity and preventive health. The market has since maintained strong momentum, with ongoing product innovation, digital health trends, and rising health awareness fueling growth. However, supply chain disruptions and regulatory scrutiny continue to shape the competitive landscape.

Vitamins and supplements encompass a wide range of products, including multivitamins, single vitamins, minerals, botanicals, probiotics, and specialty supplements. The market is driven by increasing consumer focus on preventive healthcare, aging populations, and the popularity of personalized nutrition. E-commerce and direct-to-consumer channels are expanding rapidly, making supplements more accessible than ever.

Key Takeaways

- Market Growth: The Vitamins and Supplements Market is projected to reach USD 258.4 billion by 2034, as consumers seek to boost immunity, manage chronic conditions, and support overall wellness.

- Type Dominance: Multivitamins and single vitamin supplements account for over XX% of the market in 2024, followed by minerals (XX%), botanicals (XX%), and specialty supplements (XX%).

- Platform Dominance: E-commerce and online pharmacies now represent over XX% of global sales, with brick-and-mortar retail and specialty health stores maintaining a strong presence.

- End-User Dominance: Adults aged 35 and above are the largest consumer group, representing XX% of the market, followed by children (XX%), athletes (XX%), and pregnant women (XX%).

- Driver: Rising health awareness, preventive healthcare trends, and the influence of social media and digital health platforms are fueling rapid adoption.

- Restraint: Regulatory challenges, quality concerns, and the proliferation of counterfeit products present barriers to market growth.

- Opportunity: Personalized nutrition, clean-label supplements, and the integration of wearable health tech offer significant opportunities for innovation and expansion.

- Trend: The rise of plant-based and vegan supplements, functional gummies, and subscription-based models are reshaping consumer preferences and market strategies.

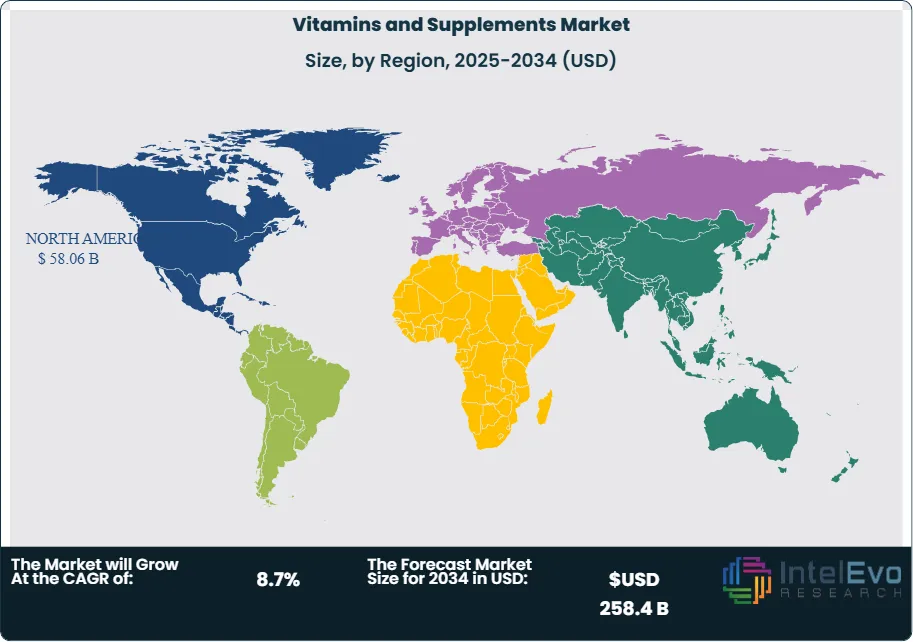

- Regional Analysis: North America leads the global market with a 38% share in 2024, followed by Europe (XX%) and Asia Pacific (XX%). Latin America and the Middle East & Africa are emerging markets with rising health supplement adoption.

By Type

The vitamins and supplements market by type is segmented into vitamins and dietary supplements, both witnessing strong global demand due to growing health consciousness and preventive care adoption. Vitamins such as A, C, D, and B-complex remain popular for boosting immunity and overall well-being, while supplements like minerals, omega-3, probiotics, and herbal formulations cater to specific health needs. Consumers are increasingly shifting toward natural, organic, and plant-based supplements to avoid synthetic ingredients. Rising awareness of micronutrient deficiencies, aging populations, and fitness-oriented lifestyles are further driving market growth. The segment continues to evolve with innovations in functional blends and personalized nutrition products designed for targeted health benefits.

