Water Treatment Equipment Market Growth, Size & Share | CAGR of 6.2%

Global Water and Wastewater Treatment Equipment Market Size, Share & Analysis Report By Equipment Type (Filtration, Membrane Systems, Disinfection, Biological Treatment, Sludge Treatment), Application (Municipal, Industrial, Commercial & Institutional, Agricultural), Process (Primary, Secondary, Tertiary/Advanced), End User & Region – Industry Overview, Dynamics, Trends, Key Players & Forecast 2025–2034

Report Overview

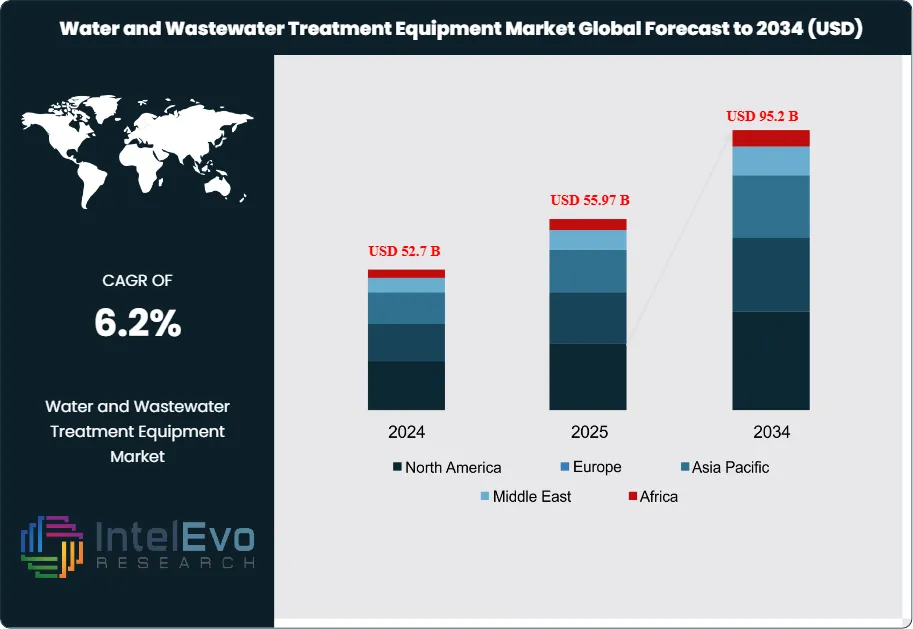

The Global Water and Wastewater Treatment Equipment Market is projected to reach approximately USD 95.2 Billion by 2034, up from USD 52.7 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2024 to 2034. The Global Water and Wastewater Treatment Equipment Market encompasses the range of technologies, systems, and devices used to remove contaminants from water and wastewater, making it suitable for reuse, safe discharge, or environmental return. This market includes filtration systems, membrane technologies, disinfection units, biological treatment systems, and sludge management equipment, all of which are essential for municipal, industrial, and commercial applications. The sector plays a critical role in ensuring public health, environmental protection, and regulatory compliance by providing clean water for consumption, industrial processes, and safe disposal of wastewater.

Get More Information about this report -

Request Free Sample ReportThe primary drivers of this market are the increasing global demand for clean water, rapid urbanization, and the tightening of environmental regulations regarding water quality and wastewater discharge. Water scarcity in many regions, coupled with growing industrialization, has heightened the need for efficient water management and advanced treatment solutions. Additionally, the push for sustainable development and the adoption of smart water technologies—such as IoT-enabled monitoring and automation—are accelerating investments in modern treatment equipment. The rising awareness of waterborne diseases and the need for safe drinking water further fuel market growth.

The market is segmented by equipment type (filtration, membrane systems, disinfection, biological treatment, and sludge management), application (municipal, industrial, commercial, and agricultural), process (primary, secondary, and tertiary/advanced treatment), end user (municipalities, industries, commercial/institutional, and agriculture), and region (Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa). Membrane systems and biological treatment equipment are particularly prominent due to their effectiveness in removing a wide range of contaminants and adaptability to various applications. Municipal water and wastewater treatment remains the largest application segment, while industrial applications are growing rapidly due to stricter discharge standards.

