Volatile Organic Compounds (VOCs) Rotors Market Size | CAGR of 8.5%

Global VOC’s Rotor Market Size, Share & Analysis By Material (Zeolite, Carbon), By Application (Automotive, Chemical, Semi-conductor), By End-User Industry Regions & Key Players – Environmental Regulations & Forecast 2025–2034

Report Overview

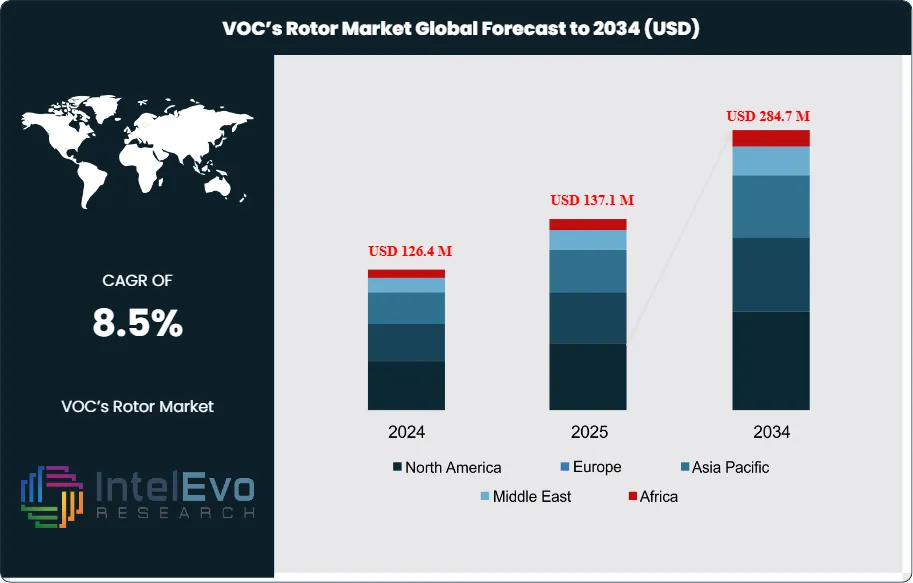

The Volatile Organic Compounds (VOCs) Rotors market is valued at USD 126.4 million in 2024 and is projected to reach approximately USD 284.7 million by 2034, reflecting a solid CAGR of about 8.5% during 2025–2034. Stricter global emission norms, rising industrial automation, and rapid adoption of energy-efficient air treatment systems are accelerating demand across chemical, electronics, and automotive manufacturing sectors. As clean-air compliance becomes a core operational mandate, industries are increasingly shifting from traditional abatement systems to high-performance rotor technologies. With sustainability reporting and ESG commitments gaining momentum, VOC rotor installations are expected to surge across both advanced and emerging economies.

Get More Information about this report -

Request Free Sample ReportOver the past decade, the VOC rotors market has grown steadily due to increasing regulatory scrutiny, rising awareness of industrial emissions, and the expanding role of air quality management across multiple industries. Historically rooted in applications within the chemical and automotive sectors, VOC rotors have become essential for mitigating emissions that contribute to ozone layer depletion and poor indoor air quality. With governments tightening emission standards, particularly in North America, Europe, and parts of Asia, industrial operators are investing in specialized air purification systems. Dehumidifiers equipped with VOC rotors now represent a critical component in maintaining compliance, reducing environmental impact, and ensuring occupational safety.

Demand is further fueled by heightened public awareness of air pollution and its health impacts. Consumer pressure and corporate sustainability commitments have accelerated the shift toward emission monitoring and abatement solutions. On the supply side, manufacturers are responding with enhanced materials, such as high-silica zeolite and activated carbon substrates, which offer better adsorption efficiency and longer operational lifespans. Zeolite-based honeycomb structures remain the industry standard due to their durability and low regeneration energy requirements.

Technological development continues to shape the adoption curve. Bactericidal VOC rotor technologies and systems capable of targeting a broader spectrum of airborne contaminants are gaining traction in highly regulated sectors such as food processing and pharmaceuticals. As a result, VOC rotors are now increasingly embedded in environmental control systems beyond their traditional industrial base.

