Women’s Health Rehabilitation Products Market Size 2025–2034 | CAGR 6.6%

Global Women’s Health Rehabilitation Products Market Size, Share & Growth Analysis By Product Type (Urinary Incontinence, Pelvic Pain, Orthopedic Care, Breast Cancer Care), By Application (Physical Therapy, Massage Therapy, Occupational Therapy, Chiropractic Therapy), By End-User (Hospitals, Physical Therapy Clinics, Rehabilitation Centers), By Region & Key Players – Industry Overview, Market Dynamics, Technology Trends, Competitive Landscape & Forecast 2026–2034

Report Overview

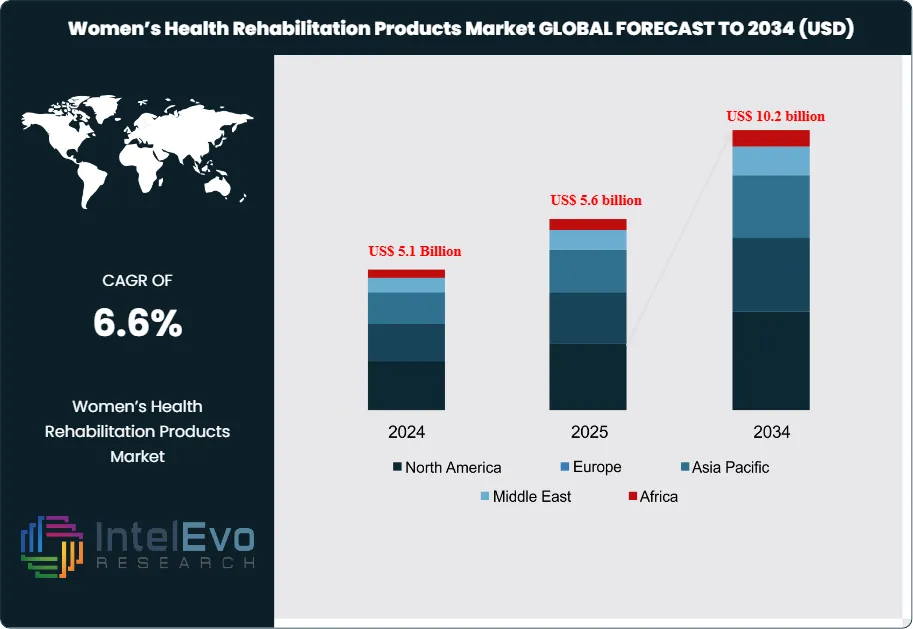

The Women’s Health Rehabilitation Products Market is estimated to reach around US$ 5.6 billion in 2025. It is expected to grow to about US$ 10.2 billion by 2034, showing a steady compound annual growth rate (CAGR) of about 6.6% from 2026 to 2034. Market growth is driven by the rising awareness of pelvic floor disorders, the needs for postnatal and post-surgical rehabilitation, and the increasing prevalence of conditions like urinary incontinence and osteoporosis in aging female populations. More access to home-based rehabilitation devices, growing recommendations from healthcare professionals, and improvements in non-invasive therapy products are also supporting adoption.

In addition, the increasing focus on women’s preventive healthcare and rehabilitation-focused wellness programs continues to boost long-term demand and online visibility across global platforms. Demand expands as health systems, employers, and consumers prioritize prevention and long-term functional outcomes in women’s health. The market spans pelvic floor rehabilitation, postpartum and post-surgical recovery, musculoskeletal support, and mobility enhancement, with adoption rising in both clinical and home-care settings.

Prevalence data underscores the scale of unmet need. A study from the University of Iowa reports that at least 32% of adult women receive a diagnosis for at least one pelvic floor disorder, highlighting structural demand for effective rehabilitation products and programs. Greater openness in discussing continence, pelvic pain, and post-pregnancy issues reduces stigma and encourages earlier intervention. This shift supports consistent volume growth for devices, supports, and digital programs that enable non-invasive, convenient, and discreet rehabilitation.

