Neuroeducation Market Size, Growth | CAGR 4.1% (2025–2034)

Global Neuroeducation Market Size, Share & Growth Analysis By Technology (AI-Driven Learning, Neurofeedback, Brain-Computer Interfaces), By Application (K-12 Education, Higher Education, Corporate Training, Special Education), By End User (Schools, Universities, Enterprises), Cognitive Science Integration, EdTech Innovation Landscape, Regional Outlook, Key Players, Market Dynamics, Trends & Forecast 2025–2034

Report Overview

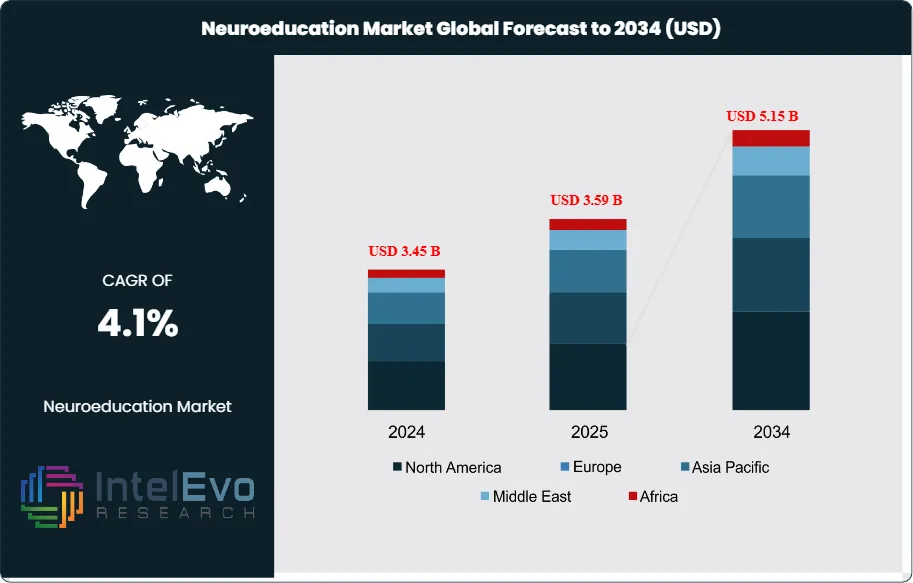

The Neuroeducation Market is estimated at USD 3.45 billion in 2024 and is projected to reach approximately USD 5.15 billion by 2034, registering a CAGR of about 4.1% during 2025–2034. This steady growth is driven by increasing adoption of brain-based learning methodologies, rising integration of neuroscience insights into curriculum design, and expanding use of cognitive assessment and neurofeedback tools in education systems. Growing emphasis on personalized learning, inclusive education for neurodiverse learners, and evidence-based teaching practices is further strengthening demand across K–12, higher education, and professional training environments globally.

Get More Information about this report -

Request Free Sample ReportThis steady expansion reflects the growing integration of neuroscience into education, where brain research is increasingly applied to improve teaching methods, curriculum design, and learning outcomes. Over the past decade, the market has shifted from niche academic interest to a structured industry ecosystem, encompassing educational software, brain-training programs, cognitive assessment tools, and professional development resources for educators.

Demand is being driven by rising awareness of cognitive science in education, coupled with the need for evidence-based teaching strategies. Neurofeedback technologies, which enhance attention, memory, and cognitive performance, are projected to see adoption rates rise by 35% year-on-year. Similarly, brain-computer interfaces (BCIs) and wearable devices are gaining traction, with adoption expected to grow by 30% in 2024 alone. These tools enable personalized learning by capturing brain activity and providing real-time feedback, allowing educators to adapt instruction to individual student needs. The broader BCI market, valued at USD 1.79 billion in 2023, is forecast to reach USD 7.42 billion by 2033, growing at a CAGR of 15.7%. Education is emerging as a key application segment within this growth trajectory.

On the supply side, technology providers are investing in AI-driven platforms that integrate neuroscience insights into adaptive learning systems. At the same time, regulatory frameworks around data privacy and ethical use of neurotechnology in classrooms remain a challenge. Institutions must balance the benefits of cognitive monitoring with concerns over student data protection and equitable access.