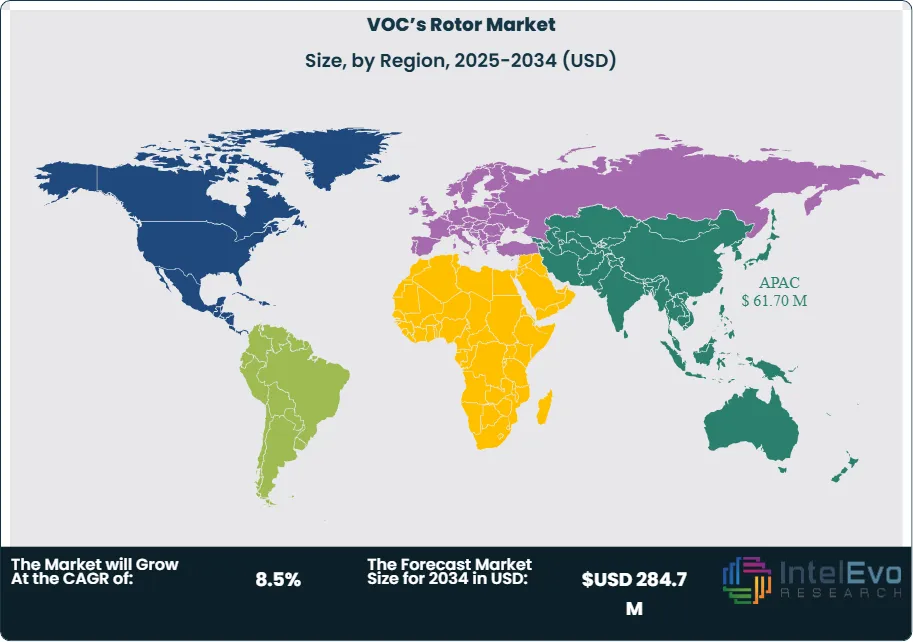

Regionally, Asia Pacific remains the fastest-growing market, driven by rapid industrialization in China, India, and Southeast Asia. Europe and North America lead in terms of technology adoption and regulatory enforcement, making them lucrative zones for advanced VOC rotor systems. Meanwhile, emerging economies in Latin America and the Middle East are becoming investment hotspots, as environmental compliance moves higher on national agendas.

The global VOC rotors market presents a clear growth trajectory, shaped by policy shifts, technological progress, and evolving end-user demands. Market players that can align product development with stringent environmental targets will be best positioned to capture long-term value.

Key Takeaways

- Market Growth: The global VOC rotor market was valued at USD 126.4 million in 2024 and is projected to reach USD 284.7 million by 2034, registering a CAGR of 8.5% over the forecast period. Growth is driven by tightening emission norms, rising environmental awareness, and increasing demand for air purification across industrial sectors.

- Product Type: Zeolite-based VOC rotors dominate the market, accounting for over 60% of global revenue in 2024 due to their high thermal stability, regeneration efficiency, and longer operational lifespan compared to activated carbon variants.

- End Use Industry: The automotive and chemical sectors collectively represented more than 55% of VOC rotor demand in 2024. These industries face stringent air emission regulations, driving continuous investment in air treatment systems.

- Driver: Rising environmental regulation is a primary growth driver. In Europe, the Industrial Emissions Directive (IED) and in the U.S., the EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) mandate VOC control systems in industrial facilities.

- Restraint: High initial capital expenditure limits adoption among small and medium enterprises. Installation of a VOC rotor-based system can range from US$50,000 to US$500,000 depending on capacity, deterring entry in cost-sensitive markets.

- Opportunity: The pharmaceutical and food processing industries offer untapped potential, with the segment expected to grow at a CAGR of 8.5% through 2028. Demand is rising for sterilized air environments and emission control in these sectors.

- Trend: Manufacturers are integrating bactericidal coatings and automation-enabled monitoring systems into VOC rotors. Companies like Seibu Giken and Munters are investing in hybrid solutions that combine rotor technology with AI-based air quality diagnostics.