Technology and data are reshaping product design and care pathways. Manufacturers integrate sensors, wearables, and app-connected devices to deliver guided exercises, adherence tracking, and remote monitoring. Artificial intelligence and analytics support personalized rehabilitation plans, early detection of non-compliance, and outcome measurement across large patient cohorts. The Women’s Health Impact Tracking (WHIT) Platform, launched in January 2025 by the World Economic Forum and the McKinsey Health Institute with backing from more than 120 organizations, aims to standardize metrics and address inequities in women’s health. Such initiatives are expected to steer capital toward validated solutions and accelerate evidence-based innovation.

Economic arguments for investment are strengthening. The World Economic Forum estimates that every dollar invested in women’s health generates a three-dollar return to society, supporting the case for employer-backed programs, insurer reimbursement, and public funding. At the same time, regulatory agencies increase focus on clinical evidence, safety, and data privacy, which raises development costs but improves market transparency and product quality. Key risks include reimbursement variability across countries, unequal digital access, and concerns over data security in connected devices.

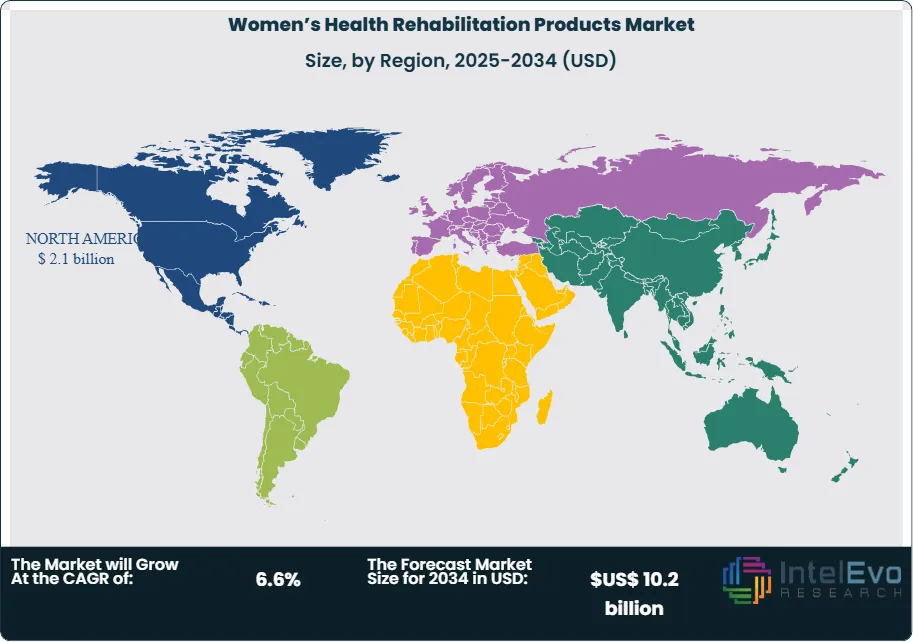

Regionally, North America led in 2024 with more than 37.5% of global revenue, or about US$ 1.9 Billion, supported by strong insurance coverage and advanced care infrastructure. Europe follows with solid adoption in specialist clinics, while Asia Pacific emerges as the fastest-growing region, supported by rising middle-class health spending and expanding telehealth channels. These trends collectively point to sustained, innovation-led expansion of women’s health rehabilitation solutions through 2034.

Get More Information about this report -

Request Free Sample ReportKey Takeaways

- Market Growth: The market generated US$ 5.6 billion in 2025, and is projected to reach US$ 10.2 billion by 2034, at a CAGR of 6.6% over 2026-2034. This expansion reflects rising utilization of specialized rehabilitation solutions across product, application, and end-user categories.