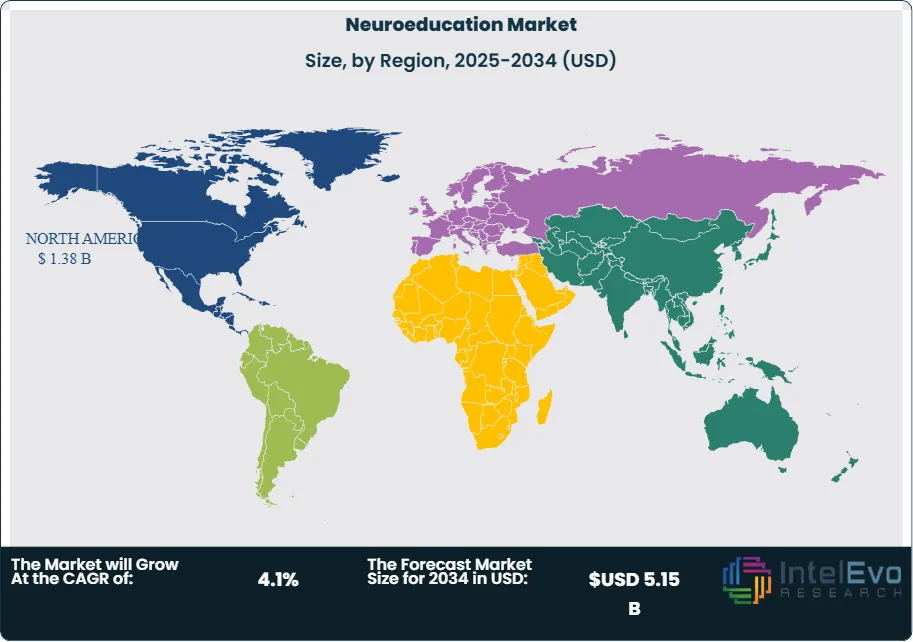

Regionally, North America leads adoption, supported by strong research funding and early integration of neuroscience into education policy. Europe follows closely, with emphasis on cognitive assessment and teacher training programs. Asia-Pacific is expected to record the fastest growth, driven by large student populations, government-backed digital education initiatives, and rising investment in edtech startups. Investors should also monitor emerging markets in Latin America and the Middle East, where pilot projects in neuroeducation are beginning to scale.

Looking ahead, the market’s trajectory will be shaped by advances in AI, wearable neurotechnology, and neuroscience-informed assessment methods, which are projected to grow by 25% annually. For decision-makers, the opportunity lies in aligning capital with solutions that improve measurable learning outcomes while addressing regulatory and ethical considerations.

Key Takeaways

- Market Growth: The global neuroeducation market was valued at USD 3.45 billion in 2024 and is projected to reach USD 5.15 billion by 2034, expanding at a CAGR of 4.1%. Growth is supported by rising demand for neuroscience-based teaching methods and the integration of cognitive science into digital learning platforms.

- Product Type: Educational software and applications accounted for 65.4% of total revenue in 2022. Their dominance reflects widespread adoption in schools and universities, where digital platforms enable scalable deployment of neuroscience-informed learning tools.

- End Use: Academic institutions represented 58.1% of market share in 2022. Their ability to integrate neuroeducation solutions at scale, supported by research partnerships and government-backed digital learning initiatives, positions them as the leading end-user segment.

- Driver: Rising adoption of neurofeedback and brain-computer interface (BCI) technologies is accelerating market growth. Neurofeedback adoption is expected to increase by 35% year-on-year, while BCIs are projected to grow at a CAGR of 15.7% through 2033, reaching USD 7.42 billion across industries.

- Restraint: Data privacy and ethical concerns around monitoring student brain activity remain a barrier. Institutions face regulatory scrutiny, which could slow adoption rates and increase compliance costs.

- Opportunity: Neuroscience-informed assessment methods are projected to expand by 25% annually. These tools provide educators with insights into cognitive processes and learning styles, creating opportunities for companies offering adaptive evaluation platforms.

- Trend: Mindfulness and meditation practices rooted in neuroscience are gaining traction. Adoption in educational settings is forecast to rise by 30% in 2024, reflecting growing emphasis on student well-being alongside academic performance.

- Regional Analysis: North America led the market with a 39.7% revenue share in 2022, supported by strong research funding and early adoption of neuroeducation technologies. Asia-Pacific is expected to record the fastest growth, driven by large student populations, government-backed edtech initiatives, and rising investment in neuroscience-based learning solutions.

Type Analysis

The neuroeducation market in 2025 continues to be defined by the dominance of educational software and applications, which accounted for more than 65% of global revenue in 2023 and are projected to maintain their lead through the next decade. This segment benefits from its ability to deliver neuroscience-based learning tools at scale, supported by widespread smartphone penetration and improved internet connectivity. The global edtech sector, valued at over USD 250 billion in 2023, has accelerated the adoption of neuroeducation apps, particularly those integrating artificial intelligence and adaptive learning algorithms.