- Regional Analysis: Asia Pacific leads in volume growth, driven by industrial expansion in China and India, and is expected to grow at a CAGR above 8% through 2028. Europe and North America remain high-value markets due to stringent regulatory frameworks and high technology adoption rates.

Type Analysis

The VOC rotor market is primarily segmented into zeolite-based and activated carbon-based types, with zeolite rotors commanding the majority share in 2025. These systems are preferred for their high thermal stability, long operational life, and low energy consumption during regeneration. Zeolite rotors now account for over 65% of total market revenue, largely due to their use in industries where high-temperature resistance and consistent performance are essential. They also perform better in high-humidity environments, making them suitable for regions with varied climate conditions.

In contrast, activated carbon rotors continue to serve applications with lower temperature requirements and cost sensitivity. Though less durable, they are still widely adopted in small-scale facilities, especially in developing markets. However, their market share is gradually declining as more end users shift toward long-term operational efficiency. Looking ahead, the dominance of zeolite-based systems is expected to grow further, particularly in industries with stringent emission controls such as pharmaceuticals and food processing.

Application Analysis

VOC rotors are increasingly integrated across automotive, chemical, and semiconductor manufacturing processes, where emissions control is mandatory. In 2025, the chemical sector holds the largest application share at approximately 42% of global demand. These facilities generate significant volumes of VOCs during production, necessitating high-capacity rotor systems for compliance with tightening emission regulations across regions such as the EU and North America.

The automotive industry remains a key contributor to market demand, especially across coating and painting operations where solvent-based VOCs are released. As vehicle production rebounds in 2025, demand for VOC abatement in automotive paint shops is expected to grow at a 6.8% CAGR through 2030. Meanwhile, the semiconductor sector is emerging as a high-growth segment. Cleanroom environments and emission restrictions in electronics manufacturing are prompting adoption of high-efficiency rotors, particularly in East Asia.

End-Use Analysis

VOC rotors are deployed across residential, commercial, and industrial buildings, with industrial applications accounting for over 70% of total installations in 2025. This dominance is driven by the need for continuous VOC control in manufacturing plants, processing units, and warehouses. Industrial users favor zeolite-based systems for their performance reliability and cost efficiency over time.

While commercial buildings, such as laboratories and large office complexes, have historically lagged in VOC rotor adoption, new building codes focused on indoor air quality are prompting gradual uptake. In contrast, residential applications remain limited to niche areas, such as high-end housing or residential zones near industrial clusters. However, government-led air quality initiatives in densely populated cities may gradually expand usage in the residential segment over the forecast period.

Regional Analysis

Asia Pacific leads global VOC rotor demand, accounting for more than 45% of global revenue in 2025, driven by industrial growth in China, India, and South Korea. Rapid urbanization and strict air pollution regulations in these countries are accelerating installation of VOC control technologies. China’s ongoing enforcement of its Blue Sky Protection Plan continues to push chemical and electronics manufacturers toward compliant air treatment systems.

Europe and North America remain key high-value markets. The EU's Industrial Emissions Directive and the U.S. Clean Air Act both mandate stringent VOC limits, spurring steady demand across automotive, chemical, and semiconductor facilities. Meanwhile, Latin America and the Middle East & Africa are in early adoption stages. Growth in these regions is tied to increasing industrialization and rising environmental awareness, particularly in Brazil, the UAE, and Saudi Arabia. As regulatory frameworks mature, these regions are likely to present substantial long-term opportunities.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Type

- Zeolite

- Activated carbon

By Application

- Automotive

- Chemical

- Semi-conductor

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 126.4 M |

| Forecast Revenue (2034) | USD 284.7 M |

| CAGR (2024-2034) | 8.5% |

| Historical data | 2021-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Material Type (Zeolite, Activated carbon), By Application (Automotive, Chemical, Semi-conductor) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Seibu Giken Co. Ltd., Gulf Coast Environmental Systems (GCES), Munters Group AB, Nichias Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date