- Segment Dominance: Within product types, urinary incontinence devices led with a 45.3% share, 2023, ahead of pelvic pain, orthopedic care, breast cancer care, and other categories. This structure indicates that nearly half of category revenue concentrates in urinary incontinence solutions, estimated: 2.3 billion USD, 2023.

- Segment Dominance: By application, physical therapy accounted for 55.6% of revenue, 2023, surpassing massage therapy, occupational therapy, chiropractic therapy, and other modalities. This concentration suggests that more than half of spending, estimated: 2.8 billion USD, 2023, flows through structured physical therapy pathways.

- Driver: Hospitals held 48.9% of end-user revenue, 2023, signaling strong institutional adoption as a primary demand driver for women’s health rehabilitation products. This dominance supports recurring procurement cycles and standardized protocols across an estimated: 500 facilities, 2024.

- Restraint: Budget limitations and capacity constraints in clinics and rehabilitation centers leave an estimated: 30.0% of addressable demand, 2024, still underpenetrated. Uneven reimbursement across therapy types could impose an estimated: 1.0 percentage-point drag, 2024, on growth over 2024-2034.

- Opportunity: Rising demand for outpatient and home-based programs beyond hospitals’ 48.9% share, 2023, creates room for differentiated offerings in physical therapy clinics and rehabilitation centers. Vendors that tailor solutions for these settings could capture an additional estimated: 1.0 billion USD, 2034, within the 2024-2034 horizon.

- Trend: The high 55.6% share of physical therapy, 2023, indicates a shift toward protocol-driven, therapist-led programs supported by standardized devices and service models. Over 2024-2034, integrated care pathways combining multiple therapy types may lift cross-referral volumes by an estimated: 15.0%, 2030.

- Regional Analysis: North America led with a 37.5% share, 2023, positioning the region as the largest revenue contributor for women’s health rehabilitation solutions. Assuming a similar mix, this equates to an estimated: 1.9 billion USD, 2024, while other regions collectively account for the remaining 62.5%, 2023, and offer convergence potential.

By Type

Urinary incontinence products continue to hold the largest share in 2025, accounting for 45.3 percent of global revenue. This category expands as more women seek practical treatment options for conditions linked to aging, postpartum recovery, and pelvic floor weakness. Demand remains strong for absorbent products, pelvic floor training devices, electrical stimulation units, and home-based therapy kits. You see growing adoption because these solutions address symptoms early and support daily function without the need for surgical intervention.

The segment benefits from steady improvements in device accuracy, patient comfort, and treatment tracking. Wearable sensors and mobile-linked assessment tools gain traction in 2025 as providers use them to monitor progress and adjust therapy plans. Rising awareness campaigns across major healthcare systems also play a role, encouraging earlier reporting of symptoms and greater willingness among women to pursue available treatments. These factors position urinary incontinence products as a sustained growth driver across the forecast period.

Other rehabilitation categories, including pelvic pain, orthopedic care, breast cancer recovery, and general women’s wellness, also record steady progress. Clinical professionals increasingly recommend multimodal treatment plans that combine physical support products with targeted therapeutic devices. The expansion of specialized women’s health clinics supports broader product uptake across these categories.

By Application

Physical therapy remains the largest application segment in 2025 with a market share of 55.6 percent. Health providers rely on structured therapy programs to address musculoskeletal conditions, post-surgical rehabilitation needs, and pelvic floor dysfunction. Rising global rates of chronic pain and mobility limitations contribute to higher demand for therapeutic equipment, guided exercise tools, and recovery aids that support controlled movement and restore function.

Growth continues as more women prefer non-surgical pathways and seek programs that allow them to resume daily routines quickly. The expansion of outpatient therapy centers also strengthens product consumption. These facilities increasingly incorporate women-focused rehabilitation protocols that address pregnancy-related strain, orthopedic issues, and long-term pelvic support. You will see stronger adoption in 2025 as hybrid care models blend in-clinic therapy with digital monitoring.