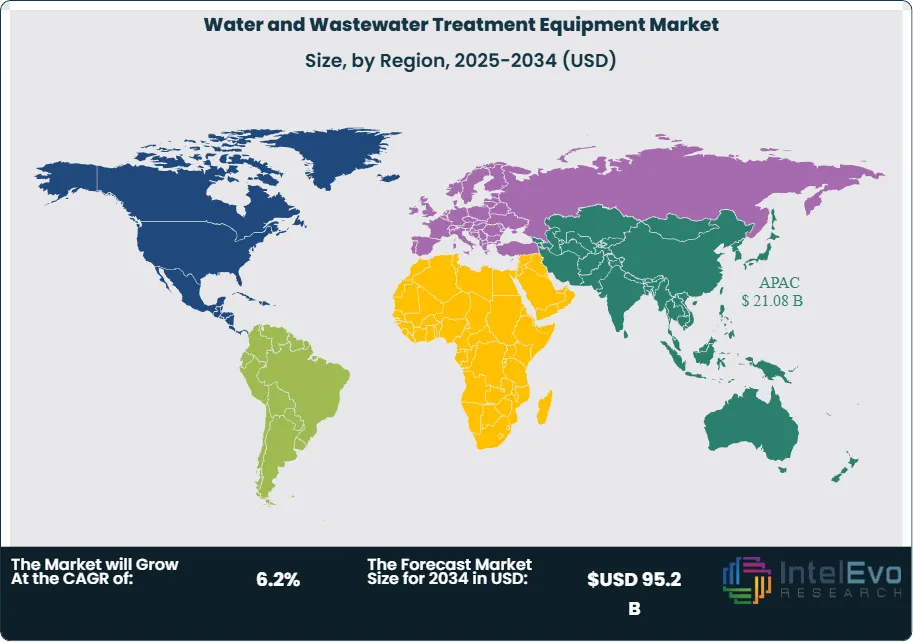

Asia-Pacific leads the global market, driven by rapid urbanization, industrial expansion, and significant government investments in water infrastructure, especially in China and India. North America is a mature market characterized by strong regulatory frameworks and early adoption of advanced technologies, while Europe emphasizes sustainability, water reuse, and compliance with stringent EU directives. Latin America and the Middle East & Africa are emerging markets, with growth fueled by urbanization, industrialization, and acute water scarcity, which drives demand for desalination and water reuse solutions. The COVID-19 pandemic underscored the importance of reliable water and wastewater treatment infrastructure for public health and hygiene. While the initial phase of the pandemic caused project delays and supply chain disruptions, it also accelerated investments in water treatment technologies to ensure safe water supply and sanitation. The crisis highlighted the need for resilient, decentralized, and automated treatment systems, prompting utilities and industries to adopt digital monitoring and remote management solutions. As a result, the market rebounded quickly, with renewed focus on infrastructure upgrades and operational efficiency.

Geopolitical dynamics significantly influence the water and wastewater treatment equipment market through regulatory policies, international trade agreements, and cross-border water management issues. Stricter environmental regulations in developed regions drive technology adoption, while trade tensions and supply chain disruptions can impact equipment availability and project timelines. Water scarcity and transboundary water disputes in regions such as the Middle East, Africa, and parts of Asia create both challenges and opportunities for market growth, as governments prioritize investments in water security and infrastructure resilience. Additionally, global efforts to address climate change and promote sustainable resource management are encouraging the adoption of advanced water treatment technologies worldwide.

Key Takeaways

- Market Growth: The market is expected to reach USD 95.2 Billion by 2034, driven by rising water demand, regulatory pressures, and the need for sustainable water management.

- Technology Dominance: Membrane filtration and biological treatment systems lead due to their effectiveness in removing a wide range of contaminants and adaptability to various applications.

- Application Dominance: Municipal water and wastewater treatment remains the largest application segment, with industrial applications growing rapidly due to stricter discharge standards.

- Drivers: Key drivers include water scarcity, regulatory compliance, industrial expansion, and the adoption of smart water technologies.

- Restraints: High capital and operational costs, aging infrastructure, and technical complexity can hinder market growth.

- Opportunities: Growth opportunities lie in decentralized treatment systems, water reuse and recycling, and the integration of IoT and AI for smart water management.

- Trends: Notable trends include the rise of zero-liquid discharge systems, digital water solutions, and the use of advanced oxidation processes for emerging contaminants.

- Regional Dominance: Asia-Pacific leads the market, fueled by rapid urbanization, industrialization, and government investments in water infrastructure.