Educational books and print-based resources remain relevant but represent a smaller share of the market, largely serving traditional institutions and regions with limited digital infrastructure. Other product types, including cognitive training kits and neurofeedback devices, are gaining traction as complementary tools. These products are expected to grow at a faster pace than books, supported by rising demand for personalized learning and measurable outcomes in both academic and professional training environments.

Application Analysis

Applications of neuroeducation are expanding across multiple domains, with digital pavers such as gamified learning platforms and interactive modules leading adoption. These tools are widely used in early childhood and K-12 education, where engagement and retention are critical. Retaining walls, represented by structured assessment and evaluation systems, are also gaining importance. Neuroscience-informed assessments are projected to grow by 25% annually, as institutions seek data-driven insights into cognitive development and learning performance.

Other applications, including mindfulness and well-being programs, are emerging as high-growth areas. In 2024, adoption of neuroscience-based mindfulness practices in schools rose by 30%, reflecting a broader shift toward integrating cognitive health with academic achievement. This trend is expected to continue, particularly as institutions prioritize holistic student development and measurable improvements in attention, memory, and emotional regulation.

End-Use Analysis

Academic institutions remain the largest end-user segment, accounting for nearly 58% of market revenue in 2023. Their dominance is underpinned by established infrastructure, large student populations, and the ability to integrate neuroeducation solutions across multiple disciplines. Universities and schools are also key partners in research collaborations, driving product validation and long-term adoption.

Healthcare providers represent a growing segment, particularly in cognitive rehabilitation and mental health applications. Hospitals and clinics are increasingly adopting neuroeducation tools for patients with learning disabilities, attention disorders, and memory impairments. The corporate sector is also expanding its use of neuroeducation, with companies investing in cognitive training programs to improve employee productivity and decision-making. Individual users, supported by the rise of consumer-focused brain-training apps, form a smaller but steadily growing base.

Regional Analysis

North America continues to lead the global neuroeducation market, holding nearly 40% of revenue share in 2023. The region benefits from strong research ecosystems, high edtech investment, and early adoption of neuroscience-based learning solutions. Companies such as Pearson, Lumos Labs, and Posit Science are headquartered in the region, reinforcing its leadership position.

Europe follows with significant adoption in teacher training and cognitive assessment programs, supported by government-backed education reforms. Asia Pacific, however, is projected to record the fastest growth through 2033, driven by large student populations, rising disposable incomes, and government initiatives promoting digital education. Countries such as China, India, and South Korea are emerging as investment hotspots, with rapid uptake of mobile-based neuroeducation platforms. Latin America and the Middle East & Africa remain smaller markets but are expected to expand steadily as infrastructure improves and pilot programs scale.

Get More Information about this report -

Request Free Sample ReportMarket Key Segments

Product Type

- Educational Software and Apps

- Educational Books

- Other Product Types

End-User

- Academic Institutions

- Healthcare Providers

- Corporate Sector

- Individual Users

Regions

- North America

- Latin America

- East Asia And Pacific

- Sea And South Asia

- Eastern Europe

- Western Europe

- Middle East & Africa

| Report Attribute | Details |

| Market size (2024) | USD 3.45 B |

| Forecast Revenue (2034) | USD 5.15 B |

| CAGR (2024-2034) | 4.1% |

| Historical data | 2020-2023 |

| Base Year For Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Report coverage | Revenue Forecast, Competitive Landscape, Market Dynamics, Growth Factors, Trends and Recent Developments |

| Segments covered | Product Type (Educational Software and Apps, Educational Books, Other Product Types), End-User (Academic Institutions, Healthcare Providers, Corporate Sector, Individual Users) |

| Research Methodology |

|

| Regional scope |

|

| Competitive Landscape | NeuroSky, Inc., Pearson plc, CogniFit Ltd., Lumos Labs, NeuroNation, Carnegie Learning, Inc., Rosetta Stone Inc., Knewton, Posit Science Corporation, BrainWare Learning Company |

| Customization Scope | Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

| Pricing and Purchase Options | Avail customized purchase options to meet your exact research needs. We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). |

Select Licence Type

Connect with our sales team

Why IntelEvoResearch

100%

Customer

Satisfaction

24x7+

Availability - we are always

there when you need us

200+

Fortune 50 Companies trust

IntelEvoResearch

80%

of our reports are exclusive

and first in the industry

100%

more data

and analysis

1000+

reports published

till date