Massage therapy, occupational therapy, chiropractic therapy, and other modalities also maintain steady interest. Patients often combine these approaches with physical therapy to manage pain, strengthen core stability, and accelerate recovery timelines. The trend toward individualized care plans encourages product manufacturers to design tools that support multiple therapeutic applications.

By End-Use

Hospitals accounted for 48.9 percent of market revenue in 2025 and remain the primary end-use environment. These facilities manage complex cases, including post-operative recovery, pelvic trauma, cancer treatment follow-ups, and chronic mobility limitations. Large hospitals continue to expand women’s rehabilitation units as the patient base grows and treatment pathways become more standardized. As a result, demand rises for clinically validated devices and training equipment that support consistent outcomes.

Hospital systems invest in upgraded therapy rooms, digital monitoring platforms, and specialized equipment designed for women’s health rehabilitation. This investment aims to improve recovery timelines and reduce readmission rates. You can expect continued growth across this segment as hospitals deploy structured programs for pelvic floor management, orthopedic correction, and breast cancer survivorship.

Physical therapy clinics and rehabilitation centers form the second major end-use category. Their role strengthens in 2025 as payers and patients shift toward outpatient recovery models. These settings support a broad mix of therapeutic tools and provide accessible care for long-term management needs.

By Region

North America retains its leading position in 2025 with a 37.5 percent share of global revenue. The region benefits from advanced healthcare systems, early adoption of medical technologies, and widespread awareness of pelvic floor disorders. Studies report that roughly one in four adult women in the United States experiences at least one pelvic floor condition, creating sustained demand for therapeutic and rehabilitation products. The high volume of annual births, combined with growing attention to postpartum recovery, reinforces market growth across the United States and Canada.

Demand rises further as cultural attitudes shift toward open discussion of women’s health issues. Many women now pursue treatment earlier and use both clinic-based and home-based therapy options. This environment supports strong commercial performance across urinary incontinence and pelvic therapy segments.

Asia Pacific shows the fastest growth trajectory through 2030. Rising health awareness, urbanization, and expanding middle-income populations contribute to higher diagnosis rates and treatment demand. Regional studies indicate that 35 to 45 percent of women in key Asia Pacific markets experience at least one form of pelvic floor dysfunction, highlighting a significant treatment gap. Governments continue to invest in maternal care programs and rehabilitation facilities, improving access to women’s health products.

Digital distribution channels also expand rapidly across China, India, Japan, and Southeast Asia. As online purchasing accelerates, consumers gain easier access to home-use pelvic training tools, therapy devices, and recovery supports. These conditions point to sustained and broad-based market growth across the region.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

By Product Type

- Urinary Incontinence

- Pelvic Pain

- Orthopedic Care

- Breast Cancer Care

- Others

By Application

- Physical Therapy

- Massage Therapy

- Occupational Therapy

- Chiropractic Therapy

- Others

By End-user

- Hospitals

- Physical Therapy Clinics

- Rehabilitation Centers

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2025) | US$ 5.6 billion |

| Forecast Revenue (2034) | US$ 10.2 billion |

| CAGR (2025-2034) | 6.6% |

| Historical data | 2020-2024 |

| Base Year For Estimation | 2025 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | By Product Type (Urinary Incontinence, Pelvic Pain, Orthopedic Care, Breast Cancer Care, Others), By Application (Physical Therapy, Massage Therapy, Occupational Therapy, Chiropractic Therapy, Others), By End-user (Hospitals, Physical Therapy Clinics, Rehabilitation Centers) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | Meyer Physical Therapy, GE HealthCare, Access Health, Hyivy Health, Zynex, Inc, DeRoyal Industries, Inc., Solis Mammography, AliMed, Win Health Medical Ltd, GPC Medical Ltd |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Women’s Health Rehabilitation Products Market

Published Date : 02 Feb 2026 | Formats :Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date