Equipment Type Analysis

The market for water and wastewater treatment equipment is dominated by membrane systems, which include technologies such as reverse osmosis (RO), ultrafiltration (UF), and nanofiltration (NF). These systems are highly valued for their efficiency in removing dissolved solids, pathogens, and micropollutants, making them the preferred choice for both municipal and industrial applications. Membrane systems account for approximately 35-40% of the total equipment market, driven by the growing need for water reuse and desalination, especially in regions facing water scarcity. Filtration equipment, such as sand filters, activated carbon filters, and multimedia filters, is also widely used, primarily for removing suspended solids and particulates as a pre-treatment step, and holds about 20-25% of the market. Disinfection equipment, including UV, ozone, and chlorination systems, is essential for ensuring water safety and pathogen removal, representing around 15-18% of the market. Biological treatment systems, such as activated sludge, moving bed biofilm reactors (MBBR), and sequencing batch reactors (SBR), are key for organic and nutrient removal, especially in municipal and industrial wastewater treatment, and account for 12-15% of the market. Sludge treatment equipment, including centrifuges, belt presses, and digesters, is used to manage and reduce sludge volume, supporting sustainable waste management, and holds 8-10% of the market.

Application Analysis

Municipal water and wastewater treatment is the largest application segment, accounting for 50-55% of the total market. This dominance is driven by rapid urbanization, increasing population, regulatory mandates, and the critical need for safe drinking water and sanitation in cities and towns. The industrial water and wastewater treatment segment is the second largest, with a 30-35% market share, and is experiencing rapid growth due to stricter discharge regulations and the increasing adoption of water reuse initiatives in sectors such as chemicals, power, food & beverage, and pharmaceuticals. The commercial and institutional segment, which includes hotels, hospitals, and office complexes, is also growing as these facilities increasingly adopt water recycling and reuse practices, accounting for 8-10% of the market. Agricultural water treatment, though still emerging, is gaining importance in regions where water quality for irrigation and livestock operations is a concern, and currently represents 3-5% of the market.

Process Analysis

In terms of treatment processes, secondary and tertiary/advanced treatment methods are the most significant, each accounting for 35-40% of the market. Secondary treatment, which involves biological processes for the removal of organic matter and nutrients, is widely used in both municipal and industrial plants. Tertiary or advanced treatment, which includes membrane filtration, advanced oxidation, and disinfection, is the fastest-growing segment due to the increasing need for high-quality effluent and water reuse. Primary treatment, which focuses on the removal of large solids and sedimentation, is also essential but represents a smaller share, around 20-25%, as it is often combined with secondary and tertiary processes for comprehensive treatment.

Region Analysis

Regionally, Asia-Pacific leads the global market, holding 35-40% of the share, thanks to major investments in water infrastructure, particularly in China and India, where rapid urbanization and industrialization are driving demand. North America is a mature market with a strong regulatory framework and widespread adoption of advanced technologies, accounting for 25-28% of the market. Europe, with a 20-22% share, is focused on sustainability, water reuse, and compliance with stringent EU directives. Latin America, representing 7-8% of the market, is experiencing growth due to urbanization and industrialization, while the Middle East & Africa, with a 6-8% share, have high demand for desalination and water reuse solutions due to chronic water scarcity.

Get More Information about this report -

Request Free Sample ReportKey Market Segment

Equipment Type

- Filtration Equipment

- Membrane Systems

- Disinfection Equipment

- Biological Treatment Systems

- Sludge Treatment Equipment

Application

- Municipal Water & Wastewater Treatment

- Industrial Water & Wastewater Treatment

- Commercial & Institutional

- Agricultural Water Treatment

Process

- Primary Treatment

- Secondary Treatment

- Tertiary/Advanced Treatment

End User

- Municipalities

- Industrial

- Commercial & Institutional

- Agriculture

Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | USD 55.97 B |

| Forecast Revenue (2034) | USD 95.2 B |

| CAGR (2025-2034) | 6.2% |

| Historical data | 2018-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Equipment Type (Filtration Equipment, Membrane Systems, Disinfection Equipment, Biological Treatment Systems, Sludge Treatment Equipment), Application (Municipal Water & Wastewater Treatment, Industrial Water & Wastewater Treatment, Commercial & Institutional, Agricultural Water Treatment), Process (Primary Treatment, Secondary Treatment, Tertiary/Advanced Treatment), End User (Municipalities, Industrial, Commercial & Institutional, Agriculture) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Veolia Environnement S.A., Xylem Inc., Ecolab Inc., DuPont de Nemours, Inc., Pentair plc, Suez SA, Aquatech International LLC, 3M Company, Thermax Limited, Calgon Carbon Corporation |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Water and Wastewater Treatment Equipment Market

Published Date : 02 Sep 2025 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date