By Form

Based on form, the global vitamins and supplements market includes tablets, capsules, powders, liquids, softgels, and gummies. Among these, tablets and capsules dominate due to convenience, dosage accuracy, and longer shelf life. However, the demand for gummies and liquid supplements is surging, particularly among children and millennials, owing to their easy consumption and appealing flavors. Powdered supplements, such as protein and meal replacement blends, are also gaining popularity among fitness enthusiasts and athletes. The increasing preference for functional and on-the-go nutrition products is pushing manufacturers to innovate with new delivery formats that enhance bioavailability, taste, and consumer engagement, thereby expanding the overall market reach across diverse demographics.

By Distribution Channel

The distribution landscape of the vitamins and supplements market is rapidly evolving, driven by the digitalization of health retail. Pharmacies and drug stores continue to hold a dominant share due to consumer trust and professional guidance. However, online retail and e-commerce platforms are emerging as the fastest-growing segment, supported by subscription-based models, personalized product recommendations, and convenience of home delivery. Supermarkets, hypermarkets, and specialty health stores also contribute significantly to sales, offering a wide variety of brands. The rising penetration of mobile health apps and direct-to-consumer brands is transforming how consumers access and purchase nutritional products, signaling a clear shift toward digital and omnichannel retail strategies.

By End User Industry

The Vitamins and Supplements Market by End User Industry serves multiple sectors, including pharmaceuticals, nutraceuticals, food & beverages, sports nutrition, and personal care. The pharmaceutical industry leads the market, driven by prescription-based and preventive supplements for immunity, bone health, and chronic disease management. The nutraceuticals segment is expanding rapidly due to rising consumer preference for natural, plant-based, and functional products. In the food and beverage industry, fortification of everyday products such as cereals, dairy, and beverages is creating new growth opportunities. Sports nutrition continues to see robust demand from athletes and fitness enthusiasts seeking performance-enhancing formulations, while the personal care industry integrates supplements promoting skin, hair, and overall beauty wellness.

By Regional Analysis

Regionally, the Global Vitamins and Supplements Market demonstrates strong geographic diversity and growth potential. North America dominates due to high consumer awareness, premium product availability, and a robust regulatory framework. Europe follows, driven by an aging population, eco-friendly formulations, and strict quality standards. The Asia-Pacific region represents the fastest-growing market, fueled by economic growth, changing lifestyles, and increasing adoption of preventive healthcare in countries like China, India, and Japan. Latin America shows steady expansion due to improved healthcare access and retail penetration, while the Middle East & Africa region is emerging as a new frontier with rising disposable income and growing awareness about nutrition and wellness.

Get More Information about this report -

Request Free Sample ReportMarket Key Segment

By Type

- Vitamins

- Vitamin A

- Vitamin B Complex

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

- Supplements

- Minerals (Calcium, Iron, Magnesium, Zinc, etc.)

- Herbal Supplements

- Omega-3 Fatty Acids

- Probiotics

- Proteins and Amino Acids

By Form

- Tablets

- Capsules

- Powders

- Liquids

- Gummies

- Softgels

By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Online Retail & E-commerce

- Specialty Health Stores

- Direct Sales

By End User

- Adults

- Children

- Geriatric Population

- Pregnant Women

- Athletes

By Region

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 166.09 B |

| Forecast Revenue (2034) | USD 258.4 B |

| CAGR (2025-2034) | 8.7% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Type (Vitamins, Supplements), By Form (Tablets, Capsules, Powders, Liquids, Gummies, Softgels), By Distribution Channel (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Online Retail & E-commerce, Specialty Health Stores, Direct Sales), By End User (Adults, Children, Geriatric Population, Pregnant Women, Athletes) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Pfizer Inc., Amway Corp., Bayer AG, Herbalife Nutrition Ltd., Abbott Laboratories, Nature’s Bounty Co., Glanbia PLC, GNC Holdings, LLC, Nestlé Health Science, NOW Foods, NutraScience Labs, DSM Nutritional Products, Himalaya Wellness, Unilever PLC (Horlicks, Olly), Church & Dwight Co., Inc. |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Vitamins and Supplements Market

Published Date : 15 Jul 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date